The SaaS industry has seen some dramatic shifts over the past year as the market moved from unchecked growth to more disciplined operations. And now things are changing (again).

To shed light on the current state of SaaS growth, we met with Ray RIke, Founder and CEO of Benchmarkit, and Ben Murray, Founder of The SaaS CFO, to share some recent trends around growth, profitability, and valuation multiples that public and private SaaS companies should factor into their planning.

This information is based on Benchmarkit’s 2023 B2B SaaS Benchmarks Report and the recent Maxio Institute Report, which each feature data from over a thousand private SaaS companies.

Curious how your company compares to public and private SaaS businesses in 2023? Let’s take a look at the data to find out.

What’s happening with growth rates in 2023?

Growth rates were significantly lower in 2022 compared to 2021 across the SaaS industry. This aligns with the shift from the “growth at all costs” mindset of 2021 to more disciplined growth in 2022. However, a recent growth upswing in H2 2023 suggests that the market headwinds of the past year may start easing up.

Here’s what the data is telling us:

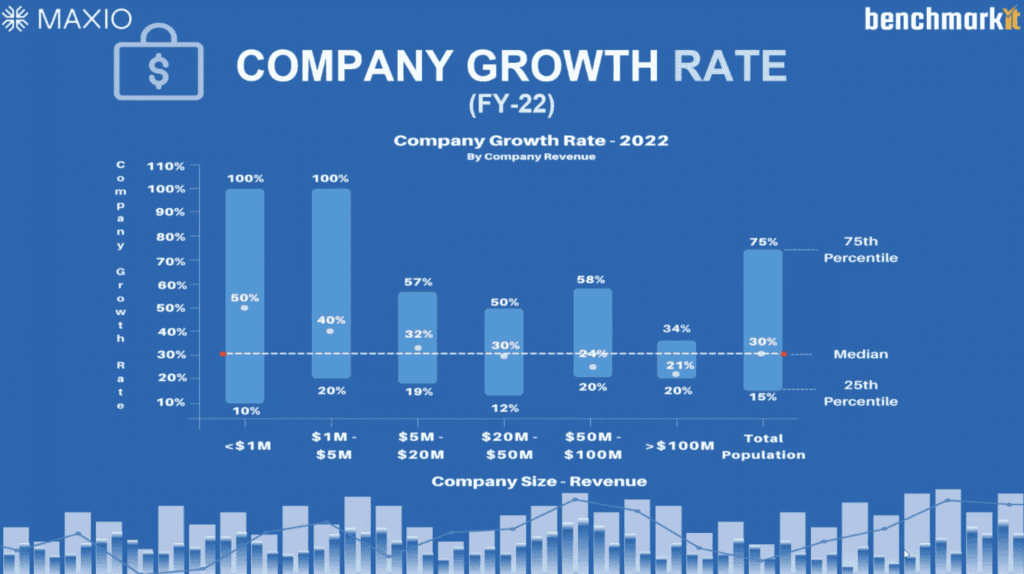

Breakdown of growth rates by company size

Smaller companies saw higher median growth rates from 2021 to 2022, with easier growth off a smaller baseline. Similarly, companies in the $50MM-$100MM ARR range saw an acceleration of growth, benefiting from scale and multiple products/markets.

Despite this general increase in growth rates, it’s been observed that the $20MM-$50MM ARR segment struggled the most with growth, with some SaaS leaders even referring to it as “the valley of death”. At this stage, it becomes much harder to grow without extending into new markets, whether that’s going from mid-market to enterprise or even expanding into new geographies.

According to Randy Wootton, CEO of Maxio, the key to marching through this “valley of death” is focusing on expansion growth—this means investing in multiple product lines, customer segments, and regions.

