According to Harvard Business Review, 80% of company mergers will ultimately fail. What is it that separates a successful merger from a bad investment? And how can you ensure the long term success of your organization?

Before Maxio, I took RocketFuel private via a PE transaction and then sold the next company I was CEO of (Percolate) to Seismic—the industry-leading Sales Enablement company. I then spent two years as the Chief Strategy Officer at Seismic and was responsible for building the business case for acquiring two companies and making a strategic investment in another.

While I had been part of many acquisition integration teams at previous companies (e.g. aQuantive, Microsoft, and Salesforce) it was during these last several years in leadership roles that I developed a more robust appreciation for how to set up an acquisition for success as an operator.

For starters, as CEO, you must develop a clear strategy about how to approach M&A and the value it will provide to your organization as a source of inorganic growth. You can think about this “value” by separating potential M&A targets into two categories:

1. Strategic M&A: This type of M&A process aims at accelerating your growth trajectory by increasing your market share (through competitive take out), broadening your customer base (through segment or region expansion) and/or adding key technical capabilities (through an acqui-hire). All of these growth investments are geared toward supporting inorganic growth that complements your organic growth (aka core business) initiatives

2. Opportunistic M&A: This type of M&A process is typically the result of a company in an adjacent category or with complimentary tech or customer base reaching out (usually via a banker) to gauge your interest in acquiring them.

While both of these processes result in potential economic gain, a strategic M&A is a long-term play, while an opportunistic M&A is usually the result of a decrease in a company’s price or valuation (hence the name).

At Maxio, the merger of SaaSOptics and Chargify was ultimately a strategic play. By offering SaaS billing, invoicing, revenue recognition, financial reporting, and SaaS metrics in one FinOps platform, we’re able to fill a gap in the market for growing B2B SaaS companies.

Even though Maxio has proven to be a success, the hard truth is that most mergers don’t work out.

According to a recent Financial Times article, companies spent around $5 trillion on M&A activity in 2021, and an astonishing 70% of mergers are estimated to fail to deliver any increase in economic value or improvement in operating profits (the definition of M&A success). This failure rate has not changed over the years. When I first started down the path of M&A, I read this article from Harvard Business Review which is consistent with many other sources.

Ultimately, The #1 cause of failed deals is accounting errors. Discrepancies in a company’s financials will inevitably be flagged during due diligence and can stop a deal in its tracks. This is one of the problems we’re solving at Maxio—our platform gives SaaS finance leaders access to accurate, up-to-date financials 24/7, so they can pass due diligence with flying colors.

To build a durable business, it’s vital to understand why so many mergers fail so that you can avoid the pitfalls and use an M&A-based strategy effectively to realize your full potential.

McKinsey Consulting has a 6 stage M&A process which is relatively simple and intuitive. In this blog, I am going to focus mostly on steps 1 and 2.

Create a strategic M&A landscape

The hard work of M&A starts with the CEO and board of directors getting aligned on what the broader market landscape looks like and where their company sits. As you evaluate the landscape, you need to make deliberate decisions about where you are going to build, partner, or buy. Building this strategic landscape requires two steps.

