What happens if you don’t report on your financials correctly?

At best, your finance and accounting teams are buried in unnecessary work. At worst, you risk losing the confidence of your board and investors, missing out on a funding round, or failing to meet GAAP compliance. For many teams, the challenge lies in pulling journal entries manually—an error-prone, time-consuming process that spreadsheets simply can’t handle efficiently.

That’s where Maxio’s Advanced Revenue Summary report comes in. It makes it easy to pull journal entry support, ensuring accuracy and streamlining your month-end close.

“What does this have to do with my financial audit?” you might be wondering. If you can’t produce accurate financials, the consequences can snowball quickly—especially during audit season.

This is what it could look like:

- Because of errors in your billing and financials, your journal entries are inaccurate which drags out your month-end close.

- In the event of an audit, the errors in your billing and financials make it near impossible to pull journal entry support in a timely manner

- You scrutinize your journal entries, but your auditor finds mistakes in your records anyways and you have to do a revenue restatement

- Your investors find out and devalue your company because your financial reporting is unreliable

This is definitely a worst-case scenario, but it’s a major possibility in SaaS where accrual accounting, multiple pricing methods, and hybrid GTM models make accounting scenarios complex.

So what’s the solution? We sat down with Maxio’s Manager of Accounting, Lindsey Arnold, to see how she uses Maxio to:

- Ensure accurate financials, always

- Avoid scrambling through old journal entries at the last minute

- Reduce the workload required from her broader finance/accounting team

Here’s what her process looks like, step-by-step.

Pulling journal entry support in Maxio

Pulling journal entry support in Maxio is as simple as clicking a few buttons, and it’s made possible through the Advanced Revenue Summary report.

