What is MRR? Calculate and Enhance Monthly Recurring Revenue

Monthly Recurring Revenue (MRR) is an essential financial metric that measures monthly predictable revenue. It includes all recurring revenue, including upgrades, coupons, and discounts but does not typically include one-time and variable fees.

What is MRR in SaaS?

MRR’s main benefit is its ability to report performance across dissimilar subscription terms. MRR isn’t a Financial Accounting Standards Board (FASB) nor a Generally Accepted Accounting Principle (GAAP) defined term, meaning there’s no “right” way to calculate it.

MRR reporting is challenging when juggling several scenarios at once, because there are so many variables to consider. Consider, for example, if you had six customers with the six unique subscription types?

Customer A subscribes to a one-year term with a $1,200 total contract value

Customer B subscribes to a two-year term with a $2,400 total contract value

Customer C upgrades mid term, adding $845 in contract value to what was previously a $1,200 contract, and is now a $2,045 contract value

Customer D downgrades mid term, reducing what was previously a $1,200 contract to $638

Customer E has a $1,200 annual contract but updates and extends the contract at the same time, establishing a new end date

Customer F fails to renew a three-year contract with a total contract value of $3,600

In each of these scenarios, using traditional methods of bookings would make it hard to get a clear sense of performance. Specifically, real growth rates and churn rates are difficult to measure without some form of contract revenue normalization.

MRR provides that normalization.

MRR is used to evaluate numerous subscription performance reports, such as momentum, customer lifetime value (CLV), and MRR cohort. It can easily be multiplied by 12 to provide a year-long overview of your finances, called annual recurring revenue (ARR).

Without MRR, it’s difficult to gain any real insight into monthly revenue on a usable scale. For startups, this could be a critical component of measuring growth.

What is MRR in SaaS?

MRR is the most important metric used in most SaaS companies, as it provides very simple and highly usable data that form decisions and shape business growth.

MRR allows teams to track recurring revenue performance across dissimilar subscription terms, which is essential for subscription-based business models, like those often seen in SaaS companies.

But MRR is not just a single number. Rather, it’s the momentum around various factors that define the company’s MRR, including:

- New MRR: Revenue generated from new customers

- Net New MRR: How much revenue has grown or shrunk compared to the previous month

- Expansion MRR: Contract upsells, cross-sells, and add-ons

- Upgrade MRR: Revenue generated from subscription plans that have increased from their original pricing to a higher price point

- Contraction MRR: The amount your company losses due to cancellations and downgrades

- Downgrade MRR: Reduced revenue from subscriptions that have moved from a higher price point to a lower price point

- Reactivation MRR: The number of churned customers who returned to a paid plan

- Churn MRR: The amount of revenue your company loses from subscription cancellations from month to month

It may sound like this metric refers to revenue recognition (it is monthly recurring revenue, after all), but that’s not true. This is a common reason for confusion in the finance department of many startups. MRR is calculated very differently.

Since there’s no standard way to calculate MRR, organizations must determine which metrics are best for them to focus on and any additional MRR details that matter. Tracking new customers is very important, as is monitoring what current customers are doing. Beyond looking at just monthly fees, you must consider the broad picture—what’s happening over time and why?

Importance of tracking MRR

MRR is used in many different ways. Companies use it to:

- Report growth from new contracts, including those with different term lengths

- Report on net gross expansion and contraction from existing customers

- Assess trends in average selling price (ASP)

- Calculate customer lifetime value (CLV)

- Report on MRR cohorts, usually by customer start month, quarter, or year

- Estimate or projects for future GAAP revenue

For subscription-based SaaS businesses, MRR is a metric used on a monthly basis to analyze bottom-line figures in a way that makes sense. Using this information, you can inform your sales team, plan for future revenue needs or limitations, and work to build new marketing campaigns or better monthly subscriptions to attract and build customers.

MRR and GAAP revenue

MRR is not typically reportable GAAP revenue because there are variances in these metrics.

