With fixed-price subscriptions, consumers often feel like they’re choosing between keeping more of their cold, hard cash, and vague features and promises of “enterprise-grade service.”

If your potential customers don’t understand exactly what they get for each of your plans, it can be a hard sell to convince larger or more active customers to upgrade.

That’s why it’s so vital to focus on tracking and highlighting key metrics that demonstrate the customer’s usage, or better yet, the performance of your service.

Then you can bill your customers based on real numbers.

And consumers respond positively to this transparency. SaaS companies that base their pricing on value metrics have 75% lower revenue churn rates than companies that base pricing on more ephemeral features.

In this article, we cover seven billable event metrics that you can use to drive more subscriptions and grow your business.

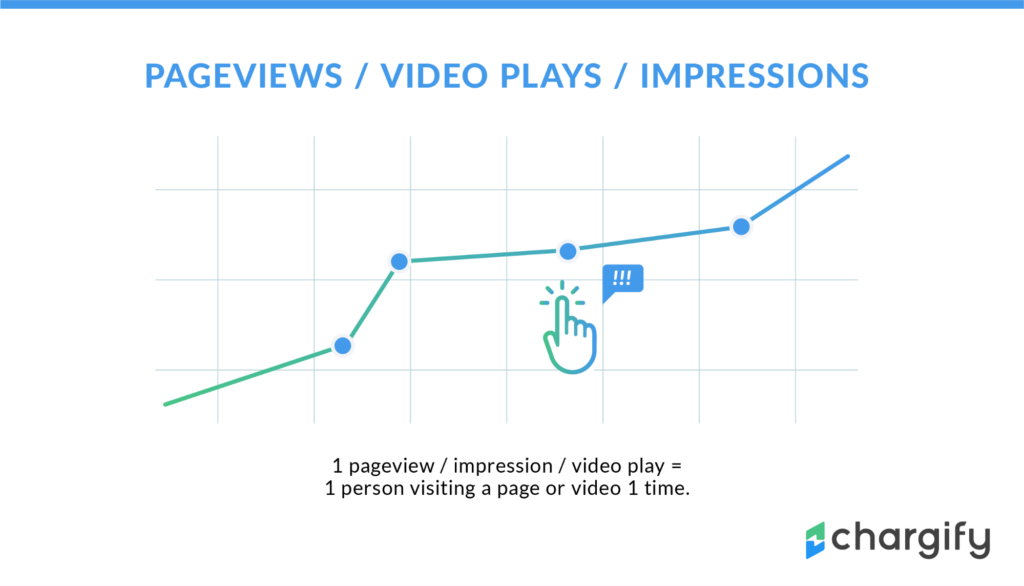

Event Metric #1. Pageviews, Video Plays, and Impressions

Pageviews, video plays, and impressions are just three different ways to measure when a single person has seen a page, element, or video.

1 pageview/impression/video play = 1 person visiting a page or video 1 time.

Whether your company is in IaaS and provides a hosting environment for video, you do advanced web analytics, or you’re selling advertising space on your page, these impression-based metrics can all be highlighted as value metrics.

They show your customer how much use they are getting out of your product. And, in the best-case scenario, exactly how much value your product is providing them.

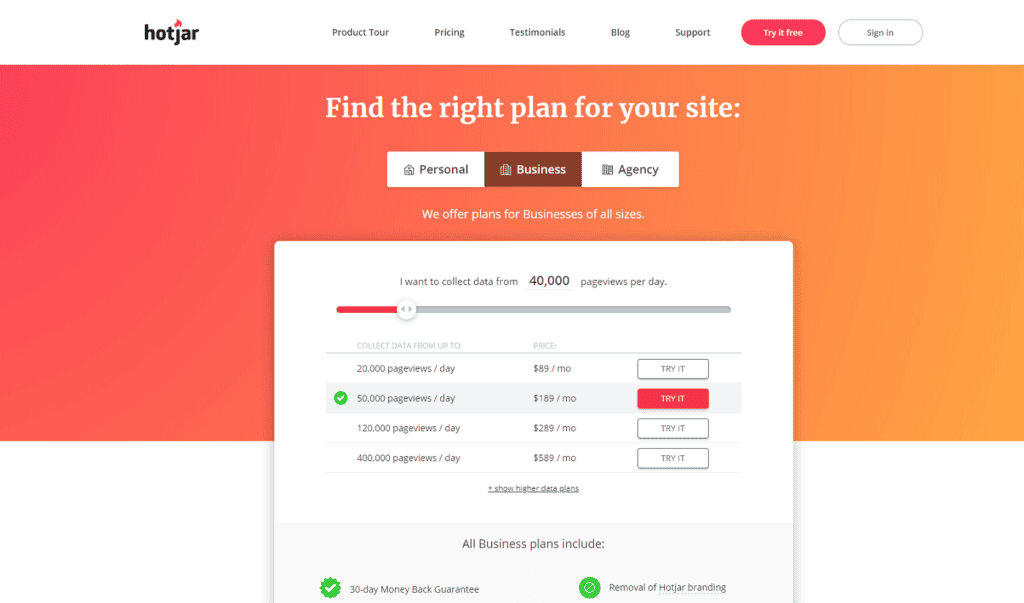

Hotjar is a behavior analytics platform that uses page views to determine how much a client is using their software, bandwidth, and infrastructure.

