Most teams don’t think about billing until it breaks. In the early days, it’s duct-taped together with spreadsheets, Stripe buttons, and crossed fingers. But as customer counts grow and pricing gets more complex, that patchwork starts leaking revenue, eating time, and creating friction for both your team and your users.

However, a modern billing system doesn’t just automate payments. It can quickly become the backbone of your revenue operations (but only if you know how to set it up correctly). In this guide, we’ll break down what billing systems actually do, how to pick the right one, and how to set it up so it scales with your business from day one.

What is a billing system?

A billing system is the nerve center of your revenue engine, and the thing that translates your customers’ product usage into cash in the bank. It pulls data from your CRM, applies your pricing logic, runs it through your chosen workflow, and handles everything from payment collection to revenue reporting. It’s the connective tissue between your product and your bottom line.

In a modern SaaS business, this system touches nearly everything: invoicing, subscription management, tax calculation, proration, and collections. It’s also responsible for enforcing your billing process, turning messy real-world customer activity into clean, auditable transactions.

Done right, a billing system ensures it moves accurately, compliantly, and on time. Done wrong, and you’re staring down revenue leakage, spreadsheet chaos, and angry customers wondering why they were double-charged.

The real value is in how it translates customer usage into revenue. When a customer hits a usage milestone—say, 100GB uploaded or an extra user added—the billing system applies the right charge, updates the invoice, and triggers the next steps in the billing management cycle. This level of automation is what makes scale possible.

It also plugs into the rest of your financial management stack. MRR, ARR, LTV, churn, upgrades—every metric your CFO obsesses over gets its data from billing. That means your billing system isn’t just a backend ops tool, but also a strategic growth lever.

And it’s not just for finance:

- Product teams use it to test new pricing models.

- Sales uses it for quoting and upgrades.

- Support uses it to resolve billing disputes.

In short, when your billing system works, it works for everyone.

Benefits of using a billing system

At the bare minimum, the main use case of a billing system is to automate transactions, but it can also be leveraged to upgrade your entire business. Here’s how it impacts operations, revenue, and the people on both sides of the invoice.

Reduces manual work and human error

Still generating invoices in Excel? Or chasing down past-due balances in Gmail threads? That’s how manual processes turn into bottlenecks. A proper billing system eliminates those friction points by automating your workflow and removing human error from the equation.

Accelerates cash flow

The faster you invoice, the faster you get paid. And in SaaS—especially in the early-stages—having reliable monthly cashflow is essential. With automated billing and integrated payment tools, you can streamline collections, reduce friction, and improve your cash flow across the board. Then, add in auto-pay, smart retry logic, and built-in dunning flows, and you’ll spend way less time worrying about late payments, and more time compounding revenue.

Improves customer experience

Customers don’t complain about billing when it just works. On-time, accurate invoices and self-service options like updating cards or switching plans all lead to higher customer satisfaction and a smoother customer experience. This kind of consistency is guaranteed when you’re using dedicated SaaS billing software vs. handling your billing processes manually.

Enables flexible pricing models

If you want to:

- Test usage-based pricing

- Launch a hybrid model

- Offer tiered discounts without rebuilding your entire backend

Then using billing software will let you experiment with each of these pricing models without dragging engineering into every change. Plus, this flexibility allows you to create pricing that matches customer value, and drives long-term profitability.