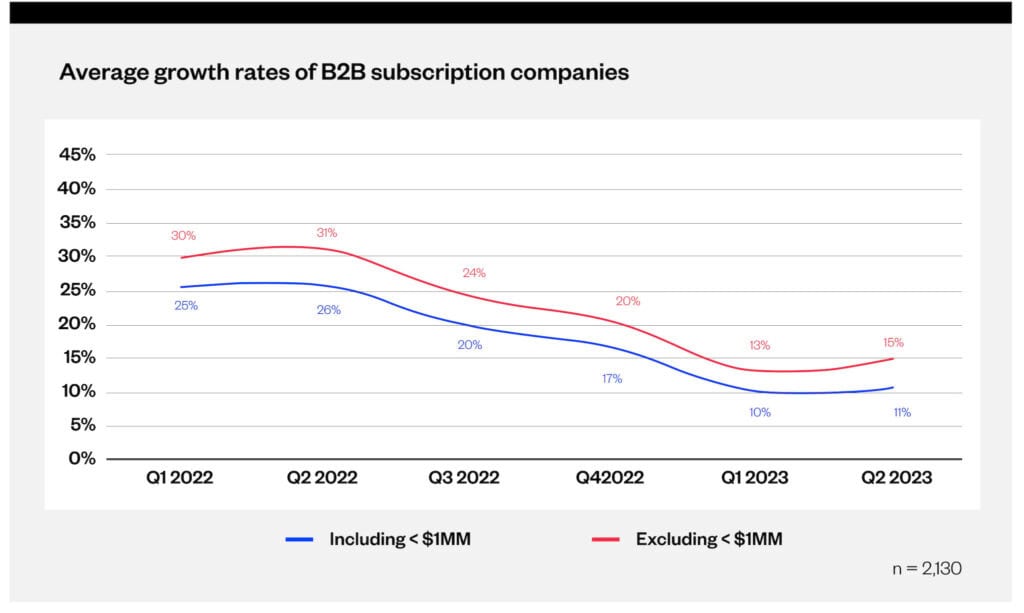

Growth rates between Q1 ‘22 and Q2 ‘23: a growth upswing

As shown in the recent Maxio Institute Report, there was a slow-but-steady deceleration in growth rates throughout 2022 due to limited access to capital and strong economic headwinds. However, in 2023, that tune seems to be changing. The small upswing in growth at the start of Q1 ‘23 may be the start of a rebound for SaaS company growth rates.

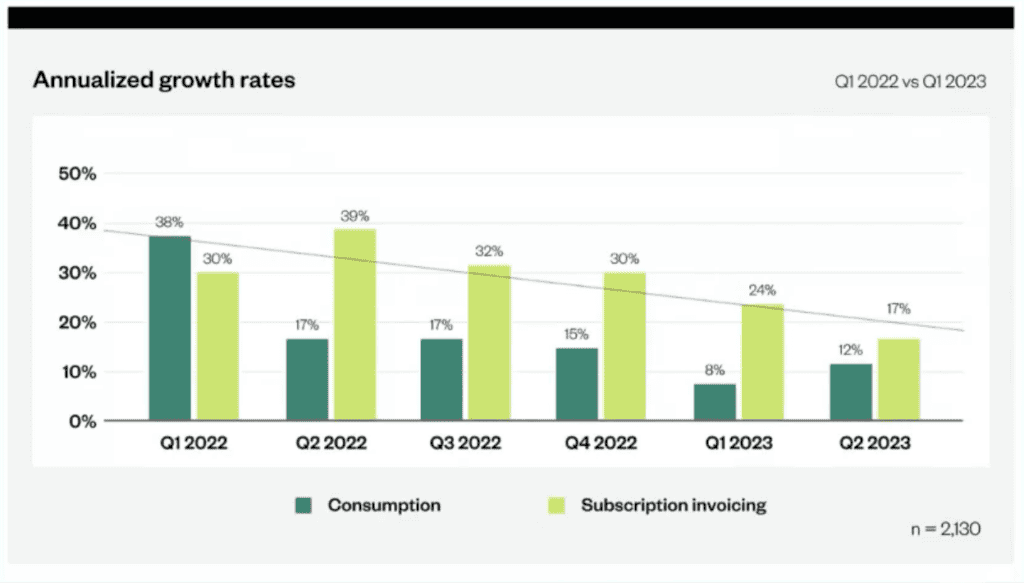

The impact of billing models (subscription vs. usage) on growth

In the Maxio Institute report, one trend that stood out was the difference between subscription vs. consumption-based billing.

