If you work in SaaS finance, your role is about a lot more than just closing the books. Today’s finance leaders are responsible for crafting the narrative behind the numbers—explaining not only what happened, but why it happened. And when a board meeting, investor call, or audit is around the corner, you need those answers fast.

That’s why drill-down reporting isn’t a “nice-to-have.” It’s an essential capability for any high-performing SaaS finance team. The ability to move from a top-level metric to the underlying contract, transaction, or journal entry in a few clicks gives you unmatched clarity, auditability, and control.

So if you’re still buried in spreadsheets and juggling static reports, it might be time to rethink your reporting stack.

The Problem: Disconnected Systems and Manual Workarounds

For most finance teams, reporting still feels like assembling a jigsaw puzzle with half the pieces missing. ARR reports are rebuilt every month. Sub-ledgers live with outsourced bookkeepers. Deferred revenue schedules are stored in error-prone Excel files that only one person truly understands. And when leadership asks, “Why did revenue drop this month?” the answer isn’t at your fingertips—it’s buried across tools and spreadsheets.

Here’s what that looks like in practice:

- Finance spends days manually pulling and validating data from multiple systems.

- Critical business questions take too long to answer—or go unanswered entirely.

- Metric definitions vary across teams (if they’re defined at all).

- Audit prep turns into a fire drill instead of a formality.

Without true drill-down capabilities, you’re left reacting instead of leading. You can’t move fast, and worse—you can’t be confident in your numbers.

What Is Drill-Down Reporting?

Drill-down reporting is the ability to trace high-level metrics back to their source data—quickly, clearly, and confidently. It bridges the gap between surface-level reports and the granular financial reality driving your SaaS business.

With drill-down reporting, you’re no longer stuck asking:

- Where did this number come from?

- How is this ARR trend composed?

- What caused the increase in churn?

- Which customer contracts are behind this deferred revenue movement?

Instead, you can follow a direct path from the metric to the data behind it.

It’s not just about numbers. It’s about visibility. It’s about telling a story with confidence—whether you’re answering to your CEO, your board, or your investors.

Why Drill-Down Reporting Matters in SaaS

SaaS finance is uniquely complex. You’re not just tracking cash in and out—you’re managing subscriptions, revenue recognition, customer cohorts, and ever-changing contracts. Without drill-down visibility, you’re forced to reconcile multiple sources of truth, often under pressure.

Drill-down reporting solves this by:

- Connecting metrics like MRR or churn to specific customer actions.

- Making audit prep dramatically faster and easier.

- Aligning cross-functional teams on a shared, reliable view of the data.

- Empowering finance leaders to provide proactive, strategic insights—not just historical summaries.

Imagine being asked in a meeting why net retention dropped by 3%—and having the answer in seconds. Drill-down reporting makes that possible.