Supports financial visibility and forecasting

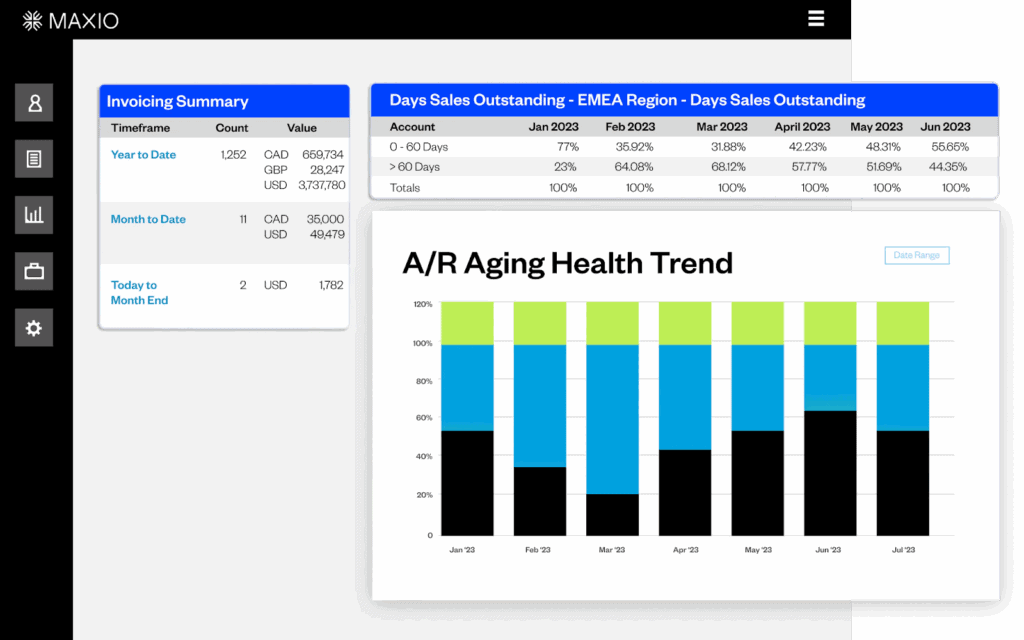

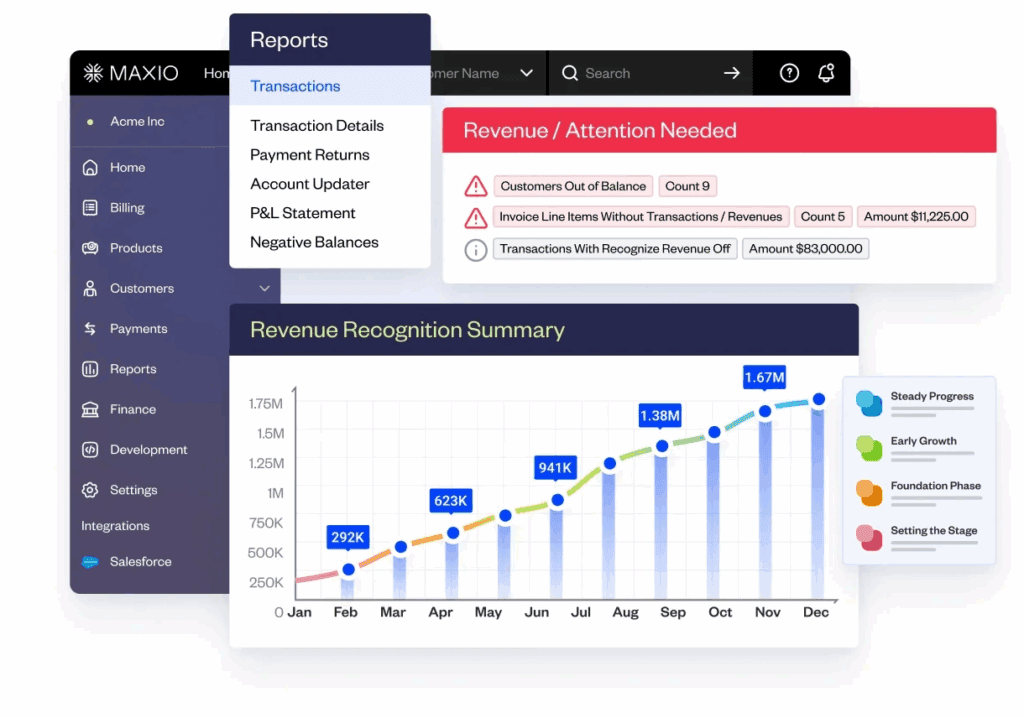

Good billing systems also surface the data that actually matters: MRR, churn, expansion revenue, and usage trends. You can see what’s working, what’s leaking, and what’s ready to scale. For example, at Maxio, our SaaS metrics and reporting functionality allows you to access and analyze all of your customer subscription and billing information to make truly data-informed decisions.