Unlike the traditional subscription billing model, consumption models saw much higher volatility in growth rates between 2021 and 2022. While the consumption/usage-based model benefited more in 2021, it saw an immediate pullback in 2022 as customers trimmed usage.

According to Randy Wootton, the future of SaaS billing means embracing the hybrid model, balancing both subscription and usage-based billing.

“Usage was great during a growth market because customers were being billed across multiple usage tiers and then getting charged for overages,” says Randy. He then added, “But in a down market, what we see in this data is that you are susceptible to quick shifts in market trends. And if you don’t have that subscription invoicing base to hold onto customers and demonstrate value, relying strictly on usage-based billing can be very volatile.”

Customer acquisition efficiency metrics: What’s driving sustainable growth for SaaS companies?

With all this data at our fingertips, it’s worth asking: What’s actually driving growth for SaaS companies?

The short answer is “it depends.” The long answer is that growth will look different across companies based on their revenue range, industry, product lines, and geographies. Still, the Maxio and Benchmarkit analyses provide key insights to give us a better idea of what’s helping SaaS companies drive growth.

In this section, we’ll examine trends across customer acquisition costs, retention rates, and department expenses to discover what growth levers are working and where companies may need to refine their growth strategy.

Get the 2023 Maxio Institute Growth Index

Get key growth insights based on the billing data of over 2,000 B2B SaaS companies.

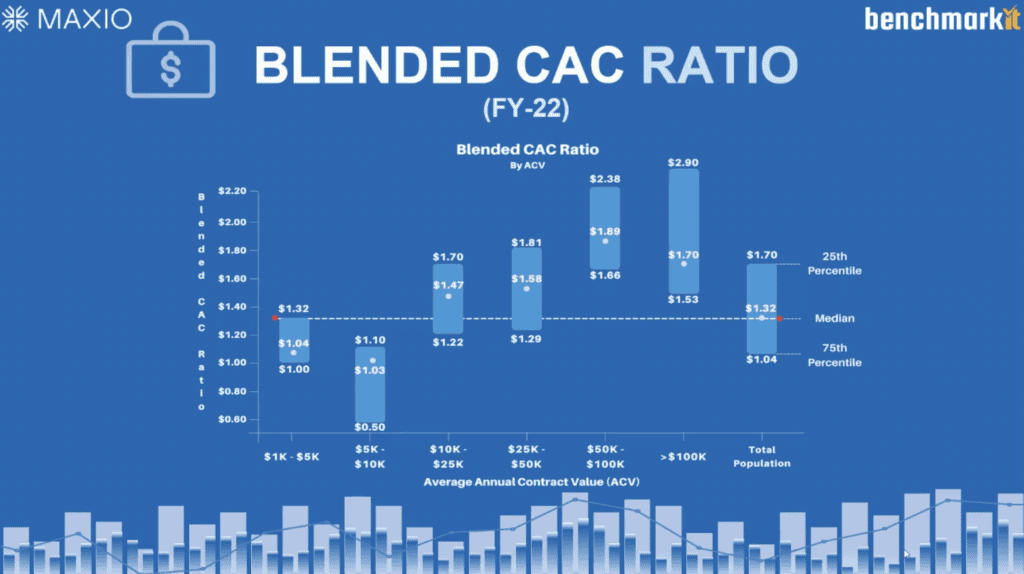

Customer acquisition cost (CAC) metrics

The first metric SaaS leaders and operators should examine is their blended CAC ratio. The blended CAC ratio measures the sales and marketing expenses required per one dollar of new ARR and expansion ARR. In 2022, the median was $1.32 per one dollar of growth ARR.

