The run-up in SaaS stocks in 2020 and 2021, and then the subsequent sell-off this year may not be telling you what you think it is. The truth is that valuation multiples for most public SaaS companies have barely moved in the last 24 months, yet the indexes tracking public stock multiples have swung wildly—what’s going on?

The answer is in the construction of the indexes themselves. Traditional indexes like the S&P 500 and the Dow Jones Industrial Average track a static pool of companies. So if the index moves a meaningful amount, most of the underlying stocks likely moved as well.

However, with SaaS companies, the popular indexes such as the BVP Nasdaq Emerging Cloud Index and the SaaS Capital Index (my favorite) are not a static pool of companies. Because SaaS is proliferating and new firms are going public all the time, indexes add companies to their calculation every quarter. For example, the number of companies in the SaaS Capital Index has doubled in the last two and a half years, and the BVP Index has grown likewise.

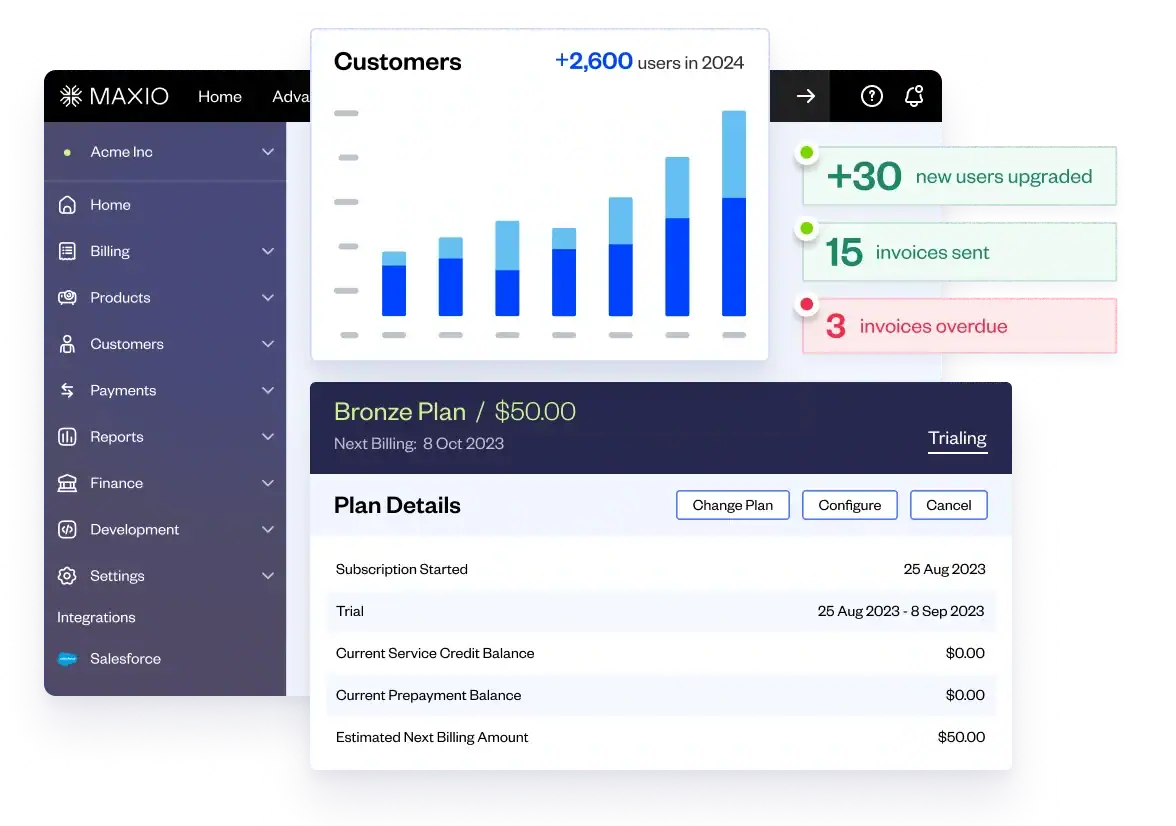

What impact has the addition of new companies made on the valuation multiples of the various indexes? A lot, as it turns out. The chart below shows the valuation multiple of the SaaS Capital Index in blue. The chart also disaggregates the index into those companies that went public before 2019 (green) and those that went public in the last two years (gray).

As you can see, the companies added to the index in the last few years account for the vast majority of the variability in the overall median valuation multiple. Said differently, if the index were a static pool of companies (green line), the valuation multiple changes would have been barely noticeable.

Taking this point to the company level, the valuation multiples of Salesforce, Workday, and other SaaS stalwarts have not changed much during the last few years. What did change was the addition of companies like Snowflake, JFrog, and Monday.com, which went public at very high multiples and are now down 60% or more on average.

So what are the implications for private SaaS companies?

Valuation multiples in 2020 and 2021 appear to be outliers

If you extend the valuation chart back a few years, it becomes apparent that the last 24 months are an outlier on a trend of slowly increasing SaaS valuation multiples. That implies it’s more likely we have recently reverted to the mean trend line as opposed to being in an outlier position below the trend.

The “work-from-home” investment thesis likely contributed to some of the high and potentially unsustainable multiples of the new IPO’s such as Zoom and BigCommerce which were new additions to the index. In other words, absent a pandemic-like catalyst, don’t expect valuation multiples to return where they were a year ago in the near future.

Public markets will impact private markets

If you plan to raise equity in 2022, be prepared for multiple compression in your valuation and possibly even a down round. Many high-performing SaaS companies will raise capital at lower valuations in 2022.

Founders, CEO’s, and investors need to get ahead of this issue and make sure the employees see it for what it is, a market correction, and not an indication the company is struggling. Public company SaaS valuations get revalued every day, and it is not the end of the world. Stock opting plans and other tools can be adjusted to mute the impact on the workforce.

The SaaS IPO market is wrecked

High-value SaaS IPOs burned many public investors in the last two years, and it’s now likely that the IPO window is pretty much closed. The number of technology company IPOs were down 92% in the first quarter of 2022 compared to 2021, and the amount of capital raised was down even more. The lack of an IPO alternative will add continued downward pressure to M&A multiples for as long as it continues.

Growth still matters, however….

Growth is still the most important valuation driver (R-squared of .42), but that is a lower correlation than the historical average, and profitability metrics such as the “Rule of 40” are increasingly correlated with higher valuations. The modest shift toward profitability helps explain why some newer IPOs have struggled. On average, they are higher in growth and less profitable than their peers. As valuations decline, capital efficiency becomes more valued.

Variability has increased 3X

The standard deviation of valuation multiples for SaaS companies has significantly increased in the last two years. (A fact that gets masked by reporting the medians.) Even with variability trending down since the start of 2020, the standard deviation is about three times higher than it was in 2017 and 2018.

The implication of higher variability is that public valuation multiples are becoming less and less useful in helping to value private SaaS businesses. When the range of public multiples is from 1 to 100, they are simply less instructive as a benchmark. If raising money in the near future, carefully construct the cohort of comparable public companies and make sure they properly reflect your metrics, growth, and go-to-market motion.

The aim of this article is not to project where SaaS stock prices are headed but to identify nuances in the recent valuation changes that are not easily seen at first glance. I believe the various indexes tracking SaaS valuations are correctly constructed. Still, users of the data need to be aware that they are not a static pool of companies, and changes in their underlying composition can significantly impact their results.