MRR is a normalized measurement of recurring revenue, most frequently measured with a constant value in each month of the subscription period. GAAP revenue is best computed using a daily recognition model. In other words, revenue is recognized pro-rata each day between the start and end date of the subscription.

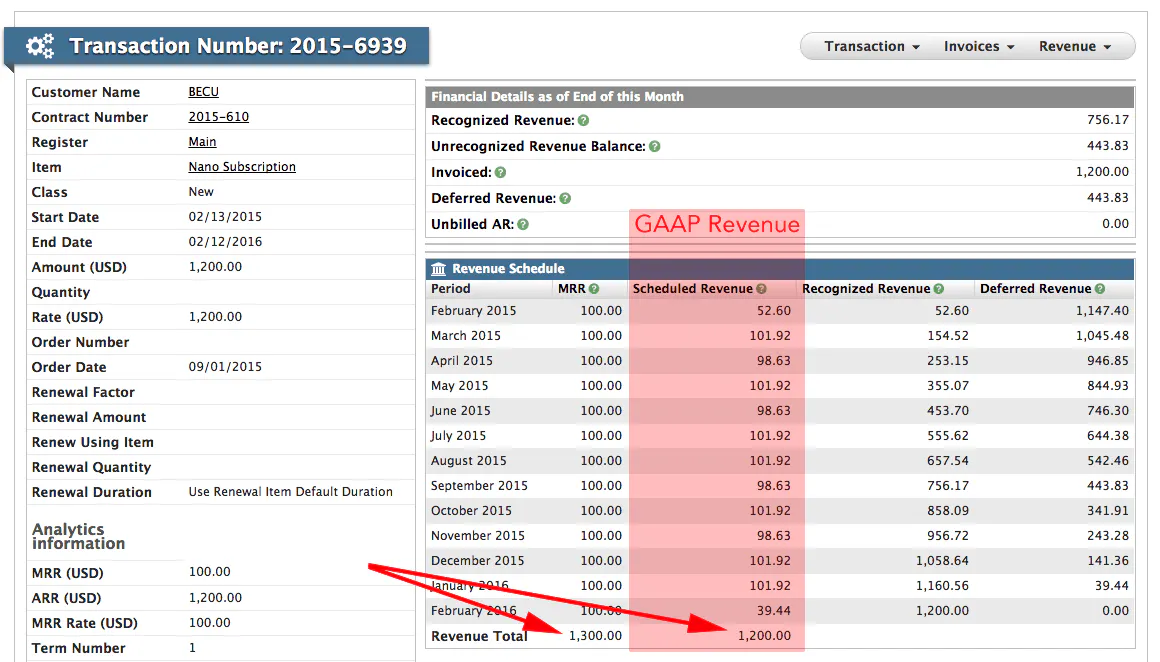

The distinction between MRR and GAAP revenue is best understood when viewing the value of the subscription’s MRR and GAAP revenues per month side-by-side.

This image shows both the MRR and GAAP reportable revenue for a $1,200 annual subscription that begins on February 13, 2015, and ends on February 12, 2016.

The GAAP revenue recognition is computed using a daily computation, the preferred (and least error-prone) method for recognizing revenue.

As a normalized measurement, one primary purpose of MRR is to remove the noise or jitter associated with real GAAP revenue when reporting on subscription growth and business momentum. If you were to use the GAAP revenue number, your momentum reporting would show significant fluctuations month-to-month. The change from February to March would indicate growth of 10%, and March to April would indicate roughly a 3% contraction, when in fact, this customer represents no subscription change at all—neither incremental growth nor incremental contraction.

While MRR is an approximation of reportable revenue, the real difference is most easily highlighted with simple math.

An annual subscription that starts on any day other than the first of the month will span 13 months, meaning the number of months inclusive from start to end is 12 + 1, whereas the annual subscription itself is actually only 12 months in duration.

In common practice, MRR is included for each month the term spans. The aggregate of MRR over the term is roughly 8% more than the GAAP revenue in this scenario ($1,300 vs. $1,200). Is that a fair analysis? What if the customer renews? After two terms, the number of reportable MRR months is 25, and the percentage difference drops with each subsequent term. At an infinite number of renewals, the numbers are mathematically the same. Before, infinity was reality, and 8% or 4% is a material difference.

