There is a big world of questions outside of just NPS and exit surveys that you should be asking your customers. If you’re not asking questions beyond these mediums then you don’t know your customers as well as you should.

The good news is that your competitors are also likely to be failing at getting to know their (and your) customers as well as they could be, so you can start diving deeper and beat them to the punch.

Getting feedback from your users is mission critical! If you’ve read our blogs, you know we’re big proponents of getting feedback from customers (and even potential customers). We’re not alone. Industry experts have expressed how vital it is to communicate directly with customers when they shared their tips for reducing churn, improving user onboarding, mastering the art of customer success, and how to be an effective Product Manager.

The most powerful thing you can do to reduce churn is going to sound simple and obvious, but so few actually take the time to do it: build a real relationship with your customers. Find out who they are, what they want, what they don’t want, and how you can make them happier than they could ever be with your competitors.Alex Turnbull, Founder & CEO of Groove

It’s important to note that we aren’t saying NPS and exit surveys aren’t valid. They are, and you should keep doing them. But there are additional opportunities to survey users that you should be aware of. Doing so improves your product, vision, and company. It even helps inform marketing, sales, and training of support team members.

When you know your customer inside and out, that’s when you’re able to come up with ideas, messaging and tactics that will change the growth trajectory of your business. Benji Hyam, Co-Founder of Grow and Convert

In today’s blog we’ll cover:

- Best practices for asking survey questions that get higher response rates and quality feedback

- Available tools that you can implement today

- Suggested questions you should be asking and the reasons behind these questions throughout the customer lifecycle

Notice in that last point we said suggested questions. Only some of the questions below will be applicable to your business. The key is to focus on the reasons behind each question. Prioritize which answers are most important to you and then tailor the questions accordingly.

And while the list of questions we’re sharing with you is long, we aren’t suggesting you bombard your prospects and users with a ton of questions. We advise the opposite — pick and choose wisely, based on your research priorities. Asking one or two key questions will provide the focused feedback you need without frustrating those you’re surveying.

Survey best practices

Surveys should be SHORT

This ties in with our point above about not bombarding prospects and customers with numerous questions. Price Intelligently analyzed SaaS customer development surveys and found surveys which took 1-2 minutes to complete had a response rate of over 90%. From the graph below you can see the longer the survey takes to complete, the lower the response rate. Price Intelligently also saw poorer quality responses on longer surveys.

Don’t ask questions you already know the answers to

Time is money. You’re asking someone to take valuable time away from activities that make them money to help you. Don’t include survey questions that ask for their email address, the plan they’re on, how often they’re signing in to use your product, or any other question that you already have the answer to.

Open ended questions allow for the best feedback

Use open ended questions to avoid confining your visitors/users to the answers you’re looking to hear. The caveat to this is situations when you’re looking for feedback on some specific choices.

For example, Feedback Lite ran a survey asking which feature, out of 5 specific options, customers thought should be the next feature added to the product.

“We knew these 5 items were good options, because we’d already had some feedback indicating their worth, we just needed to put it out to a wider audience to confirm our suspicions. After we ran the survey for a couple of weeks, there was no doubt which feature we should invest our time developing, and we got a great result,” says Paul Dunstone, Feedback Lite founder and CEO.

Don’t be afraid to experiment with wording

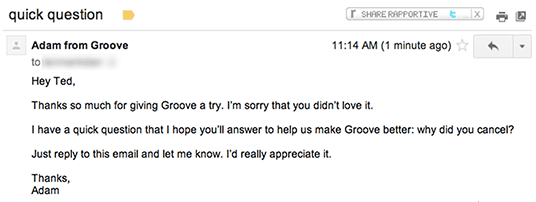

Small word changes can have big impacts on responses. Initially, Groove’s exit survey was a short email with a simple, open-ended question:

Then they tested changing from “why did you cancel?” to “what made you cancel?” The latter resulted in a response rate increase to 19%!

“I suspect that ‘why did you cancel?’ simply sounds more standoffish and puts the reader on the defensive, whereas ‘what made you cancel?’ doesn’t have the same accusatory tone,” writes Groove CEO Alex Turnbull.

Build loyal customers and they’ll be happy to give you feedback

One of the many benefits of doing a good job at customer success is that you build a base of happy, loyal customers. Happy, loyal customers are more likely to provide insightful feedback. Make it a partnership by letting them know their feedback helps you improve the product and an improved product helps your customers enjoy even more success.

