The financial health of any subscription-based business depends on how efficiently it manages cash inflows and outflows. Choosing the right billing and payment processing platform ensures that your company can manage transactions smoothly, automate recurring payments, and maintain accurate financial records.

What Is Payment Processing for Subscription Businesses?

Payment processing is the foundation of how recurring revenue companies handle transactions. It involves more than just collecting payments. Effective processing systems manage the entire payment lifecycle, including subscription renewals, refunds, and secure data handling across connected systems such as CRMs and accounting software.

For example, Maxio offers financial operations tools that synchronize data between systems like QuickBooks, Salesforce, HubSpot, and NetSuite. This ensures accurate tracking and consistent cash flow across the entire order-to-cash process.

Common Challenges in Managing Payments

Early-stage software companies often start with a simple payment gateway. While this approach works initially, it can quickly become inefficient as the company scales. Common challenges include:

- Subscription complexity: Managing upgrades, downgrades, and cancellations without automation can create bottlenecks.

- System silos: Disconnected systems lead to manual reconciliation and data errors. Platforms like Maxio centralize these functions to eliminate inefficiencies.

- Customer experience: Users expect flexible payment options and transparent invoicing. Modern payment platforms provide these capabilities to improve satisfaction and retention.

Why Billing Should Be Part of Your Core Strategy

Billing and payment processing is more than an administrative back-office task. When integrated into your overall business strategy, it improves operational efficiency, enhances the customer experience, and increases retention.

For example, integrating billing and payments with subscription management allows you to automate time-consuming tasks like invoice generation and payment reconciliation. This ensures that your operations run smoothly and your finance team can focus on higher-value activities—rather than spending all day chasing down payments.

Payment Processors vs. Billing Platforms

Before choosing a solution, it’s important to understand the distinction between payment processors and billing platforms. They serve different roles but work best together.

What Is a Payment Processor?

A payment processor manages the secure handling of transactions between customers and your business. It enables the acceptance of various payment methods, including credit cards, ACH transfers, and digital wallets.

Key capabilities:

- Transaction handling: Processes payments securely and quickly.

- Subscription payments: Manages recurring transactions for subscription-based pricing models.

- Integrations: Connects to billing platforms for seamless invoicing and data flow.

- Cost structure: Typically charges a percentage of payments processed plus a fixed transaction fee.

What is SaaS Billing Software?

