Get plug-and-play access to SaaS metrics—without ditching your existing billing software with Maxio Metrics.

Investor-Grade SaaS Metrics for B2B Finance Teams

At Maxio, we’ve partnered with thousands of B2B SaaS operators who run sophisticated finance teams and FinOps stacks. Still, when it comes to measuring growth and efficiency, too many teams lack a consistent, reliable view of the metrics that matter most.

Why do B2B SaaS teams struggle to align bookings, billings, revenue, and ARR/NRR?

- Competing definitions: There’s no governing body for SaaS metrics, so leaders disagree on what counts toward ARR, NRR, and other vital KPIs.

- General-purpose tools: Many finance platforms weren’t built for B2B SaaS metrics. Their dashboards go a mile wide and an inch deep.

What common fixes fail for SaaS metrics?

Spreadsheets break under ARR/NRR nuance

No amount of color-coding or access control eliminates formula risk or manual rework. And because SaaS metrics aren’t standardized like GAAP revenue, small definitional differences create big reporting gaps.

Are ERP modules enough for SaaS metrics?

ERPs solve real problems, but most were designed for manufacturing—not subscription models. Add-on modules for billing or SaaS metrics often miss the nuance needed to satisfy investors, acquirers, or day-to-day operators.

Custom BI burns time you need for analysis

Hiring an analytics pro to hand-craft dashboards can work—but it’s slow. Months spent building (and rebuilding) metric logic is time not spent analyzing the business and advising leadership.

How does Maxio Metrics deliver investor-grade SaaS analytics?

Maxio Metrics delivers investor-grade SaaS metrics and analytics for B2B SaaS—tied directly to the money movement in your business. Use it alongside your existing billing system or ERP as the source of truth, or run it as part of the broader Maxio platform for billing, collections, and revenue recognition.

Which SaaS metric reports come out of the box?