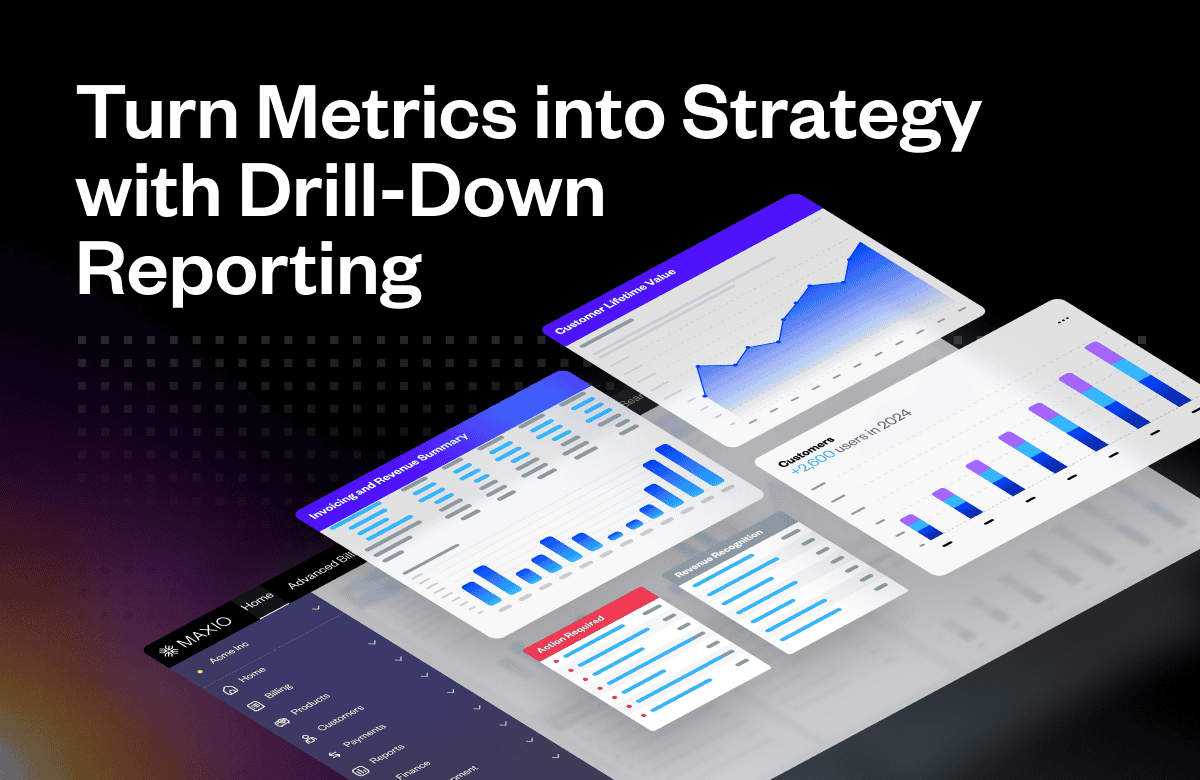

How Maxio Powers Drill-Down Reporting for SaaS Finance

At Maxio, we’ve built drill-down reporting specifically for the needs of SaaS companies. Here’s how it works:

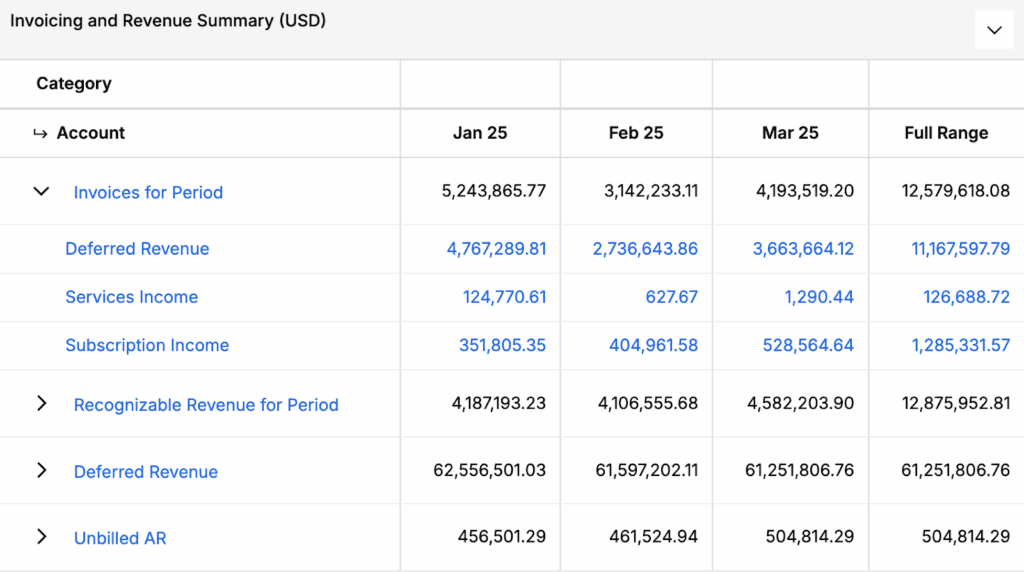

1. Trace Revenue Back to the Source

Maxio connects the dots between customers, product lines, invoices, and transactions. Want to understand February’s recognized revenue? Click on the figure and you’ll see the exact line items and contracts that generated it.