Don’t be afraid to experiment with wording

Small word changes can have big impacts on responses. Initially, Groove’s exit survey was a short email with a simple, open-ended question:

Then they tested changing from “why did you cancel?” to “what made you cancel?” The latter resulted in a response rate increase to 19%!

“I suspect that ‘why did you cancel?’ simply sounds more standoffish and puts the reader on the defensive, whereas ‘what made you cancel?’ doesn’t have the same accusatory tone,” writes Groove CEO Alex Turnbull.

Build loyal customers and they’ll be happy to give you feedback

One of the many benefits of doing a good job at customer success is that you build a base of happy, loyal customers. Happy, loyal customers are more likely to provide insightful feedback. Make it a partnership by letting them know their feedback helps you improve the product and an improved product helps your customers enjoy even more success.

Survey tools you can use

There are many website survey tools that allow you to ask questions to your website visitors and current users via email, in-app, or on-site survey. Below is a list of some popular options:

Survey/Feedback Widgets

Traditional Surveys/Forms

Word of caution: don’t let tools be the bottleneck. You can always use good old fashioned email for many questions. Or, if you already use a service like Intercom, think about how you could use it for outreach as you read the questions below.

Pre-conversion: Survey questions to ask your website visitors

For this segment, email surveys don’t make as much sense since you don’t have an email yet. You’re going to get better data with an on-site survey widget; get input while they’re still on your website and your company is top-of-mind.

What did you come to this site to do today?

While many companies suggest asking “how did you find us?,” I prefer the question above. You can easily cross reference Google Analytics and a variety of other analytics tools to determine visitor traffic sources. Asking the visitor what brings them to your site can provide insights into the motivation of your prospective customers and ways you can help move them forward in the sales funnel.

What could we do to make our website easier to navigate?

This is a variation of “How easy is our website to navigate?” but that wording makes it easy for a respondent to say “easy” or “not easy” and then move on.

The reason behind this one is simple. What do you do when you’re on a site that is a pain to navigate? If you’re like me (and the majority of website visitors), you leave the website and don’t return. Making your site easy to navigate is a no-brainer. Having awesome content doesn’t mean much if your site navigation and structure have visitors bouncing.

Were you able to find the information you were looking for on this page?

The answers for this question can be yes or no, with a follow-up question asking for details if the answer is no. If the answer is yes you may want to follow-up with “What more do you want to know about [product] before purchasing [or signing up]?”

What did you come to this site to do today?

While many companies suggest asking “how did you find us?,” I prefer the question above. You can easily cross reference Google Analytics and a variety of other analytics tools to determine visitor traffic sources. Asking the visitor what brings them to your site can provide insights into the motivation of your prospective customers and ways you can help move them forward in the sales funnel.

The feedback can help you make improvements to content on the page. For instance, Grow and Convert asked the latter question to visitors on the website of a SaaS company that makes communication apps.

Many of the responses indicated they wanted to know how it worked. In the company’s mind they had already explained that, but it was clear site visitors thought differently.

After digging deeper with additional follow-up questions, “we eventually found out that all customers wanted to know was that the product was easy to use and that we didn’t explicitly say that anywhere on the site,” explains Devesh Khanal.

“After numerous iterations, we finally changed the wording on the site to a simple section that explained how the product works in 3 steps (and got the results we were looking for).”

Khanal noted, in retrospect, they also could have asked “about what one feature or benefit the prospects were hoping to get.”

What is your biggest challenge with [problem your product is trying to solve]?

Or: What frustrates you most about [problem your product is trying to solve]?

Again, don’t be afraid to experiment with wording :). The juxt of this question is to identify prospective customer’s pain points. If you’ve already reached product/market fit, you may think you’ve already correctly identified and are solving for users’ challenges. And that’s probably true. But, it is crucial to keep pulse as your market changes to ensure you’re addressing current pain points as well as those you have previously identified.

Do you intend to return to purchase from [brand]?