Larger clients with more popular websites and bigger budgets have to pay proportionally to the number of page views they use Hotjar on.

Their basic plan starts at 20,000 page views/day, a total of 600,000 per month, for a total of $89/month. If the user consistently uses all their page views, that’s an average price of $0.000148 per page view.

A large number of companies utilize the page view value metric for a reason. It’s easy to measure and communicates value to your customers.

With analytics tools, users know that they’ve gathered insights from X thousand user interactions. With advertising platforms, they know that they’ve reached X thousands of potential customers.

The perceived value of this kind of reporting and billing makes it much easier to justify remaining a paying subscriber of your service.

Event Metric #2. Clicks

If your main product is advertising, most performance-based pricing models use clicks as a basis.

1 click = 1 person clicking a link/ad 1 time.

Starting even before Google AdWords all the way back in the year 2000, 20 years ago, clicks have been one of the main billable metrics in digital advertising.

The first banner advertising sites didn’t charge by clicks, they charged for impressions at an agreed-upon CPM.

But advertisers realized that there was no guarantee ad was being meaningfully engaged with, regardless of how many impressions their banner got.

As a result, some platforms started to offer a pay per click (PPC) option, where you could pay for clicks instead.

That was Google’s business model with their initial in-search ads, one they still follow, for the most part, to this day.

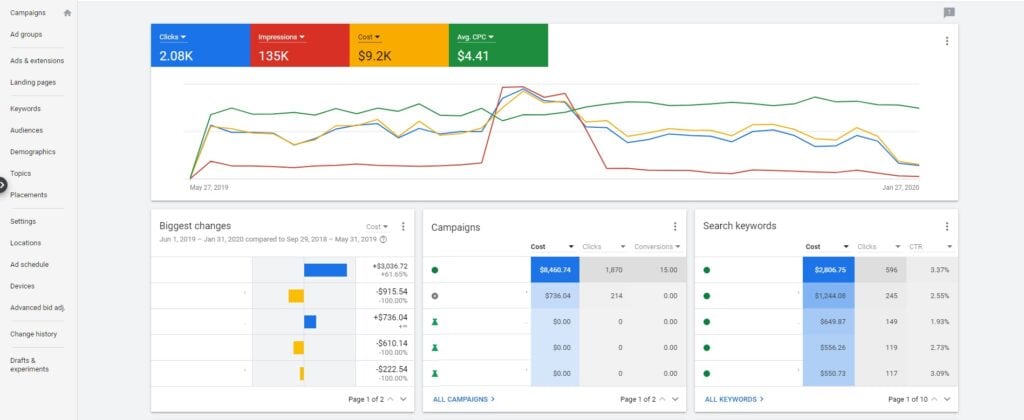

If you look at the Google Ads dashboard, you will see how prominent clicks are in their reporting/billing process.

Because Google implements a bidding system, the clicks aren’t counted as equal but rather assigned a unique value during each transaction.

So rather than a simple billable unit, it becomes a slightly more complex system where Google needs to register each auction result in a database, and then use that data to calculate monthly costs.

The real-time auction creates a more complicated process, but you could use the number of clicks as a standalone billing unit.

It’s easy to understand the value of a click from a marketing standpoint, which means it will be a useful tool for conveying the value to your customers as well.

You could, for example, use clicks as a metric for a premium template addon for an email marketing tool or a floating call-to-action widget for a specific CMS solution.

Focusing on tangible metrics like clicks will help you create value-based pricing pages for your SaaS.

Event Metric #3. Revenue Generated, Recovered, or Processed

Your revenue can be another metric/billable unit you can use to calculate the value your product is contributing to a customer.

It doesn’t matter if you measure the revenue being generated, recovered, or processed by your software/app.

For example, a payment processor like Paypal, or even a credit card company, will typically deduct a % of the payments they process.

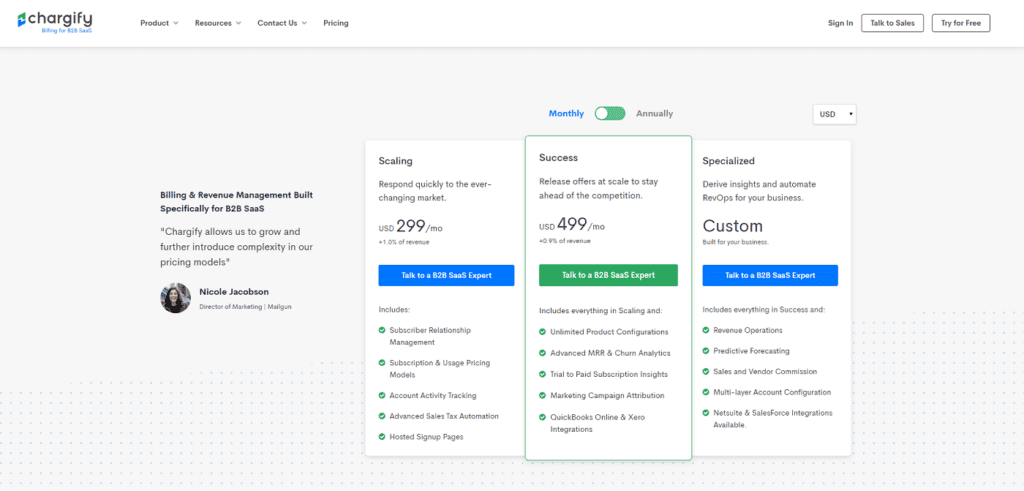

As a billing and revenue management company, we follow the same model at Maxio as well.