(Source)

Improves compliance and audit readiness

When you’re preparing for a financial audit, or begin talks about a potential acquisition, you’ll want detailed, consistent records of your company’s financial health. A billing system with built-in tax and revenue recognition tools keeps you compliant with ASC 606 and ready for scrutiny. In other words, clean books equals faster due diligence and fewer surprises for you and your team.

(Source)

How does billing software use automation?

Automation is one of the biggest reasons to start using a billing systems. With these automations in place, your billing software can take dozens of time-consuming, error-prone tasks and turn them into background processes that just work.

Here’s how modern billing software puts automation to work across your business:

Automates recurring billing cycles

Once a customer signs on and an order is in place, automated billing kicks off as part of the broader order-to-cash cycle. From that point, the billing system handles everything downstream: generating and sending invoices based on the contract terms (monthly, quarterly, annually) without human intervention. No one’s manually pressing “send” on the 1st of the month. It’s automated, rules-based, and fully integrated with your revenue workflow.

You configure the rules once. After that, it’s fire-and-forget.

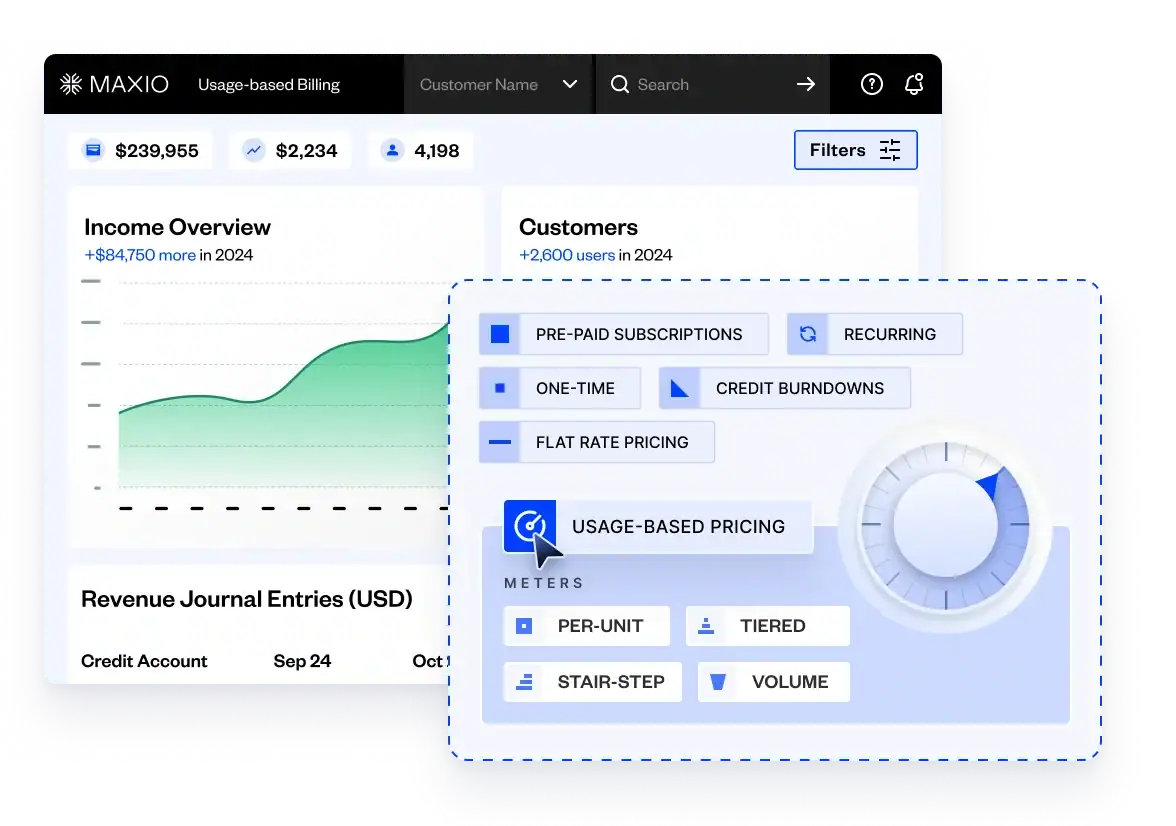

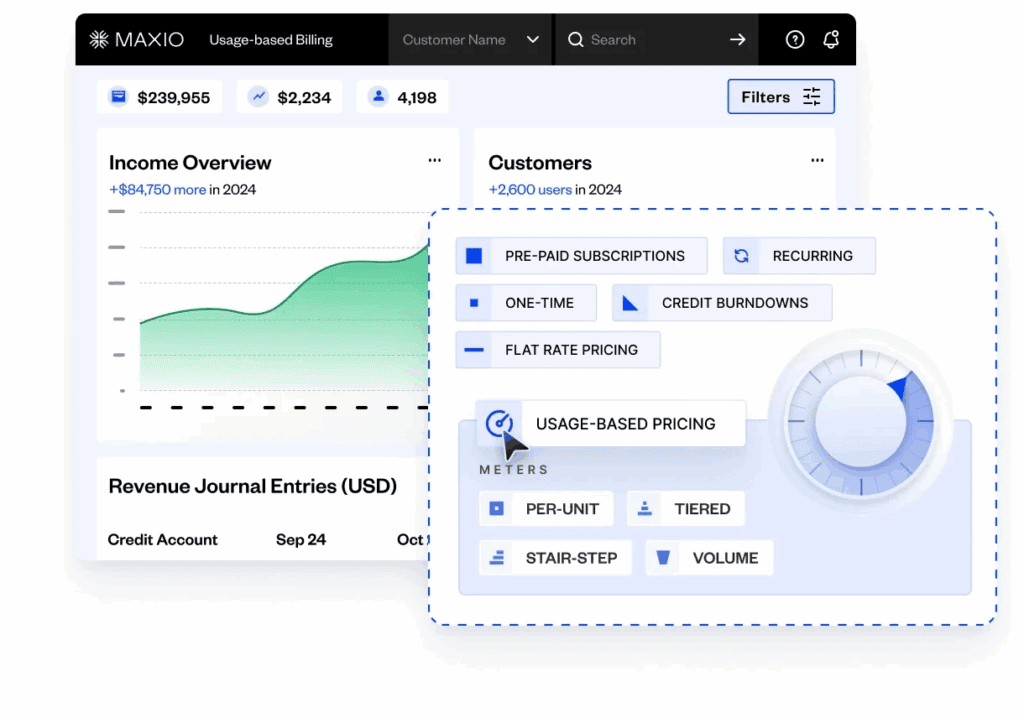

Handles complex usage-based billing in real time

If you need to bill per API call, gigabyte, or user seat, usage-based billing software can track usage in real-time by integrating with your backend. They apply pricing logic instantly, meter events, and update charges dynamically, without any manual intervention from your or your teams.

(Source)

Triggers event-based actions

Automated billing isn’t limited to fixed schedules. It also responds to customer actions. For example, when a trial ends, the billing system activates the subscription and sends the invoice. Or, if a payment fails, it triggers a reminder and starts a retry sequence. The events-based billing functionality lets you apply prorated charges and generate a new invoice automatically when a customer changes their subscription plan.

These actions are powered by pre-configured rules, webhooks, and notifications that ensure the billing system stays in sync with customer behavior.

Eliminates manual tax and currency calculations

Tax rates and currency conversions shouldn’t be managed manually. A billing system applies the correct tax rules based on region and ensures currency conversions are current and accurate. This reduces errors and eliminates time spent on manual data entry.