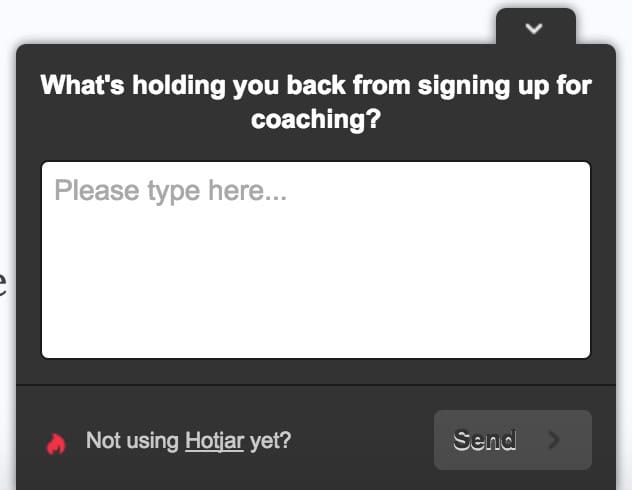

If you use this question, you’ll want to immediately follow-up with an open-ended question asking for specifics. Another, more specific variation, could be to ask on the pricing or signup page, “What is holding you back from signing up for (or purchasing) [product]?”

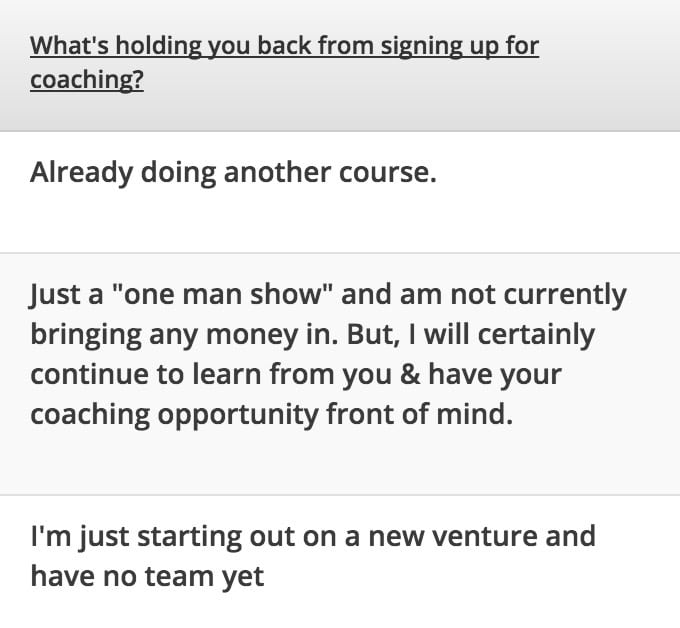

In addition to alerting you to potential sales objections to overcome and content opportunities, the feedback may also give you insight into the type of people who are hitting that page. Grow and Convert offers a great example. The following is the on-site feedback survey on their coaching page, with responses from a specific visitor segment below the survey question:

Some of the responses point to site visitors who are just starting out:

These responses alerted Grow and Convert to a specific visitor segment and their unique pain points.

Understanding how early in a business’ lifecycle they’re interested and researching your product is very important.

Post-conversion: Survey questions to ask current users

Once the user converts to using your product (on a free trial or plan) or to a paying customer, in-app and email surveys are popular survey methods.

How did you first hear about us?

This is different than “how did you find us?”

“Understand your customer’s first memories of how they heard about you, not the ‘referral source,’ which you can easily obtain from Google Analytics. Then, run a cross-tab report comparing where customers heard about you against their Net Promoter Score,” advises Rodrigo Fuentes, ListenLoop co-founder and CEO.

What can we do to improve the sign-up process?

Having leads bail mid-signup or abandon the cart is a leak you want to patch as much as possible.

There will always be some abandonment at signup, but the responses to this question help you identify how to improve.

What could we have done to make your decision to purchase [name of product] easier?

This is similar to the question from the previous section, “What more do you want to know about [product] before purchasing [or signing up]?”

Identifying pain points in the purchasing decision process allows you to better address those points on your website and in corresponding marketing campaigns (including retargeting).

Similar questions:

What’s the one thing that nearly stopped you from buying from us?

Or: What was your biggest fear or concern about using us?

“Ask this question to your successful purchasers to determine the biggest hurdle they had to overcome in buying from you. Odds are you’ll find many more people who dropped off at that hurdle, giving you a great starting point for fixing conversion issues,” advises Qualaroo.