Our clients pay a flat fee, plus a set percentage of their revenue, for us to handle their billing from invoice, to reminder, to payment.

It’s hard to argue with revenue as a value metric, especially if you can measure the effects of using the service from within the dashboard itself. As long as our clients consistently see their revenue numbers grow at a faster rate than before, they’ll be more than happy to stay on board.

But you don’t need to be in payment processing or billing to use revenue as a billable metric.

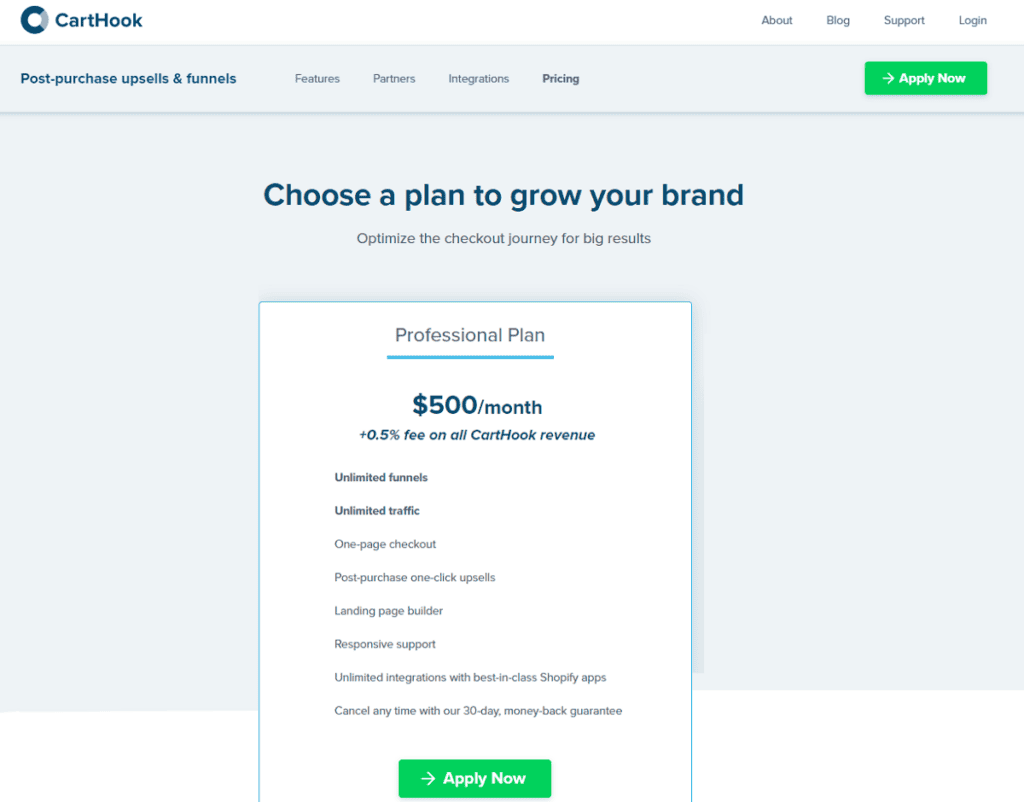

Certain eCommerce platform add ons and extensions, like CartHook, calculate bills based on the revenue generated through their platform.

They charge a flat subscription of $500/month, plus 0.5% of all the revenue generated through CartHook.

Another great thing about a revenue-based approach is that it gives the SaaS companies an incentive to strive to maximize the revenue of all their clients. It can create a culture of testing, innovation, and close collaboration with long-term/active customers.

You could also measure recovered revenue through dunning or abandoned cart campaigns, and charge based on a percentage of what’s recovered through your software.

Event Metric #4. Number of Emails or SMS Messages

The number of messages metric is relevant for messaging and unified communications services that want to charge, at least partially, on a pay-as-you-go basis.

Many email/SMS services require payment up-front through a credit system, but you could also implement a real pay-as-you-go system with total messages as your billable metric.

A traditional cell phone carrier plan charges a small fee for every SMS message or every minute of voice calling. Many modern businesses in related industries can benefit from adopting a similar pay-as-you-go approach.

