We’ve got good news and bad news.

The bad news: we’re in a market downturn. The good news? You don’t have to sit idly by and watch your revenue take a hit.

We consulted with pricing experts and SaaS leaders to get their take on how to approach your pricing and packaging in a downturn, so you can capture the full value of your SaaS, navigating volatile market conditions unscathed.

You can’t outsmart the market

There are no magic bullets to be found here. You can’t outstrategize or outsmart the natural ebb and flow of market demand, and it’s important to keep this in mind when evaluating a new pricing strategy.

If you’re still experiencing spikes in churn or stalled growth after running a pricing experiment, recognize that there are larger macroeconomic factors at play. Try not to be tempted to keep running endless pricing experiments in hopes that something will stick.

Making changes to your pricing and packaging too often signals to your customers that you’re not sure how to properly value your offering. Instead, take a slow, iterative approach, run A/B tests, and use SaaS metrics and analytics to determine if your sticker price is supporting your broader monetization strategy.

Flexibility is key to successful pricing in a downturn

There’s a fine line between becoming a trusted partner and being labeled as just another transactional vendor. The ability to price flexibly and meet your users’ needs makes all the difference.

For example, providing more flexibility on net payment terms can give your customers relief if they’re experiencing cash flow issues. Similarly, if flat fees are eating up customers’ budgets, you could offer to switch them to a usage-based pricing plan where they’ll have more control over how they use your product and how much they’ll pay each month.

A note about raising prices:

Increasing your list price is the most straightforward method to hedge against inflation and keep your profits out of the red. After all, flexible pricing isn’t a one way street.

Not all of your customers will be able to handle a pricing hike (startups and early-stage companies, for example), however, raising prices for specific customer cohorts or product lines could actually increase long-term loyalty.

Here’s a quick step-by-step on how to introduce a price increase during a downturn:

- Conduct a cohort analysis of your customers to identify accounts with high ACVs or CLVs—your highest paying customers will typically be able to withstand an increase in price

- Based on your pricing model (per user, usage-based, tiered pricing), develop a revised pricing plan based on the advised strategies below to help achieve your goal (beat inflation, hit revenue targets, etc.)

- Communicate your pricing change in advance to ward off churn and maintain healthy relationships with your customers.

(Did we mention that you can execute each step in this process with Maxio?)

Effective pricing plays you can use during a market downturn

Before you put a red slash through your current list price, consider this: you can offset your customers’ lower willingness to pay by providing additional value via product, support, and partnerships.

Brian Martell, Head of Product Marketing at Mosaic, offers these “techniques” to help SaaS companies maintain pricing integrity during a market downturn:

- The Barter Method Offer discounts off your list price in exchange for a commitment for case studies, G2 crowd reviews, or customer references. These marketing activities have economic value and will help you increase ARR through customer acquisition.

- The Freebie Offer Offer one or two months of your product for free. You’ll take a small hit to revenue in year one in exchange for a long-term agreement, which will pay off in years two and beyond. Plus, this method protects your [perception in the marketplace by not discounting the list price].

- The First Class Treatment If you have tiered pricing plans (i.e. basic, business, enterprise), offer your mid-level plan at the same price as your first-tier plan for one year only with the stipulation that your new customer will move up to the mid-level price in year two. This tactic helps introduce advanced product capabilities to new users and protects your overall list price from dropping. Be careful though: this could dilute the value of your premium offer if misapplied.

- The Value Play Offer non-monetary perks that make your buyer feel like they’re getting more value for the price. This feels like a discount because the psychological mechanics of discounts are all about relativity—feeling like you’re getting something extra for free. Examples of perks:

- Premium support

- Quarterly 1:1 sessions with the executive team

- Sneak previews or early access to new features or special prices on new features

- Free tickets to an annual user conference

- The strategy here is that it’s better to take an immediate hit on OPEX (operating expenses) or services fees than on your long term ARR.

- The “Payday” Strategy If you’re really having to tighten your belt, the ‘payday’ strategy is a great way to ensure faster collections and avoid cash flow issues. Here’s how it works: Offer a discount on your list price in exchange for more favorable payment terms. Instead of net 45, require net 30. The hit to ARR will be made up for by faster cash collection and more cash in the bank to fund the business. This is a solid option for early-stage businesses who are worried about cash flow or who don’t have the cash runway needed to keep them in business.

