Want to bridge the gap between your funding rounds? Or shore up your balance sheet? Or stop sweating bullets every time you check on your cash projections?

As SaaS owners and operators continue to feel the squeeze of the market, alternative funding options like revenue-based financing (RBF) are quickly gaining in popularity. That’s why we’ve teamed up with revenue-based financing provider, Capchase, to help you understand exactly when (and why) it makes sense to pursue RBF.

Here’s what you need to know.

What is revenue-based financing (RBF)?

Revenue-based financing (RBF) is a type of financing where a company receives funding in exchange for a percentage of its future revenues. In an RBF agreement, the investor provides capital to the company in exchange for a percentage of the company’s gross revenues until a predetermined amount of money has been paid back.

Unlike traditional debt financing, where the borrower pays back a fixed amount of money plus interest, RBF does not require fixed payments. Instead, the payments are based on a percentage of the company’s revenue, which means that the amount paid back to the investor will fluctuate based on the company’s performance. This can be a more flexible financing option for startups and early-stage SaaS companies that may not have a consistent cash flow to make fixed payments.

What are the advantages of revenue-based financing?

1. Fast time-to-value: The availability of SaaS financials and metrics allows for pretty seamless and rapid underwriting of software companies. For example, by partnering with a SaaS FinOps platform like Maxio, RBF provider, Capchase, is able to take SaaS metrics like ARR, NRR, and CLTV to draw up a funding offer within a few days. This frees up time for the entrepreneur or founder that wouldn’t be made possible when pursuing a traditional VC funding round.

2. Flexible and scalable: When you take out a term loan from a bank, it comes out in one chunk (and you might be drawing more out than you actually need). However, with RBF, you can draw out your funding in increments—this could be week by week or month by month.

RBF providers like Capchase encourage founders to think about how much capital they actually need. The ability to determine the length of your cash runway gives founders the working capital they need to pursue efficient growth without being tied to a huge capital funding raise and the strings attached that come with traditional venture capital.

3. Simple and straightforward deal terms: When compared to traditional VC funding, RBF deal terms are pretty easy to understand. There are no warrants, covenants, and no strings attached. Financing is calculated as a percentage of ARR and the only fee charged is the interest rate on the loan.

Who is a good fit for RBF?

In short, revenue-based financing is ideal for SaaS companies that are looking to:

- Access capital faster and spend more time scaling

- Fund growth without more dilution

- Withdraw funding as needed

You need fast access to capital

Technically, you can start accessing funding against your revenue as soon as you’re revenue positive. Przemek Gotfryd, Co-founder and COO of Capchase, notes that most of the companies that Capchase works with typically start at a few 100k of ARR. Then, as your revenue grows, so does your availability of working capital—this could span anywhere from $10,000 to hundreds of millions of dollars.

You want to diversify your funding sources

In many instances, it makes more sense to stick to the traditional funding route. For example, Venture Capital might be the solution for some investments that you’re making multiple years out in the future such as hiring engineers or investing heavily in research and development.

Then, once you find product/market fit or start steadily generating revenue, you can use that revenue as an asset to raise working capital via revenue-based financing. This capital raised through RBF is best used to fund activities that generate predictable returns (i.e. Marketing spend, hiring staff, and go-to-market campaigns).

Another use case for revenue-based financing is to bridge the gap between funding raises. While not all companies that pursue RBF are VC-backed, revenue-based financing allows businesses to extend their cash runway when raising a round doesn’t make sense (e.g. raising a down round, avoiding dilution, or dodging poor deal terms).

A revenue-based financing success story: Blue Triangle Technologies

While RBF makes sense in theory, does it actually work well for high-growth SaaS companies?

Here’s what Lance Ullom, CEO of Blue Triangle Technologies and Capchase client, had to say:

We looked at a number of different fundraising opportunities, everything from equity financing, venture debt, hybrid, and revenue-based financing, and ultimately, we decided to go with revenue-based financing. Some of the challenges we had with more traditional equity investments was the timing—especially with due diligence. And while we didn’t need additional capital, we thought it would be good to shore up our balance sheet due to the current uncertain economic outlook. So, after reviewing all our options, Capchase turned out to be an excellent solution for us.

— Lance Ullom, CEO of Blue Triangle Technologies

How should founders be thinking differently about their funding strategy?