As expected, there’s a strong correlation between CAC ratio and ACV where higher ACV solutions typically have a higher CAC ratio. For example, SaaS companies with a $50K-100K ACV had a median $1.89 CAC ratio, which is far higher than SaaS companies with lower ACVs.

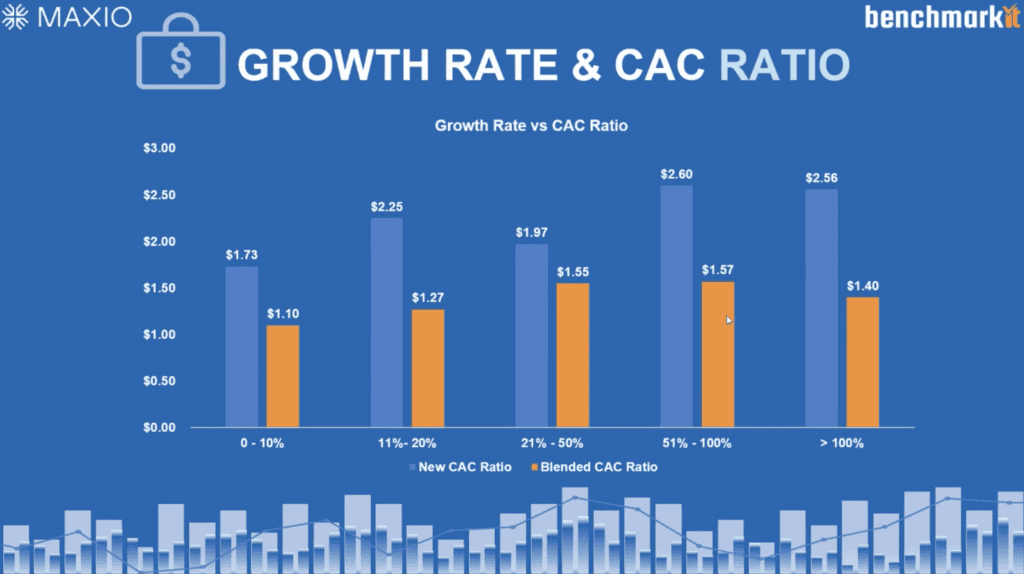

There’s also a strong correlation between CAC ratio and growth rate that’s worth attention. Lower CAC ratios (more efficient) are correlated with slower growth rates. On the other hand, the highest growth companies (50-100%) had the highest CAC ratios. Based on this information, we can see that there is clearly a tradeoff between growth rate and CAC efficiency, and SaaS leaders need to understand this tradeoff as they plan for 2024 and beyond.

