Maxio + Anrok: Automated tax compliance built into billing

Connect automated billing with modern tax compliance.

The Anrok integration brings real-time accuracy, visibility, and control to recurring-revenue workflows. It removes manual mapping and spreadsheet tracking ensuring every invoice is accurate and audit-ready.

Why Maxio + Anrok

Automation

Stop tracking tax by hand. Taxes are calculated automatically during subscriptions, one-time charges, and invoicing. This reduces manual work and streamlines the entire billing process.

Accuracy

Confidence in every invoice. Real-time calculation ensures every invoice reflects the correct tax at the right time, helping teams close faster with fewer adjustments.

Visibility

Know your tax impact before you bill. Finance teams can preview and validate tax amounts in real time, reducing surprises and minimizing reconciliation effort.

Compliance

Compliance built in. Anrok manages jurisdiction-specific and international tax rules, while Maxio ensures invoices stay accurate, transparent, and audit-ready across regions.

How it works

The Maxio + Anrok integration works seamlessly in the background to ensure every transaction is taxed correctly, without added effort.

When enabled, Maxio communicates directly with Anrok in real time at each billing event, applying accurate taxes automatically and maintaining compliance across jurisdictions

Whenever a subscription, invoice, or one-time charge is created, Maxio calls Anrok’s tax engine instantly.

Anrok applies the correct rates and rules based on jurisdiction and transaction type, returning precise tax amounts directly to Maxio.

Your product catalog in Maxio syncs automatically with Anrok, keeping product and component data consistent for ongoing tax accuracy.

Tax category management remains in Anrok, giving finance teams visibility and control over how items are classified.

As invoices and subscription previews are generated, Anrok’s calculated tax appears instantly in Maxio, No imports or manual updates required.

Teams can review tax details in invoice views and reports, ensuring transparency before billing.

Anrok manages jurisdictional and international tax obligations, while Maxio provides the detailed invoice and transaction data for audit readiness.

Together, they keep your tax reporting accurate and your billing operations simple.

Request Beta Access

Beta Access is open for Maxio customers who want real-time, automated tax compliance powered by Anrok.

Sign up now for beta access

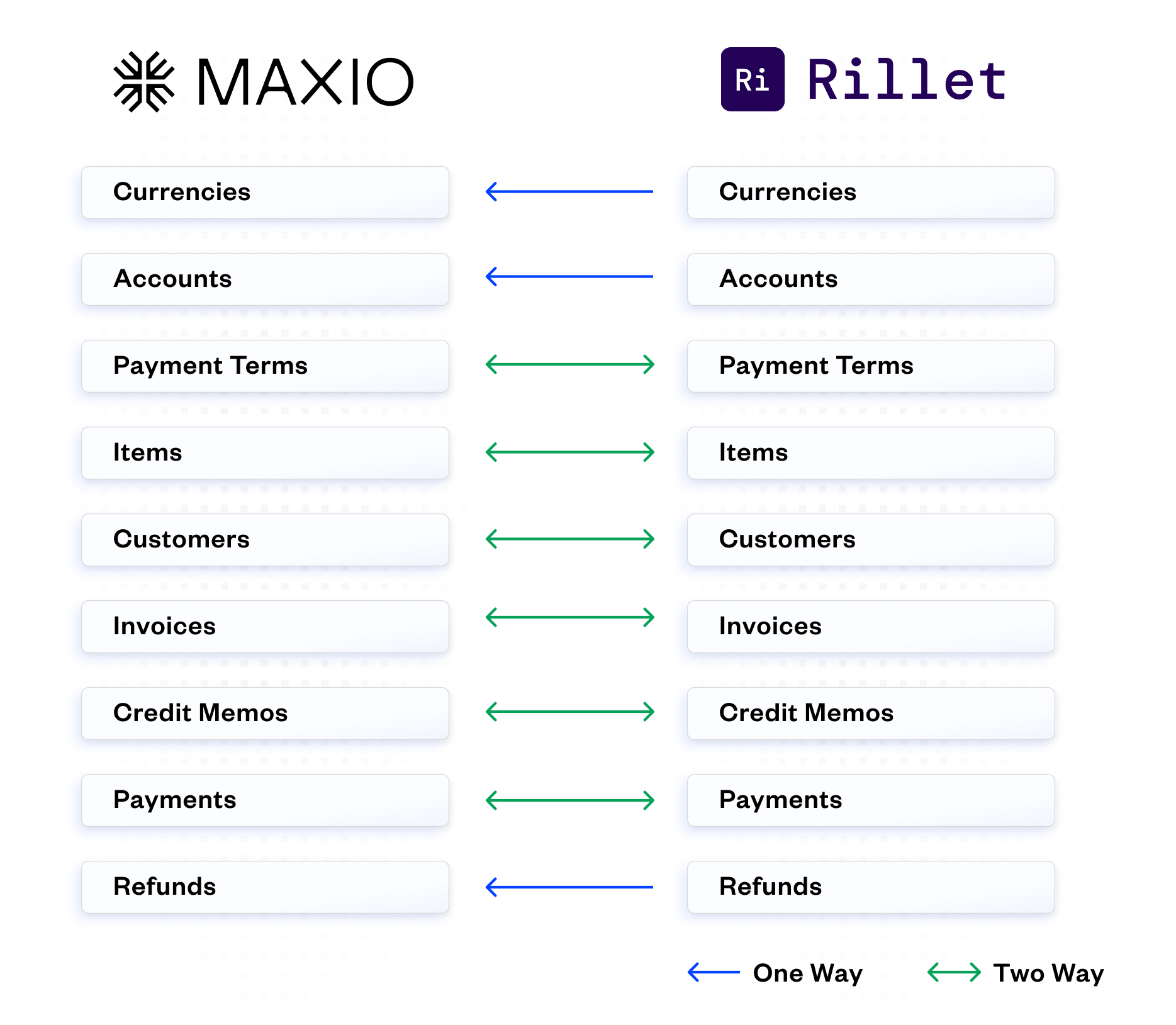

Maxio + Rillet: Modern billing meets an AI-native ERP

Unify automated billing, revenue recognition, and accounting data in one integrated finance stack.

