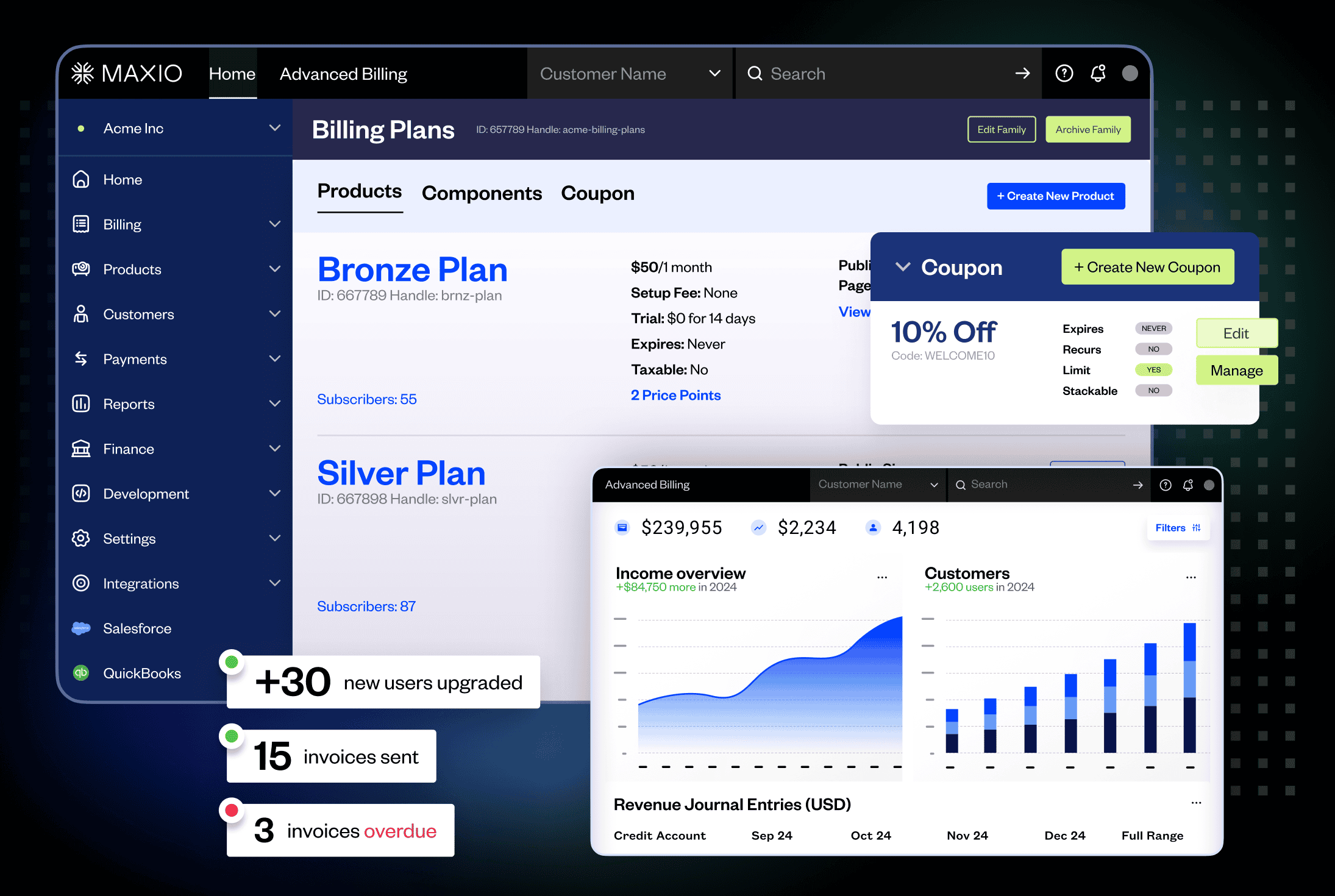

Automated recurring billing software to streamline your cash flow

Maxio Advanced Billing’s flexible, automated recurring billing provides real-time billing functionality that supports all business needs.

Subscription billing automation made simple for any business model

Optimize complex billing processes with adaptable recurring billing logic that supports countless ecommerce combinations across various business models, including B2B, B2C, Cross-Sell, and Resell.

Set renewal timing

Customize subscription payment terms to bill on any specified renewal date. Supported functionality includes the ability to charge the full amount, prorate, or delay the transaction upon signup.

Determine payment type

Create recurring payments charged to the payment method on file, or provide customers a prompt for payment with net billing terms.