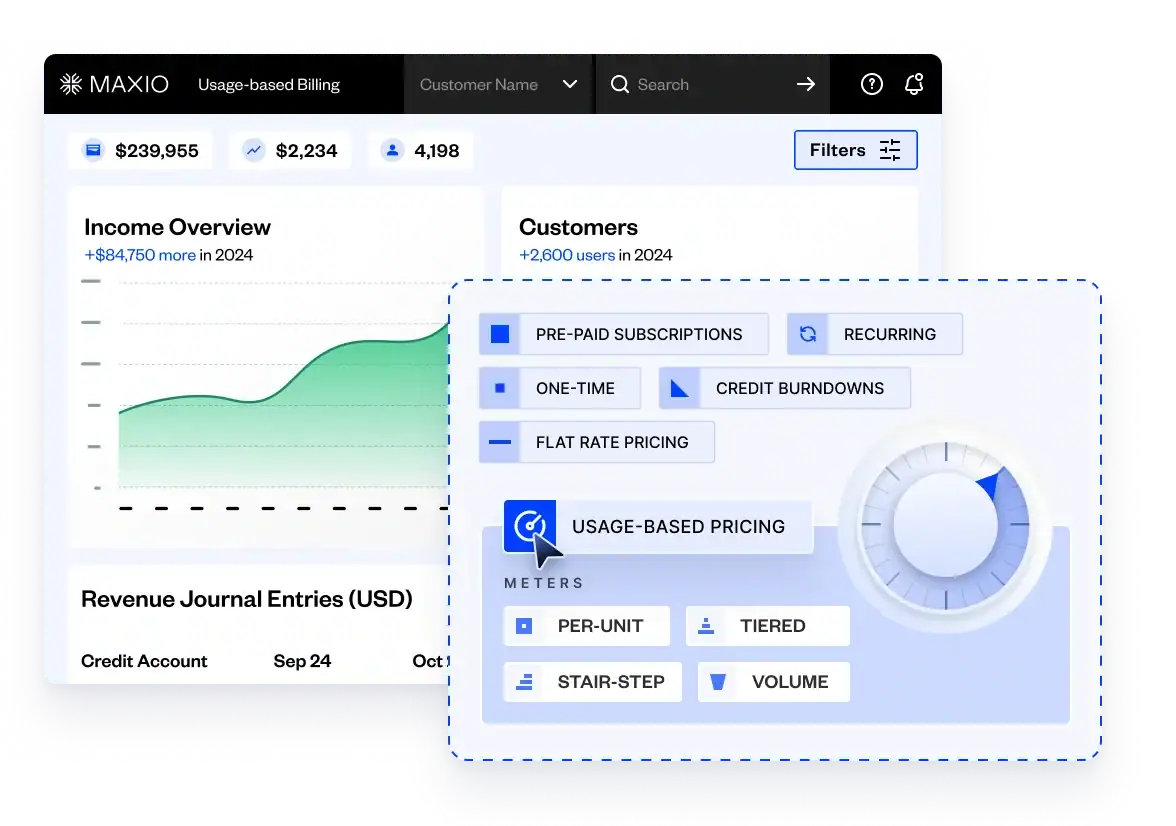

On the other hand, SaaS billing software takes a broader approach by handling the lifecycle of customer billing. It’s designed to automate complex billing tasks, such as calculating subscription charges, managing usage-based pricing, generating invoices, and integrating with payment processors to collect funds.

Key capabilities:

- Subscription Management: Handles upgrades, downgrades, cancellations, and free trials.

- Invoice automation: Creates and sends invoices with calculated line items and taxes.

- Pricing flexibility: Supports multiple pricing models, such as flat-rate, usage-based, or tiered pricing.

- Data insights: Provides financial reports and dashboards for strategic planning.

- Cost structure: Often involves a fixed monthly fee, a percentage of total billings, or a combination of both.

SaaS billing Software vs. Payment Processors

| Feature | Payment Processor | Billing Software |

| Primary purpose | Processes and secures payments | Manages subscription lifecycles and invoices |

| Handles recurring billing | Yes, but limited to payment execution | Yes, including detailed invoicing and usage tracking |

| Supports pricing models | No | Yes, including tiered and usage-based pricing |

| Integration with other systems | Limited | Extensive, connects to CRMs, ERPs, and payment gateways |

| Cost structure | Percentage of transactions + fixed fee | Fixed monthly fee or percentage of billings |

Choosing Which to Implement First

When building your payment infrastructure, deciding whether to start with a billing platform or a payment processor affects scalability and efficiency.

Why This Decision Matters

Choosing the right starting point impacts more than just your payment process. It affects your company’s ability to:

- Simplify complex tasks like subscription management and recurring invoicing.

- Ensure timely payments and reduce revenue leakage from failed transactions or manual errors.

- Improve collaboration between your finance and product teams by automating workflows and reducing friction.

- Provide your C-suite with better financial data for forecasting and decision-making.

Why Start with a Billing Platform

Based on our work with thousands of subscription businesses, we’ve learned that most SaaS companies benefit more from starting with a holistic billing platform rather than a standalone payment processor. Benefits include:

- Holistic management: A billing platform manages the entire subscription lifecycle, from invoicing to revenue recognition and gives your business a comprehensive tool for scalability.

- Flexibility: Most billing platforms integrate seamlessly with multiple payment gateways, allowing you to choose the processor that best fits your needs down the line.

- Scalability: As your business grows, a billing platform supports advanced pricing models, international payments, and detailed reporting—features that many payment processors don’t offer.