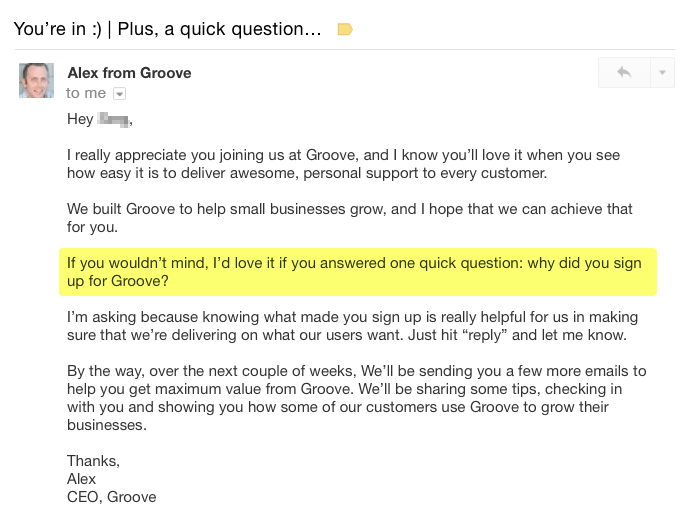

Why did you originally decide to use [product name]?

Remember the example from Grow and Convert’s SaaS client? On-site feedback survey responses helped them identify what product benefits prospects wanted to be informed of. This question is similar in that responses will help your company determine what product features or benefits are selling points.

Groove’s Len Markidan says this question is powerful because it tells you “exactly what success with your product means to the customer. Often, success means different things to different customers.”

It’s so powerful, Groove includes it in the intro email they send to all new users:

- What other options did you consider before choosing [product name]?

- What do we do better than those alternative options?

- What do those alternative options do better than [product name] does?

The sequential questions listed above help you identify your competitors and what users view as your competitive advantages and weaknesses.

You may be tempted to use the word “competitors” in place of “options,” but consider the user research lesson Sujan Patel learned when he headed Growth at When I Work:

In the same vein as the questions above, they asked users “What would you likely use as an alternative to [product or company name] if it were no longer available?”

Instead of naming When I Work’s competitors, the majority of responses indicated the alternative they would utilize was an Excel spreadsheet. When I Work was expecting another company to be identified as a competitor, not an Excel spreadsheet. If they had used the word “competitor” instead of “alternative” it is possible the respondents would have felt pushed to name a company rather than a spreadsheet.

“In fact, ‘Excel’ as the primary competitor became so well known, that they were able to use this to collect leads for their app by offering Excel templates for scheduling in exchange for email addresses,” relates Benji Hyam.

What do you like most/least about [company or product name]?

Or: What is the one thing we should never stop doing?

These are variations of questions that identify what you (either your company or product) are doing well and where improvement is needed.

“Understand what your customers love about your company [or product]…This is often what your customers will mention in a referral to a friend or colleague,” says Fuentes.

How would you describe [company or product name] to a friend?

Or: How would you describe what we do to a friend?

As mentioned above, the responses may share what they love about your company or product; these are the things they’ll mention when referring others to your product.

Companies are not always great at short and clear descriptions of their company or products. Asking users for a description helps you learn new (and potentially easier) ways to describe your product. You’ll also want to pay attention to whether the descriptions are more benefit or feature focused. It is likely they are benefit focused, which you’ll want to mimic in your own marketing content and campaigns.

What is the one thing we could do to make you happier?

Or: What challenge are we not solving for you that we could be?

Both questions are directed towards understanding how you can excel and create a stellar experience for your users. Groove uses the second question because “long-term customer loyalty isn’t just about great support; it’s about making life as easy for your customers as you possibly can,” explains Markidan.

How would you feel if you could no longer use this product?

- Very disappointed

- Somewhat disappointed

- Not disappointed

- N/A I no longer use your product

According to Ellis, if more than 40% of respondents select “very disappointed” then you have product/market fit. But, you can also ask it as an open-ended question to users even after you’ve determined product/market fit to try to get users to give more detailed responses about why they would feel that way.

Consider whether you need to ask that many questions, though. Remember, less is more. Keep your questions to a minimum and you are more likely to be rewarded with better quality feedback and higher response rates.

Wrap-up

As you can see, there is a wide world of prospect and user research questions outside of NPS and exit surveys. This isn’t meant to be an exhaustive list of possible survey questions, nor are we suggesting that you use all the questions listed here.

Our goal with this post is to introduce you to the multitudes of survey question opportunities you can use to get to know your website visitors and users even better. Having the inside track on their needs, wants, and desires is key to your company’s overall success.

The key takeaway is to determine the area of feedback that is your priority (i.e. determining lead sources, discovering pain points, improving user experience, etc.) and tailor a few questions accordingly. Keep the questions to a minimum to avoid the risk of annoying (or even losing) prospects and customers.

Now it’s your turn: What user research questions do you ask your users? What survey methods have you found to be most successful (on-site, in-app, email)? Share your own experiences in the comments below. We appreciate your feedback!