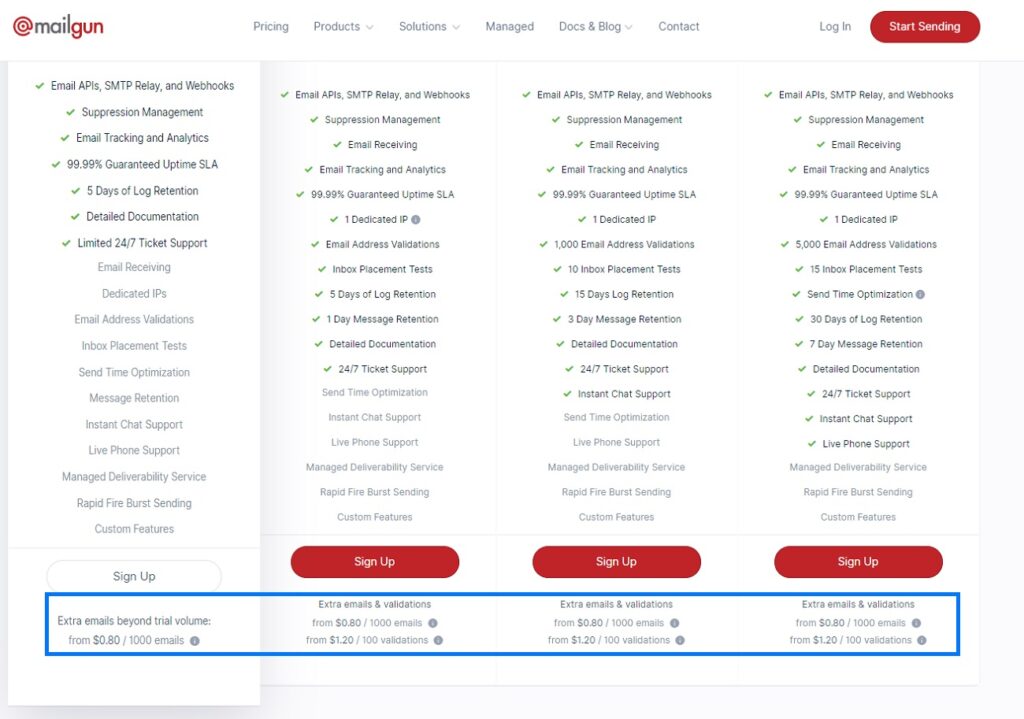

For example, MailGun bills an extra $0.80 for every 1000 emails sent beyond what is included in their plans.

If your clients mostly use transactional emails for order confirmations, payment reminders, and other notifications, it’s a no-brainer. A perfectly-timed email will easily deliver more value than its cost of $0.0008 (less than a tenth of a cent.)

If you are paying to send messages, whether they are emails, SMS, push notifications, or social media messages, it’s hard to argue against the cost scaling to match the number of messages you send.

SMS services also need to consider the country of the destination number, so they need to structure their invoices differently with multiple tiers. For example, you can group destination country messages by equal price, or SMS messages to each country code can be their own billable unit.

Customers can analyze their usage history and know exactly why they are paying what they are paying and what they get in return.

If the main value proposition of your service is high deliverability, you should also measure and could potentially bill for successfully delivered or opened emails.

Event Metric #5. Number Of Active Users

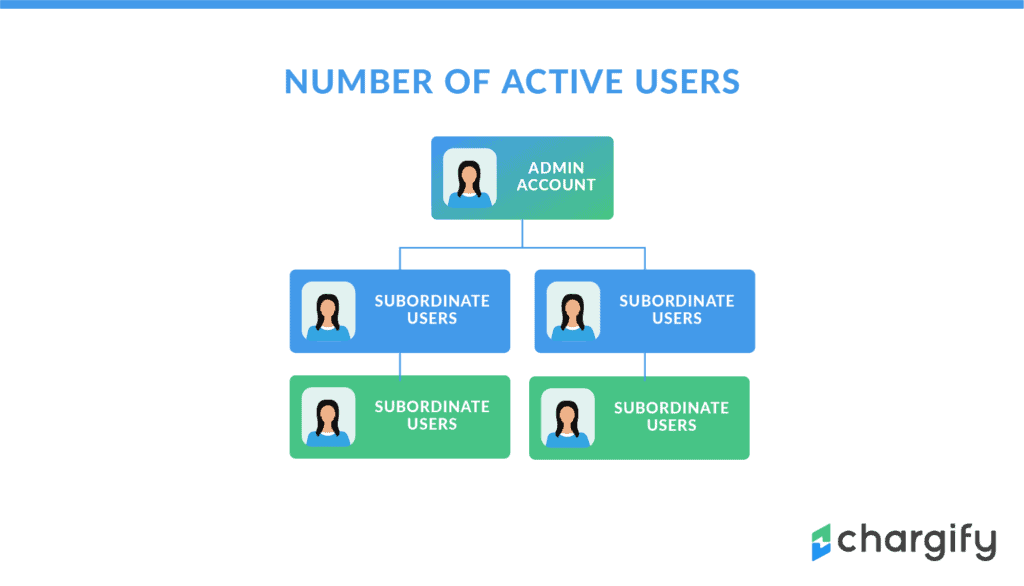

The total number of active subordinate users in an account is another metric.