Improves cash collection and reduces involuntary churn

When a payment fails, a billing system can automatically retry the card, send follow-up payment reminders, and apply fallback methods if available. This makes it much easier to recover revenue without manual follow-up and keeps churn rates lower.

Feeds real-time dashboards and financial reports

Certain tools like Maxio automatically push your billing data into dashboards that track key metrics like MRR, ARR, churn, and payment status. This gives SaaS leadership teams real-time visibility into business performance and helps finance teams stay current without exporting spreadsheets.

Reduces dependence on engineering for changes

With the right billing system, non-technical teams can make updates without developer support. That includes pricing changes, discounts, new plans, and edits to invoice templates, which are all manageable through the billing system’s admin interface.

Common types of billing in SaaS

SaaS companies today have more flexibility, and complexity, than ever when it comes to monetization. With this in mind, choosing the right pricing model isn’t just about how you charge customers. It shapes how they perceive value, when they convert, and how they grow with you over the lifecycle of the relationship.

Below are the most common types of billing, along with examples and trade-offs to help you choose the right fit.

Flat-rate billing

What it is:

One price, one product, one plan. All subscribers pay the same amount regardless of how much they use.

Examples:

- $99/month for access to all features

- Clean, simple pricing pages with a “Starter” and “Pro” tier

Pros:

- Dead simple to implement and explain

- Predictable revenue for you, predictable spend for them

- No usage tracking or manual billing required

Cons:

- Doesn’t scale with customer value

Power users may feel underserved; light users may churn faster

Limited room for expansion revenue

Use when:

You’re targeting SMBs, early adopters, or buyers who want clarity over customization. Flat-rate wins on simplicity.

Usage-based billing (Metered billing)

What it is:

Customers pay based on what they consume, such as storage, API calls, tasks automated, or emails sent..

Examples:

- $0.01 per API call

- $5 per 1,000 emails

- $0.25 per GB transferred

Pros:

- Perfect alignment between price and value

- Scales automatically as customer usage grows

- Great for infrastructure, platform, and dev tool products

Cons:

- Revenue can be lumpy and harder to predict

- Customers may slow down usage to control costs (or experience bill shock)

- More complex to implement and communicate

Use when:

Your product has a clear consumption metric and your users vary widely in how they engage.

Recurring / Subscription billing

What it is:

Customers pay a recurring fee—monthly, quarterly, or annually—for continued access.

Examples:

- $49/month for Standard

- $499/year for Pro

- Think: Figma, Notion, Slack

Pros:

- Predictable lifecycle revenue

- Easier for forecasting, budgeting, and investor reporting

- Annual plans improve retention and upfront cash

Cons:

- Requires more upfront trust (or a free trial)

- Can leave money on the table if usage varies widely

Use when:

Your product has high stickiness and delivers ongoing value, regardless of activity level.

Hybrid billing (Subscription + Usage)

What it is:

You charge a base subscription plus a variable usage fee on top.

Examples:

- $99/month + $0.02 per additional message

- $500/month for 100K API calls, then $0.01 per extra

Pros:

- Combines predictability with flexibility

- Expands revenue as customers grow

- Accommodates light and heavy users without friction

Cons:

- More complex to communicate and implement

- Requires robust billing tools to handle overages and tiering

Use when:

You want to land with a stable monthly price and grow with your customers’ success. Hybrid gives you the best of both worlds, if your billing system can keep up.

What to look for in a new billing system

Choosing billing software is as much of a finance decision as it is a growth decision. The right billing solution can unlock pricing agility, reduce overhead, and scale with your customer base. But if you choose the wrong one, it can quickly become duct-tape infrastructure that slows every team down across your organization.

Whether you’re evaluating a startup-friendly tool or a robust enterprise platform, here’s what to look for based on your real business needs.

Security

Why it matters:

Your billing system will process customer data, credit card details, invoices, and millions in transactions. That makes it a prime target, and a potentially high-stakes liability for your organization.

