We’ve written a lot of popular topics covering individual funnels of the SaaS customer lifecycle, but it is time to think Big Picture. How? By bringing it all together and looking at the customer lifecycle as one big funnel. This post is a must-read for any SaaS company at any stage. Let’s get started.

To give you a little background, a few years back one of our ELT members was at a local marketing meetup and someone was discussing how their subscription business’ revenue had become stagnant. Of course, everyone’s inclination was to say they needed to spend more on marketing. But we asked:

- What’s your website visitor-to-sign-up ratio?

- What are your trial-to-paid conversion rates?

- What does churn look like?

Turns out, there were other obvious issues. Throwing more money at marketing and lead generation was a bad idea until the subscription business optimized converting more of the customers that were already coming in and worked on “stopping the leak” through reduced churn. Spending more on marketing or adding headcount to their sales team would have just been a waste of money until the other items were addressed.

This isn’t the first time that’s happened, either. While it seems pretty intuitive, when we explain the importance of the whole customer lifecycle funnel, we typically get a response like “ahh, that makes so much sense” or “you’re so right, I wish more people understood this.” Which is precisely why we’re writing this post.

To build a successful SaaS business, whether you’re B2B or B2C (but especially B2B), you need to look at the whole funnel and optimize key metrics within each portion to create a well-oiled machine that can thrive. Every “unicorn” has mastered the whole funnel. Are you ready?

In this blog post we’ll explain:

- The 3 main components of the customer lifecycle funnel—Acquire, Engage, Retain

- Common inefficiencies in each section of the funnel

- The individual metrics you should track and optimize for each section of the funnel

- The end results when all departments work together to optimize the entire funnel

Understanding the customer lifecycle funnel

In a perfect world, the customer lifecycle funnel would look like this:

Unfortunately, your funnel will never look like this. Not everyone that visits your site will sign up, not everyone that signs up will convert, and not everyone that converts will remain a loyal customer forever.

In reality, the funnel should look like this:

But this isn’t always the case.

If your SaaS funnel doesn’t look like the one above, don’t worry. Keep reading, because below we illustrate common inefficiencies in the funnel. Then we’ll take a deeper dive into each of these scenarios and the metrics you should be looking at across the various stages of the SaaS customer lifecycle:

1. Acquire: This is the first stage of the funnel. Bringing in a ton of traffic is great, but only if you’re attracting traffic that’s interested in your product. Tons of traffic and lackluster signups (or whatever conversion event you define) can mean you’re marketing to the wrong buyer personas, you have issues with your product/market fit, or your website lacks perceived value.

2. Engage: You’re getting solid traffic and getting users into the conversion funnel, likely through a free trial. Great! But are they completing mission critical steps to extract value out of your product/service and becoming paid customers? If the answer is “no,” you might have issues with your onboarding process. Or there could be a misalignment of your website’s perceived value and the product’s true value which is causing potential customers to abandon ship and cut their customer journey short. Fixing these issues will yield much higher returns from your marketing spend so consider it a gift that will keep on giving.

3. Retain: Acquiring new customers is much harder (and more expensive) than retaining existing customers, so don’t make the mistake of ignoring the customers you already have! Ideally you want to prevent churn before it happens by providing amazing customer success and support, and identifying red flag metrics to proactively reduce churn.

But sometimes the best way to prevent churn is to understand why people ultimately churn. Some questions you should be asking at this portion of the funnel:

- Are there key features you’re missing?

- Was service unreliable or buggy?

- Are customers going to a competitor?

- Was customer support lacking?

By encouraging customer feedback, you’ll improve customer satisfaction, increase customer loyalty, and (most importantly) boost your customer lifetime value.

Improve your customer lifecycle funnel through these key metrics

The takeaway from the information above is that truly successful SaaS companies don’t operate in silos. Marketing, sales, product, customer success, and support are all important pieces of the customer retention puzzle, but “winning” requires cross-functional team collaboration to optimize each portion of the customer lifecycle funnel.

