Maxio Institute Report

The Growth State of B2B SaaS Businesses in January 2024

Growth rates seem to have steadied throughout 2023—but what that means for each business is a little different. In this report, we dig into the “new normal” for businesses based on billing type, size, region, and—new to this report—industry.

Table of contents

- Part 1: The state of B2B subscription growth

- Part 2: Consumption vs invoicing companies

- Part 3: Growth by size

- Part 4: Growth by industry

- Part 5: Growth by US region

- Key takeaways

Part I: The state of B2B subscription growth

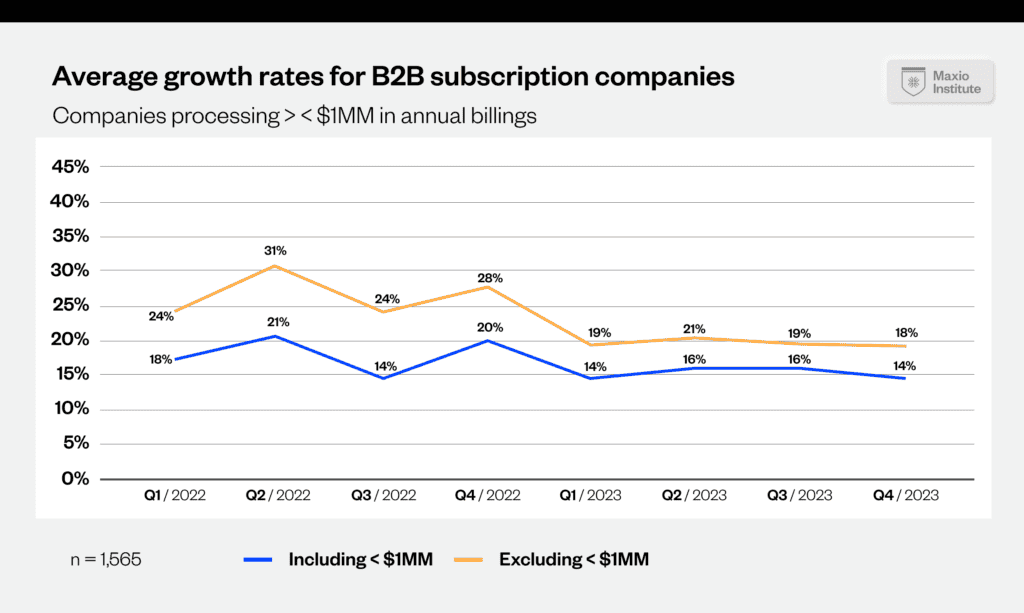

B2B businesses’ growth rates seem to have steadied throughout 2023. While we observed modest improvement in growth rates throughout Q2 and Q3 of 2023, growth rates for subscription businesses processing up to $100MM leveled off and slightly declined to finish the year at 14% growth in Q4, a 6% decline from the same period in Q4 2022.

During the Federal Reserve’s most recent meeting, it was noted “recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter.” Our analysis suggests the growth rates observed throughout 2023 are here to stay for the foreseeable future. We believe the market is returning back to normalized growth levels after experiencing a period of abnormal growth and fluctuation. This period of abnormal growth continues to weigh heavily throughout the private technology and subscription sectors.

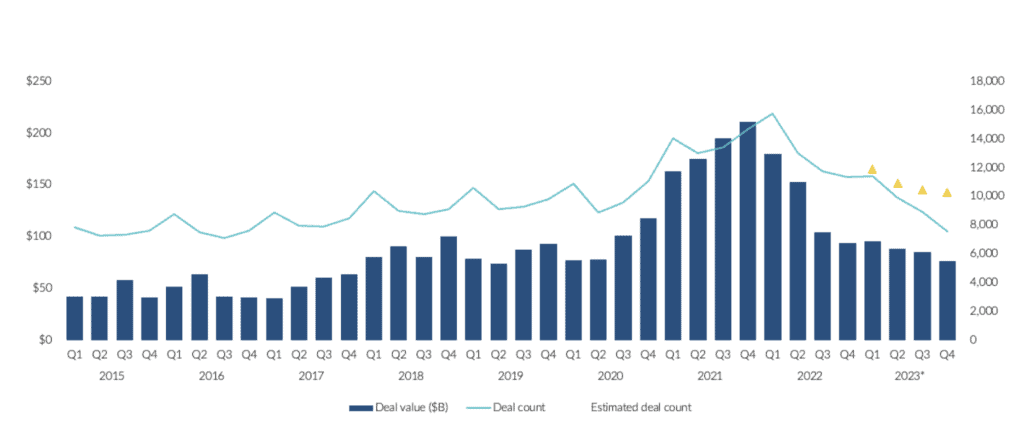

As PitchBook observed in their Q3 2023 Venture Monitor, “More companies are taking bridge, continuation, or down rounds; inside rounds are at multi-year highs; and there are fewer rounds with a new lead investor obtaining a board seat than at any time in at least a decade. Investors and founders alike are optimizing for stability and cash flow to meet the challenges of the current market.” If businesses have not yet reoriented around cash-efficient growth, it may be too late. You might be forced to raise capital just to keep the lights on.

Declining growth rates are weighing on investors’ ability to effectively deploy capital raised in the last three years. Some VC/PE firms have paused investing in new funds, as OpenView observed in December, and we would not be surprised to see others potentially return capital to investors beginning in 2024, a trend last broadly observed in 2008/2009.

The quantity of deals is the lowest it has been since 2016, and we expect this trend to continue at depressed (or, rather, normalized) levels. The bar for receiving investment remains high, or at the very least, expensive, if you lack high growth and favorable unit economics.

The remainder of this report walks through key findings from our analysis of more than 2,000 B2B SaaS companies, representing $15B in annualized volume over the last 24 months. We’ll dive deeper into notable growth insights based on:

- Billing type

- Industry

- Size

- Region

The State of SaaS Growth 2024

In this report, we present an update on the overall state of today’s B2B subscription marketplace based on the actual billing data of over 2,000 B2B SaaS companies. We discuss:

- The general return to normalized growth levels in 2023

- The differences in “normalized” growth rates for each industry, including which industries grew the most and which proved “recession-proof”

- The impact of billing model on company growth from $0-$1MM, and then to $100MM

Get the full report

About the Maxio Institute

The Maxio Institute is a research arm of Maxio, the #1 billing and financial operations platform for B2B SaaS businesses. Through our work with over 2,000 subscription businesses, we’re uniquely positioned to provide data-backed insights and benchmarks. Our goal is to help B2B SaaS businesses of all sizes gain an accurate picture of the current market, so they can make informed decisions about their future.