Examining 7 key revenue growth performance and customer success metrics that are essential for scaling your SaaS business

For any growing business, capturing and analyzing financial data is critical for scaling and making informed decisions. With the right performance metrics and insights at your disposal, you won’t be blindsided by changes in the business. You can proactively address issues quickly and drive growth confidently. And when you’re ready to seek capital, you can deliver the metrics and insight into the financial health of your business that investors and venture capitalists will, without a doubt, expect.

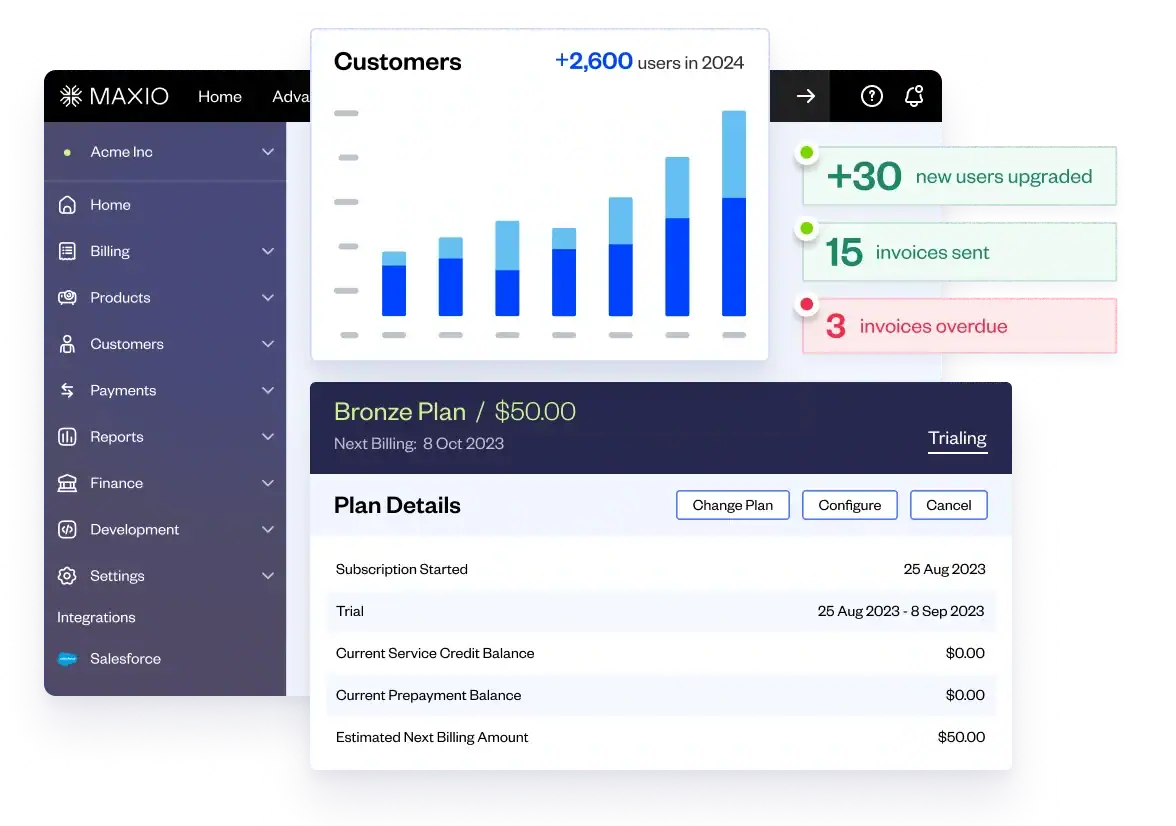

But for B2B SaaS businesses, the approach isn’t one-size-fits-all. Traditional financial metrics can’t provide the insight you need because they simply don’t work for a recurring revenue business model. That’s because SaaS businesses aren’t static, and the volatility that comes with customer upgrades, downgrades, and cancellations is impossible to track using a spreadsheet. Spreadsheets can be valuable for ad hoc financial analysis and financial modeling, but they are poor at managing data.