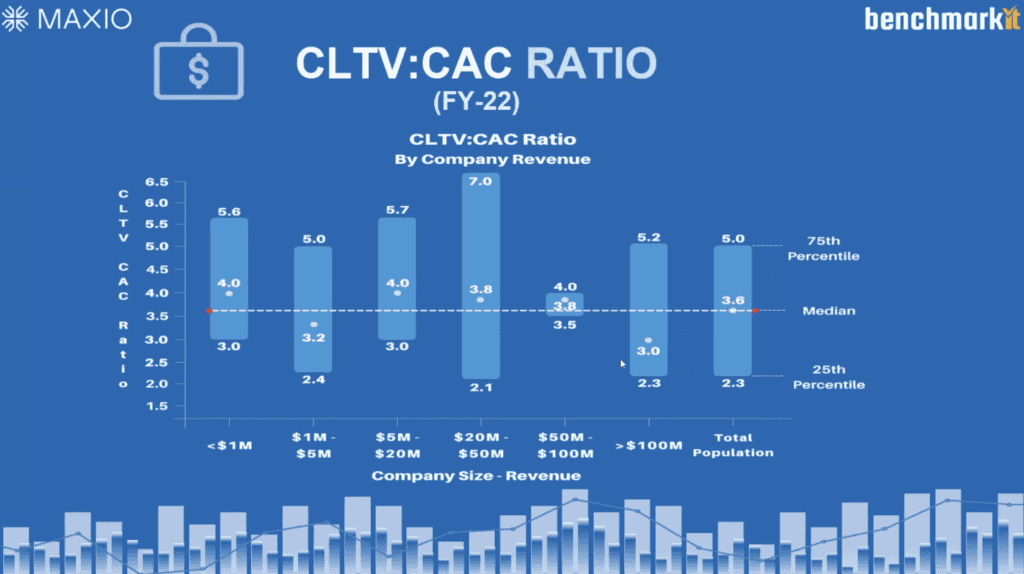

Finally, the last CAC metric that tells a unique story about a SaaS company’s growth efficiency is the CLTV:CAC ratio.

According to Ben Murray, he finds that the CLTV:CAC ratio is very appropriate for smaller ACV self-service, high-volume SaaS companies. The only caveat here is that many early-stage companies haven’t been around long enough to make an accurate measurement of their average churn rate. In this case, Ben recommends plugging in a reasonable churn rate to make a rough estimate of the CLTV:CAC ratio.

Customer retention and expansion metrics: How well are SaaS companies retaining and monetizing existing users?

According to Ray Rike, the most important revenue retention metric is the one that tells you how well a customer is performing after they sign up—which is why we’re looking at the average net revenue retention rates (NRR) of SaaS companies in 2022.

What the Benchmarkit data shows us is that unlike unicorn SaaS companies like Snowflakes and Twilio who boasted having 130%-160% NRR a year and a half ago, the median NRR in the private company cohort is right at 105%.

And, much like the cost to acquire a customer, we see a strong correlation between higher ACV levels and higher net revenue retention. This is typically because enterprise SaaS companies with higher ACVs have stickier solutions with greater expansion potential across their product lines and customer cohorts.

Operating efficiency metrics: How are department expenses impacting growth rates?

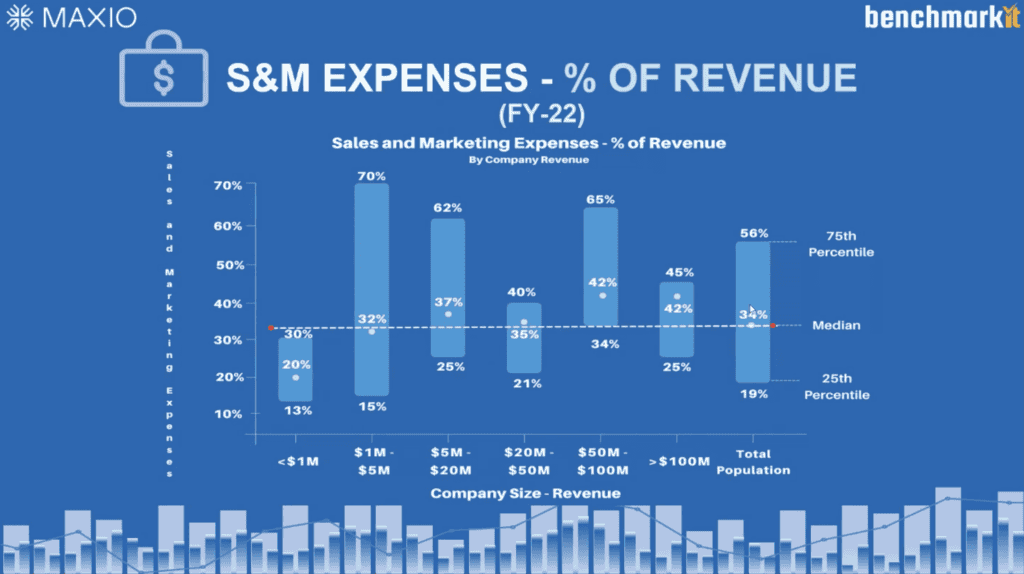

According to Ray Rike, one of the big efficiency metrics SaaS leaders have been focusing on over the last 12 to 18 months is OPEX and department expenses. Specifically, many SaaS leaders want to know what percentage of their revenue gap is being allocated to sales and marketing investments.