Billing for the number of active users is not the same thing as having multiple contracts with different people in the same company. Typically, a manager will have a single admin account, and the number of subordinated users, owned by regular employees, controls the final price.

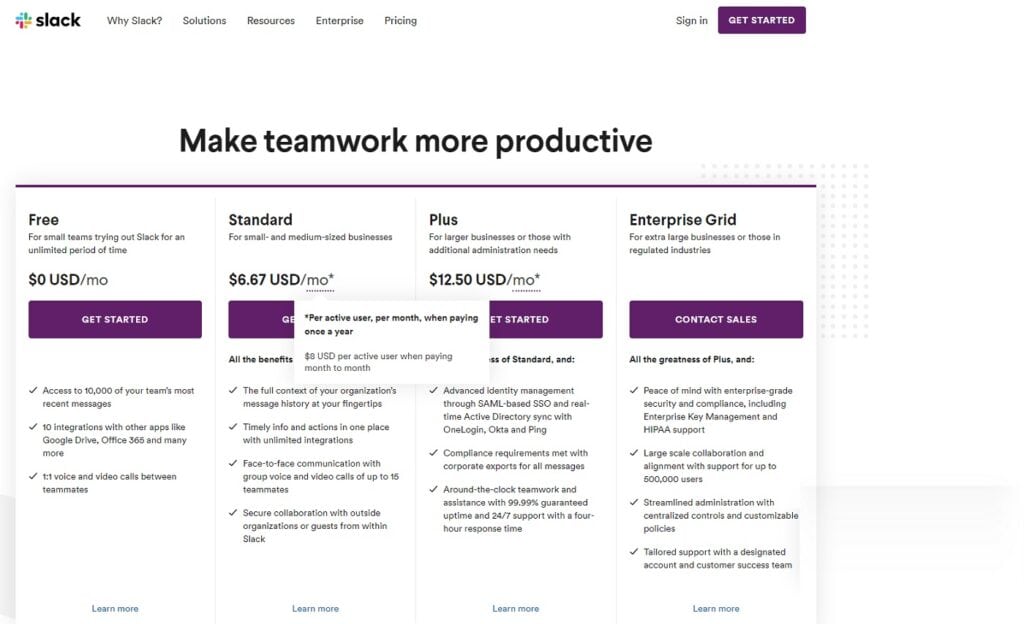

For example, with a “Standard” or “Plus” Slack account, you will not be billed based on how many workspaces/admin users you create. Instead, you get billed based on the number of active users that are directly associated with your workspace.

How you should identify and separate active users from inactive users depends on your service. An easy way would be just to include all users currently registered to a workspace/admin account and leave the responsibility up to the customer. An alternative would be to track user activity, and only charge for users active within the last billing cycle is a standard and perhaps the most appropriate approach.

User-based pricing/billing is an industry-standard in the collaboration, workforce management, productivity tools, and other markets.

Trello, Asana, Salesforce, are just a few other industry-leading companies that follow this metric/model.

But even if your company is in a different industry, you can still price and bill based on the number of users. For example, any software product that is suitable for both solopreneurs/freelancers, and agencies/in-house teams might be a good fit.

If you offer a CMS solution, design software, analytics/reporting/marketing tools, accounting software, or something along those lines, offering multi-user accounts could be a source of extra revenue.

Event Metric #6. Number Of Contacts, Subscribers, or Customers

If your company offers a CRM solution, or an email marketing automation tool, you’re probably already familiar with this metric and pricing model.

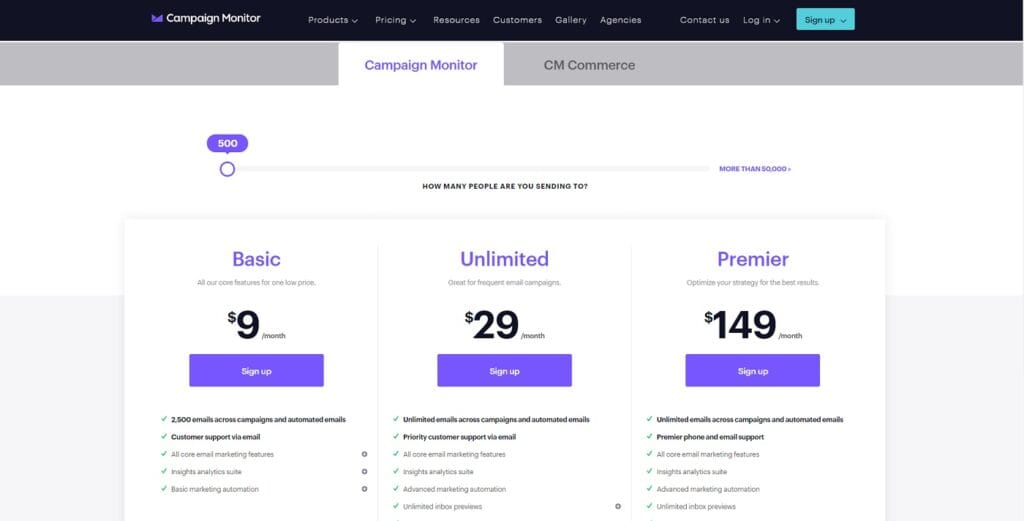

Campaign Monitor uses the total number of contacts as a key value metric that influences the pricing of their different tier-level subscriptions.

