In a recent joint webinar, Maxio CFO Adam Morson and Riverside Acceleration Capital Partner Jonathan Drillings took a deep dive into raising a Series A. The pair covered everything from how to know when it’s time to raise your first institutional round to the broader implications of raising capital.

If you’ve been wondering if your B2B SaaS company is ready to take the next step in its funding journey, read on.

Series A Readiness Sign #1: You’ve hit some key growth milestones.

A crucial component of your readiness to seek a Series A is your company’s achievement of key growth milestones.

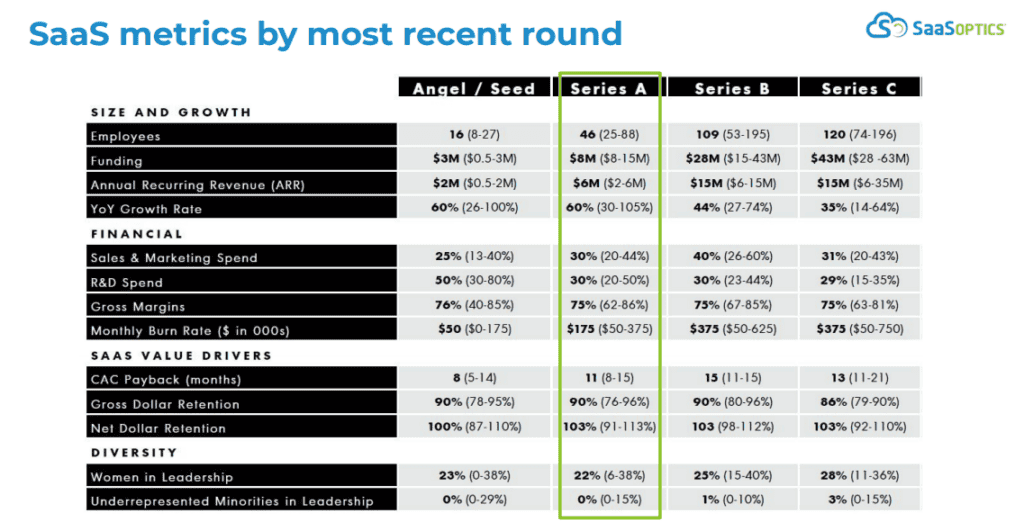

According to data from OpenView, Boston-based private equity and venture capital firm, companies raising a Series A typically fall within a given range on key SaaS metrics related to size and growth, financial performance, SaaS value drivers, and diversity.

Series A Size and Growth Metrics

- Between 25-88 employees

- Between $8M-$15M in capital raised

- Between $2M-$6M in ARR

- Between a 30%-105% YoY growth rate

Series A Financial Metrics

- Between 20%-44% sales and marketing spend

- Between 20%-50% R&D spend

- Between 62%-86% gross margins

- Between $50K-$375K monthly burn rate

Series A SaaS Metrics

- Between 8-15 months CAC Payback

- Between 76%-96% Gross Dollar Retention Rate

- Between 91%-113% Net Dollar Retention Rate

Series A Diversity Metrics

- Between 6%-28% of leadership is comprised of women

- Up to 15% of leadership is comprised of underrepresented minorities

Check out the graphic below for a comprehensive snapshot of the average milestone attainment broken out by funding round:

Series A Readiness Sign #2: You have a clear plan to deploy the capital and achieve revenue goals.

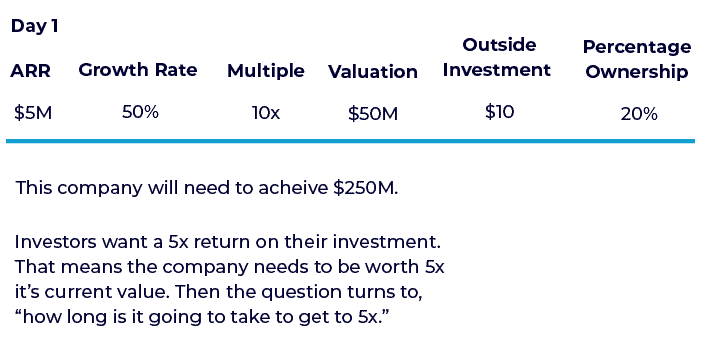

Because most VC and PE firms expect a 5-10X rate of return on their investment, it’s important to have a clear and concise plan for how you’re going to deploy their capital to achieve revenue goals.