How to retain your users: 4 strategies

Before we dive into the metrics, let’s touch on the strategies you can employ to keep your users signed up and sticking around. Bear in mind, if you want to reduce churn, these are table stakes.

- Build a comprehensive knowledge base: shortening your time-to-value is key to retaining users. By building out a knowledge base, you can ensure your users aren’t getting hung up on or confused by how your core features work.

- Keep users updated on new features: sometimes feature gaps are the main culprit behind churn. By acting as a promoter and updating your users on new features, they have a greater likelihood of sticking around for future product improvements, updated pricing, or new product messaging.

- Track user milestones: by tracking user milestones (i.e. when users get value from your product), you can figure out how to improve your user onboarding flows and ensure customers aren’t wasting their time on accessory features.

- Encourage product advocacy: every SaaS solution needs product champions. By encouraging product advocacy within your existing user base, you’ll have a direct line to your target audience. You can even incentivize your product champions to share your product on social media or through word-of-mouth referrals.

Key acquisition metrics to pay attention to

Monitoring and optimizing the following metrics will help you and your team get one step closer to “unicorn” status.

Each of the metrics below could have an entire blog devoted to it, so our goal here is to highlight some of the key metrics you should be aware of for each portion of the customer lifecycle funnel. This isn’t an exhaustive list, and every business is different, so there will be other unique metrics that are critical to your own company’s success.

Remember what I mentioned earlier: in the acquire portion of the funnel, it isn’t just about driving traffic and recurring revenue, but driving the right traffic and the right revenue. Acquisition metrics help you identify the best sources of traffic and the costs associated with each customer acquisition—both ideal and real. You can compare your ideal and real customer acquisition metrics throughout the lifecycle of your company to ensure you’re optimizing the right marketing channels in order to acquire the best traffic for your product/service!

1. New Visitors: The number of new eyeballs visiting your site.

2. Channel Specific Traffic: You’ll want to measure/track traffic being driven through each channel—direct, referral, organic, social, and paid channels.

3. Total Conversions: How many people complete the conversion events you’ve defined, such as: start a trial, fill out a form, or download a whitepaper. Be careful not to confuse total conversions for acquisition with paid conversions outlined in the Engage section below.

4. Visitors to Conversion (or Signup) Ratio: The percent of visitors that complete the conversion event listed above (again, don’t confuse this with conversions in the engagement section below).

5. Customer Acquisition Cost (CAC): CAC is how much it costs to acquire new customers. This can be a detailed formula, but for the “quick and dirty” calculation. “Simply add up all of your expenses for marketing and sales last month. Divide that number by the total number of customers you acquired in the same period. This will give you the average amount you spend for each new customer.” Lars Lofgren (former Director of Growth at KISSmetrics) points out that while the simplified calculation isn’t detailed, it does provide “a quick check on the health of your business.”

You should have a benchmark of the maximum CAC you can realistically pay to receive a return on your investment. Calculating your ideal CAC involves knowing other key metrics, like average revenue per account, conversion rates, and churn.

Once you’ve determined the ideal CAC for your SaaS business, you can test different marketing mediums. For each medium, if its CAC is below the CAC the calculator provided, then you know it is a good CAC number. Keep doing what you’re doing with that medium! If a marketing medium’s CAC is above the ideal CAC, you need to improve these campaigns or move on to test something else.

Key engagement metrics

Engagement is all about implementing effective onboarding, leveraging customer data, and utilizing customer success across various touchpoints to improve your customer relationships. The focus is on getting users to complete mission critical steps to become happy, loyal, paying users. After you define the critical engagement metrics for your company, you’ll want to take benchmark measurements and increase those metrics by improving onboarding and adequately communicating your product value.