Why Maxio + Rillet?

The Maxio + Rillet integration connects automated billing and revenue data from Maxio with Rillet’s AI-native ERP, giving finance teams a unified foundation for accurate, efficient, and scalable operations. By synchronizing billing and ledger data through a direct, bi-directional connection, the integration reduces manual effort, eliminates reconciliation errors, and keeps financial information consistent across systems.

Why this matters:

- Close faster: Cut days off month-end with connected billing and ledger data.

- Stay accurate: Keep revenue and payment data consistent across systems.

- See in real time: Get instant visibility into revenue and collections.

- Scale easily: Support multi-entity and global operations without added complexity.

What You’ll Get

Synchronize key billing and accounting data between Maxio and Rillet for a consistent, audit-ready view of revenue and ledger activity.

- Bi-directional data sync: Keeps Customers, Invoices, Credit Memos, and Payments aligned across Maxio and Rillet.

- Flexible account mapping: Maps key billing and accounting fields to match your chart of accounts.

- Audit-ready traceability: Links invoices and payments across systems to create a clear, verifiable record.

- Simple, reliable connection: Built on Maxio’s ERP-agnostic architecture for straightforward setup and maintenance.

Ready to run your finance stack the modern way?

Sign up for early access to the Maxio + Rillet integration and get ready to streamline your finance operations, improve accuracy, and accelerate insight.

Sign up now for early access

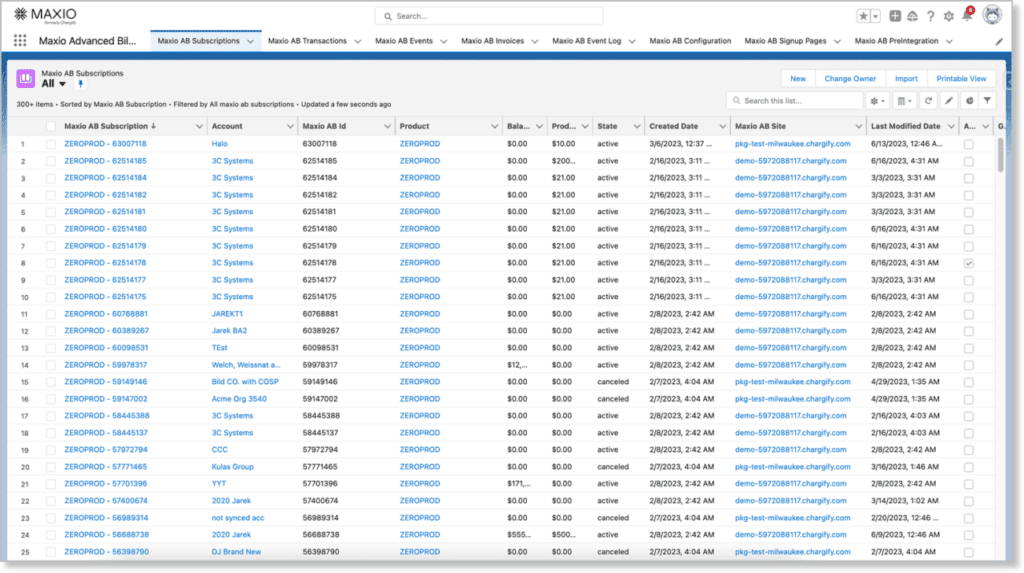

Pipedrive Integration

Experience a smoother hand-off from sales to finance

Connect Maxio to Pipedrive to automatically generate invoicing and revenue recognition schedules and send invoices directly from the platform.

Connect SaaSOptics to Pipedrive

Maxio has a native integration with Pipedrive. Connecting Maxio allows you to send data from Pipedrive to Maxio so you don’t have to manually enter sales orders into Maxio.

Map your fields

Map any important customer fields you want captured in Maxio such as customer name, billing address, and industry segment, as well as order fields such as items purchased, quantities, amounts, discounts, and any other custom field you wish to include.

Sync your sales orders

Process your orders efficiently and integrate all of your data so you can have confidence that your sales records will always match your financial records.