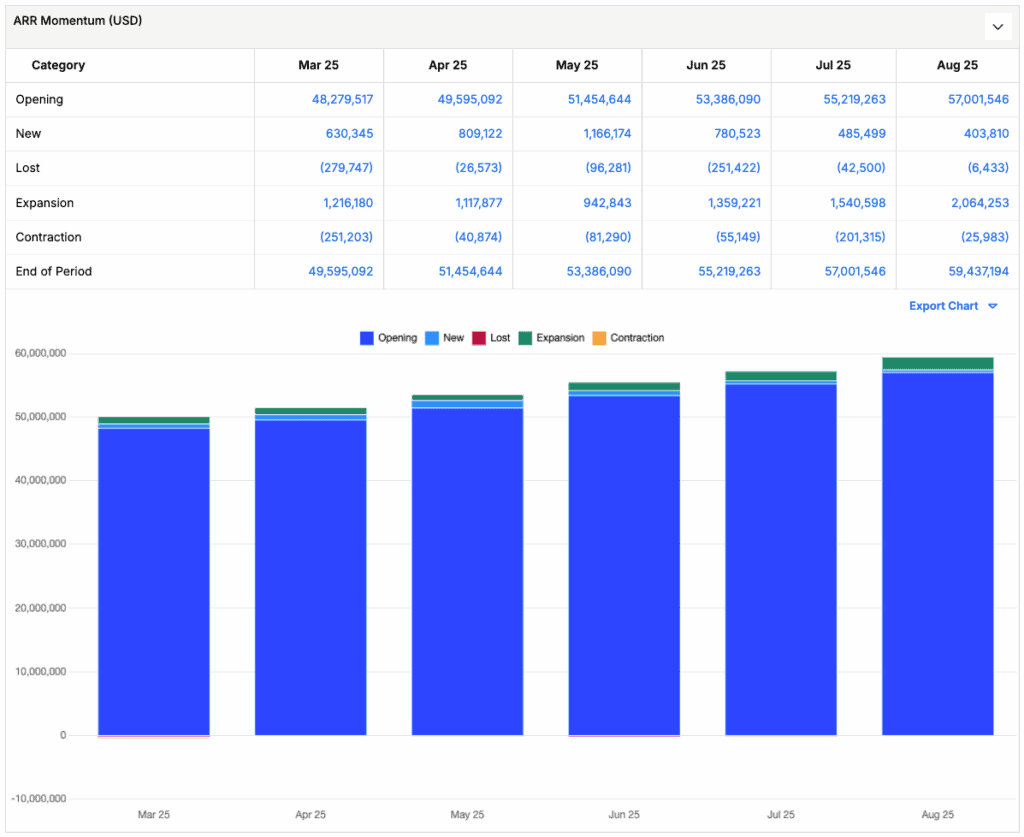

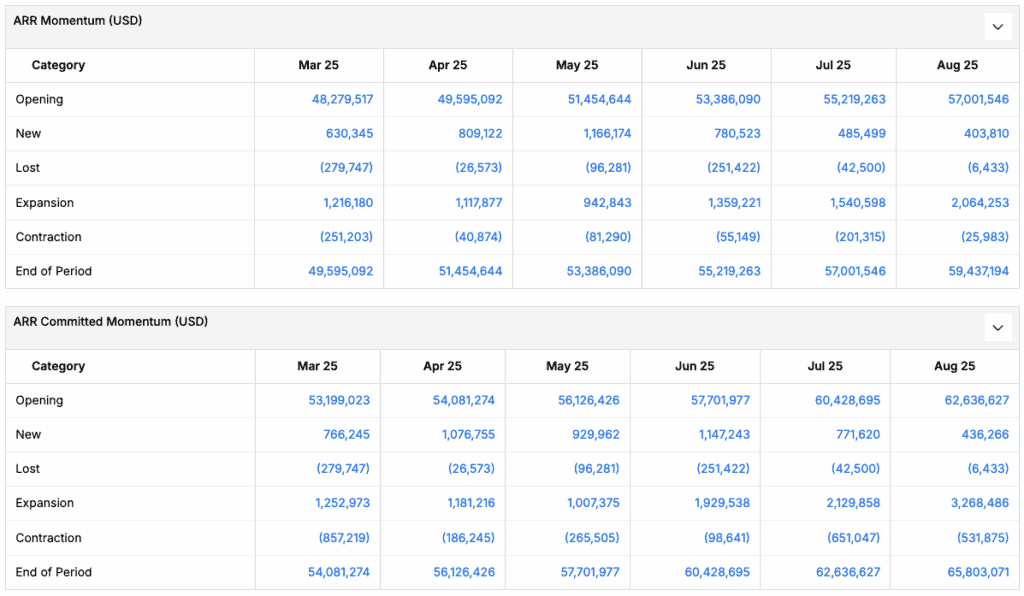

Momentum (snowball): categorize ARR consistently

ARR is automatically categorized into New, Expansion, Contraction, and Churn—the same way, every period. That consistency eliminates spreadsheet drift and makes trends obvious.

ARR/MRR: committed vs. live, handled correctly

Differentiate “committed” vs. “live” ARR, account for mid-term changes, early renewals, delayed starts, mid-month activations, and more—without one-off logic.