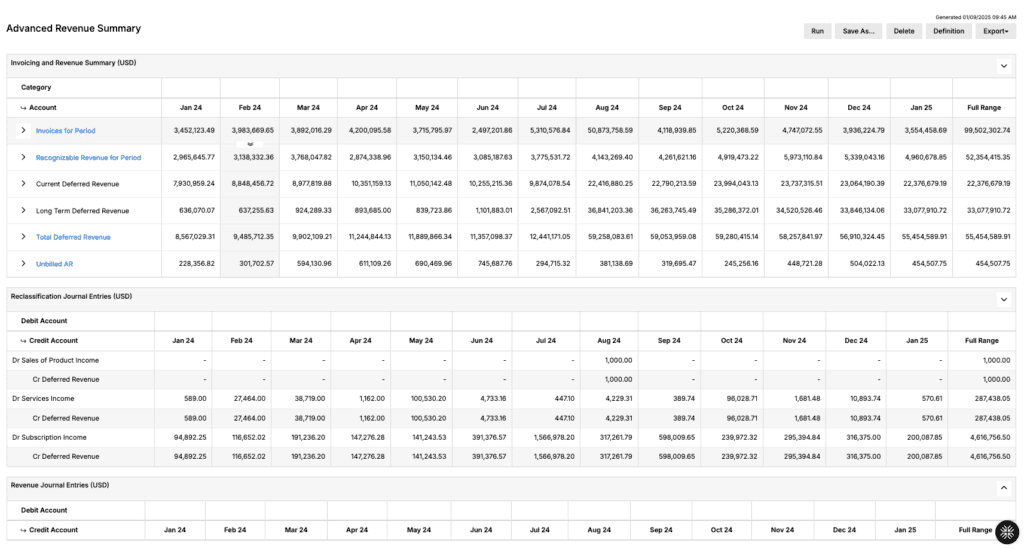

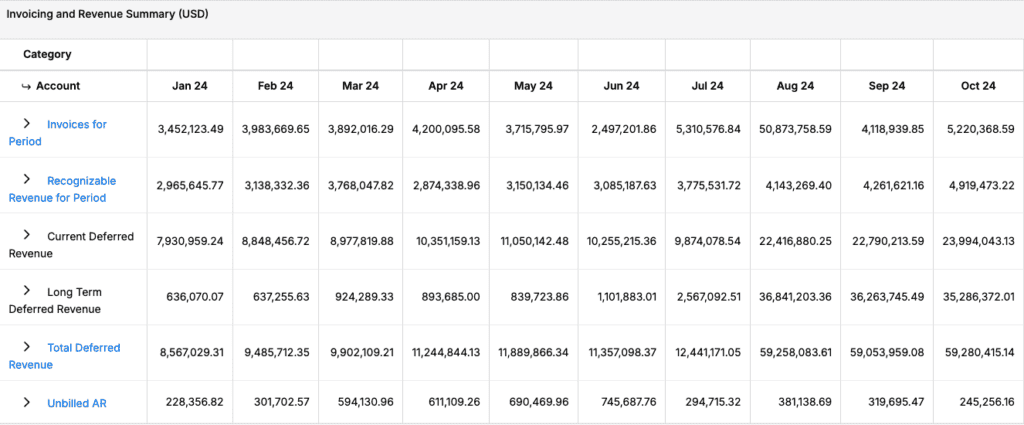

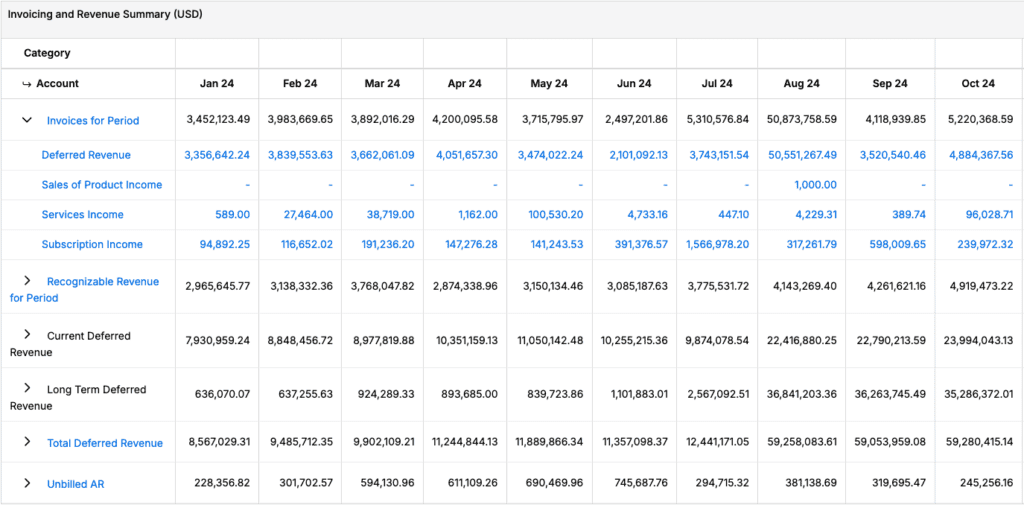

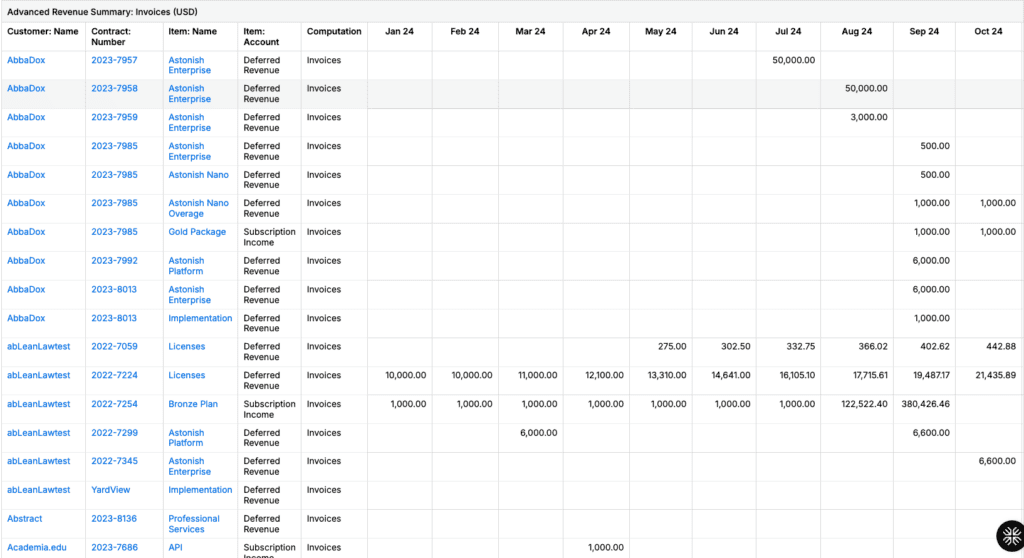

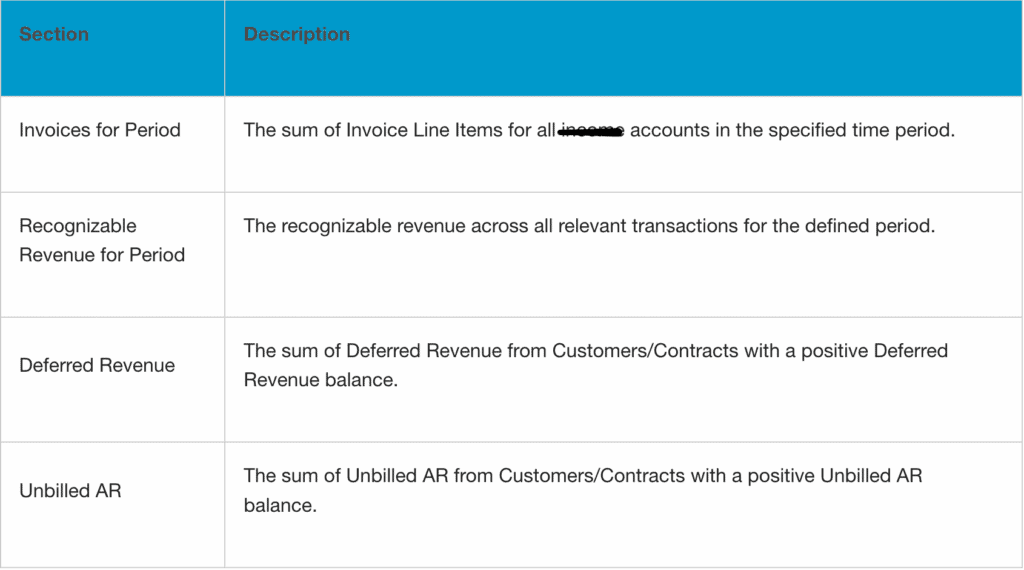

The Advanced Revenue Summary report provides summary invoice, revenue, deferred revenue, long-term deferred revenue, unbilled AR, and summary and detailed journal entries needed to book revenue, liabilities, and assets related to your subscriptions. The report also provides detailed drill-down capabilities.

Not to mention, because Maxio offers billing and invoicing directly from the platform, financial records are created automatically so they never fall ouof sync.

What are the advantages of this report vs. a spreadsheet?