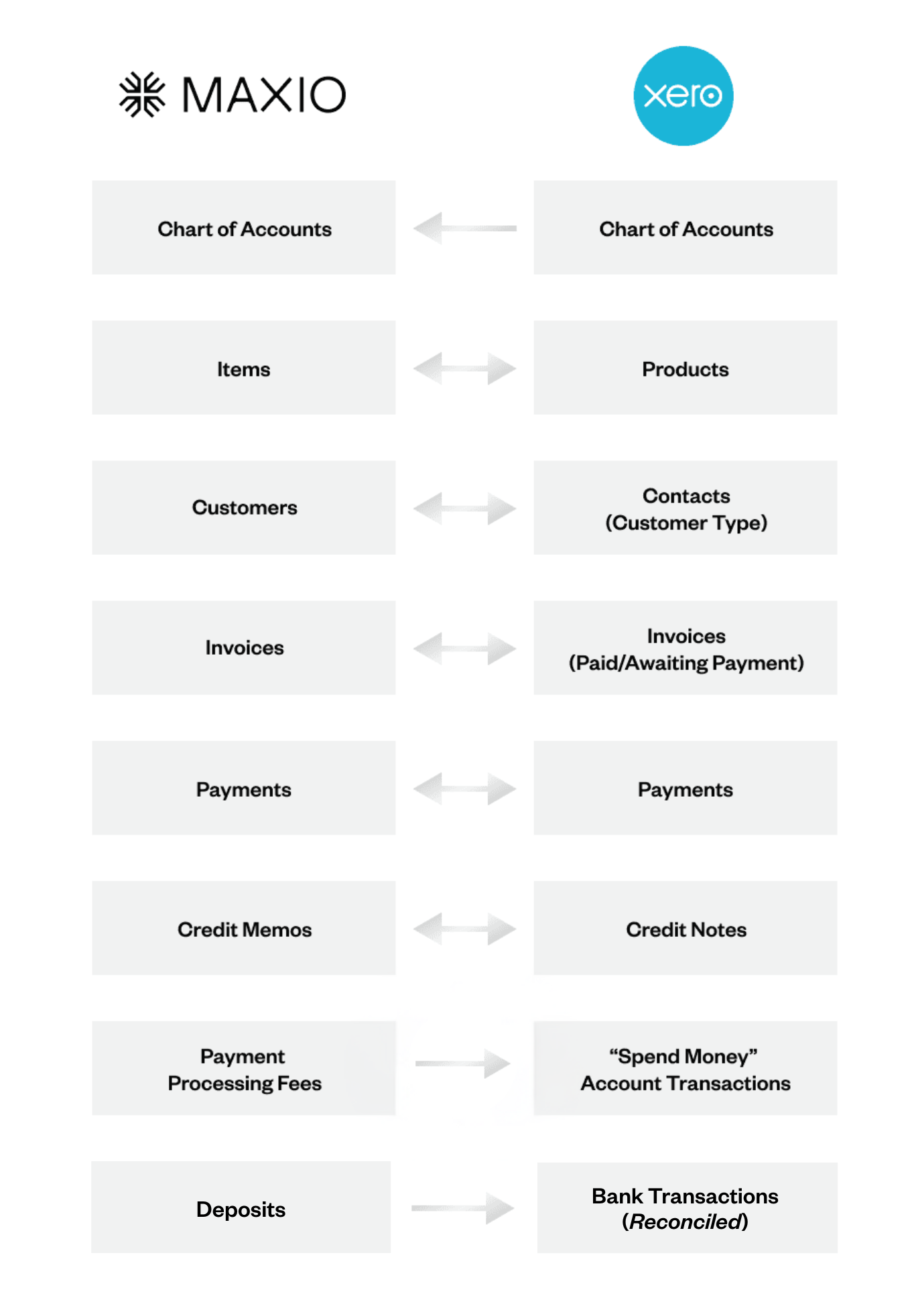

Xero

Streamline Accounting for Subscription Businesses

Maxio and Xero work together to automate the order-to-cash workflow for recurring revenue businesses, including invoicing and payment syncing, and deposit reconciliation.

Why Connect Xero and Maxio?

Connecting Xero and Maxio streamlines your business operations by automatically sharing data between the two systems. With this integration, you only need to enter your customer information, create invoices, and record payments in one place: Maxio.

All that financial data then seamlessly syncs over to your Xero account. This eliminates the hassle of manually transferring things like your customer contacts, invoices, payments, and credit memos between the two platforms.

This means no more double data entry or risking errors from copying information over — instead, Maxio becomes the centralized hub for all your billing and revenue activities, while Xero accurately maintains your books with that same financial transaction data.

How it works

Maxio is a financial operations platform for B2B SaaS companies that serves as a primary interface for managing contracts, transactions, invoices, and payments. This information can then be synced to Xero, keeping your accounting records up to date.

Even better, updates made in either system automatically update the other. This two-way sync gives you:

- A single view of your financials across platforms

- Automatic journal entries from Maxio transactions to Xero accounts

- The ability to email invoices directly from Maxio

- Automated deposit reconciliation

With this information flowing between Xero and Maxio, you’ll gain a more holistic understanding of your company’s financial performance.

Product Details

The Xero integration is configured through Maxio’s settings panel.

Within the settings panel, you can choose how frequently you want data to sync between the two systems — nightly, every 4 hours, or even hourly. This automation ensures your records are always up-to-date.

Our Xero integration also lets you streamline your workflow in other ways, too:

- You can have Maxio automatically create product/service profiles, complete with details like revenue recognition schedules, when new items sync over from Xero. This saves you from having to configure those settings manually.

- Keeping customer addresses aligned is a snap too. Just map the address fields in Xero that you want to use for billing and shipping addresses in Maxio. No more inconsistent contact info!

- What about those generic invoice line items that don’t specify a product/service? No problem — you can assign a placeholder item in Maxio to handle those while still maintaining accurate invoice totals.