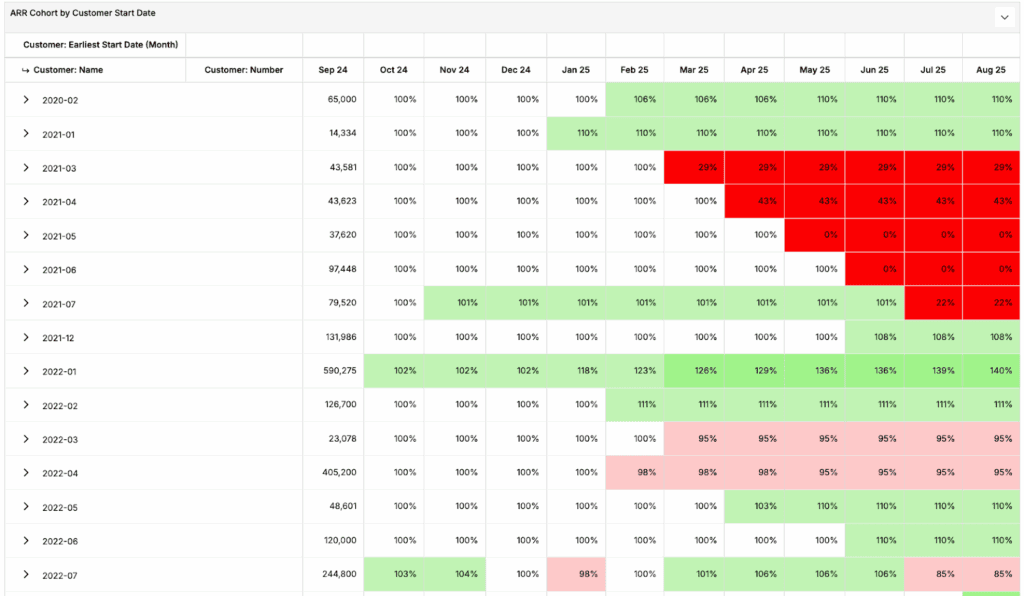

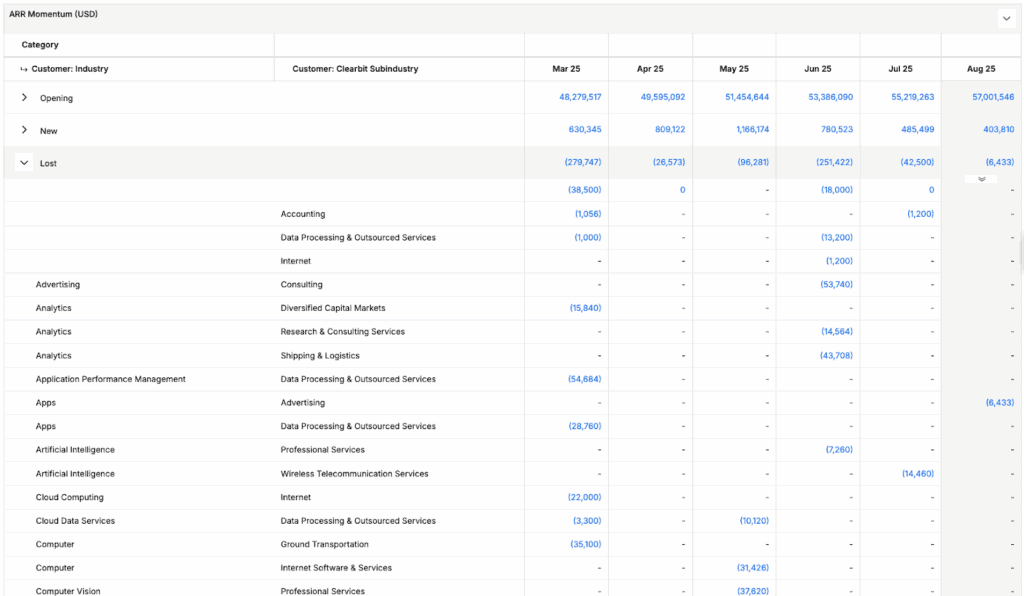

Cohort analysis: find retention and expansion levers

Drill into performance by start date, industry, segment, sales owner, plan, or any attribute you care about. Spot retention patterns and expansion levers fast.

Custom objects: enrich and segment your way

Bring in attributes from your CRM or GL to slice and dice by ICP score, customer size, location, and more. You can also enrich with attribution data to standardize segmentation.

Why do finance leaders and investors rely on this approach?

- Consistent definitions across periods and teams

- Audit-ready lineage back to transactions

- Drill-downs that explain the “why,” not just the “what”

- Fast time to value without a year-long BI project

Maxio powers thousands of B2B SaaS companies and is trusted by leading investors and operators to validate growth narratives, accelerate funding conversations, and run the business with precision.

Ready to level up your SaaS metric reporting?

Get a demo and see how quickly you can move from spreadsheet wrangling to decisions you trust.

Get a demo

Explore the #1 billing and finance platform for B2B SaaS.

FAQ

Can we bring in historical data?

Yes. Most teams import 1–2 years of history to establish baselines and trend lines. We’ll align on the right window during scoping.

How long does implementation take?

Implementations are designed to be quick. Depending on your data sources and import method (direct ingestion, CSV, or API), teams typically go live in days to a few weeks.

What’s the best “source of truth” for metrics?

We generally recommend billing/payments or your GL because they reflect the real financial relationship with customers. Some teams choose their CRM; we support that too, but finance-grade metrics are strongest when anchored to billing or GL data.the source of truth.