The following post about bottoms-up modeling contains Chapter 2 of our Complete Guide to Revenue Modeling produced in partnership with Burkland.

To get the full guide, download here.

Bottoms-Up or Revenue Driver ARR Modeling

The Bottoms-up approach to modeling ARR involves breaking down the key components of a company’s growth into its underlying revenue drivers, which represent the company’s funnel of new business and net retention. The company evaluates how these revenue drivers will shift over time, leveraging historical data, external benchmarking, and general insights on the business opportunity.

Bottoms Up Model Vs. Top-Down Model

The top-down ARR model approach involves looking at historical trendlines for ARR growth and extrapolating future growth based on those trendlines. By and large, it’s a much less detailed approach than the bottoms-up model, making it quicker to build and update and easier to make high-level adjustments.

Who Should Use a Bottoms-Up Approach?

This method is most appropriate for early-stage companies that don’t have sufficient historical ARR data on which to forecast ARR based on trend lines. For these companies, the bottoms-up approach allows them to break apart the key components of revenue growth to validate the reasonableness of revenue growth projections.

Bottoms-up forecasting can be useful for later-stage companies as well, particularly if their historical data isn’t representative of future growth.

For example, this can happen when a company pivots, launches a new product or targets a new market with a different customer profile.

Another instance in which the bottoms-up approach might make sense is for companies that sell to large enterprises where there is significant variability in the revenue expectations and economics between different accounts.

In such an instance where the company may have a relatively small number of customers, it can make sense to forecast revenue at the individual customer level.

How to Build a Bottoms-Up ARR Model

Step 1. Identify the Revenue Drivers

Revenue drivers will be unique for every company, but they often include the sales and marketing funnel, product line and pricing, and expected distribution of new customers between different products. You should also include expected net retention of customers over time as well as expectations around revenue derived from both software subscriptions and professional services.

Step 2. Determine How Revenue Drivers Impact ARR

The ARR forecast should include all of the revenue drivers, some of which are inputs to the model and others which are calculations in the spreadsheet based on the inputs (e.g. advertising spend is an input while the number of monthly web visitors is calculated based on advertising spend, conversions and viral web visitors).

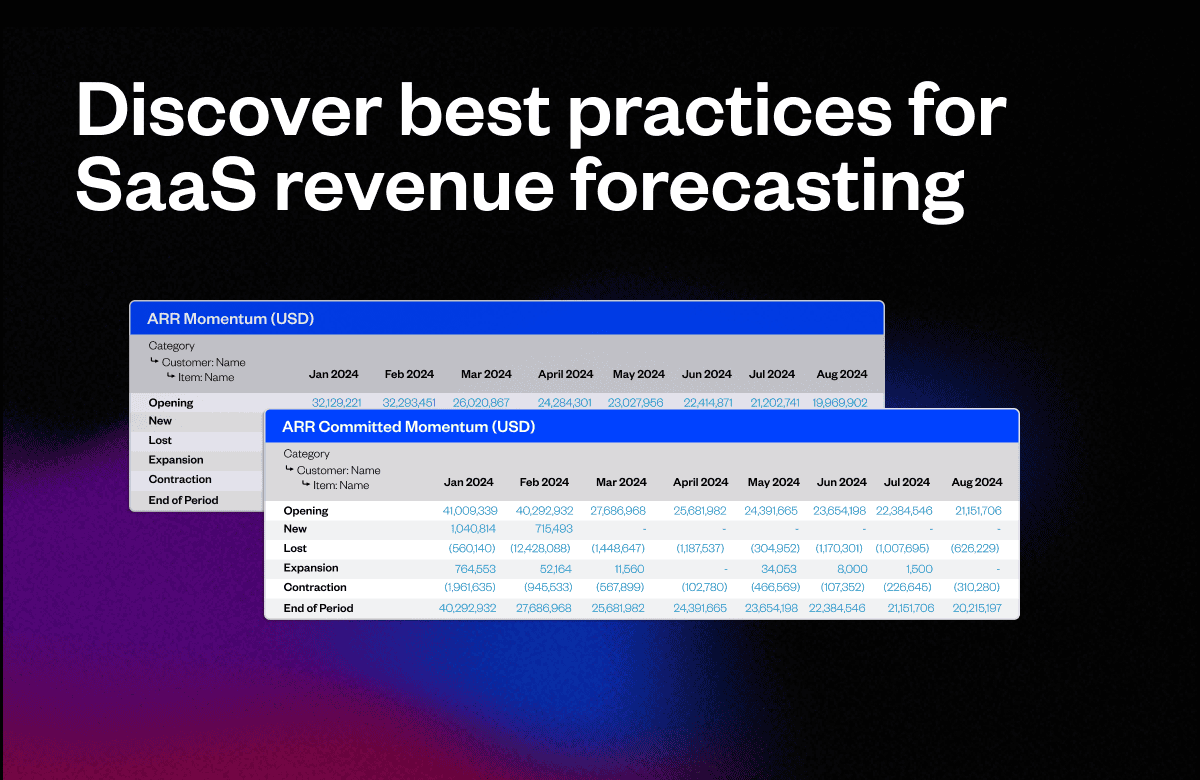

The outputs of the revenue model should feed into a monthly ARR momentum table, which breaks out growth between New ARR, Expansion ARR, Contraction ARR, and Churned ARR.

Revenue driver growth assumptions should be validated based on external benchmarks, like this one that Keybanc Capital partners publish annually, internal trendlines, and general reality-checks for reasonableness.

Step 3. Reality-Check Assumptions With Opportunities in Pipeline

In addition to external benchmarking, you should also make adjustments to your bottoms-up ARR forecast based on opportunities in your sales pipeline. Many companies look at a weighted probability of their current pipeline to ensure that they have sufficient coverage of opportunities in their forecast for the next quarter.

Specifically, a company should review all of the opportunities in their pipeline that are likely to close in a given month, multiply the dollar value of these opportunities by the probability of close, add together all the weighted probability opportunities and compare it to the bottoms-up forecast for that month.

If the weighted probability forecast is greater than the bottoms-up forecast, the company can feel comfortable that they will be able to achieve the forecast. If the weighted probability forecast is lower than the bottoms-up forecast, the company should re-evaluate and adjust the revenue driver inputs that are factored into the bottoms- up forecast.

Other Considerations

Bottoms-up models can be difficult to update.

Bottoms-up ARR forecasts work well for setting an initial plan, but they are often cumbersome to update monthly with actual results and then roll forward an updated forecast. This can be especially hard on lean teams trying to scramble to put something in front of leadership or the board.

It’s not well-suited for scenario planning.

Because bottoms-up plans are modeled in such granular detail, it’s challenging to do high-level scenario planning. In the current environment, many companies are conducting scenario planning to evaluate the impacts of revenue loss and slower-than-anticipated revenue growth. It’s painstaking to account for those, “what if we took a 10% revenue hit?” scenarios when working with a detailed, bottoms-up model.