- You have full control over what data syncs as well. Date filters let you prevent historical records from crossing over, while also allowing you to backfill recent invoices or payments that didn’t initially sync.

- Lastly, you can even have Xero generate the invoice numbers to maintain your branded numbering system.

With options for automation frequencies, streamlined product setup, address mapping, placeholder items, date filters, and more, the Xero integration gives you both flexibility and consistency across both platforms.

Further Product Details

Maxio offers closing date, transaction lock date, and Xero lock date options to prevent changes to synced records. While the closing date finalizes Maxio records, the Xero lock date — which occurs on or after the Xero closing date — takes precedence. This ensures data integrity when statutory deadlines are in place for your linked Xero accounting period.

This integration maps Maxio revenue and liability accounts to the corresponding accounts in your Xero chart of accounts. This allows invoices, payments, and credit transactions to post to the proper income, expense, asset, and liability accounts for accurate financial reporting and reconciliation.

When you enable the “Auto Generate Profiles” option, any new items you create in Xero will automatically sync over to Maxio with important profile fields pre-populated based on the account type. And don’t worry, this auto-generation only applies to newly added Xero items. Any existing product/service profiles you already have in Maxio will be left untouched to avoid disrupting your current setup.

Customer records created or updated in Maxio automatically sync to the Contacts section in Xero. Key fields like names, addresses, and contact information remain aligned across both systems. This provides a centralized view of customer data.

Invoices generated in Maxio flow over to Xero in a two-way sync. Invoice details like dates, amounts, line items, and taxes are matched in both platforms. Any updates made to synced invoices in either system will be reflected in the other for consistent billing records.

Similar to invoices, payments received and recorded in Maxio are automatically logged in the Xero account register. This seamless sync ensures payment data is current in both systems for monitoring receivables without redundant data entry.

Credit memos issued against invoices in Maxio convert to credit note transactions in Xero. The original invoices are adjusted in both systems so financial records remain aligned with refunds or adjustments applied to customer accounts.

When payments are processed in Maxio, any third-party fees charged by the payment processor (e.g. credit card processing fees) are calculated. These fee amounts are then synced to Xero and recorded as account transactions coded to the appropriate fee expense account per your chart of accounts mapping.

Customers are matched using selected Xero address fields like postal data. Shipping addresses can also integrate through optional mapping. Consistent contact info enhances the customer experience.

The date filters give you control over what financial data syncs between Maxio and Xero. This prevents issues with historical records while allowing new transactions to flow seamlessly once you’re past a certain date.

Non-specific line items import with zero amounts as placeholders to maintain your invoice totals/balances for financial accuracy. This ensures all charges are represented without disrupting sync workflows.

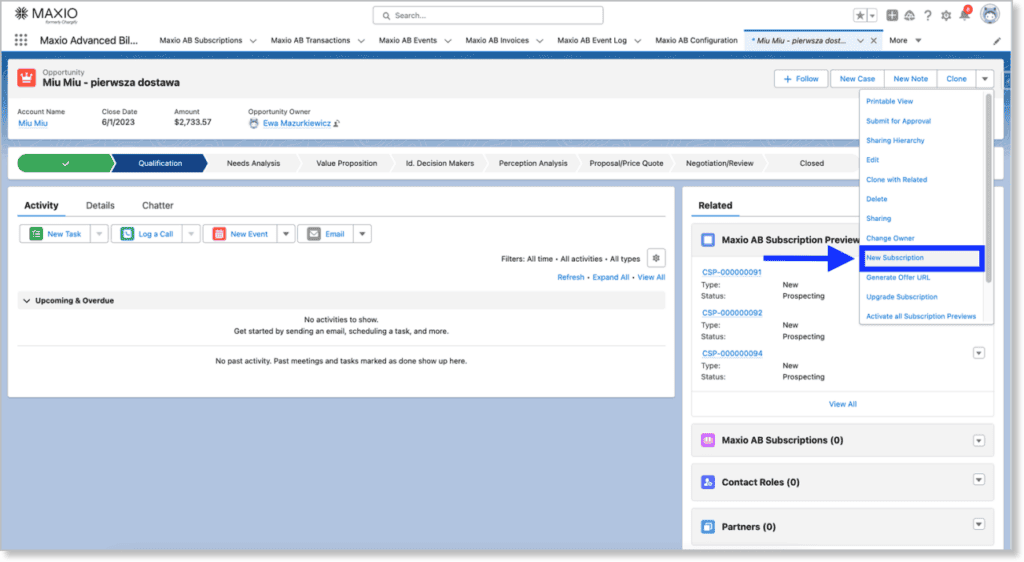

Salesforce

Streamline Accounting for Subscription Businesses

Maxio and Salesforce work together to automate the order-to-cash workflow for SaaS and subscription businesses.

Why Connect Salesforce and Maxio?

Connecting Salesforce and Maxio empowers businesses to streamline their sales and billing processes, ensuring seamless two-way data synchronization between the two platforms.

As a result, this integration eliminates manual data entry, reduces errors, and provides your teams with real-time insights into customer accounts and billing information.

How it works

This integration between Salesforce and Maxio creates a unified system that seamlessly connects your sales with your billing operations.

This means that your Salesforce Accounts and Contacts automatically sync with Maxio’s Customer records, keeping your customer information consistent and up-to-date across both platforms. For example, if an account has multiple contacts, you can specify the relevant contact during the creation of a customer or subscription in Maxio.