Their approach is an example of the most prominent standard billing practice in the email marketing industry, contact-based pricing. Pay-per-email, like Mailgun uses, is the second most popular model.

The number of contacts or email subscribers is not just a value metric. It’s also a vanity metric that people/companies like to flaunt for social proof.

An interesting side-effect of this is that for many years, the customer and the service provider have an incentive to keep contact numbers artificially high. (For example, keeping 100% inactive subscribers in the list for months or even years.)

But over the past few years, email marketers have started to focus their attention on maintaining a targeted list of active, high-quality leads.

You could differentiate your service by automatically segmenting out inactive subscribers, and not counting them towards the billable total. Some CRM/marketing automation solutions that have native email marketing tools also use contacts/customers as a metric that influences their pricing. Keap (formerly InfusionSoft), HubSpot, Ontraport are just a few examples.

If you’ve developed extensions or custom solutions for ecommerce platforms, you could even charge by the existing number of customers.

Event Metric #7. Number Of Products or Pages

Ecommerce solutions automatically create a page for each product, which makes the number of products the equivalent metric of pages for a CMS.

If your company develops extensions or third-party tools that interact with an eCommerce platform like Shopify, or a CMS like WordPress, you could measure and charge based on the total number of products or pages.

The Smart Tags Shopify app lets Shopify vendors automatically tag different customers based on custom fields.

One of the metrics the app focuses on in its pricing is the total number of unique products, which influences the bandwidth and data load on the app’s side.

If you use your in-house servers to process/handle the data for your service, the number of pages/products will be an accurate forecasting metric for the load each user will put on your hosting environment.

How Do You Implement Pay-as-You-Go Billing?

Usage-based or pay-as-you-go billing is a bit more complex than just charging a fixed price.

The first thing you have to do is decide on a specific pricing model; what you will charge for each unit or different quantities.

You also need to figure out what solution you will use to bill your customers dynamically.

To implement an automated, scalable system, you then need to establish communication between your app and your billing solution.

Quantity Billing vs. Metered Billing

Quantity-based subscription billing is when a plan includes up to a certain number of units. For example, an autoresponder plan with up to 1,000 contacts.

With metered billing, you measure the number unit each month (starting from 0) and generate the cost and invoice based on that. What each user pays depends on how much they use your service.

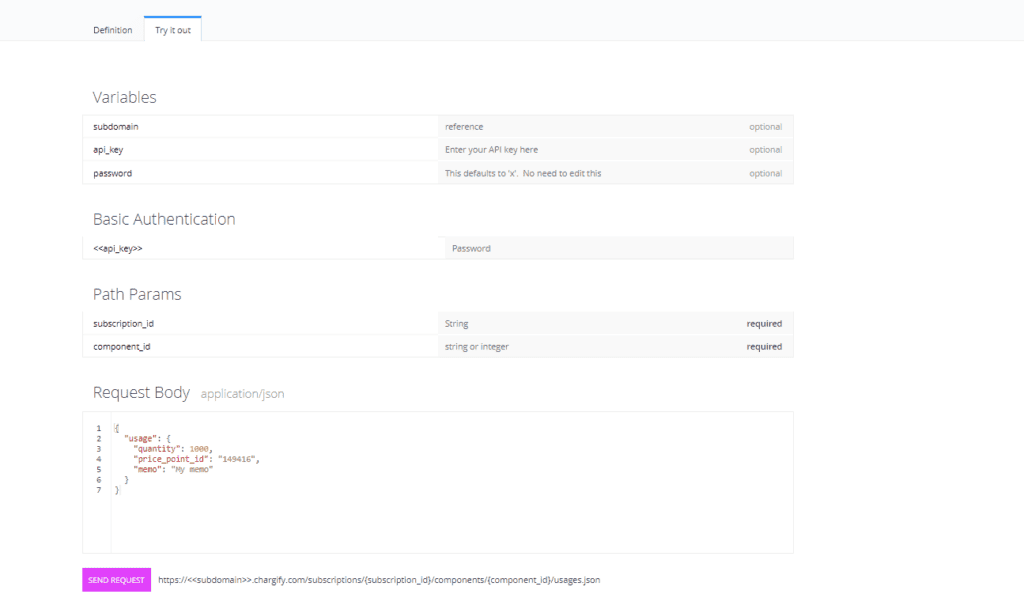

With the metered approach, you need to automatically send the number of units used by a subscriber to Maxio, each time they use units. (Think no. of clicks on an ad, or SMS messages sent.)

With quantity billing, it’s possible to maintain manually with an end-of-the-month review, but this isn’t scalable. For the best results, you need a billing solution that supports integrations and workflow automation here as well.

Advanced Subscription Billing/Revenue Management Software

If you work with a simple payment gateway/processor like PayPal, chances are you need to develop custom solutions to implement metered billing.

They aren’t developed to generate custom invoices based on usage/event metrics, just to send and receive payments, with some basic subscription functionality.