Based on the data provided by Benchmarkit, it was found that software companies tend to spend a higher percentage of revenue on S&M, R&D, and G&A when scaling from $20MM to $50MM ARR. From Randy Wootton’s point of view, this is largely because as SaaS companies launch new products and enter new markets, they need additional overhead to support it.

For example, you may need to hire additional GTM leaders to handle specific regions or product lines. Similarly, you may need to bring on an engineering manager to oversee the development of a new product or feature. While these investments take time to pay off, SaaS companies will ultimately benefit from a more complex, diversified portfolio and GTM motion.

You can see the full breakdown of S&M, R&D, and G&A expenses by watching a recording of the 2023 B2B SaaS Benchmarks webinar.

Ultimately, Randy, Ben, and Ray agree that you shouldn’t live and die on one metric alone. Using a handful of metrics is the best way to measure your company’s growth efficiency and tell your board and investors an accurate story.

One metric to rule them all: the Rule of 40

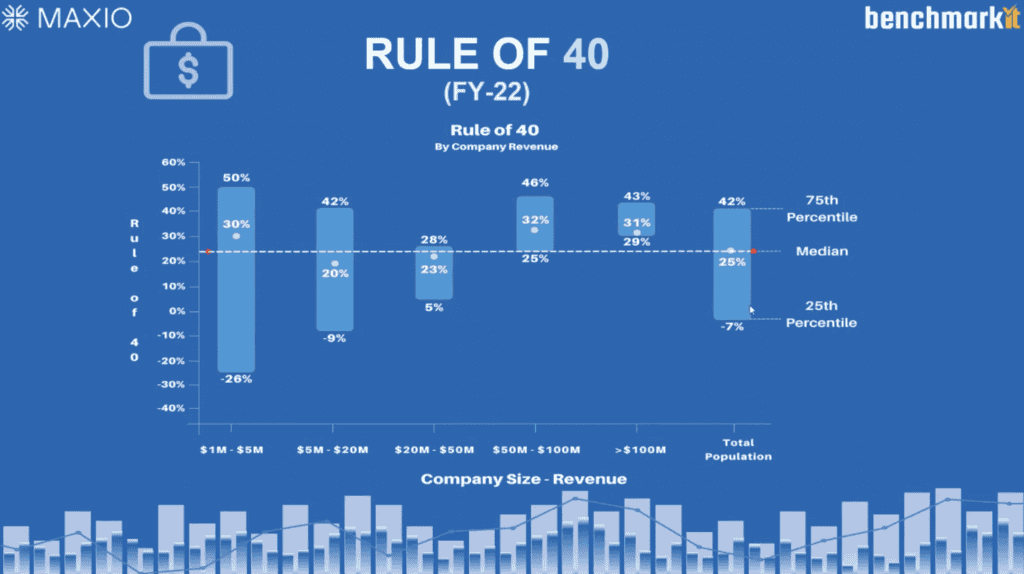

While it’s important that SaaS leaders track and measure multiple performance metrics, there is one metric that seems to stand out among the rest: the Rule of 40.

As a refresher, the Rule of 40 is a principle that states a software company’s combined revenue growth rate and profit margin should equal or exceed 40%. SaaS companies above 40% are generating profit at a sustainable rate, whereas companies below 40% may face cash flow or liquidity issues.

In 2022, the median Rule of 40 for private SaaS companies was only 25%, far below the “rule.” The data also found that smaller companies tend to have a higher Rule of 40 due to faster growth rates. Then, as SaaS companies invest more in operating expenses, the Rule of 40 declines until they reach scale above $50MM ARR.

