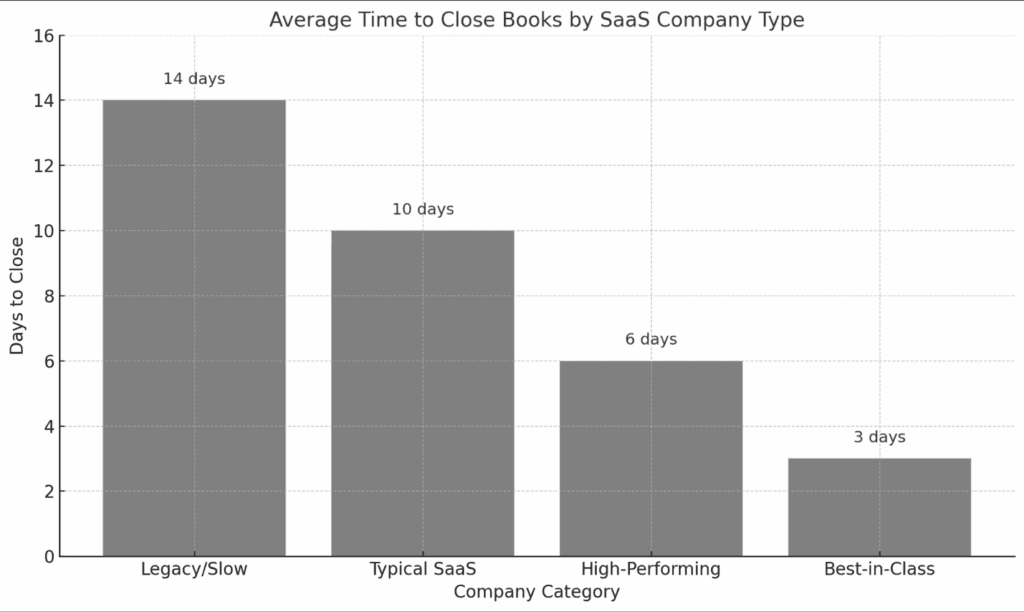

I have made hundreds of investments in SaaS companies and am more likely to fund those that close their books quickly and efficiently. That’s because how quickly a company closes its books (with all accounts reconciled) is a good indicator of a well-run company.

Why Book Closing Speed Matters to Investors

Let me explain further. Closing the books quickly and accurately means:

- The company is data-driven. Managers who use data to run their business will not wait 20 days for results.

- The company is financially predictable. This does not mean they will be successful, but they will not be surprised financially.

- The risk of fraud is lower. Particularly if cash is reconciled. Fast-close companies rely on tech instead of spreadsheets, where errors and fraud often develop.

Retention Reporting: Another Key Litmus Test

The other financial litmus test is the quality and timeliness of retention reporting. Slow or inaccurate retention reporting is a big red flag. Why? It means the owners don’t understand the importance of retention, which means they don’t understand SaaS.

What Does “Good” Look Like?

If a company has under $3 million in ARR, its books should be closed no later than the 15th. That was the deadline for financial reporting at SaaS Capital, the lending company I founded.

If the business has over $5 million in ARR, “good” is books fully closed within a week of month end.

Setting the Gold Standard for Retention Reporting

For retention reporting, the gold standard is a static pool analysis. This allows you to drill down into revenue by customer by month and see:

- Gross retention

- Net retention

- Logo retention

It’s also essential to isolate different revenue streams: subscription, usage, services, etc.

Why Technology Matters for Speed and Accuracy

You can reach this level of reporting speed and detail with just a GL package and a spreadsheet—but only if the business is exceedingly simple and has just a few dozen customers.

Almost all companies hitting the benchmarks above had some supporting technology beyond the GL.

Build It Right or Reset It Completely

High-performing finance groups either:

- Build a clean finance function from the start, with good contracts, chart of accounts, and processes, or

- Hit a hard reset button at some point.

The underlying data and structure must be clean and well-conceived. In many cases, it must be rebuilt from the ground up.

Check out a great, recent webinar by Ben Murray and Maxio’s Jon Cochrane on this topic.

Fast and Accurate Reporting Builds Investor Confidence

Closing your books quickly, efficiently, and accurately will not ensure a successful fundraising, but in this difficult environment, it will help. With all the experienced SaaS finance professionals and supporting tech, slow and sloppy reporting is inexcusable—and it makes investors wonder what else in the business may be deficient.