Over the last six months, I have interviewed and worked with dozens of SaaS companies, VCs, and lenders. And as I’m sure most of you are aware: unless you are “killing it,” capital is exceptionally scarce. As a result, most SaaS companies are no longer planning for their next capital raise; they are now planning to reach breakeven.

With breakeven as the goal for so many SaaS companies, the question is, what’s a reasonable growth rate for your company once you reach breakeven? Obviously, the higher the growth, the better, and we would all love a high-growth and profitable SaaS business. But what is realistic when looking to set investor and board member expectations and simply do planning?

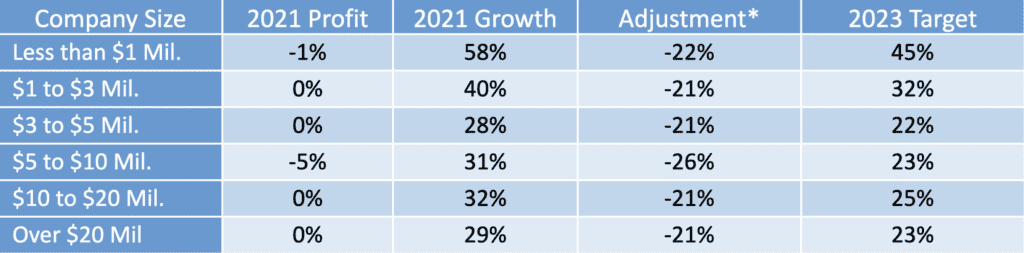

To approximate the answer, I took growth rates from last year’s SaaS Capital survey, which is broken out by ARR and consists primarily of bootstrapped companies. I then adjusted those rates downward based on the deceleration in growth in public SaaS companies in recent quarters.

This is as good an approximation as I have found for a private SaaS business’s target growth rate when operating at breakeven. Smaller companies always have higher growth rates based on a small denominator; however, growth rates do not continue to go down as ARR reaches ten million or more primarily due to survivor bias which means the slow-growth companies at the smaller ARR levels don’t ever graduate to the larger ARR levels to push down those averages.

These data support conversations I have had with a number of long-time bootstrappers who never raised outside capital. Mid 20’s growth rates were the norm, with a few companies pushing into the low 30’s. And while this level of growth may sound anemic in VC land, it turns a $1 million ARR business into a $9 million ARR business in 9 years. It takes patience, but it works: creating life-changing wealth for founders but weak IRRs for VCs who live and die by IRR.

With the benchmarks in the chart as a starting point, the other necessary input would be your historical growth rate. Tweak these averages up or down based on your prior 12-month growth and pay particular attention to your NRR. Companies with high NRRs will slow down less with cuts to spending than businesses with similar historical growth rates that rely more on new customer acquisition.

There are dozens of other individual company factors that will drive performance up and down from these averages, but in the final analysis, forcing spending to align with revenue should not bring growth to a sudden halt. If the transition to profitability completely stalls revenue growth, there are unit economic issues with the business in terms of net dollar retention or CAC payback ratios, or both.

My friend David Spitz wrote a compelling blog post on “walking dead” SaaS companies. He correctly observed that most SaaS companies abandoned by their VCs will not go out of business but will limp along at breakeven.

Instead of thinking this is negative, focus on the positive aspects of breakeven. For one thing, the atmosphere of board meetings changes. When founders no longer rely on their investors for more capital, there is a shift in the power dynamics. Freed from the VC treadmill focused on fundraising and maximizing the pre-money of the next round, you can now spend more time focusing on running the business.

Forget double, double, triple. Instead, grow at 25%, make a little money, and then do it again and again. You will absolutely be creating enterprise value.