If you want to bill your customers with dynamic subscriptions at scale, you need advanced subscription billing software.

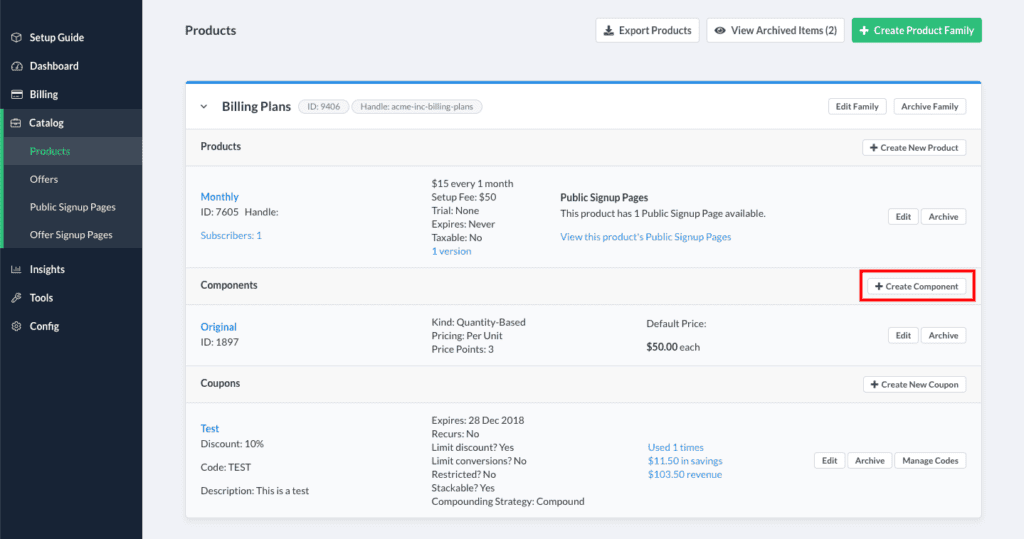

With Maxio, there are two basic ways to generate custom billing plans based on usage metrics. The first approach is to create a quantity-based component and set a price based on pre-set quantities.

It will allow customers to self-select the necessary quantity, for example, three extra users, when they create a new contract.

But if you want to allow your users more flexibility, you can let them automatically add/remove users and bill them based on the real numbers for each billing cycle. That requires a line of communication between your app and the billing solution.

Metered billing also needs this to work effectively in the first place.

Components, APIs, Webhooks, and Events

For an effective, scalable process, you need to set up communication between your in-house web app database where you track the metrics, and the billing management solution you use.

This is typically achieved with an API, JSON commands, webhooks, and events.

Maxio components (add ons) support both metered and quantity-based billing. They are used to calculate the final cost for each customer.

A Maxio component has a set quantity (if metered, it starts at 0 each month) that you can edit with simple JSON commands through the Maxio API.

For rarer event metrics like contacts, you can update the total quantity whenever a new one has been added.

With more frequent metrics like impressions, you can schedule the update, for example, through using cron jobs, at the end of each day, week, or billing cycle.

Once you have implemented the new billing model, our processes will also help you accurately measure SaaS MRR.

How Do You Make Changes During the Billing Cycle?

One key question that worries many new business owners is how they can implement billing changes during an active subscription.

When users need new functionality, they probably don’t want to hold out until the end of the billing cycle, and then upgrade at precisely the right time.

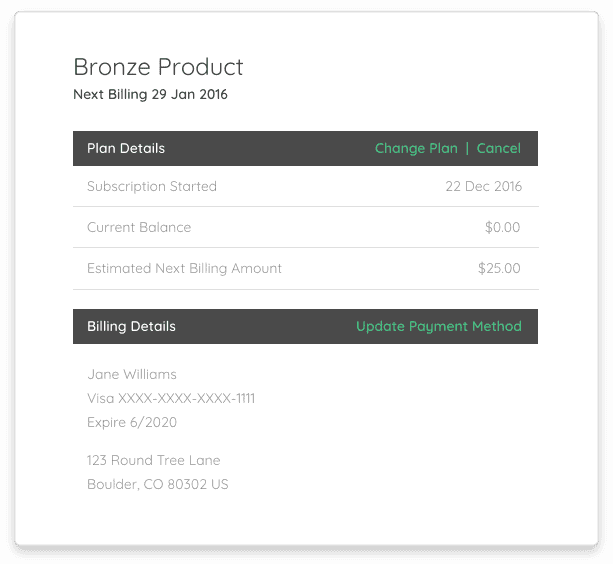

To enable users to upgrade or change their subscriptions in the middle of the billing cycle, without restarting the contract or doubling up on payments, your billing solution needs robust subscription management.

With the right system in place, there are a few ways you can handle these changes in real-time without causing any issues.

Common Solution: Proration or Credit

To prorate means to assess or distribute something proportionately. In the context of subscription upgrades, it means taking the following into consideration:

- What the customer has already paid for the month.

- The cost of the upgraded/downgraded plan.

- How much time has passed in the billing cycle.