While the Rule of 40 is great at measuring how well SaaS companies are able to balance growth vs. profitability, it isn’t without its flaws. Specifically, the Rule of 40 doesn’t always take into account the differences between companies that are growing at 100% with negative 60% EBITDA vs. companies that are growing at 40% with 0% EBITDA.

So how can SaaS leaders get the best use out of this popular metric?

Todd Gardner, Managing Director of SaaS Advisors, who wasn’t on this webinar but none-the-less offers a poignant insight into this conversation, suggests that business leaders use the dolphin strategy to achieve efficient growth when thinking about the Rule of 40.

According to Todd, the dolphin strategy states that SaaS companies can operate underwater (unprofitable) for long periods and still create substantial value. The vast majority of public SaaS businesses are unprofitable. However, there are substantial benefits to periodically coming up for air (operating profitably). Ultimately, SaaS companies need to prove that they can operate profitability every once in a while, and then they can figure out where their next growth investments are going to come from.

What’s happening with SaaS company valuations? Goodbye to growth at all costs, hello to disciplined growth

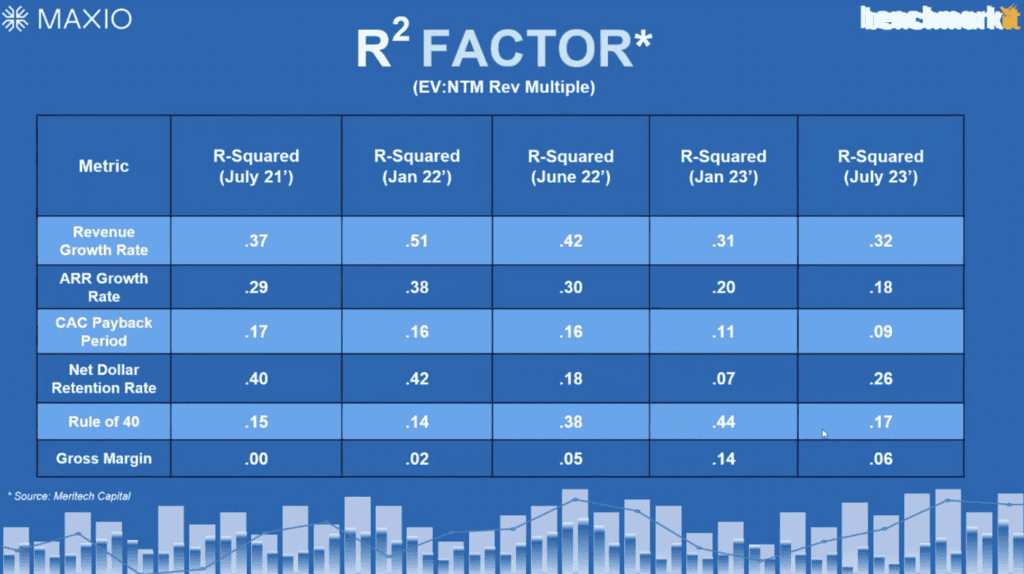

Most SaaS leaders are aware that the market has shifted focus from unchecked growth to balancing growth and profitability. This would explain the hype around the Rule of 40 as a critical valuation metric. But what performance metrics are really impacting company valuations in 2023?

According to data from Meritech Capital, the Rule of 40 far outweighed other valuation metrics in H2 ‘22 and H1 ’23. However, that’s no longer the case. Revenue growth and retention are once again taking the spotlight and telling us that growth still matters— especially when it comes to receiving a favorable valuation.

Benchmark your company’s performance against your peers

The data and insights shared by Maxio and Benchmarkit illustrate just how fast the market can swing from one direction to another. Ultimately, SaaS leaders need to understand how these trends in growth, profitability, and valuation should inform their strategy and planning in 2023 and beyond.

Want to see how your company stacks up against your SaaS peers? Download the Maxio Institute’s The State of SaaS Growth 2023 report to benchmark your growth.