How to calculate MRR

Your MRR calculation must take into account the following:

- Number of days in the given month

- Length of the contract

- Mid-term contract changes, early upgrades, and renewals

Because of these variances, it’s best to calculate MRR at the contract level. Here are a few ways you can do it:

Basic MRR formula

MRR = Number of Customers x Average Revenue Per User (ARPU)

This is the simplest, most straightforward way to calculate MRR.

Using this calculation, if your company has 20 paying customers which pay an average of $100 per month, your MRR is then $2,000.

20 x $100 = $2,000

Things get more complex as we begin factoring in more details.

MRR for first- and end-of-month start dates

Scenario: A new $120,000 annual contract starts on May 1, 2020, and ends on April 30, 2021. The contract does not renew in 2021.

Question: How much MRR was added, and when?

Answer: $10,000 in May 2020, specifically May 1, 2020.

Question: How much MRR was lost, and when?

Answer: $10,000 was lost, but in what month? We would suggest May 2021, which is when the contract should have renewed (specifically May 1, 2021). Unless clearly defined, someone could easily decide to put the loss on April 30, 2021, the last day of the term. But by doing so, you both gain and lose $10K within a single 12-month period.

MRR for mid-month start dates

Scenario: A new $120,000 annual contract starts on May 15, 2020, and ends on May 14, 2021. The contract does not renew in 2021.

Question: How much MRR was added, and when?

Answer: $10,000 in May 2020, specifically on May 15, 2020.

Question: How much MRR was lost, and when?

Answer: $10,000 in May 2021, specifically on May 15, 2021, when it did not renew.

MRR for gaps in contracts

Scenario: A new $120,000 annual contract starts on May 15, 2020, and ends on May 14, 2021. After a gap due to contract negotiations, the contract renews for $120,000 on June 26, 2021, for a new term through June 25, 2022.

Question: How much new MRR was added, and when?

Answer: $10,000 on May 15, 2020.

Question: How much MRR was renewed, and when?

Answer: There is no “right answer” here. You just have to decide how you want to calculate it. Options include considering it a non-renewal in May 2021 and a renewal in June 2021, placing it into a bucket of “open renewals” in May, simply renewing it in June 2021, or renewing it effective May 15, 2021 at $9,230 MRR (effectively discounting it by considering it a 13-month term).

MRR for early renewal upgrades

Scenario: A new $120,000 annual contract starts on May 15, 2020, and ends on May 14, 2021. The customer orders an upgrade on December 31 that goes into effect on January 15, with a new end date of September 18, 2024, and for an additional $247,000.

Question: How much new MRR was added, and when?

Answer: That one is still easy–$10,000 on May 15, 2020.

Question: How much MRR was renewed or upgraded, and when?

Answer: This is defined by you. Define the MRR rules as best you can and record the transactions as consistently as possible.

If this all becomes a little too complicated as your business grows and your subscriptions become varied, contact us here at Maxio for a free demo of our subscription management platform to keep them all straight so your SaaS metrics are flawless.

Invoice and other adjustments in MRR calculations

It is up to you to decide the appropriate data to include and adjustments to make in your MRR calculations. Define your key metric and then consider the types of MRR as they appeal to your business objectives and revenue growth goals.

Given the complexity of these financial adjustment transactions, many organizations simply don’t include adjustments in their calculations. However, inaccurate or incomplete bookkeeping practices make it difficult—if not impossible—to adjust transactions in MRR computations when and if desired.

In our work with many early-stage and emerging businesses, we’ve seen a few very common patterns.

In the early days of the business, when the focus is on cashflow and simple viability, bookkeeping practices are erratic, inconsistent, and often inaccurate. An invoice might be associated with one income account while the invoice’s credit memo is associated with a completely different income account (typically based on the use of different sales items in the invoice and credit memo). Broad stroke journal adjustments and the use of a generalized non-product specific “credit” sales item are also common.

