The collapse of SVB has increasingly stacked the odds against SaaS founders and operators who were already scrambling for cash.

According to Crunchbase, in the fourth quarter of 2022, North American startup investment was down 63% YOY, driven largely by plummeting later stage financings. And now with the fall of SVB, the norms of the SaaS funding environment have fundamentally changed.

VCs will no longer be handing term sheets to half-baked startups with a promising IRR and zero due diligence (for now). If you’re determined to navigate these headwinds unscathed and deliver good news to your investors and the board, you need a renewed focus on cash. This means reducing expenses, understanding your cash inflows and outflows, and making accurate financial forecasts.

We spoke with Josh Aharonoff, Founder of Mighty Digits, to see how SaaS leaders can preserve cash and straighten out their financials in the event of a major financial crisis.

Here’s what we found:

Start with a strong financial model

An effective SaaS finance and accounting function should always has a centralized view of what’s happening in your organization financially. You need to know what your financial situation is today and how it will change over time—especially during a downturn when private and public markets could swing either way.

You need to be able to drill down into your financials, and your company’s master spreadsheet with 20 color-coded columns and endless rows just won’t cut it. Bain & Company research has found that companies make more dramatic gains and losses during downturns than during stable periods.

If you want to ensure you’re a part of the winning majority, you need a centralized dashboard that provides visibility of the following metrics:

- Revenue: Summary totals by account for invoicing, revenue, deferred revenue, and unbilled A/R. Additionally, your finance department should have tools available that make it easy to pull detailed journal entries. These journal entries are necessary to book month-end revenue, liabilities, and assets.

- Rollforwards: Your model should allow you to view the changes in deferred revenue and A/R during a specified time period.

- Contracts: Internal stakeholders need the ability to see revenue, deferred revenue, and invoice waterfalls at a moment’s notice.

- A/R aging: To keep cash flow consistent, you’ll need tools to track how much each of your customers owes you, grouped by days past due.

- A/R health trends: Trends in your A/R allow you to check the composition of your A/R balance over a period of time based on how long invoices have been outstanding.

- Days sales outstanding: Your DSO allows you to find out exactly when invoices are being paid, so you can maintain consistent cash flow month-over-month.

Once you have high-level visibility of these metrics, you can start charting the course and planning scenarios for navigating a down market.

Brainstorm future scenarios: should you play offense or defense?

Once you’ve made an accurate assessment of your starting position, you’ll have a better understanding of which recessionary levers will stimulate growth.

If you have both a strong strategic and financial position, it’s time to play offense. You can afford to push the envelope on market share, leadership, and growth.

But what if you’re short on cash? In this case, it’s advisable to focus on your core products and services. Without VC funding or extensive cash reserves to fall back on, the potential reward of “growing for growth’s sake” is not worth the risk.

To determine your financial position, integrate cash flow forecasting into your profit and loss outlooks and scenario modeling. You need to know when, where, and how cash is being used throughout your organization, as well as how much cash is coming in the door each month.

Keep your finger on the pulse with budget vs. actuals

While you’re digging into your accounts payable and receivable to determine your future cash position, stay focused on what’s right in front of you. You can get a grip on your current financial standing by consistently running your budget vs. actuals.

When you run your monthly budget vs. actuals, pinpoint where your assumptions were right and where they were wrong.

SaaS leaders who don’t keep up with the financial standing of their organization often end up losing money and are forced to raise in a down round or make severe budget cuts to recoup their loss in profits. You don’t want to find yourself in either of these situations.

Protect your most important financial asset: cash

When crisis strikes, successful SaaS companies immediately take stock of market conditions and start laying the foundation for a solid recovery. The vital first steps are setting up a cash war room, developing a cash flow forecast, modeling profit-and-loss (P&L) scenarios, and initiating greater oversight on spending.

Once your leadership teams have those basic elements in place, you can focus on sustaining a stable liquidity position over the next 12 to 18 months and beyond. An effective plan focuses on two key goals: rigorous liquidity monitoring and actions that can significantly improve or even transform your company’s cash position.

Maintaining an unflinching eye on cash is critical. This task may feel difficult amidst all the unknowns, especially if the downturn is at an early stage and recovery seems more than a year away. But sustained cash management practices will lay the groundwork for your company to emerge from the market downturn in a position to grow.

How to preserve cash during a downturn

1. Get clear on your burn rate

In order to protect your working capital you need to figure out your cash burn rate and project your “cash out” date (when you’ll go out of business if cash runs out). With a clear understanding of how fast capital is being used up in your business, you can make plans to reduce expenses or allocate spending to higher ROI activities.

