In the capital constrained environment of 2023, the role of the SaaS CFO is changing. The modern CFO isn’t just a financial advisor, but is now playing a central role in guiding their organization through economic uncertainty. In 2023, this means identifying areas to reduce costs, extending cash runway, and prioritizing key financial and operating metrics that the rest of the business can rally around.

We asked our very own CFO, Dan Owens, how he would advise other SaaS finance leaders to successfully navigate 2023. With over 20 years of experience leading and advising public and private-equity owned tech companies, Dan knows a thing or two about achieving financial success in challenging market environments.

Here was his advice:

“How would you advise other CFOs to reduce tech spend in the current market?”

When asked his thoughts on reducing tech spend, Dan said, “You need to avoid a death by a thousand papercuts scenario.”

In other words, an overgrown tech stack can contribute significantly to your OPEX. Dan recommends prioritizing SaaS purchases based on the following areas to determine what’s really worth the investment:

1. Software that supports revenue: e.g. a Sales Engagement Platform = immediate feedback on which sales activities create the greatest ROI = a more efficient sales org.

2. Software that leads to increased efficiency within your organization: e.g. a CRM = pipeline management = greater efficiency when closing deals.

3. Software that helps you reduce spend and maximize revenue: e.g. a dedicated Financial Operations Platform = visibility into financial and operating metrics = identify areas to reduce spend and maximize revenue.

Ideally, your vendors of choice should provide enough value to the point where you can view them as partners, and not just another line item on your PnL statement.

“What is your best advice for monitoring tech spend?”

As with any other business activity, Dan recommends implementing a simple, repeatable process for monitoring your tech spend:

- Capture vendor information and contract details in whatever ERP or accounting system you’re using. You should have your net payment terms, renewal dates, and other contract details readily available—especially when you’re looking to reduce software spend.

- Assign clear ownership over individual pieces of software. Assigning ownership at the individual or department level will help you set expectations for how software is being used and managed across your organization.

- Once ownership is assigned, perform regular reviews of software spend during budget meetings. How are we tracking/managing spend? Are we still getting good ROI out of this tool? Do we need to scale up or down on licenses or usage? These are the questions your assigned software owners should be prepared to answer.

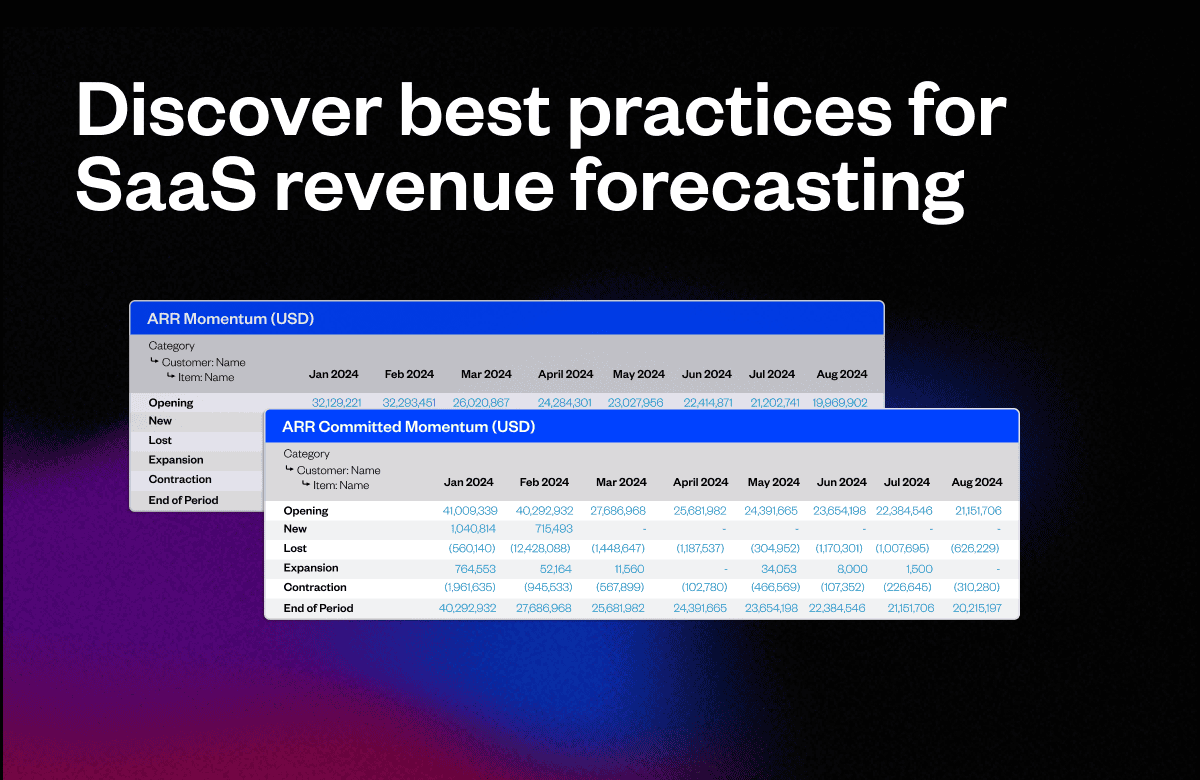

By investing in a tool like Maxio, you can track and manage unexpected variances in expenses, which is often the case when you’re paying for software that uses a consumption or usage-based pricing model. If you want total visibility over tech spend and related expenses, a Financial Operations Platform like Maxio is the perfect solution.

“What are the north star metrics SaaS finance leaders should be focused on in 2023?”

“Cash and cash burn. Without a doubt.”

Of course, there are dozens of metrics associated with enterprise value and success, but cash is top of mind right now for most finance leaders. For Dan, this is largely due to the uncertainties surrounding current market conditions. As companies continue to cut down on software spend, SaaS CFOs need to preserve cash, reduce their burn rates, and double down on retention. If necessary, it may be advised to raise a down round or seek out alternative financing options such as debt financing.

Achieving Growth in Leaner Times

Cutting costs and extending runway may be a key objective for now, but the ultimate goal for any CFO is predictable growth over time. Growth in leaner times is possible, but CFOs are likely to be much more selective about spending, turning to advanced scenario planning and modeling to inform their decision-making.

According to the PwC Pulse Survey, 47% of CFOs say their top priority is building predictive models and scenario analysis capabilities.

With Maxio, you can leverage real-time SaaS metrics based on the same data as your financials to model dozens of scenarios and prepare for any headwinds you may face in 2023. Check out the Maxio buyer’s guide to see how SaaS finance leaders are using Maxio to achieve disciplined growth in an unpredictable market.