What to look for:

- PCI DSS compliance for secure payment handling

- SOC 2 Type II certification

- Encryption at rest and in transit

- Granular permissions and audit logs

- SSO and MFA access controls

Bonus:

Look for providers that include built-in fraud detection or allow seamless integration with external risk tools.

Ease of Use

Why it matters:

If your finance team needs a developer to change a plan or issue a credit, that’s a bottleneck. Modern management software should empower your operators and not require engineering overhead.

What to look for:

- No-code UI for configuring plans, pricing, and customer logic

- Easy exception handling (credits, discounts, cancellations)

- Role-based access and intuitive navigation

Bonus:

Good documentation, responsive support, and an interface that doesn’t feel like it was built in 2008.

Automated Invoicing

Why it matters:

Manually generating and sending invoices might work for 10 customers. At 100+, it becomes a full-time job. At 1,000+, it becomes a risk.

What to look for:

- Scheduled recurring and usage-based invoicing

- Branded, customizable invoice templates

- Support for taxes, discounts, and multi-currency formatting

Bonus:

Built-in PDF generation and clear mapping of payment terms to contract logic.

Online Payment Capabilities

Why it matters:

If your billing flow doesn’t support how customers prefer to pay, you’re creating friction, and delaying revenue.

What to look for:

- Plug-and-play support for gateways like Stripe, PayPal, ACH

- Saved payment methods, auto-billing, and dunning workflows

- Support for both one-time and recurring payments

Bonus:

Look for systems that offer a white-labeled customer portal or seamless integration into your product experience.

Scalability

Why it matters:

Think about your billing processes with scale in mind. Your billing tool should evolve with your customer base, product catalog, and go-to-market strategy.

What to look for:

- Can handle complex pricing structures: tiers, bundles, overages

- Integrates easily with your CRM, accounting software, data warehouse, and analytics stack

- Handles global compliance: currencies, tax zones, invoice localization

Bonus:

Robust API coverage and sandbox environments for testing before rollout.

How to set up a billing system

Setting up a billing system is like setting up a revenue engine for your business, so you want to get it right from the start.

Whether you’re ditching spreadsheets or migrating from a legacy tool, the steps below apply across the board. We’ll walk through each phase with general guidance and show how the process works inside Maxio as an example of best-in-class execution.

Step 1: Import customer information

Everything downstream, including your billing logic, reporting, and payments depends on clean data going in. You’ll need each customer’s contact info, payment methods, active plans, and any relevant history (like unpaid receivables, past invoices, or usage totals).

This is the time to eliminate duplicates, fix inconsistent records, and decide what data to carry over.

In Maxio, this setup starts by creating a “Site”. your dedicated billing environment. From there, you can import customers via CSV upload or Maxio’s RESTful APIs. You can also import historical billing records to maintain continuity in your invoicing process.

Step 2: Associate billing codes with usage or subscription options

This is where you define your monetization logic. Every SKU, feature, or metered event should map to a pricing rule: is it a flat monthly fee, a per-unit charge, or part of a bundle? Don’t forget to handle upgrades, downgrades, proration, and discounts. The goal is to ensure that every customer action is traceable back to a charge.

