Board meetings, due diligence requests, month-end close, auditor requests—how many all-nighters have you endured to ensure your company is well represented? Too many.

Our team has talked to thousands of SaaS finance professionals over the years, and we’ve seen three common challenges finance teams at SaaS companies face:

- Standing out to investors and passing due diligence

- Completing month-end-close efficiently

- Achieving a quick and clean audit

In our recent webinar, Stop Pulling All-Nighters: Avoid the scramble for due diligence audits and month-end close, we dove into each of these challenges and shared actionable advice you can use to avoid the spreadsheet scramble. In this recap, you’ll learn how to help your company stand out to investors while increasing efficiency and time savings in your day-to-day work.

Are your eyes getting tired from scrolling? You can listen to the full webinar recording here.

Challenge #1: Getting funded

A thoroughly documented financial process is a big green flag that signals to investors that you are proactively working to track and manage your company’s growth. If you want to truly stand out to investors and raise your next round, you’ll need:

- Detailed and accurate financial reports

- Real-time updated SaaS subscription metrics

Detailed and accurate financial reports

The ability to quickly pull financial reports is a huge competitive advantage when building relationships with potential VC partners. Not knowing your historical revenue and other key financial metrics can erode investor confidence in your company.

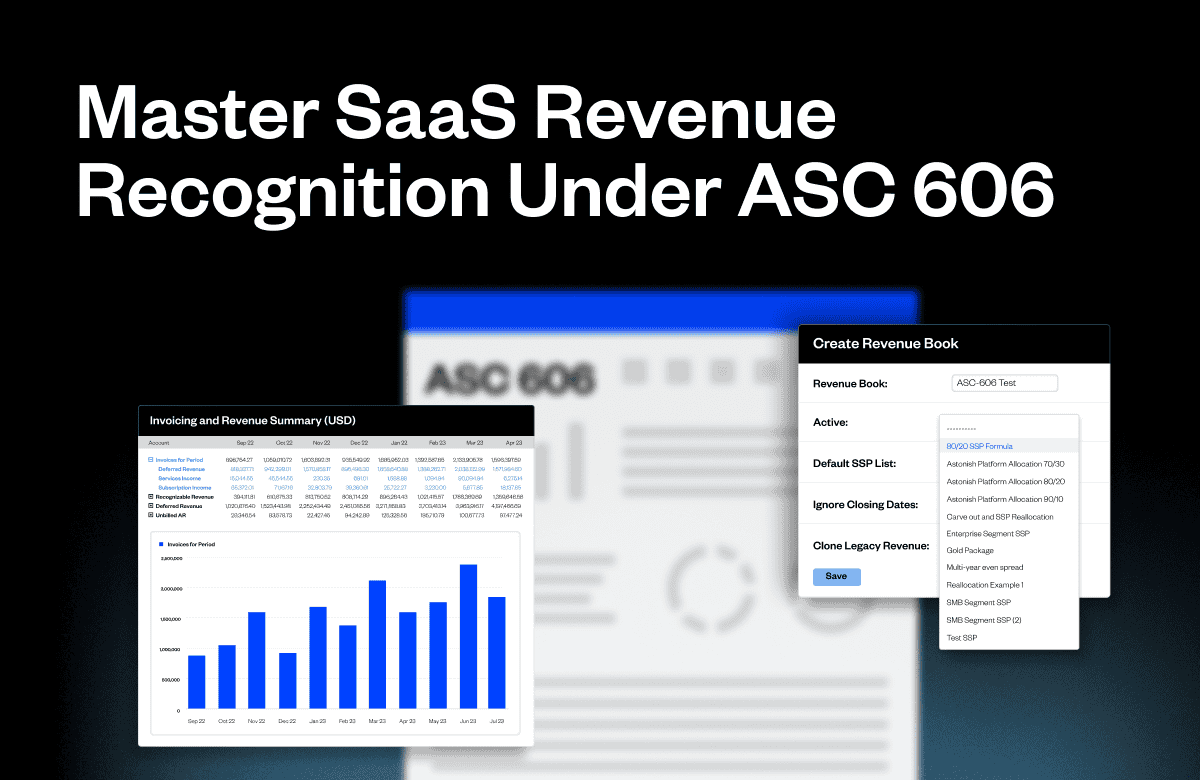

However, before you can start pulling detailed and accurate financial reports, Clayton Whitfield, co-founder of Maxio, recommends reviewing your company’s revenue recognition policy and automating the revenue recognition process.