Once you finalize the numbers in your monthly report, those numbers are locked, so you don’t run the risk of pulling incorrect data in the face of auditors. You also have the option of going in and segmenting your data and presenting it to auditors based on customer records, contracts, by month, or by line item. The ability to slice and dice data at a moment’s notice is invaluable during an external or internal financial audit.

How to pull journal entries in Maxio

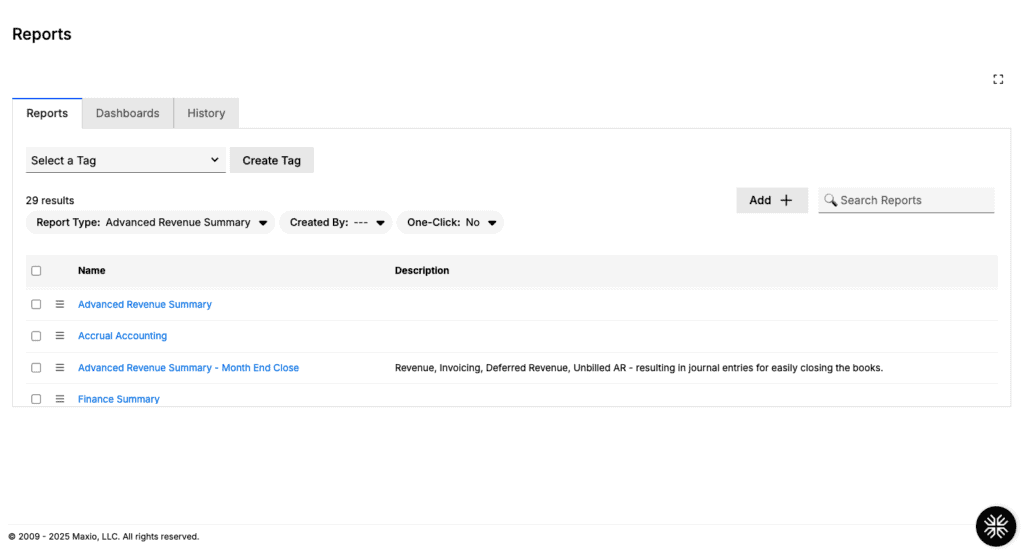

1. Select the Advanced Revenue Summary report

First, click on the reports tab in the left-hand sidebar and locate the report under ‘Report Home’ or ‘Report List’. The Advanced Revenue Summary report will be featured in a drop down alongside Maxio’s other financial reports.