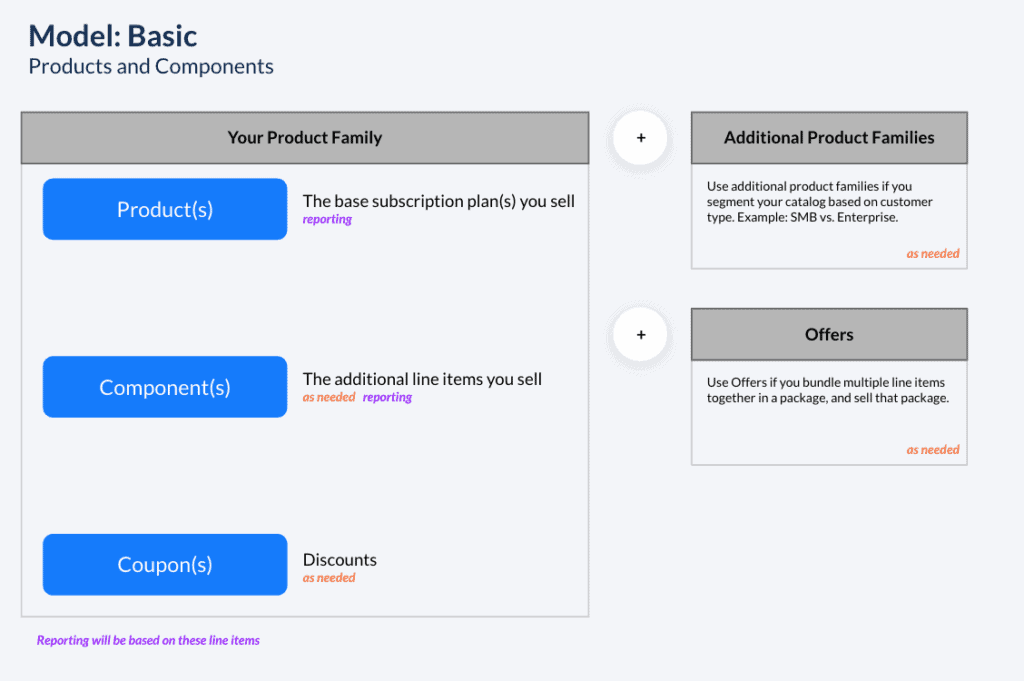

For this use case, Maxio uses a structured Product Catalog system to define products, components (SKUs), and their pricing models, including flat-rate, recurring, usage-based, or one-time.

You can configure billing intervals (e.g., monthly or quarterly), tiers, overage thresholds, and proration settings. Advanced settings let you specify sync cadence and map usage events directly to revenue recognition rules.

All of this reduces manual config and makes scaling pricing changes easier.

(Source)

Step 3: Connect payment gateways and banking details

Before you can collect payments, you need a live connection to a payment processing gateway. Think Stripe, PayPal, or ACH processors. You’ll also need to support a range of payment options: recurring charges, one-time transactions, credit cards, debit cards, even wire transfers for enterprise deals.

And don’t forget your dunning and retry logic. This is how you recover revenue from failed payments without chasing it down manually.

Maxio supports out-of-the-box integrations with all major gateways, including Stripe, PayPal, and their own Maxio Payments offering. You can set up automated payment processing, configure payment routing by geography or plan, and create rules for retries, reminders, and email comms.

The Maxio platform also supports multiple payment methods per customer and allows you to white-label the experience so billing feels native to your product.