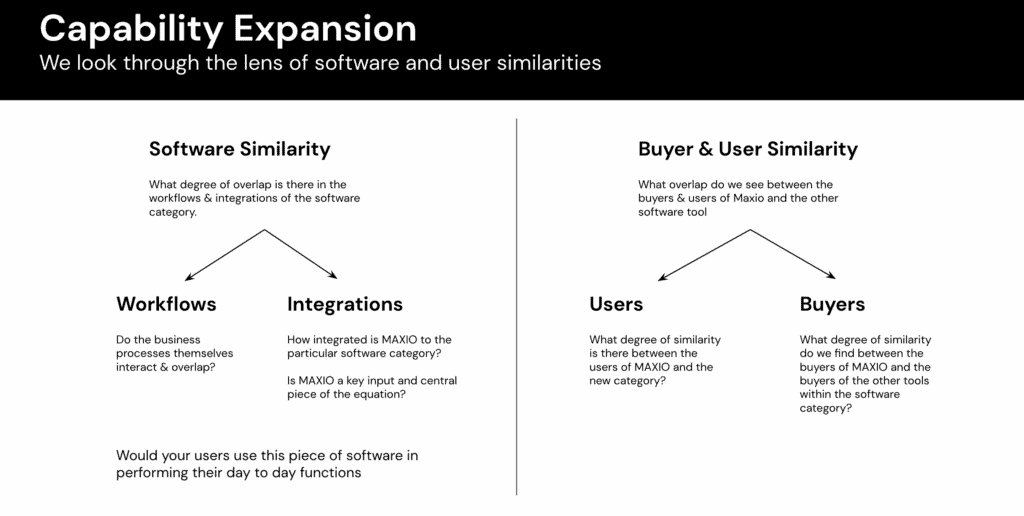

1. Create a “lens” through which you evaluate EVERY opportunity. I have found it helpful to use two dimensions to view potential targets: Software similarity and user/buyer similarity.

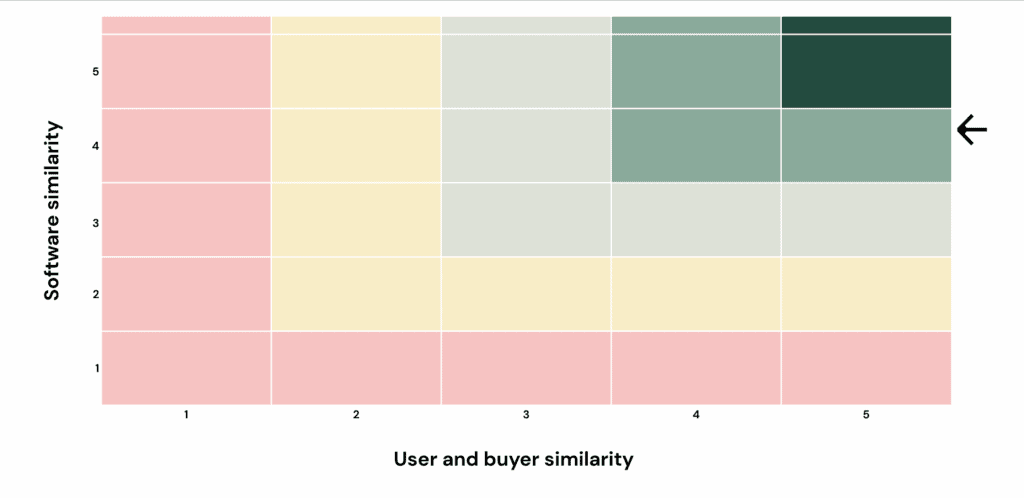

2. Plot out the landscape of capabilities across a matrix. (Note: I am repurposing a model from Bain Consulting)

You start by putting your core capability in the upper right. You then place different “capability categories” in the different cells. For each of these capabilities, you need to decide whether to build, buy, partner, or ignore.

One example of using this framework was the investment we made in Payments. We spent 6 months last year partnering with a leading PayFac to bring Maxio Payments to market because the capabilities were valued by our buyers and users, but it would have taken YEARS for us to build on our own. As we look at other adjacent categories, there are several where we want to aggressively pursue M&A versus partner or build because we think there is interesting luck in tech investments.

Once you have your strategic landscape laid out and are aligned with your board, you can then evaluate opportunities that pop. In the current market environment, there are going to be a plethora of opportunities popping up as companies don’t achieve their growth ambitions and find it hard to raise new capital. I have 2-3 “great deals” to look at each day. 99.9% of them I pass on, but there have been a couple over the past 3 months that I have engaged with because they fit into our strategic plan.

Complement, but don’t cannibalize

Software similarity

When evaluating the software similarity, it is important to understand whether the two companies truly complement one another. Will the merger add value for existing customers? Will it make it easier to recruit newcustomers?

Consider product adjacencies, but also the merged company’s potential for expansion into new regions or market segments. It is also important to understand the tech stack and whether core technologies can be integrated without rebuilding from the ground up. We are an AWS shop and will not look at companies built on other clouds.

However, Seismic (where I worked previously), had a different philosophy. They chose to be cloud agnostic and supported customers who wanted to be on GoogleCloud, Azure, and AWS. This is a very different strategy and requires a different architecture. At the application level, it comes down to what languages they are using. You can’t just take a Python code base and flip it to Java. Often, this should be a deal killer.