Define tax rules

Automate the calculation of geolocated tax rates for over 10,000 jurisdictions across the US, Canada, and EU. Additionally, create custom tax rules to address other locations or requirements.

Model customer/payer relationships

Create parent/child relationships to increase payment options with WhoPays™ and streamline who pays for what subscription plans within a customer’s account.

Manage billing changes

Handle hassle-free billing changes for upgrades, downgrades, reactivations, and cancellations in real-time with immediate or delayed, prorated adjustments.

Accommodate adjustments

Modify a subscription balance manually by applying credits, adjustments, promotions, or one-time charges to a customer’s account.

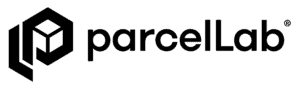

Billing solutions that improve the customer experience

Improve customer experience and optimize workflows with automated billing software that adapts to your business needs.

- Beautifully designed invoices—recurring and one-time—provide clear, easy-to-digest pricing summaries.

- Consolidate multiple subscription plans into a single invoice and payment.

- Create payment options using WhoPays™ to assign or reassign a customer’s payment responsibility for a subscription or group of subscriptions.

- Send invoices before and/or after the transaction with customizable emails.

- Extract the metadata required for accurate revenue recognition.

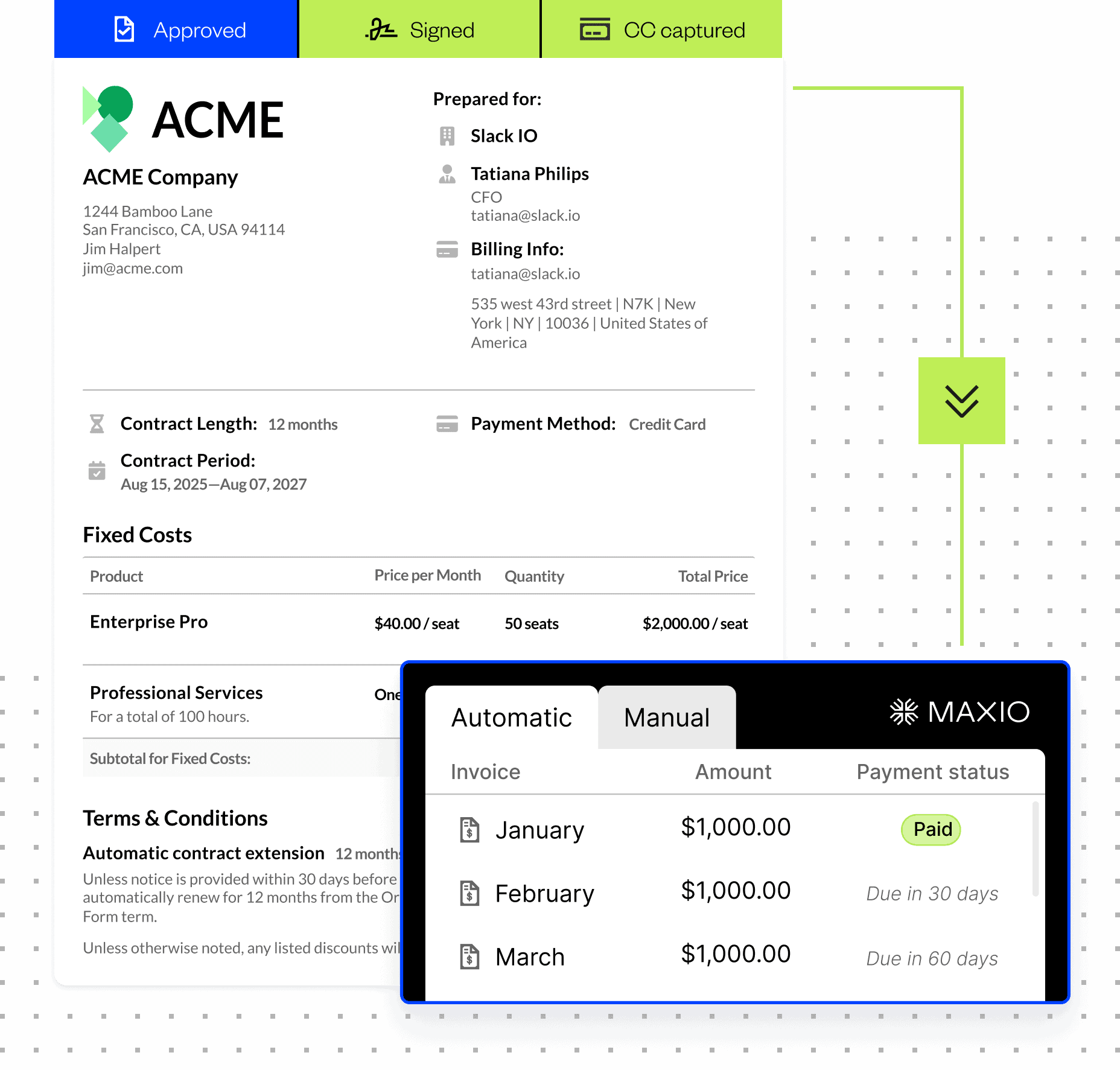

Integrated to the world’s leading payment providers

With 20+ popular payment gateway integrations and supported currencies, you can quickly integrate and start accepting payments. If you have not yet selected a payment gateway provider, we can help.

Recurring payment options for any pricing model

Enhance customer experience by offering multiple payment options. Give customers the option to pay through ACH, credit cards, debit cards, PayPal or other manual payment methods.

Accounting integrations to streamline payment processing

Seamlessly sync transactional data from Maxio to integrations such as QuickBooks, Xero, or NetSuite. Automating accounting workflows will dramatically reduce reconciliation time and save finance departments countless hours every month.

Optimize your billing cycle with Maxio add-ons

Customize your Maxio subscription plan to fit complex business needs with our wide range of available add-on modules.

Advanced API access

Maxio’s HTTP-based API follows REST principles and provides an extensive range of features and benefits, including a rich community of supporting client libraries.

Multi-currency support

Easily define multiple currencies and set specific pricing for each catalog item, or by using an exchange rate to streamline payment information.

Real-time usage tracking

Transform, enrich and analyze usage-based data streamed in real-time from your platform to form computed totals of usage to easily invoice customers.

Automated recurring billing: FAQs

Automated recurring billing is a payment solutions system that automatically charges customers at set intervals (e.g., monthly, quarterly, annually) for ongoing services or subscriptions. It eliminates the need for manual invoicing and payment collection, streamlining cash flow and helping to maintain a consistent revenue stream for businesses.

