Deferred Revenue vs. Revenue Backlog

What’s the difference between Deferred Revenue and Revenue Backlog?

While commonly confused with each other, deferred revenue and revenue backlog are distinctly different. And if your company is treating deferred revenue and revenue backlogs as the same thing, you risk misstating GAAP Revenue and losing credibility with auditors and investors.

Keep reading to make sure your company isn’t treating deferred revenue and revenue backlogs as the same thing and throwing off GAAP reporting.

Deferred Revenue

Deferred Revenue is a current liability account used in financial reporting. Deferred Revenue appears on the balance sheet and is calculated as follows:

The sum of (the total of invoices for all contract elements for a single contract — the total of recognizable revenue for all contract elements for a single contract). Note if the calculation for a contract produces a negative number, the value is included in unbilled AR; a balance sheet current asset.

Revenue Backlog

Also sometimes referred to simply as “backlog”, revenue backlog is the sum of the balance of unrecognized revenue that occurs when you recognize revenue for term subscriptions over the term of the subscription.

How do you calculate deferred revenue vs. revenue backlog?

Generally speaking, both numbers would be calculated using the same revenue schedules and are drawn down using those schedules. However:

- Deferred Revenue is a financial reporting number that appears on the balance sheet.

- Revenue backlog is not a balance sheet item, but could and frequently does appear in financial commentary.

- The Deferred Revenue calculation involves invoices, and because it does, the value can bounce up and down based on how you are invoicing the customers

- The Revenue Backlog calculation does not involve invoices and because of that, it declines over time as the revenue is recognized

- Deferred Revenue might be split into two accounts, “Current Deferred Revenue” for Revenues within the next 12 months, and Long Term Deferred Revenue for revenues in excess of 12 months

- Revenue Backlog is not typically constrained to a timeframe

- Deferred Revenue starts when the first contract invoice is sent

- Revenue Backlog starts when the contract is executed, which is to say when an order is typically “booked”

Let’s look at two examples to illustrate the differences.

Example Subscription #1

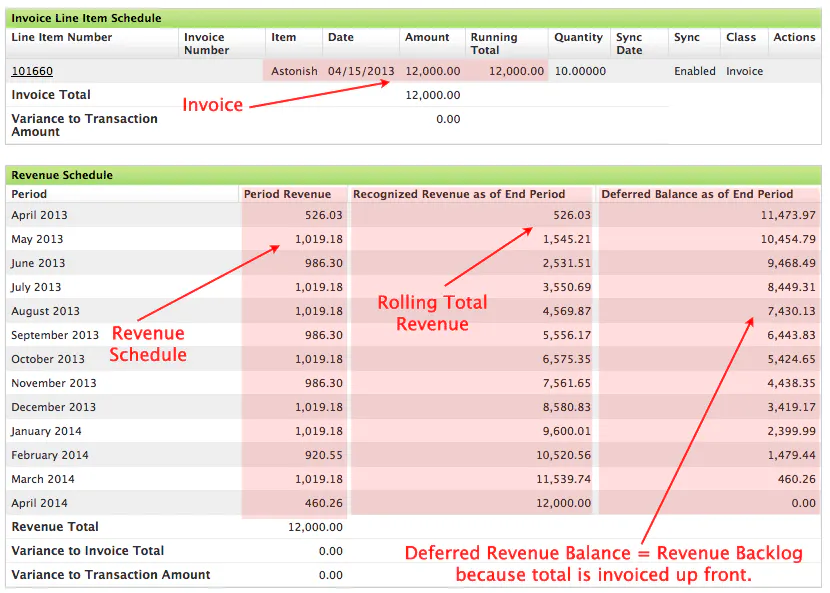

A one-year 12,000 subscription has an order date of April 1, 2013, a subscription start date and revenue start date of April 15, 2013, and a subscription end date and revenue end date of April 14, 2014. The subscription is invoiced all on the subscription start date of April 15, 2013.

In this image, there is an invoicing schedule with one record, and a revenue recognition schedule with a record for each month of revenue recognition over the term.