Growth requires real-time insight into the financial health of your business. To be successful, you need:

- An understanding of the key performance metrics you should be tracking and why

- Quick access to those metrics and high-quality financial information so you can make smart decisions, properly manage your business, and raise capital with confidence

- GAAP financials that, when combined with subscription metrics, provide the insight and financial maturity you need to grow.

Which metrics are important, and which are just nice to have? Let’s start with the foundational metrics.

REVENUE GROWTH PERFORMANCE METRICS

These metrics provide visibility into the health of your business and its potential for growth:

- Monthly Recurring Revenue (MRR) — MRR is the value of the contracted recurring revenue components of your term subscriptions normalized to a one-month period. It’s important to track new MRR and also expanded, contracted, expired, and canceled revenue, which are essential to understanding the health of your business. Looking at MRR and breaking it down by these types can reveal how your business is growing. You’ll use it to report on growth from new contracts, in-expansion revenue, and contraction, while cancellations from existing customers will identify churn (i.e., decline) or retention and drive cohort analysis, pricing trends, and estimated future revenue.

- Annual Contract Value (ACV) — This is a measure of the average value of a subscription over the term of the contract. It reveals the size of your contracts, whether they are growing or shrinking, and how many deals you need in order to reach your revenue goals each period. These numbers are essential inputs into your marketing plan for visibility into how many leads and opportunities are needed to achieve your plan’s goals, based upon win rates. A growing ACV indicates that you’re increasing the revenue per customer while producing additional expected revenue.

- Customer Acquisition Costs (CAC) — CAC measures the total resources (think sales and marketing) associated with acquiring a new customer. This metric is especially valuable when comparing it to customer lifetime value (CLV).

- Customer Lifetime Value (CLV) — This is an estimate of the average gross revenue a customer will generate before they churn. The CLV/CAC ratio indicates what you can expect to net for every dollar you spend to acquire a customer.

CUSTOMER SUCCESS METRICS

Every touchpoint can impact whether or not you retain that customer over time. Growing your SaaS business will depend on measuring customer success and setting goals around these metrics: Expansion Revenue

- Churn and Retention — Churn is calculated as the number of customers lost in a period of time or the number of cancelled customers divided by the ending customer count. You can calculate churn based on gross or net revenue or logo, also known as customer count. As your company becomes larger and the size of your subscription base grows, the revenue lost to churn can also grow, requiring more bookings from new customers simply to replace what was lost. This means your growth is slowing — significantly. High churn usually indicates that your product isn’t meeting customer needs. With insight into the factors driving churn, you can take action to turn things around.

- Cohort Analysis — Cohort isn’t a metric per se, but it is just as important. By definition, a cohort is a group with a common statistical characteristic such as a common price band or geography. A cohort report is useful in indicating churn and also can be used to test marketing campaigns and resource allocation. For example, if you generate a cohort report based on subscriptions initiated during a specific date range, it should indicate if customers acquired at that time and subject to the same level of product maturity, customer support, on-boarding, pricing, and packaging are growing in MRR contribution or shrinking relative to customers from other cohorts. You’re able to correlate performance with marketing actions, sales plans, pricing, and support policies that were in effect at that time, and you can use this information to identify the business practices and processes that maximize the revenue contributions of customers.

“For B2B SaaS businesses, the approach isn’t one-size-fits-all. Traditional financial metrics can’t provide the insight you need because they simply don’t work for a recurring revenue business model.”

Whether you’re motivated by raising capital or by making more informed decisions for your business, sound SaaS financial operations start with measuring what matters. Long-term success in a SaaS business requires a metrics-driven culture and operating model. Begin with the end in mind and build processes to capture the right information that enables optimal decision-making through good times and bad.

This was originally published in Software Executive Magazine.