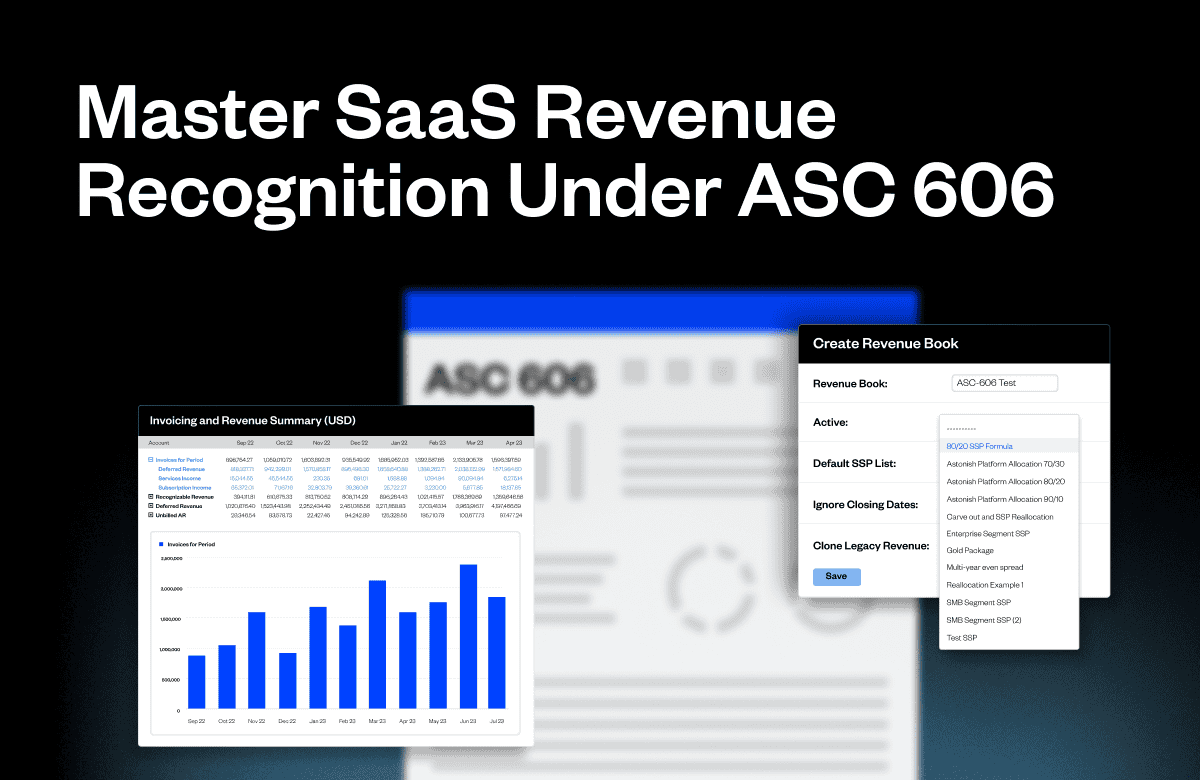

2. Get Audit-Ready Without the Stress

Revenue recognition schedules are automatically generated and fully traceable. When auditors ask for evidence, you’re just a few clicks away from the complete story—no scrambling required.

3. Ditch the Fragile Spreadsheets

Deferred revenue schedules no longer need to live in hidden Excel tabs. Maxio makes them visible, dynamic, and easy to reconcile. Plus, you can instantly see how contract changes impact your books and your forecasts.

4. Trust the Metrics You Report

Maxio’s Subscription Momentum report shows you what’s happening—and why. You’ll always know how your SaaS metrics (ARR, CAC, churn, LTV, etc.) are defined and what’s driving the changes. No more guesswork.

5. Give Each Team the Visibility They Need

With customizable dashboards, every stakeholder—from finance to sales to leadership—can track the metrics that matter to them. Sales can view ARR by rep. Finance can analyze expansion by cohort. Everyone’s on the same page.

Finance Needs More Than Snapshots—It Needs a Story

It’s no longer enough to report on the past. SaaS finance teams are expected to shape the future of the business, guiding strategy through data. But you can’t do that with disconnected tools and delayed answers.

Drill-down reporting gives you the full picture—the ability to investigate, explain, and influence. It turns reporting from a reactive chore into a strategic advantage. If you’re ready to stop fighting spreadsheets and start owning your metrics, Maxio can help. Book a demo and see how drill-down reporting can change the way you work—for good.