In addition to this two-way sync, products created in Maxio appear as products in Salesforce, with details like price points and currency managed through Salesforce Price Books. This ensures your pricing information is accurate and easily accessible within Salesforce. Additionally, you can create subscription previews from Salesforce Opportunities, allowing you to save and activate pricing previews when a deal is won, or manually when needed.

Another key feature of this integration is the ability to generate PDFs from subscription previews, which can be shared with customers during negotiations—this can help streamline your sales process by providing clear and professional pricing documentation for both your sales reps and your potential customers.

And if that wasn’t enough to pique your interest, then you’ll be happy to know that when you create subscriptions with a “Consolidated” Invoice Type, they form a subscription group in Maxio, making it easy to manage your billing operations.

Product Details

Customer and contact management

By linking Salesforce Contacts with Maxio Customer records, you can maintain detailed customer profiles that capture all relevant billing and subscription details. Additionally, this integration allows for easy migration of existing Salesforce Contacts to new or different Maxio Customer records, ensuring that all information remains accurate and current.

Subscription management

You can add Subscription Previews to Salesforce Opportunities, providing a preview of the subscription details that can be activated upon deal closure. This feature also streamlines the sales process by allowing sales teams to prepare and finalize subscription details in advance. Additionally, during the creation of a subscription, you can collect payment profile information, ensuring that all necessary payment details are gathered upfront.

Invoicing and payments

With this integration, you can perform various invoice actions within Salesforce such as recording payments, applying credits, and generating public URLs for invoices. Additionally, you can generate one-time invoices directly from Salesforce, with customizable fields and line items.

Custom fields and quoting

You can use this integration to use subscription previews as quote versions. This enables you to negotiate deals with accurate, detailed quotes before closing potential opportunities.

Customizable offer signup pages

Create customizable offer signup pages with unique links for customers to self-service their subscriptions.

Availability and pricing

The integration is available on Salesforce Developer, Professional, Enterprise, and Unlimited plans, and is compatible with both Salesforce Classic and Lightning. It works seamlessly in both sandbox and production environments, supporting multiple API keys and subdomains.

To ensure a smooth implementation, we strongly recommend testing the integration in a Salesforce sandbox account before enabling it in production, as this helps identify and resolve any potential conflicts with custom workflows or processes.

Sage Intacct

Maxio + Sage Intacct: The Ultimate Financial Operations Integration for SaaS

Unify your billing, revenue, and reporting workflows with a purpose-built integration designed for growth-stage B2B SaaS and software companies. Automate complex billing, eliminate data silos, and unlock investor-ready insights—all within your existing Intacct environment.

Why Maxio + Sage Intacct?

In today’s fast-scaling SaaS landscape, financial operations are no longer just a cost center—they’re a growth catalyst. This integration bridges the gap between disconnected billing and accounting systems, turning financial operations into a strategic advantage.

Why this matters:

- Accelerated Growth: SaaS companies with unified financial systems grow 34% faster than those using fragmented tools.

- Operational Efficiency: Maxio eliminates manual quote-to-cash steps that slow down go-to-market execution.

- Strategic Visibility: With real-time metrics and cohesive data flows, finance leaders can make confident, data-driven decisions.

- Audit-Ready: Automate revenue recognition and reduce risk ahead of fundraising, diligence, or global expansion events.

What You Get

Maxio’s integration with Sage Intacct empowers B2B SaaS businesses with bi-directional data flows that unify subscription billing, revenue recognition, and analytics within a single connected ecosystem.