For example, if a user upgrades to a $200/month enterprise plan, from the $100 pro plan, that’s a $100 in price between the two plans.

If 15 days, or half a 30-day billing period, has already passed, $50 of pro plan time has been spent. The remaining 15 days of the enterprise plan would cost $100 pro-rata, so the user would pay $50 to upgrade the rest of that month to premium users.

When users downgrade, they can receive credit towards their next invoice. One event that you should definitely implement proper billing for is a plan upgrade. With Maxio, you can give customers access to a self-service billing portal by working with our API.

You can then confirm plan changes by using webhooks to confirm the event: upgrade_downgrade_success and pulling their new subscription ID from there.

The low-fi solution would be to ask customers to contact customer service, and have your staff manually change subscriptions and billing cycles.

Confirming Upgrade Success/Failure

Whenever you make changes to the automatically billed amount, it slightly increases the chances that they don’t go through.

For example, in the event of an automatically upgraded plan, you need to make sure that the payment goes through.

Like with metered billing units, our API has the answer. You just need to work with Maxio’s webhook events for successful and failed payments to confirm that users should have continued access to their accounts.

For example:

- Upgrade_downgrade_success

- Upgrade_downgrade_failure

If the payment goes through, or they had enough credit in their account, your app needs to upgrade the user level in your database automatically.

But in the event of a failed payment, you need to make sure the account doesn’t get increased access on your side and triggers an “upgrade failed” warning.

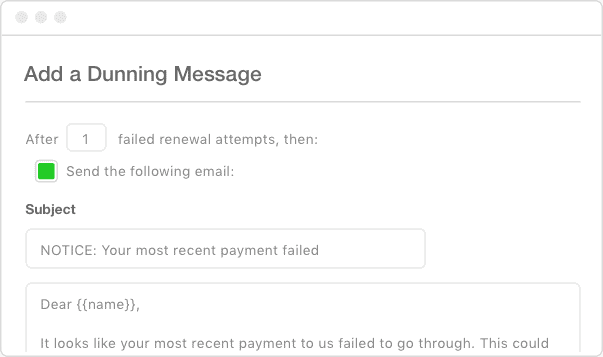

But with Maxio, you don’t need to go to the trouble of sending any manual reminders if the payment doesn’t go through.

We’ve got best-in-class dunning capabilities, and many of our customers have had great success by implementing dunning ( reminders for failed payments) campaigns. Some clients have even seen ROIs of up to 3924%.

These automated reminders and invoice reissues are easy to set up and require no custom dev work on your part.

Just set up a message, edit the merge files and copy, and you’re good to go.

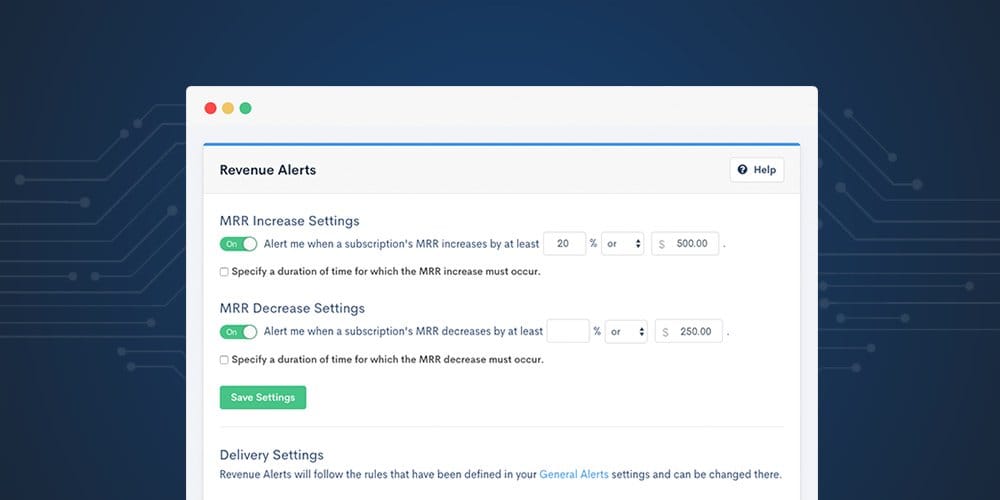

Keep Track Of Changes With Revenue Alerts

With our detailed analytics, you can stay on top of the impact implementing these billing changes have on your MRR.

You can even set custom revenue alerts that will let you know when individual subscriptions increase or decrease significantly in value.

Conclusion: Gain Full Control over Subscriptions and Billing

If you’re working with a basic payment gateway, or worse, manually invoicing your clients, you won’t be able to implement scalable, fluid billing across all existing and future subscriptions.

Maxio gives you complete control over your pricing plans, including metered components that let you calculate the cost of your service each month based on real usage/performance numbers.

You will also get comprehensive subscription management tools, laying the foundation for automatic upgrades mid-cycle, addons/extensions, and much more.

Finally, we help you minimize lost revenue due to credit card changes and with our dunning functionality and automated email campaigns.

You can learn more about billing on our blog, or contact one of our B2B experts today for more information on how we can help your company.