- Automation: By automating invoicing, payment reminders, and reconciliation, billing platforms free up your team to focus on strategic initiatives.

The Pros and Cons of Each Option

| Factor | Billing platform first | Payment processor first |

| Ease of setup | Moderate complexity, but covers more functions upfront | Simpler to implement but limited in scope |

| Scalability | High: supports complex pricing models and growth | Low: may require switching or adding tools later |

| Integration | Connects to multiple payment gateways | May not support billing platforms out of the box |

| Cost efficiency | Streamlines operations, reducing manual tasks | Limited to transactional functions |

| Data insights | Offers detailed financial reporting | Basic payment data only |

Build vs. Buy: The Billing System Dilemma

Some companies attempt to build their own billing infrastructure. While this can seem cost-effective at first, it often leads to long-term inefficiencies. Custom systems can lack flexibility, are difficult to maintain, and divert engineering resources from core product development.

Challenges of building in-house:

- Development time detracts from product innovation

- High maintenance and support costs

- Limited automation and scalability

A proven billing platform allows your team to focus on growth instead of internal system maintenance.

How to Select the Right Billing Platform

Choosing the right platform involves evaluating your business needs, integration requirements, and long-term growth plans.

Step 1: Define Your Business Needs

The first step in selecting a platform is to thoroughly assess your business needs. Are you still finding product-market fit? Do you have an ample cash runway in case things go south? Are you rapidly expanding your customer base?

Based on these answers, consider the pricing models you currently use and whether or not you’ll need support for flat-rate, tiered, usage-based, or hybrid strategies. For example, we built Maxio’s subscription billing solution with this kind of flexibility in mind to make it easy to adapt to complex pricing structures as your business evolves.

You should also think about how much automation you need—automating tasks like invoicing, payment reminders, and reconciliation can significantly enhance the efficiency of your day-to-day operations. Additionally, you’ll want to evaluate the integrations that are vital to your workflows, such as CRMs, accounting software, or different payment gateways.

Maxio connects seamlessly with leading tools like Salesforce and QuickBooks to ensure that you can continue using all the preferred tools in your tech stack. And if global expansion is part of your strategy, Maxio’s support for multi-currency transactions and compliance with international tax regulations makes it an excellent choice for SaaS businesses operating on a global scale.

Step 2: Compare Key Features

Once you’ve outlined your business needs, you should then compare the key features of the different billing platforms you’re evaluating. We even put a list together of the best subscription billing tools if you need a place to start your search. As you start evaluating these different tools, look for flexibility in pricing models and the ability to adapt them based on changes in your billing strategy. For example, if you’re finding it difficult to attract users downmarket, you may consider setting up a free trial or freemium pricing model.

Step 3: Evaluate Total Cost of Ownership

Consider both upfront costs and long-term value. A slightly higher subscription fee may yield a stronger return if it reduces errors and saves time. Maxio’s transparent pricing model helps businesses understand value without hidden fees.

Step 4: Review Support and Scalability

Customer support and scalability should also influence your final decision. You’ll want to choose a platform that offers reliable 24/7 support, comprehensive documentation, and the ability to scale with your business as transaction volumes and complexities increase. Maxio’s dedicated support team is available to guide you every step of the way, and our platform is designed to grow with your business, supporting higher transaction volumes and increasingly complex workflows.

Step 5: Test Before You Commit

Finally, before you make a final decision, take advantage of any potential free trials or demos to test the platform in real-world scenarios. After all, just because a tool looks great on paper, doesn’t mean it will offer the same value once you take a look under the hood.

If you do manage to sign up for a free trial or demo, assess the user interface for ease of use, how the platform performs under typical workloads, and how well it integrates with your existing systems.

A well-chosen billing and payment processing platform strengthens your financial operations, improves customer satisfaction, and supports long-term growth. The right tools simplify recurring revenue management and reduce manual work for finance teams.

Explore how Maxio can help you streamline billing, automate payments, and scale your operations effectively.