Businesses use it to automate invoicing, payment processing, and tax management. Recurring billing benefits SaaS companies, subscription-based services, and businesses with long-term customer relationships by improving efficiency, ensuring payment consistency, and enhancing the customer experience with seamless, hassle-free transactions.

The automated billing process begins when a customer subscribes to a service and provides payment details at checkout. The system schedules charges based on the billing cycle, generates invoices, and processes payments. Tax calculations and compliance are handled automatically, and customers receive notifications for payments or failures. Businesses can sync transactions with their accounting software using native integrations, ensuring accurate financial records. This automation reduces errors, minimizes missed payments, and enhances operational efficiency for subscription businesses.

The best recurring billing software depends on a business’s needs. Maxio offers end-to-end subscription and usage-based billing, advanced invoicing, tax management, and accounting integrations for B2B SaaS businesses.

Maxio’s automated recurring billing platform streamlines billing, automates renewals, and supports various payment methods, ensuring sustainable revenue collection and customer retention while scaling with a business’s growth.

A recurring billing system ensures predictable cash flow, reduces churn, and improves business operations by automating invoicing and payment collection. Businesses can scale easily, adapt to different pricing models and broader business needs. Customers benefit from a seamless payment experience, bettering the customer experience.

Recurring billing systems minimize administrative work, increase customer retention with automated reminders and dunning management, and integrate with accounting software for accurate financial reporting, making it essential for subscription businesses.

To automate recurring billing for a SaaS business, select a platform like Maxio that supports your business model and integrates with your payment gateway.

Get a demo now to learn how Maxio can support your business with our optimized billing system that is built for B2B SaaS companies.

Automated recurring billing improves customer retention by eliminating payment friction and ensuring seamless transactions. Customers enjoy the convenience of automatic payments and flexible billing options.

Dunning management reduces involuntary churn by retrying failed payments and sending reminders. Additionally, transparent invoicing and multiple payment methods improve trust. By minimizing disruptions and simplifying payments, businesses strengthen customer relationships and maintain steady, long-term revenue growth.

See what Maxio can do

Subscription billing

Manage complex billing scenarios without cluttering your product catalog.

SaaS reporting tools

Never lose sight of your business performance with accurate, reportable SaaS metrics.

Subscription management

Streamline every step of your customer’s lifecycle, from onboarding to renewal and beyond.

Revenue recognition

Help your finance team sleep at night with revenue recognition built for the complexity of B2B SaaS.