In use in this example is the GAAP friendly daily amortization schedule. The second column, Period Revenue, is the revenue for the month. The third column, Recognized Revenue as of End Period, is the rolling total of revenue as the months progress. The fourth column is the Deferred Revenue Balance as of the End of the Period.

In this example, the Backlog would be 12,000 reportable as backlog from the order date of April 1 through April 15. Since there is no invoice prior to April 15, there is not deferred revenue to report between April 1 and April 15.

On April 15, when the entire 12,000 is invoiced, and thereafter, the Revenue Backlog equals the “Deferred Revenue Balance as of the End of the Period,” column 4 in the Revenue Schedule. Again, this is because the total of 12,000 was invoiced on April 15.

If the 12,000 were invoiced on April 1, the Deferred Revenue would be reportable as of April 1 as 12,000, and remains 12,000 through April 15 when the revenue schedule begins. So, in the case where the Order Date equals the Invoice Date and there is a single invoice for the subscription, the Revenue Backlog and Deferred Revenue are identical at all times.

Example Subscription #2

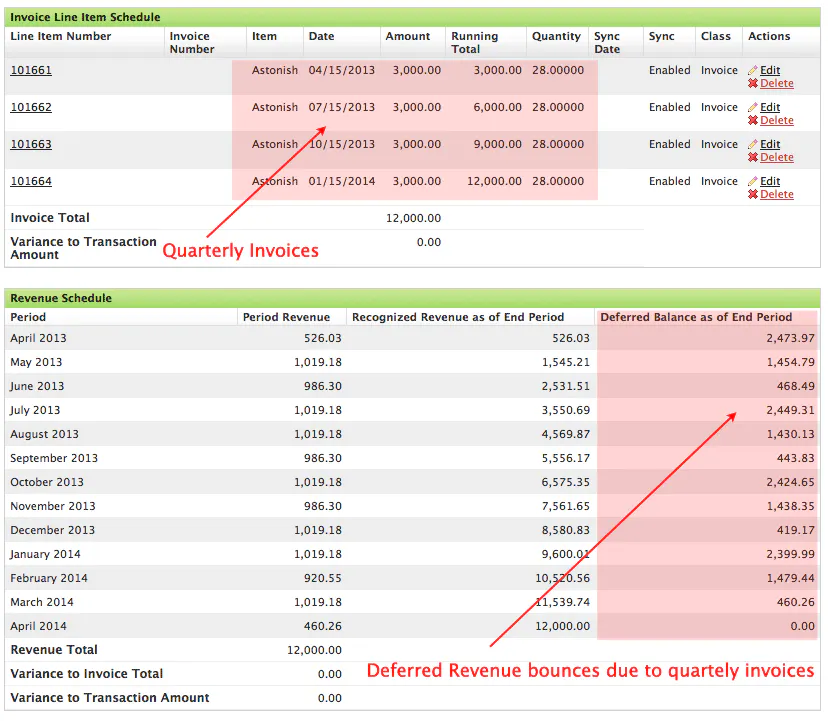

The value and dates of the subscription are identical. A one-year 12,000 subscription has an order date of April 1, 2013, a subscription start date and revenue start date of April 15, 2013, and a subscription end date and revenue end date of April 14, 2014.

However, this subscription is invoiced quarterly starting on April 15, 2013In the Revenue Schedule table, the values in columns 1, 2, and 3 are identical to that in Example 1 above. It is only the 4th column, Deferred Balance as of the End Period that is different.

In example 2, the Revenue Backlog is the same as it is in example 1 on any given day because Revenue Backlog is not affected by invoices. Below, we have added a Revenue Backlog as a 5th column. Here, you can clearly see the significant difference between Deferred Revenue and Revenue Backlog.

Conclusion

Have follow up questions about revenue backlog? Don’t hesitate to reach out to us here at Maxio.

FAQS

Is backlog the same as deferred revenue?

The short answer: No. The long answer: Deferred Revenue is invoices (or payments) to date minus revenue recognized to date whereas backlog is the unbilled portion of contracts.

What is backlog in accounting?

A backlog is the unbilled portion of a contract.