Ideally, you’ll have access to a dedicated financial operations platform that sits between your CRM and GL to ensure that all your financial records remain up-to-date. Then, you can start generating reports on revenue, deferred revenue, invoicing, accounts receivable, and other key financial metrics.

But what about just using spreadsheets?

Managing revenue recognition in spreadsheets is fine when you only have a handful of customers, but when you scale to hundreds or even thousands of customers, it’s not sustainable. One of the biggest risks of using spreadsheets to warehouse your financial data is that things will fail silently. All it takes is one manual error to break the integrity of your financial records. Before you know it, your data is all screwed up, and you have no way of articulating the current health of your business to your executive leadership team, your board, or potential investors.

Real-time updated SaaS subscription metrics

In order to stand out to potential investors, Whitfield also recommends that you have clearly defined SaaS subscription metrics on hand and available for investors. The ability to quickly pull real-time metrics, make predictions, and explain specific business outcomes will help you gain trust and credibility with investors, increasing your chances of receiving funding and boosting your valuation. The more salient you are to your investors, the more likely you are to get funded.

Challenge #2: Month-end close

Between error corrections, adjustments and reconciliations, and producing your P&L, the time it takes to close the books can easily spill over from one month to the next.

The typical month-end close involves a constant back and forth between your spreadsheets and general ledger. In the early stages, many SaaS businesses supplement spreadsheets with general ledger software as an “easy option” but quickly realize that general ledger software doesn’t efficiently manage subscription revenue recognition.

And to make matters worse, most finance professionals have to complete month-end close on top of their other responsibilities. It’s like a never-ending game of catchup. This process won’t be sustainable for long if your company has its sights set on rapid or consistent revenue growth.

How can you fix the scramble for month-end close?

First, you need to define what “efficiency” looks like. Does your month-end close take five days? Do you need to cut it down to three? Do you want to be able to identify data errors ahead of time? Or eliminate them altogether?

Once you’ve determined what success looks like, you need to re-evaluate your financial tech stack. To execute these new goals and solve for your accounting pains, you can implement a FinOps tool (like Maxio) to act as your single source of truth for financial and subscription data. This tool will sit between GL/CRM and keep data flowing between both systems.

With a dedicated FinOps platform, you can:

- Automate billing & collections, financial reporting, and A/R management

- Generate revenue and expense reports, which are fed directly from your customer contracts

- Capitalize, recognize, and report on expenses automatically

And most importantly, reduce your month-end close from a few days to a few hours.

Challenge #3: Passing your audit

The word “audit” can be a scary tune for most people—but not if you have the right processes in place. How can you conduct a quick, clean audit without causing a massive pain for your finance team?

Here’s a few tips:

Close your books with detailed schedules

Each time you provide a summary number, ask yourself: can I pull the details behind this number? (For example, if you say revenue for the last quarter was $3.5 million, can you provide a schedule showing the revenue by customer, contract, and item supporting that summary number?) If you don’t, start preparing now.

Don’t forget, in addition to the detailed schedules, you’ll be asked to provide additional support for a subset of those customers. Ensure you can easily provide copies of contracts, addendums, SOWs, POs, vendor contracts, invoices, batch deposit support, bank statements, time entry reports, and any details behind the percentage-of-complete revenue. Nothing is off the table.

Perform reconciliations regularly

Avoid the scramble of a one-time reconciliation. Reconcile on a monthly or quarterly basis to keep your skills sharp, identify reconciling items, and give yourself time to investigate and resolve discrepancies.

Address key transactions, commitments, and contingencies

Do yourself a favor and make a list of key transactions or commitments/contingencies that could have a potential impact on the financial statements. As a general rule of thumb, your auditors will want all the details on anything over 10% of bookings, revenue, invoicing, etc.

Break the “one spreadsheet, one person” rule

In fear that a small error will break everything, many growing SaaS businesses have one team member that owns their financial spreadsheet. In this model, you have two points of failure in your business—it’s an unnecessary risk you can’t afford to make when audit time rolls around.

In lieu of a spreadsheet, a finops tool gives you reports and features you can trust:

- Deferred Revenue Rollforward

- Out of Balance Notifications

- Amortized Commissions

- RevenueBooks

Goodbye spreadsheets, hello term sheet

Whether or not your ultimate goal is to raise a funding round, eliminating spreadsheets is the first step to streamlining your financial processes and impressing investors. With an integrated financial tech stack, growing SaaS companies can easily tackle their due diligence, month-end-close, and audits (without creating unnecessary finops debt).

For more advice on streamlining your financial processes, you can access the full webinar here. Or, you can start making improvements today with our revenue policy template.