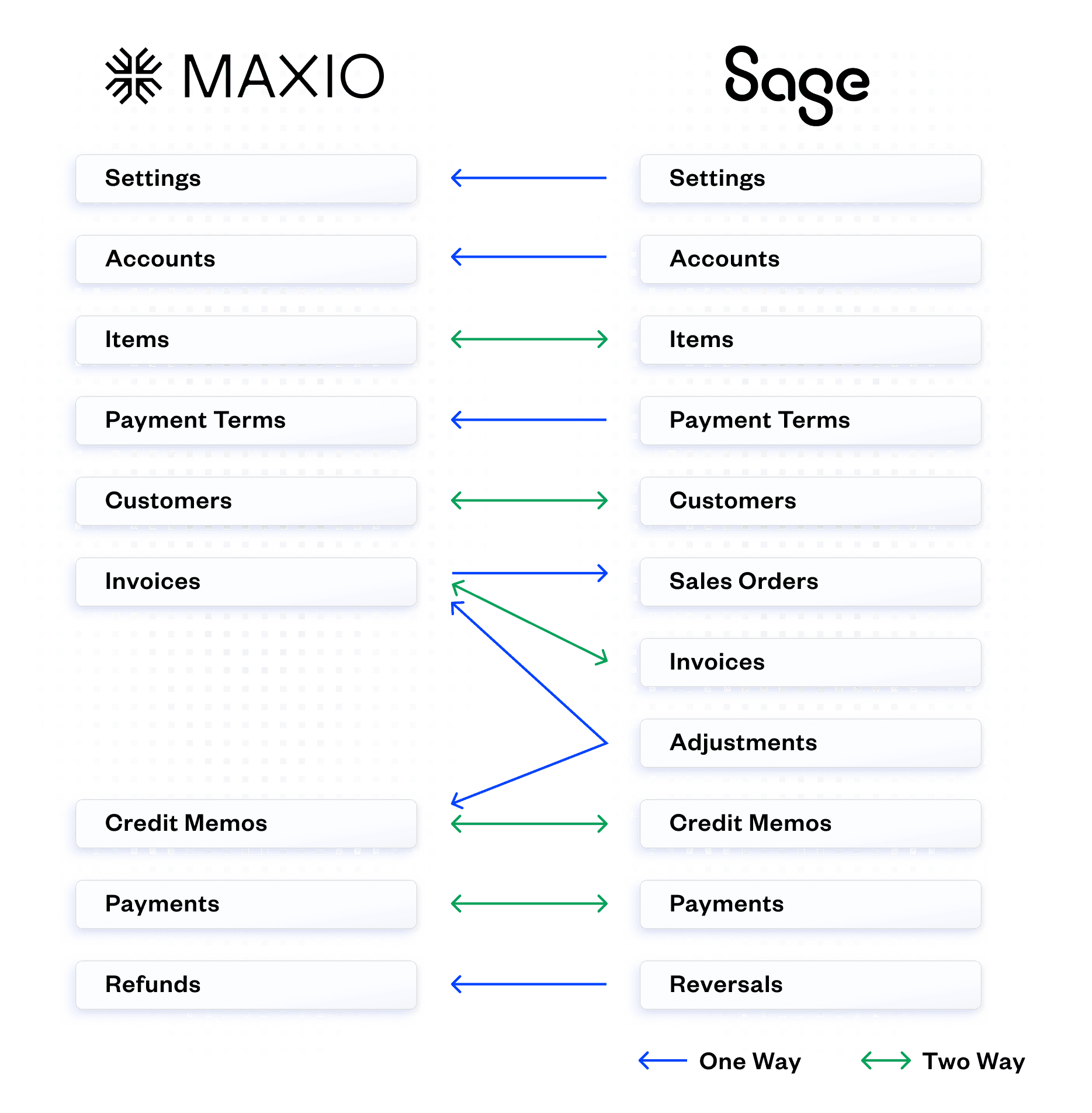

- Two-way Syncing: Maxio integrates directly with key Sage Intacct objects like customers, sales orders, invoices, credit memos, payments, and adjustments. This creates a single source of truth across billing, revenue, and ARR reporting.

- Tailored to SaaS Needs: Go beyond Sage Intacct’s native capabilities with Maxio’s specialized support for usage-based billing, hybrid pricing models, and advanced contract modifications.

- Automated Workflows: Simplify complex AR processes, automate contract changes, and launch flexible pricing—without requiring developer support.

- Faster Time to Value: Customers like Vero reduced their time to close by 75%, while others have automated pricing launches, ARR reporting, and revenue workflows in days—not weeks.