Recording financial records this way makes it difficult to even have the option to include such transactions in MRR calculations. Yet, these can be important metrics in the subscription business model.

Inclusion of variable, usage, or consumption fees in MRR calculations

Variable, usage, or consumption fees are sometimes included, but only when you can make a strong contractual or statistical argument that the revenue stream is predictable or consistent. This is most often the case with a “capacity”-based subscription model, where the subscription includes X units/instances/actions per month, term, or billing period.

Best practices for calculating and analyzing MRR

Common mistakes in MRR calculations lead to bigger problems when you make decisions about customer retention strategies or marketing methods based on these metrics. Here are some best practices to streamline your MRR growth rate calculations and processes.

Double-check for non-monthly billing intervals

It’s common for quarterly, semi-annual, or annual contracts to be reported as a full payment in a single month. If a customer pays for their full membership upfront, that should not be included for a single month but instead divided by how many months the subscription is pre-paid for to provide a truly accurate figure.

Always include coupons and discounts

Failing to include the discounted rates that subscribers receive is a misleading error as well. Even if you only offer a small discount, when multiplied across several hundreds or thousands of subscribers, that can create a large difference on your revenue report. If you don’t capture that difference, your MRR will be artificially inflated.

Always include or consider MRR components

Don’t ignore the types of MRR components that could play a role in creating a more accurate picture of your company. This includes all of the previously mentioned components, such as new and net new MRR; expansion and contraction MRR; and churn and reactivation MRR.

Don’t include leads, trials, and non-recurring revenue

Items such as one-time purchases or non-recurring fees should never be included in MRR calculations. If you have a trial period, don’t include that customer in the metrics until after the trial ends. Otherwise, these types of non-recurring revenue figures inaccurately inflate your MRR metrics.

Don’t treat MRR like an accounting figure

As we mentioned earlier, MRR is not an accounting figure. It should not be used for tax or accounting needs. Instead, MRR should be used to track revenue growth trends that can inform business insights decisions.

Your Plug-and-Play SaaS Metrics Dashboard

In this template, you’ll find a comprehensive set of pre-built SaaS metrics (that you can trust) to wow investors and make key business decisions with confidence.

Chart your path to profitability with metrics like:

- Subscription Momentum (ARR, customer count, average ARR)

- Churn & Retention (churn rate, renewal rate, net revenue retention)

- Customer Lifetime Value (CLV)

How to increase your monthly recurring revenue

MRR can provide an essential overview of your business’s financial health. But knowing how much revenue your business brings in each month will almost immediately lead to a second question: How can we grow this number?

To increase your total MRR, consider these strategies:

Revisit your pricing plans

How does your net new MRR look? How about your churn MRR? Look at these metrics in relation to your pricing plans. Are you over- or under-charging? Do you need to adjust your subscription pricing model to improve revenue? While you’re here looking at your subscriptions, take a look at competitors, too. Make sure your pricing reflects your product, and your customer base believes in what your product does differently as opposed to competitors.

Grow your customer base

This one feels like a no-brainer, but we had to include it. By increasing your total number of customers, your MRR is bound to increase as well.

Of course, it’s one thing to say you’ll grow your customers, and another to actually do it. Our best advice on increasing your subscriber count is to consider new expansion strategies. For additional ideas, check out our case study on bootstrapping from $1m to $50m in ARR.

Reduce your churn rate

You can also increase your MRR by finding out why people are leaving and, when possible, correcting that problem. With work, you can minimize your churn rate by addressing issues that may occur, such as targeting the wrong audience, limited features that don’t actually solve your users’ needs, or inconsistencies in service. You may need to put new customer retention strategies into practice to keep more users present and boost your MRR growth rate in the process.

Another benefit to this strategy is that, by retaining existing customers, you don’t have to focus spending on ever-growing customer acquisition costs.

Offer upsells and cross-sells

If you want to see a boost from the previous month, consider an upsell or cross-sell. That is, encourage your current customers to add on to the services they already receive from your business. What could you offer to boost your revenue coming in and make your customer base even happier with your service?