2023 Maxio Institute Report

The Growth State for B2B Subscription Businesses

We’ve analyzed the billing data of over 2,100 B2B SaaS companies between 2022 and 2023 and have presented key insights, including growth rates of businesses based on billing type, where some of the fastest growing companies are located, and the bar for raising your successive round of investment.

Table of Contents

Part I: The state of B2B subscription growth

Part II: Consumption vs invoicing companies

Part III: Growth by size

- Annualized growth rate by cohort

- How to break break past $1MM in recurring billings

- The best (90th percentile) vs the rest (50th percentile)

Part IV: Growth by region

- East Coast, West Coast, or Midwest?

Part V: Growth by funding

- What it takes to get funded and stay funded

The state of B2B subscription growth

B2B subscription businesses continue to display resilience in the face of a challenging economic environment. Despite tightened access to capital, B2B subscription businesses have continued to grow since the beginning of 2022s, averaging 10-15% YoY growth throughout the first two quarters of 2023.

While this continued growth is encouraging, it’s still a large decline from the growth rates experienced in 2021 and 2022 amid a period of unprecedented stimulus programs and soaring valuations. The decline in growth has driven a shift from “growth at all costs” to “efficient growth” as access to capital at desirable valuations is no longer an easy task.

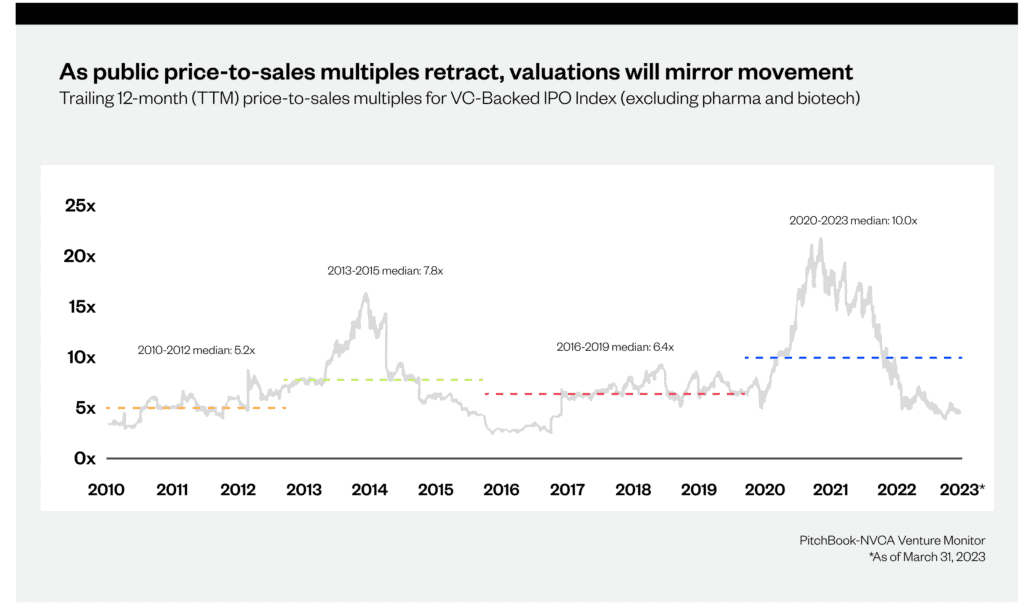

According to the pitchbook venture monitor report, the median price-to-sales multiples for VC-backed public companies between 2010 and 2023 was 10.0x. This was largely driven by the valuations in 2021 (~20.0x) and into the first half of 2022 (~10.0x). However, the economic outlook in 2023 is significantly lower with the average valuation standing around 5.0x, a 75% decline from the average valuations seen in 2021.

While we believe the current economic state is here to stay for the next 12 months (at least), we’re confident B2B companies can weather this period of economic uncertainty if they are able to manage their cash positions.

The following report walks through key findings from our analysis of more than 2,100 B2B SaaS companies over the past 18 months. We’ll analyze notable growth differences between businesses based on:

- Billing type

- Size

- U.S region

- Funding stage

Want more? Download the full report using the form below.

The State of SaaS Growth 2023

We’ve analyzed the billing data of over 2,100 B2B SaaS companies between 2022 and 2023 and have presented key insights, including:

- Growth rates of businesses based on billing type

- Where some of the fastest growing companies are located

- The bar for raising your successive round of investment.

Download the report

About the Maxio Institute

The Maxio Institute is a research arm of Maxio, the #1 billing and financial operations platform for B2B SaaS businesses. Through our work with over 2,000 subscription businesses, we’re uniquely positioned to provide data-backed insights and benchmarks. Our goal is to help B2B SaaS businesses of all sizes gain an accurate picture of the current market, so they can make informed decisions about their future.