Notice any surprises on your tax bill this year? For many SaaS companies, their R&D costs were significantly greater than in previous years—and it’s all because of new legislation that slipped under most peoples’ noses. Until now.

What is this new tax legislation?

According to Sec. 174 Amortization of Research and Experimental Expenditures, taxpayers are required to capitalize and amortize research and experimental (R&E) expenses over five or 15 years for tax years beginning in 2022 or later.

Why is this a big deal?

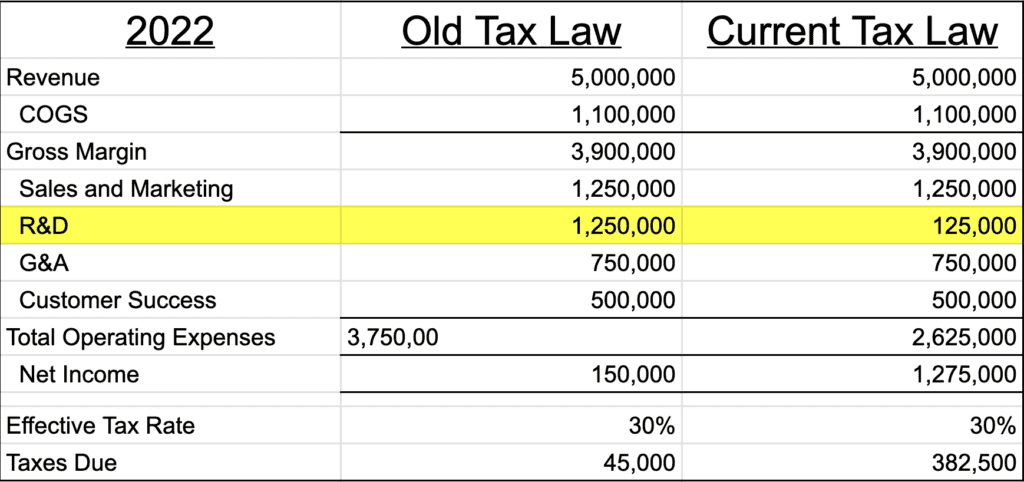

The average SaaS company spends 25% of its revenue on software development. The example Todd Gardner, Managing Director of SaaS Advisors, shares below is based on SaaS Capital survey data of over 1,000 companies. As a result of this new legislation, the typical tax bill for a five-million-dollar SaaS company could increase eightfold. That’s no small number.

What are the immediate implications of Sec. 174?

To better understand the ripple effects of this new legislation, we sat down with Tyler Kem, Co-Founder & President of Strike Tax Advisory—an advisory firm that’s solely dedicated to helping businesses optimize their R&D tax credits.

According to Tyler, “The way [Congress] wrote the code is that, after five years, the benefits would offset themselves. But here in the first couple of years, it’s going to have a significant impact on [SaaS] businesses by artificially creating taxable income out of thin air. Now, these businesses are really going to have to reconsider the onshore/offshore model as a result. Typically, it’s been very favorable to go offshore due to lower development costs, but now SaaS companies are only going to be able to deduct 1/15 of those costs in the current year on their tax return.”

This has a significant impact on SaaS companies that are consistently dealing with net operating losses—especially if they thought they had more cash on hand than they actually do.

How are SaaS owners and operators responding to this new legislation?

According to Tyler Kem, here are the most common actions SaaS owners and operators are taking as a result of this new legislation.

Extending their tax deadline: “Given the tax deadline, a lot more businesses are working to extend their tax return in hopes that Congress will repeal something, push something out, extend the current expensing rules, etc.” says Tyler.

Reevaluating onshore vs. offshore dev teams: Now that the nature of R&D expenses has changed, there is potential that SaaS companies will start to reevaluate offshore development teams. For now, most SaaS leaders are still trying to wrap their heads around the long-lasting impact of this legislation in hopes that it will get repealed.

Pulling out credit lines or debt-financing: SaaS owners and operators who have been hit with this unexpected tax bill are now having to make quick decisions about their method of payment. With churn on the rise and funding rounds slowing down, many business leaders are turning to funding alternatives such as pulling out lines of credit or revenue-based financing.

Many aren’t sure what to do: Tyler Kem also adds that “the one really unique thing about the section 174 amortization rules is that CPAs never had to identify it before—it didn’t matter because you could always expense everything. For example, if you had to pay $100, you could write off $100 on your tax return. Now, you have to classify the expenses and determine ‘is it for research and experimental?’, ‘should it be deducted or should it be amortized?’, etc. It used to be that only the R&D consultants were looking at 174 expenses because they were the only ones trying to go in identify these documents.”

What are the best next steps for SaaS founders and leaders?

Before we dive into next steps, it’s important to note that the tax credit itself isn’t changing.

According to Tyler, “the way that we calculate the credit is not changing. It’s all about how you deduct those expenses on a tax return. The biggest impacts that we’re seeing are on businesses that are right around breakeven (between one to five million ARR) that are now potentially facing $500,000 to $700,000 R&D tax expenses.”

With many SaaS leaders staring down these new expenses, here are the best next steps to take to ensure you’re not footing the bill unnecessarily:

1. Reach out to your CPA

Before taking any action, it’s best advised to reach out to your CPA and see if this change will impact your company. Todd Gardner recommends that you add up what you spend on your development team fully loaded with benefits, and then add 15% for other costs. Take that number and multiply it by .9, and that is the increase in your taxable income for 2022.

2. File for an extension

If you are impacted significantly, the most common advice is to file for an extension and hope that congress changes the law. The problem is that you will need to pay estimated taxes based on the current law. According to experts, extending and paying estimates based on the old tax code would almost certainly result in penalties and interest. Instead, you can apply to the IRS to pay your tax bill in installments which might be easier than getting a loan (if you can make the payments).

3. Identify previous tax credits and roll them forward

If you’re not claiming the R&D tax credit, it’s possible to go back and maximize your credits over the last couple of years and amend your prior tax returns. By rolling these credits forward, you can plan ahead for any surprise tax expenses in the future.

4. Reach out to an R&D tax credit advisor

If you’re working with a CPA that doesn’t have a background in calculating documents substantiating defending credits under audit, then there are risks in claiming the credit with that CPA. By working with a dedicated R&D consultant, you can maximize your available credits and significantly reduce your tax expense.

Minimizing your tax expenses and seeking alternative funding

If you’re determined to claim the R&D tax credit, working with a dedicated R&D tax consultancy is your best bet to maximize your credits and reduce your tax expenses.

However, this doesn’t guarantee that the state of cash in your business won’t take a hit. If you’re interested in bolstering your cash flow without raising a down round or seeking out investors, you may want to consider an alternative funding source like debt financing—this is why we’ve partnered with Todd Gardner, Managing Director of SaaS advisors, to build this Loan Analysis Calculator.

The calculator will help you see how different debt structures will impact your cash runway up to 36 months, and make accurate assumptions of how raising debt can help you fuel growth or breakeven in the future.

You can download it here.