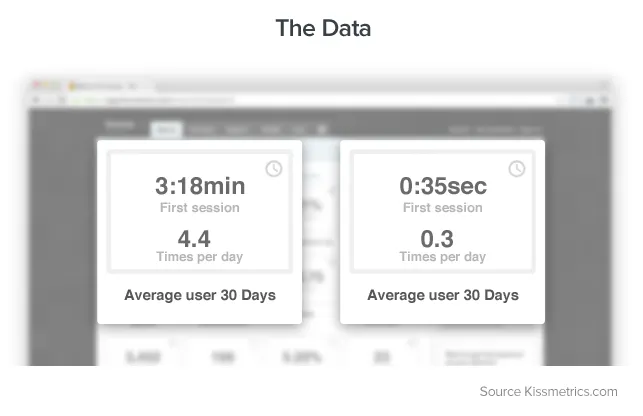

6. First Session Length: The time frame a user interacts with your product in their first session.

7. Returning Sessions/Visit Frequency: How often a user returns to interact with your product or service.

According to Totango, “how often a user returns to your service is a key reflection of the value they get from it.”

Of course, every business will have visitors who sign up and then don’t log back in for days, weeks, or ever. You can use tools like Intercom to automatically communicate with these users and offer assistance to bring them back.

When Groove explored the reasons behind a high trial churn rate they were experiencing, they identified the two metrics above (length of first session and frequency of returning sessions) as the most significant indicators of Groove trial users who were not converting to paying customers. In reviewing the metrics, they discovered “the average user who did not quit after 30 days spent three minutes and 18 seconds using Groove in their first session, and logged in an average of 4.4 times a day. The average user who quit spent 35 seconds using Groove in their first session and logged in an average of 0.3 times per day.”

They realized they needed to optimize their onboarding communications. By sending “targeted emails to users who spent less than 2 minutes on their first session, as well as to those who (regardless of first session time) logged in fewer than 2 times a day in their first 10 days,” Groove was able to significantly reduce their trial churn. That’s the power of engagement!

8. Core Tasks Completion: These are the core tasks/activities a user needs to complete to get the most out of your product (one of the most important metrics in the SaaS customer lifecycle funnel).

Remember what I asked earlier in the blog—are your users completing mission critical steps to extract value out of your product/service and becoming paid customers? Core tasks may be creating a task, uploading a file, inviting a team member, etc. You can use tools like KISSmetrics to create funnel reports to monitor the core task completions:

Completing core tasks leads to happy, paying customers. If users are getting lost during onboarding, ask yourself “how can we make completing those tasks more intuitive?”

9. Trial to Paid Conversions: The percentage of trial users who convert to paying customers. This is really what it all boils down to.

Remember, don’t confuse the conversion to paying customers (here) with the “visitors to conversion ratio” in the acquire portion of the funnel. They are two distinctly different metrics.

10. DAU, WAU, MAU: (most basic engagement metrics) “Daily, Weekly, and Monthly Active Users is the unique number of users who are “active” within a given amount of time,” according to Popcorn Metrics’ Paul Boyce.

Most (myself included) see these as vanity metrics, but I’ve included them (lastly) because “comparing the Daily Active Users with Monthly Active Users can be used to indicate stickiness, which is a measure of how much users are engaging with the product.”

Once you’ve converted users to paying customers, your job isn’t over. You’ve simply moved over to the “retain” portion of the SaaS customer lifecycle funnel.

Key retention metrics

Retention really boils down to churn. You already know building an awesome customer success team, understanding user pain points, and providing support are key to improving the customer experience. Below are a few additional ways to be proactive and avoid churn.

Define red flag metrics to help identify and retain customers before they churn. Some common red flag metrics for subscription-based businesses include:

11. Activity Churn: Indicated when you see a “drop in usage across an entire team” from previously active users.

“It’s acceptable for one user from a team to disappear temporarily; it’s when the activity of an entire team is dropping that you worry you’re losing a customer,” says Intercom co-founder Des Traynor. A drop in use by an individual team member can simply indicate they’re enjoying a holiday away from work!

12. Cancel Intent Behavior: An action indicating they’re thinking of canceling, such as removing your widget from their website, mousing over the cancel button, or telling support staff they intend to cancel.

Any cancel intent behavior “should trigger appropriate intervention to try to move them back on track toward achieving their Desired Outcome,” writes Lincoln Murphy.