2. Run the revenue report

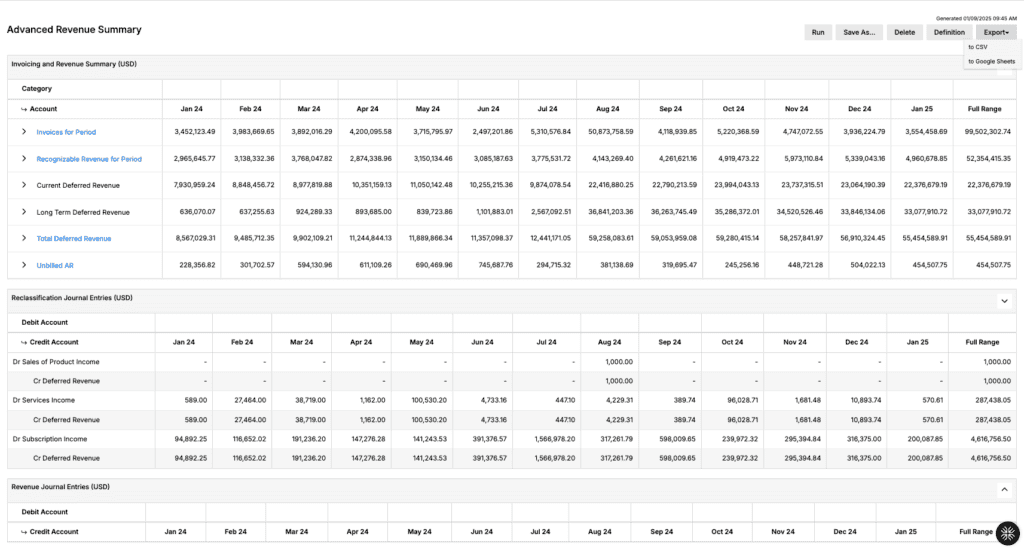

3. Export to the desired file type

What are the main features of Maxio’s Advanced Revenue Report?

Expand/collapse rows

All rows in the invoicing and revenue summary can be expanded or collapsed to quickly see additional details based on the income account configured for each item.

Collapsed

Expanded

Drillable reports

Select a row header, income account, or individual month to quickly drill into additional detail.

Item mappings

If your GL system is connected to the Maxio Platform, we perform an additional check on your item settings. The advanced revenue summary report automatically maps items in your Maxio account to items in your general ledger, so you know revenue is being booked in the correct place in your chart of accounts.

Maxio’s invoicing and revenue summary

Maxio’s Advanced Revenue Summary provides you with a financial summary detailing the following:

What’s the cost/benefit of using Maxio vs. a spreadsheet?

Accurate financials, always

As a former auditor, Accounting Manager, Lindsey Arnold, has had her fair share of poring over inaccurate financial statements as a result of spreadsheet usage.

“1,000 different things can go wrong when prepping for a financial audit. One of those is trying to answer questions about your financials from months ago. Without a revenue reporting tool, you could have no idea what the answer is—which is not what you want during an audit. With Maxio, as soon as you make an entry, your books are locked and nothing is going to change. It’s easy to go back and pull journal entries at a moment’s notice.”

— Lindsey Arnold, Accounting Manager at Maxio

Tell a story about financial performance

Not only does Maxio ensure accurate financials, but it makes it easier to tell a story about why revenue is trending a certain way in your business.

“For example, if an auditor were to ask why February revenue was a little lower than all the other months, it’s very easy to just pull the [Advanced Revenue Summary] report and say, well, here you go. The ability to drill down on those journal entries is super important. That’s not something that a lot of people were able to do with spreadsheets.”

— Lindsey Arnold, Accounting Manager at Maxio

Complete your financial audit as a team of one

It truly takes a village to execute all the necessary steps to complete a financial audit—though this is only true if you’re still using spreadsheets.

“If your audit is going poorly, the entire finance team may need to get involved. If revenues aren’t adding up, your audit could get rolled up to the senior leadership level and cause a scramble to get your books in order. Not only does this create the risk of not meeting GAAP standards, but you’re taking time away from strategic work that could be used elsewhere. With Maxio, I was able to complete most of our audit prep entirely on my own, and hand over other tasks to my co-workers when necessary.”

— Lindsey Arnold, Accounting Manager at Maxio

Ace your audit in record time with Maxio

From ease of access to specific records, accuracy of information, and the ability to share Maxio reports with auditors, Maxio has helped countless B2B SaaS companies prepare for financial audits.

Need to prep for a last-minute request from auditors or investors? Pull audit samples quickly with our waterfall reports for invoicing, revenue, and deferred revenue that can be generated at both the customer and contract level. Also, take advantage of Maxio’s Dropbox integration, where you can add a customer’s signed contract directly in Maxio to help you stay organized and find your files with ease.

Schedule a demo with our team to see how Maxio can cut your audit prep in half.