2. Understand where your expenses are coming from

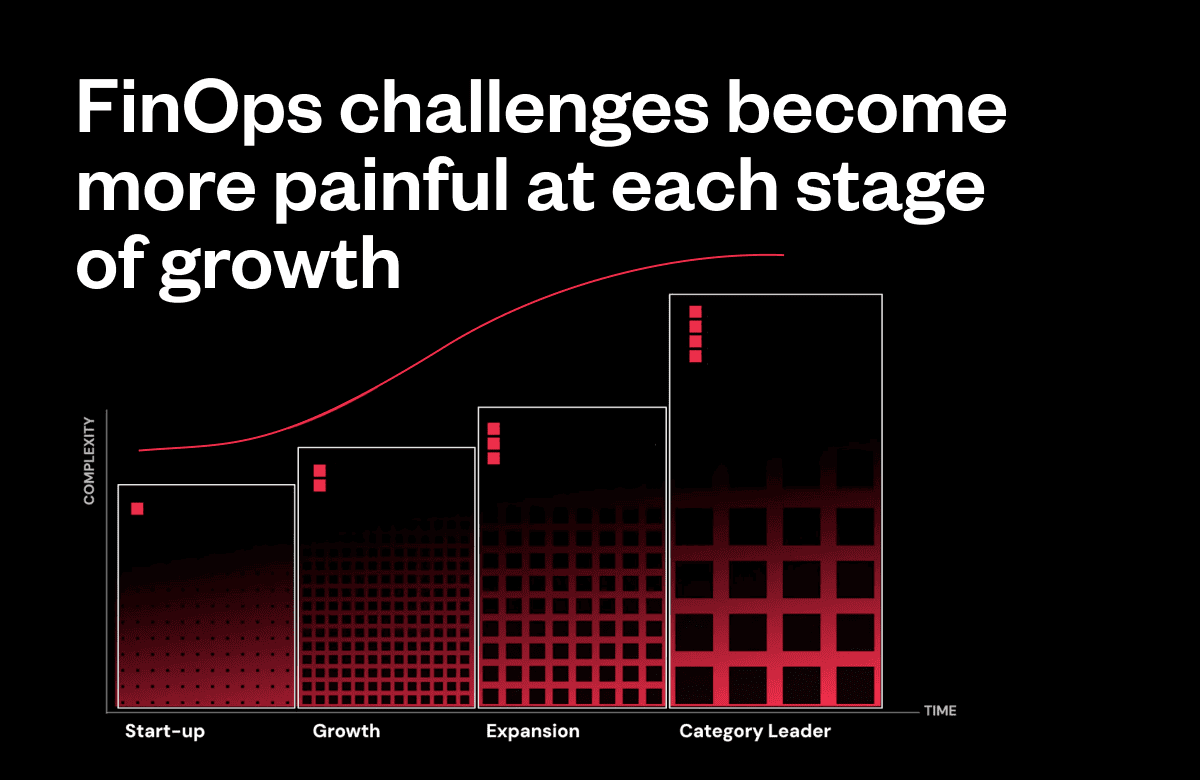

SaaS leaders should understand their business on a P&L classification basis (how much budget is going towards payroll, software, advertising, and other areas of their business). Even if you have a master Excel spreadsheet, you still won’t be able to drill down deep enough to see where your money is being spent—this is why having access to a FinOps tech stack that gives you real-time access to all your financials is a must for SaaS finance teams.

3. Eliminate overspending: the silent SaaS killer

Keep a watchful eye on your spending practices. Use daily spending review sessions to assess whether purchase requests are critical to your business. This will help you start cutting costs and save your remaining capital. You can also consider expanding the authority of these spending review sessions to oversee other decisions, such as recurring spending, capital expenditures, and hiring.

4. Consider restructuring opportunities

Restructuring organizations to support cash preservation over the long term is what gets companies through volatile market environments time and time again. You can start by assessing various business units, geographies, channels, and product lines to identify areas that are underperforming. Then, you can determine where to deploy improvement plans and where to implement a broader restructuring plan to reduce drag on your organization.

5. Study how revenue is moving in your business

Before you can make clear predictions on how much cash you’ll be able to safely stow away, you need to understand how revenue is moving in your organization over time. What are your ARR and MRR movements each month? How much is going towards new, contraction, and churn? Financial metrics like these will be top of mind for board members during a downturn.

6. Perform regular cash flow forecasting

Ensure weekly cash inflows and outflows match the short- and long-term forecasts. Improve forecast accuracy where your predictions vary. Refresh cash flow forecasts as new information arises and monitor key metrics like available cash and cash burn rate. Continue to track cash collections and pursue customers with outstanding account balances.

Need help managing cash? Our A/R Management Playbook helps you break down the different components of effective A/R management and show you how Maxio automates the entire process so you can get cash in the door faster.

Achieving efficient growth post-SVB

Once you’ve got a solid financial plan in place, you need to start doubling down on other key business areas to ward off looming economic threats caused by a major financial crisis. At Maxio, we created a playbook to help you do just that.

In Scaling During a Recession: Winning Strategies for SaaS Leaders you’ll learn how pricing consultants, fractional CFO’s, and SaaS veterans recommend you adapt to keep winning—even in a volatile market.

Get access to the complete playbook here.