How It Works

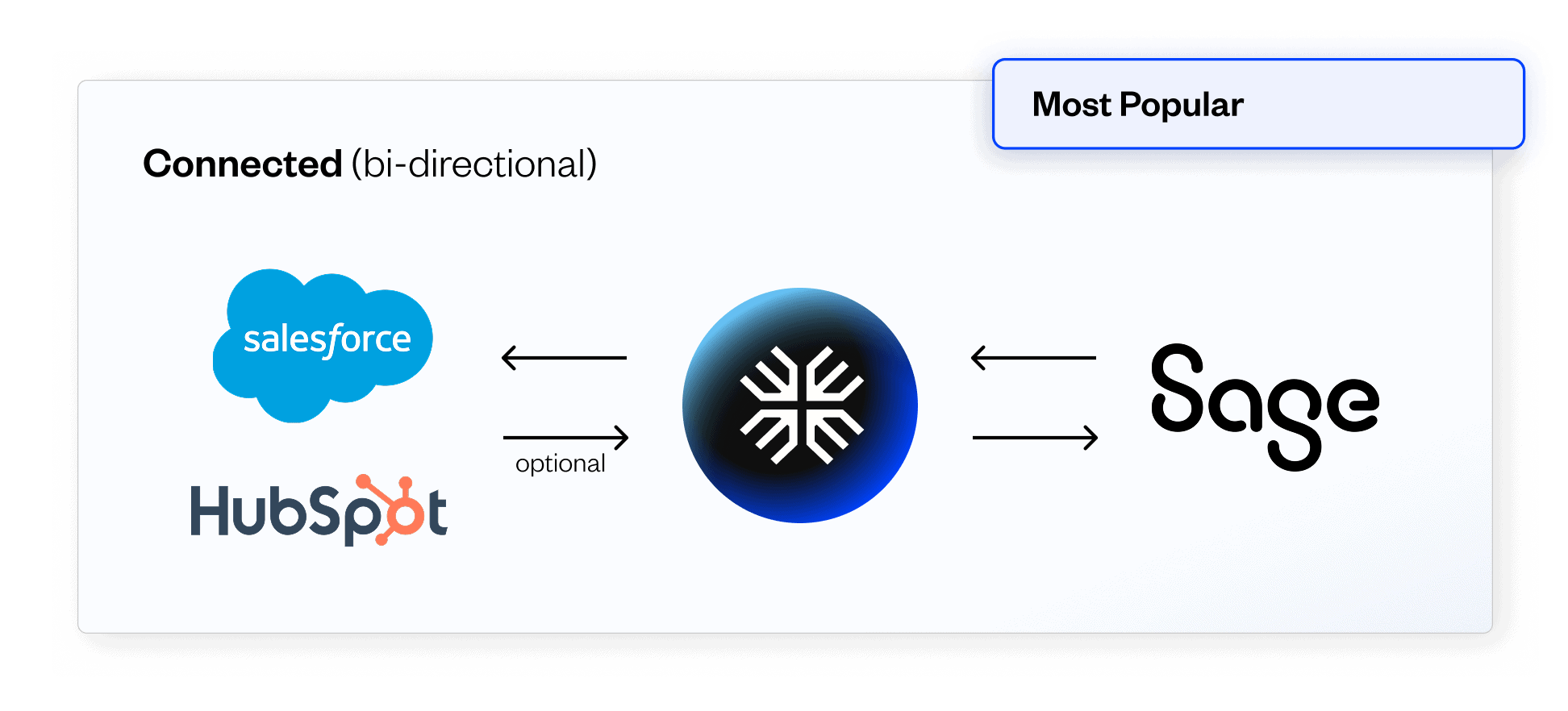

The Maxio + Sage Intacct integration is designed to seamlessly connect your CRM, billing, and financial systems, eliminating manual processes and accelerating your quote-to-cash operations. Choose the integration model that fits your business.

Maxio acts as the primary bi-directional connector between your CRM and Intacct to automate your quote to deposit workflows and create all customer and billing records.

“Maxio Metrics” is designed to ingest data from Intacct to automate ARR reporting while leveraging Intacct for billing and rev rec.

Maxio may be connected to a CRM but can run disconnected from Intacct. A summary entry is recorded for revenue each month but no customers, invoices, or related records are directly created in Intacct from Maxio.

Core Functionalities

Automate subscription invoicing, collections, and revenue recognition workflows.

Configure usage-based pricing, milestone billing, or hybrid models with no-code flexibility.

Sync payment data, contract terms, and financial metrics to remove manual reporting bottlenecks.

Maxio Metrics ingests Sage Intacct data to deliver investor-grade SaaS analytics, including ARR, churn, and retention.

Quotapath

Revolutionize Your Sales Commission Tracking

Say goodbye to spreadsheet hassles with Maxio’s QuotaPath integration.

How long does it take your team to calculate and account for sales commissions in spreadsheets? If the answer is “too long,” we have the perfect solution for you.

We’ve partnered with QuotaPath to transform how you manage sales commissions. QuotaPath is a powerful commission tracking platform designed to simplify and automate the entire process.

Combined with Maxio’s Expense Recognition module, this integration not only streamlines commission calculations but also automates the accounting of sales commissions. This means you’ll always know exactly how much to pay your team and can account for it effortlessly.

Why Connect QuotaPath and Maxio?

QuotaPath helps sales teams design fully customizable compensation plans, forecast commissions in real-time, and uncover valuable insights — all within an intuitive dashboard. Say goodbye to manual calculations and data entry. With QuotaPath, you can automate commission payments and rely on Maxio’s Expense Management module for seamless accounting and financial reporting.

Key Features of the QuotaPath Integration

1. Customizable Compensation Plans

Design compensation plans that fit your unique business needs. QuotaPath allows you to create and manage various commission structures, ensuring your sales team is rewarded accurately and fairly.

2. Real-Time Commission Forecasting

Stay ahead with real-time insights. QuotaPath’s forecasting tools enable you to predict future commissions, helping you make informed decisions and adjust strategies promptly.

3. Intuitive Dashboard

Gain complete visibility with an easy-to-use dashboard. Monitor performance, track progress, and surface insights without the hassle of navigating complex systems.

4. Automated Calculations

Eliminate human error and save time. QuotaPath automates commission calculations, removing the need for manual data entry and reducing the risk of inaccuracies.

5. Seamless Sync with Maxio

Ensure your financials are always up-to-date. Commissions calculated in QuotaPath sync automatically into Maxio as Expense Obligations, simplifying your accounting processes.

How it works

Once connected, commissions calculated in QuotaPath sync automatically into Maxio as Expense Obligations. From there, you can process these obligations to amortize expenses and generate the necessary financial records. Here’s a step-by-step overview:

Payout Commissions

Payout a sales commission in QuotaPath.

Sync and Import

Complete a sync with QuotaPath in Maxio; commissions come in as Expense Obligations.

Process Obligations

Generate the necessary vendor, contract, expense transaction, and bill records.

Expense Recognition

Create an expense recognition schedule for advanced reporting.

Product Details

The QuotaPath integration is configured through Maxio’s settings panel. Here’s a closer look at these specific QuotaPath product details:

The authentication token is a unique identifier that QuotaPath uses to verify and allow access to your account. This token ensures that only authorized users can sync data between QuotaPath and Maxio.

Vendors in QuotaPath typically refer to your sales representatives or agents. By enabling the sync vendors option, you allow Maxio to import and maintain an up-to-date list of these sales reps. This is especially useful for ensuring that commission payments and related accounting entries are correctly attributed to the right individuals. If your sales team frequently changes or if accurate vendor tracking is critical for your operations, enabling this setting can save significant time and reduce errors.

The Default Register setting determines which accounting register in Maxio will receive the expense obligations imported from QuotaPath.

An accounting register is essentially a ledger where financial transactions are recorded. Choosing the appropriate default register is important to ensure that all commission-related expenses are accurately tracked and reported. This helps you maintain organized financial records and simplifies the reconciliation process.