13. Past Due Accounts: A past-due or failed payment attempt is an indication of churn potential.

Dunning is the process of communicating with customers to collect payment of past due accounts prior to account cancellation. Effective dunning strategies have been proven to recover potentially lost revenue and reduce churn. Some examples of dunning communications include:

- If their credit card on file is expiring soon

- When processing a transaction fails for various reasons

- If their account is past due, but not canceled

- Prior to account cancellation, if payment is not received

Reducing churn is fantastic, but no SaaS provider can completely eradicate churn. Customers are going to churn for various reasons. The following aren’t metrics, but they allow you to gain knowledge from churned customers in order to combat future churn.

A Cancel Flow is z’an off-boarding workflow that allows users to cancel in-app if they want, but reminds them what they’ll lose if they do and gives them another, compelling option other than canceling, [such as downgrading to a lower priced plan],” according to Murphy. He points out sometimes just having the option to cancel in-app is all a user needs to feel more comfortable with your product.

I also recommend using exit surveys. Exit surveys can be presented in various ways:

- As the customer hits the cancel button

- As a survey in the cancellation confirmation email

- As a personal call following cancellation

When Groove tested exit surveys with close-ended and open-ended questions, the survey with an open-ended question had dramatically higher response rates. They even found that changing the question from “Why did you cancel?” (10.2% response rate) to “What made you cancel?” (19% response rate) made a significant change in users’ willingness to respond.

Murphy also advises making the survey about them (something like “Tell us about your experience”) instead of a request like “Tell me what we can do better, so we can…” which makes it about you.

Once you have churn under control, the key retention metric for growth is Expansion MRR.

15. Expansion MRR: Increased revenue from upsells and cross-sells.

As we explained in a previous blog, happy, paying customers make ideal upsell candidates. Once a customer is fully engaged and has extracted value from your product, they are more likely to upgrade for advanced features and functionality.

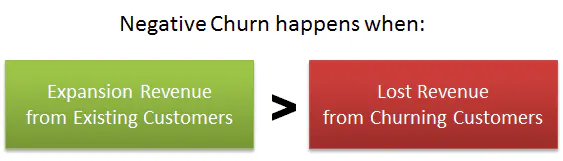

Expansion MRR allows you to work towards negative churn! Negative churn occurs when upgrades and up-sells are greater than what is lost by cancellations and downgrades. Want to learn more about negative churn? Check out this great post from Tomasz Tunguz.

Bottom line: the results

Understanding the customer lifecycle funnel and key SaaS metrics is great, but in the end you want to see the results. Let’s look at an example to see what all these metrics look like when improved individually vs as a whole.

Let’s assume a company has:

- 1,000 current paying customers at $100/month ($100,000 MRR)

- 30,000 visitors a month to website

- 1% visits-to-sign-up ratio

- 5% trial-to-paid-conversion rate

- 5% monthly churn rate

Now, let’s assume that, all things remaining constant, we improve the following (very realistic) metrics:

- Increase website traffic by 5% each month

- Increase visit to signup ratio by 1%

- Increase trial to paid conversions by 5%

Decrease monthly churn by 3%

The biggest individual improvement came from increasing the visit-to-signup ratio by 1% OR trial to paid conversions by 5%—both of these increased MRR by 29.2% over the course of 12 months. But all of the improvements combined almost doubled (96.3% increase) MRR over 12 months!

Please keep in mind these are simply theoretical numbers, but they’re not far off from many SaaS benchmarks you may see. Don’t get hung up on the baseline numbers as much as the big picture: All the individual improvements move the needle in the right direction, but all of them combined have a HUGE impact on revenue growth.

The final takeaway: It is easy to only focus on one portion of the SaaS customer lifecycle funnel, but don’t let tunnel vision distract you from looking at the bigger picture. Directors and leadership must unite to understand all key metrics across the entire funnel. While all the metrics are important to optimize, sometimes your biggest growth levers may not be your biggest priorities—you can change that!