Capital is no longer abundant or cheap. This could change in a few years as the market swings the other way, but for now, this is the state of funding.

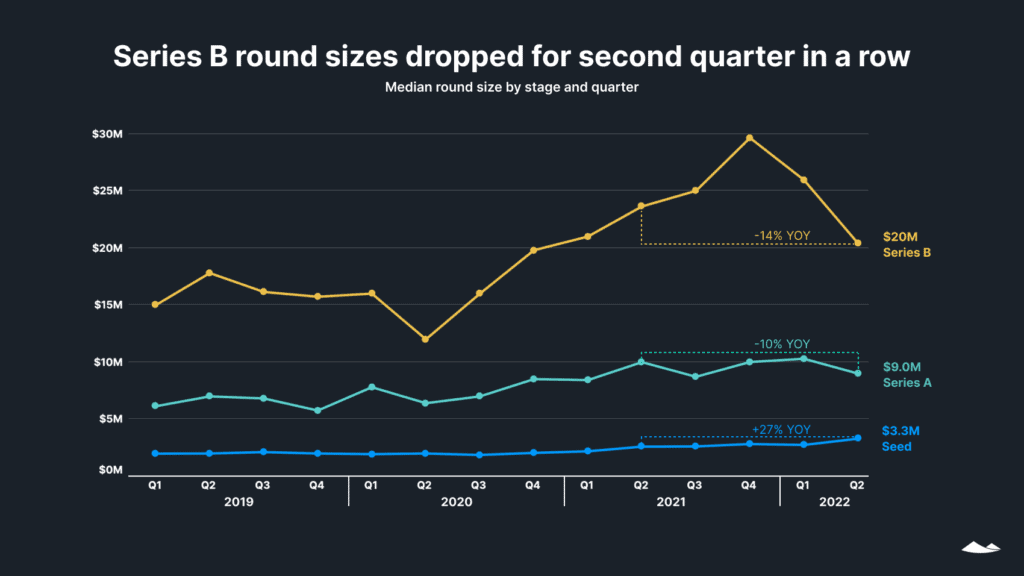

According to Carta, Series D saw the steepest drop in total cash. Cash going to Series D rounds dropped by 48% from Q1 to Q2. And regarding early-stage raises, series B round sizes dropped for the second quarter in a row.

This uncertainty created by the pullback in VC funding is forcing SaaS owners and operators to be agile and explore alternative funding options (like RBF). This is due to multiple reasons such as longer funding cycles, increased due diligence, and greater equity dilution. While not all VCs are pulling their term sheets, the current state of funding means founders need multiple financing options to shore up their balance sheet and ensure their cash reserves are healthy.

Founders and SaaS executives should also be concerned about the state of their lenders’ balance sheets as well. Based on recent events such as the collapse of Silicon Valley Bank and general market volatility, owners and operators need to be well aware of the stability of their lenders.

What does the revenue-based financing process look like?

Now that we’ve covered eligibility and use cases for revenue-based financing, here’s what the typical funding process looks like from start to finish:

1. Sync your data

Using an RBF platform like Capchase, connecting your accounting and billing data through Maxio can be done in only two minutes. If you’re not a Maxio customer, many revenue-based financing providers also accept Excel files or additional documentation of your company’s financials or operating metrics.

2. Seamless underwriting

Once your metrics have been reviewed, a funding offer can be given in as little as 48 hours later. This offer will tell you what percentage of your ARR is available for financing, as well as any additional costs, the length of the funding term, and the specified payback period.

3. Access your capital

Once approved, SaaS owners and operators can access their capital directly from Capchase or their chosen revenue-based financing provider.

4. Additional funds

One of the biggest pros of revenue-based financing is that it can be drawn on an as-needed basis with minimal equity dilution. If you need additional funding, you can repeat the financing process with your RBF provider and raise an additional round based on the current state of your ARR and other SaaS metrics.

Extend your cash runway with Maxio + Capchase

You don’t need to give up equity, sit through lengthy funding cycles, or drastically cut overhead to extend your cash runway. By exploring funding alternatives like revenue-based financing, SaaS founders and executives can strengthen their cash reserves and take meaningful steps toward their next stage of growth.

Want to join thousands of other SaaS founders taking control of their funding?

See how you can use Maxio and Capchase together to fund your growth.