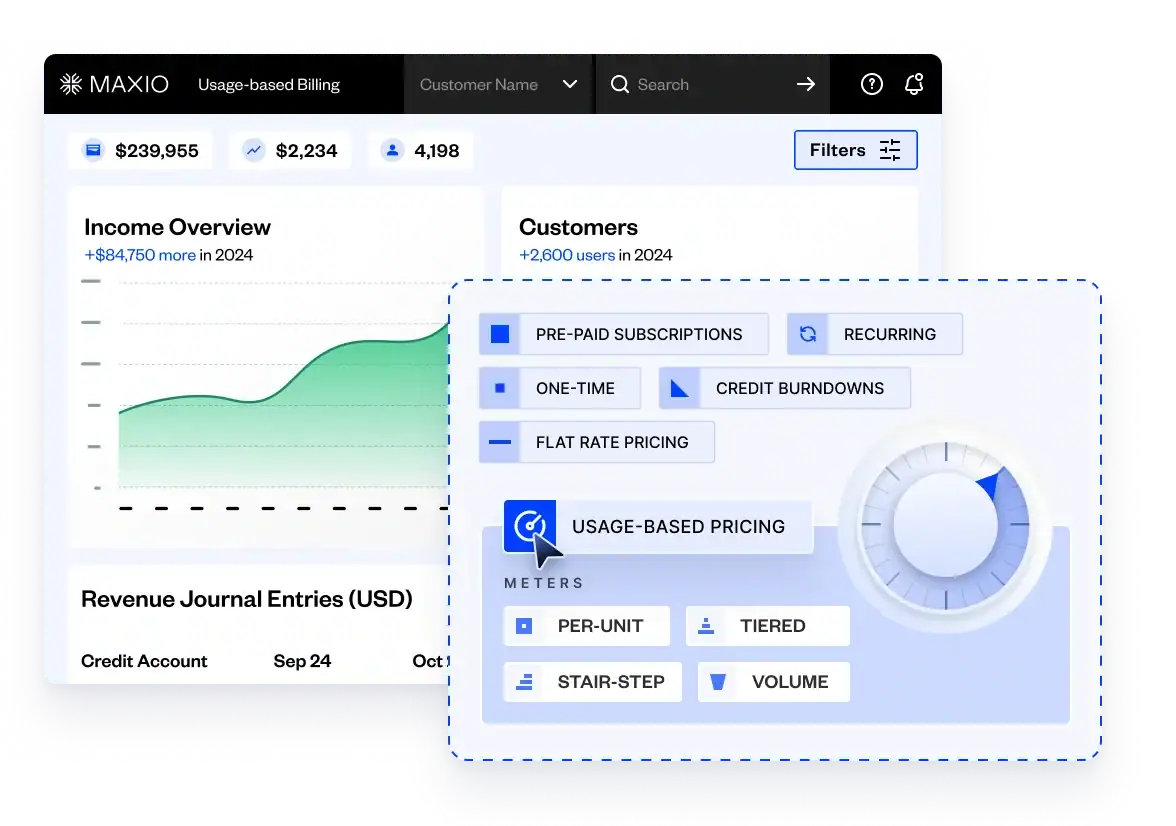

- Bonus: Introducing a new billing model If you’re strictly charging per user or per seat, you could face serious drop offs in revenue during a recession. As discretionary spending decreases, many of your customers could try to eliminate their user seats or licenses as a way to save money—all at the expense of your bottom line. Adopting a value-based pricing method like usage-based pricing ensures you’re not pigeonholing yourself by offering customers flexible payment options. How to communicate a pricing change to your customers Restaurants, airlines, and publicly-traded software companies are quick to raise prices when economic conditions change. Why don’t SMB SaaS companies do the same? Why don’t they adjust pricing more frequently, test higher price points, or at least peg monthly rates to inflation?

Scott Hurff, Co-founder & CPO of Churnkey, has a hypothesis. “After speaking with hundreds of SaaS founders and operators, [our company] realized it comes down to a fear that growth will fall, there will be a massive customer backlash, or one’s reputation will be destroyed,” said Scott.

“If you’re feeling pricing pressure in your business, it’s possible to raise prices with proper telegraphing. Be open and honest about the changes, give [your customers] plenty of time, and don’t make it about you. The key here is empathy. If a pricing increase is difficult for any of your customers, find an equilibrium that works for both of you.”

A word of caution: the pricing balancing act and long-term effects When growth stalls, it’s tempting to start pulling all your growth levers in an attempt to hit revenue targets. The problem is, this is more of a knee-jerk reaction than a viable long-term strategy. Brian Martell, Head of Product Marketing at Mosaic, agrees that this type of impulsive decision-making won’t do your business any good. Future-proofing your SaaS pricing strategy

Pricing plays a big part in the three fundamental goals of every SaaS business:

- Maximize ARR

- Protect ARR annuity

- Optimize cash collection

“There’s an always-on balancing act between these three things,” says Martell. “For example, lowering your prices can result in a higher quantity of deals, but at lower ACVs. Similarly, offering discounts off list prices in exchange for faster payment terms means cash in the door faster, but lower ARR. It’s helpful to keep this foundational “push-and-pull” context in mind before making hasty pricing decisions.”

There’s no question you’ll likely have to get creative on pricing in a downmarket. The key is to make sure if you give up something on price, then do everything you can to get something back in exchange. Quid Pro Quo. This doesn’t always have to be monetary to have value to the business

Martell adds, “The easiest and most impulsive thing to do is lower your list price. Make the product cheaper, and more people will buy it. While this is true (basic supply and demand), you’ll need to be careful with this approach. Try to make this your last resort option. It increases your CAC ratio, lowers ACVs, hurts your unit economics, and sends a message to buyers that you don’t really have confidence in the value of your product. If you did, why would you be willing to discount 20%, 30%, 40% of that value?”

Recession or no recession, your pricing strategy requires constant attention and reiteration to help you capture the full value of your SaaS.

That’s why, at Maxio, we conducted a comprehensive study of the billing and pricing trends of SaaS companies in 2023. You can use this report to benchmark yourself against your peers and find inspiration to inform your future billing and pricing strategy.

You can access the full report here.