Buyer similarity

When evaluating the buyer similarity, it is much easier to add a capability that can be sold by your current GTM team and infrastructure than it is to add on a whole new ICP/target persona that the acquiring company has to embrace. It can be done, but it is incredibly difficult. The two companies’ GTM strategy and pricing models should also align or work in ways where alignment can easily be achieved without major disruption. Could each team easily sell into the other’s customer base? Does one sell seat-based deals and the other usage-based deals? This can confuse buyers and slow down deals as you work through contract redlines.

The best mergers bring obvious synergies—in tech, markets, regions, etc—that allow both companies to grow and add value, but also enough contrasts that both companies each bring something unique to the table. Ideally, you should aim for about 70% overlap of culture and mission to ensure that you can succeed.

Timing is essential

Even if both companies are a good match on paper, deciding when to merge is critical. You need to consider their combined total addressable market, expansion trajectory, and their opportunities for growth.

You also need to understand the invested capital and expected valuation/ return by the target’s investors. There are lots of great deals that could happen, but the two parties can’t agree on valuation.

Finally, the most important factor to consider is evaluating your company’s stage of development and capacity to absorb an acquisition. Does your executive team have experience scaling organizations from your size today to what will be the combined size? Do you have systems and infrastructure in place to support the next stage? If not, you might want to spend some time building a solid foundation before trying to merge/integrate with another company. You don’t want to build a second story on a house that is already shaking in the wind.

You need to be clear about the work involved, and the opportunity costs you’ll incur when you devote resources to an integration. I cannot emphasize this enough. To make an integration work, it is a “whole company” bet.

Do you have the capacity on your team to fund an integration center of excellence? Will the benefit you get in 12 months be worth the 12 months of distraction that you take on with an integration? During this time, the competition is going to be innovating and pointing out to all of your customers that you are losing focus and not keeping up with the market. Would you be better simply focusing on your own internal roadmap and executing?

Leadership is everything

My old CEO, Doug Winter, said to me when I was the Chief Strategy Officer: “Bankers don’t sell companies. CEOs do.” As the acquiring CEO, you are the one who has to create the strategic M&A roadmap. And you have to be the one to sell the board and your executive team that this is a great idea given all the potential downside risks. You also have to be the one to take point in leading the process with the target. Your banker, your VC/PE partner, and/or Corp Dev team can help field the opportunity, but ultimately it is going to come down to how you and the other CEO view the broader landscape and feel about the potential of 1+1=3. The only way to turn two organizations into one is if both CEOs see eye-to-eye on the future of the merged business.

This requires radical transparency and extending a level of trust early in a relationship—probably earlier than most people feel comfortable. The two CEOs and then, over time, the two executive teams, need to bring to the table everything they know about their culture and the companies they’ve built.

During this process, both leaders should be selling their vision and scrutinizing the package they’re being sold—like a job interview where you’re simultaneously the candidate and the hiring committee. Both CEOs should come out of that process with a strong gut feeling that what they’ve built will be preserved and nurtured and that the new alliance will unlock bigger opportunities for both sides. There are going to be some hard times and a lot of tough decisions to be made about people, brand, and tech–especially in the first year. Both parties, together, need to be able to come back to the investment thesis and help people manage through the change.

Once you’re aligned on the vision, it’s time to lock down the post-deal process of change management and culture building. I have found this is where people usually underestimate the time and energy required. Assuming you have done robust due diligence and internal evangelism up-front, then as the CEO you have to make a swift pivot to implement the merger, integrate the two companies, and move efficiently through the transition. You have to create forums for the employees, the leadership team, and the board to hash out issues and ensure that you deliver on the promise of the investment thesis over time.

Success story

At Maxio, we used this approach—leveraging the amazing work of our existing leadership, the insights and culture of both companies and a strong, data-driven vision for the future—to unlock value for our customers and open the door to new opportunities.

We’ve been extremely mindful of our need to continue serving existing customers and expand the value we deliver as we integrate our product and operations. We’ve also worked to keep our employees energized and informed at every step of the way. It wasn’t always easy, but I can feel that we have moved from integration to innovation once again as we approach the 2nd birthday of the merger.

Like any business, Maxio is a work in progress. But our success shows that when it’s done right, an M&A strategy can pay enormous dividends if you take the time to understand your business and your growth strategy, articulate a powerful vision for the companies you’re drawing together, and then ensure you have laser-focus on execution.