Accepting the wrong capital at the wrong time can be more harmful than helpful. It can lead to excessive dilution, a lack of optionality, and poor investor/board alignment.

Take for example a company that raised $10M at a $100M valuation:

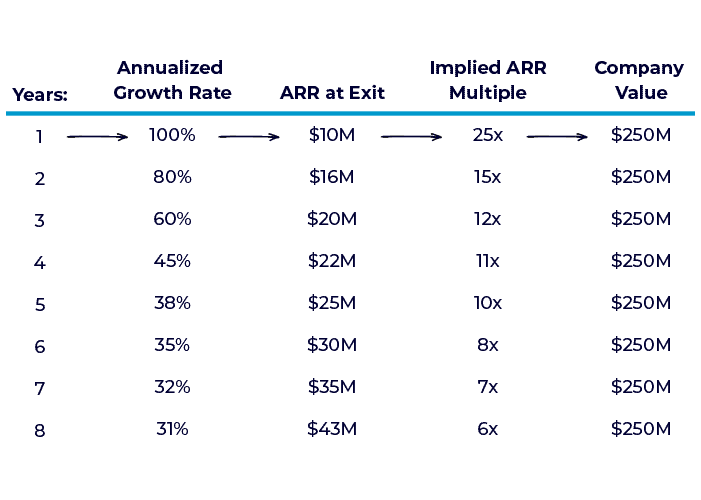

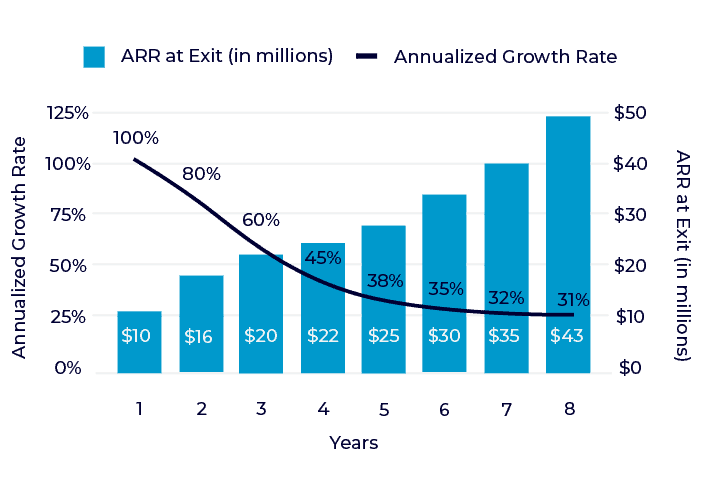

There are a number of ways the company can get to a 5X return. For example, take the table and graph below. If the company maintains a higher annualized growth rate, it can reach a 5X return in a shorter time span. If their growth rate decreases, however, they’ll need more time to return the fund.

The company in our example above believes the most reasonable growth rate for them is around 40% per year. In this instance, it will take 4-5 years to achieve a 5x return on the investment.

But what happens if the growth rate drops? If the growth slows, the time it will take to return the investment gets longer.

While many companies are positioned to achieve these numbers, it’s important to be realistic about your own company’s growth potential.

Not every company is poised to achieve this level of growth.

For companies with more conservative growth plans/potential, there are a variety of alternative funding options available such as debt financing, revenue-based financing, and good old-fashioned angel investments.

To read more about alternative funding options, check out this blog post.

Series A Readiness Sign # 3: You have a story to tell.

Though it sounds cliché, Series A investments (and any round for that matter) are about more than just the numbers.

Certainly, the numbers are important, but having a clear vision for the future and being able to articulate that is equally essential.

The right partner will share your company’s vision for the future and work alongside you to achieve your goals.

To learn more about how to fine-tune your story, check out this blog post about how to make your pitch deck stand out using metrics.

For more on raising a Series A, check out our on-demand webinar, Raising Series A: Advice & Considerations from Riverside Acceleration Capital.