This setting allows you to determine how frequently Maxio should sync data with QuotaPath. You have three options:

- Manual: Sync only when manually triggered by a user.

- Nightly: Automatically sync once every night, ensuring daily updates.

- Hourly: Automatically sync every hour for the most up-to-date information.

Selecting the right sync schedule depends on your business needs. If you require real-time data updates, the hourly option is ideal. For less frequent updates, nightly or manual syncing might suffice.

This setting defines the starting point for syncing legacy bills from QuotaPath into Maxio. By specifying a date, you can control which historical data gets imported.

This is useful if you only want to sync bills from a certain fiscal year or project start date. It helps avoid cluttering your current financial records with outdated information and ensures that only relevant data is synced.

Similar to the previous setting, this one specifies the end date for syncing legacy bills. It defines the cutoff point for the data you want to import into Maxio.

Setting this date helps maintain a clean and organized financial database by preventing the import of future or irrelevant bills. Together with the “Sync Bills On or After Date,” it allows for precise control over the range of data synced.

Enabling this setting allows QuotaPath to make updates to Expense Transactions in Maxio. This means that if any changes occur in the commission calculations or payments within QuotaPath, these updates will be reflected in Maxio.

When this setting is enabled, the associated Bills and Expense Schedules in Maxio will be regenerated to match the latest data from QuotaPath. This is particularly useful for ensuring that your financial records are always accurate and up-to-date, accommodating any adjustments or corrections made after the initial sync.

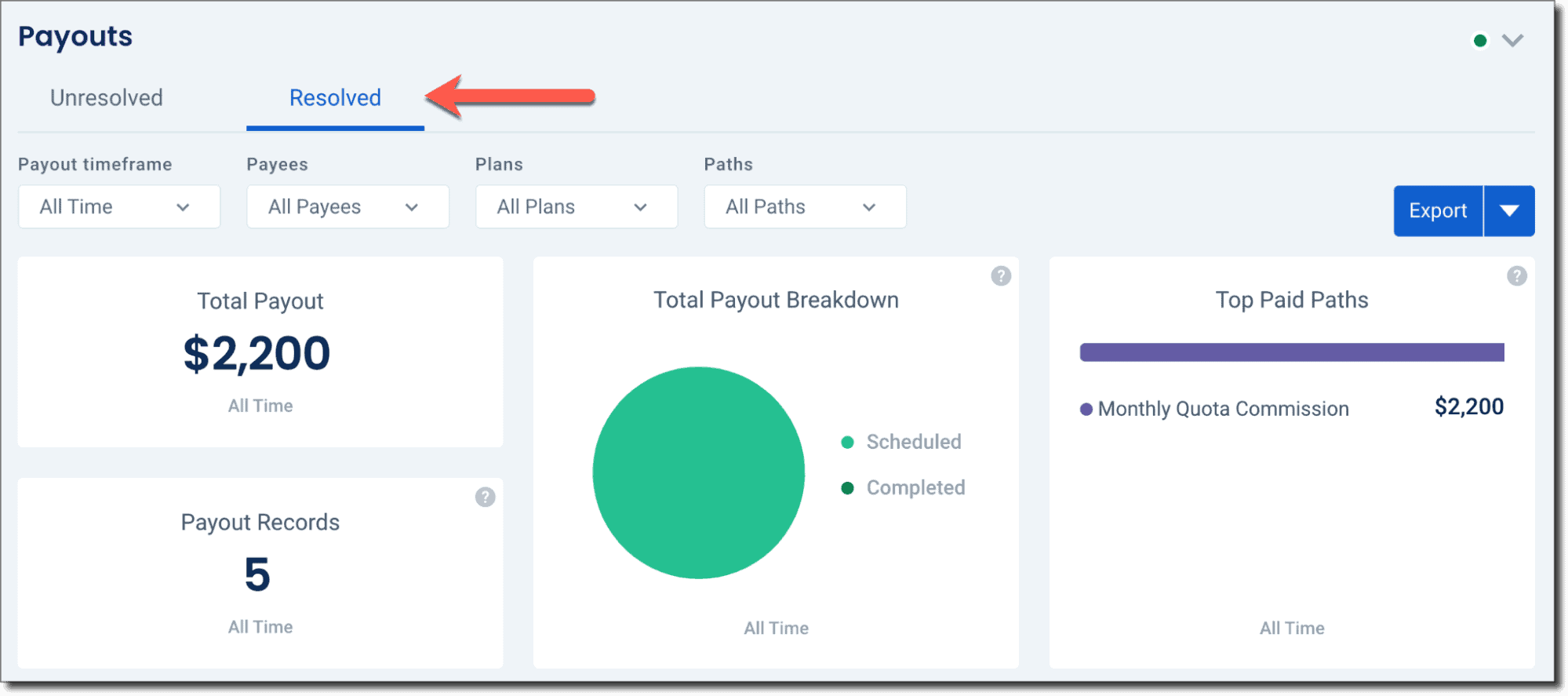

Reliable and Compliant Payouts

Maxio pulls “Resolved” payouts from QuotaPath, ensuring data accuracy and reducing the risk of changes affecting your financials.

Concerned about accruing unpaid amounts? Maxio accounts for the date commissions were earned versus paid, maintaining compliance even with significant delays between earning and payment dates. Our purpose-built expense recognition feature also handles cumulative catch-ups, making it easy to manage prior accounting periods.