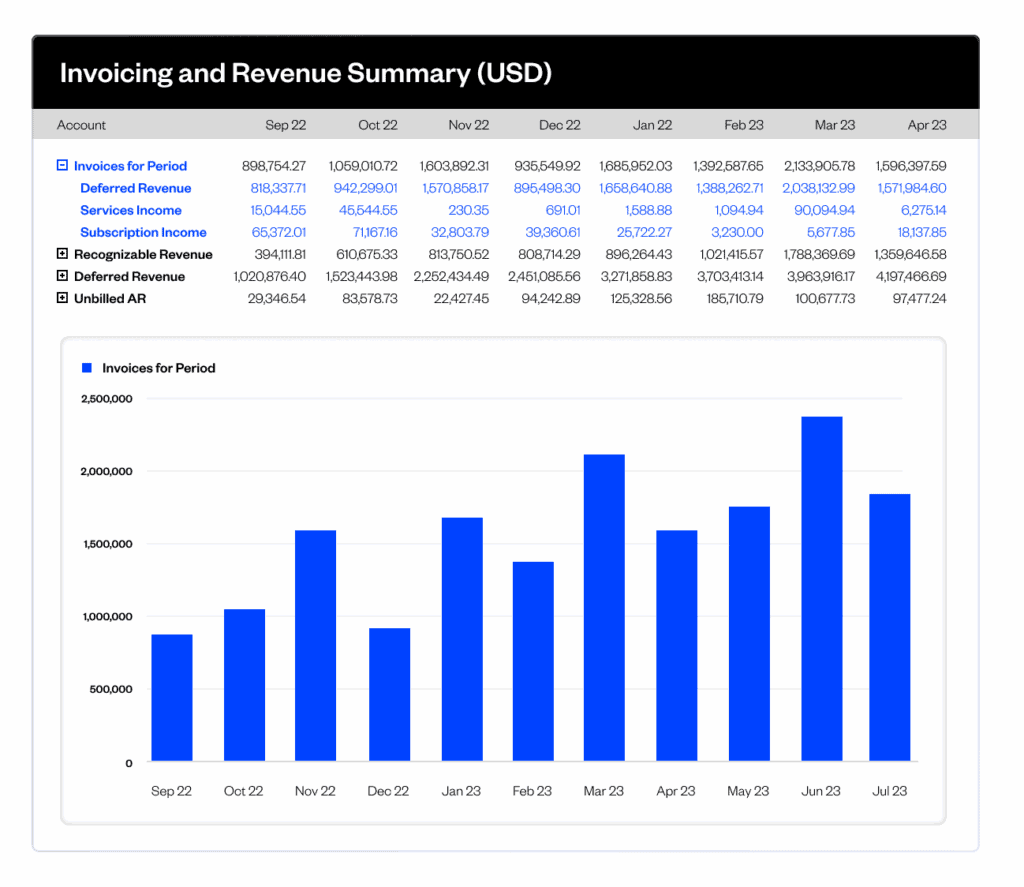

Step 4: Build SaaS metrics dashboards and automate invoicing

Once the system is running, it’s all about visibility and automation. You want real-time access to billing KPIs (MRR, churn, failed payments) and a reliable invoicing process that scales as you grow. That includes automated invoice generation, tax calculations, custom templates, and delivery logic.

For example, Maxio auto-generates and sends branded invoice PDFs based on your configured billing cadence. You can customize invoice templates, add region-specific tax rates, and even support multiple languages or currencies.

Plus, invoices are grouped intelligently by account, queued, and sent based on due dates or triggered events.

Bonus Step: Sync with your general ledger

For growing teams, syncing billing data with your accounting software (like QuickBooks or NetSuite) is essential for accurate books and investor-grade reporting. You also need to comply with revenue recognition standards (like ASC 606) to ensure deferred and earned revenue are tracked correctly.

Maxio offers pre-built integrations to major general ledger systems, allowing us to track and categorize revenue over time based on the product rules you define. That means less spreadsheet work and more confidence in your numbers when audit season (or acquisition talks) hits.

It’s all exportable, auditable, and aligned with GAAP.

(Source)

Billing system FAQs

What is an automated billing system?

An automated billing system is software that handles the entire invoicing process, from generating and sending invoices to tracking payments and managing due dates, with minimal manual input. It eliminates time-consuming tasks like calculating charges or chasing late payments, making it easier to scale without adding headcount.

Which software is best for billing?

The best invoicing software depends on your company’s needs. Small businesses might prefer simple tools like FreshBooks or QuickBooks, while SaaS companies with complex pricing models often lean toward platforms like Maxio. Look for a solution that balances flexibility, automation, and reporting.

How can I automate customer billing?

You can automate customer billing by integrating your billing system with your product and CRM, setting rules for due dates, and using features like auto-pay, dunning, and dynamic invoicing. Most modern systems allow you to configure these settings once and let automation handle the rest.

How can a billing system improve business efficiency?

A modern billing system streamlines your metrics, improves cash flow, and reduces the burden on finance and operations teams. By replacing spreadsheets and manual processes with automation, you save time and get real-time visibility into revenue, customer behavior, and payment health.