Subscription Billing Software

If you can build it, we can bill it.

Get rid of your billing headaches. Maxio helps you manage even the most complex recurring billing models so you can focus on building your business.

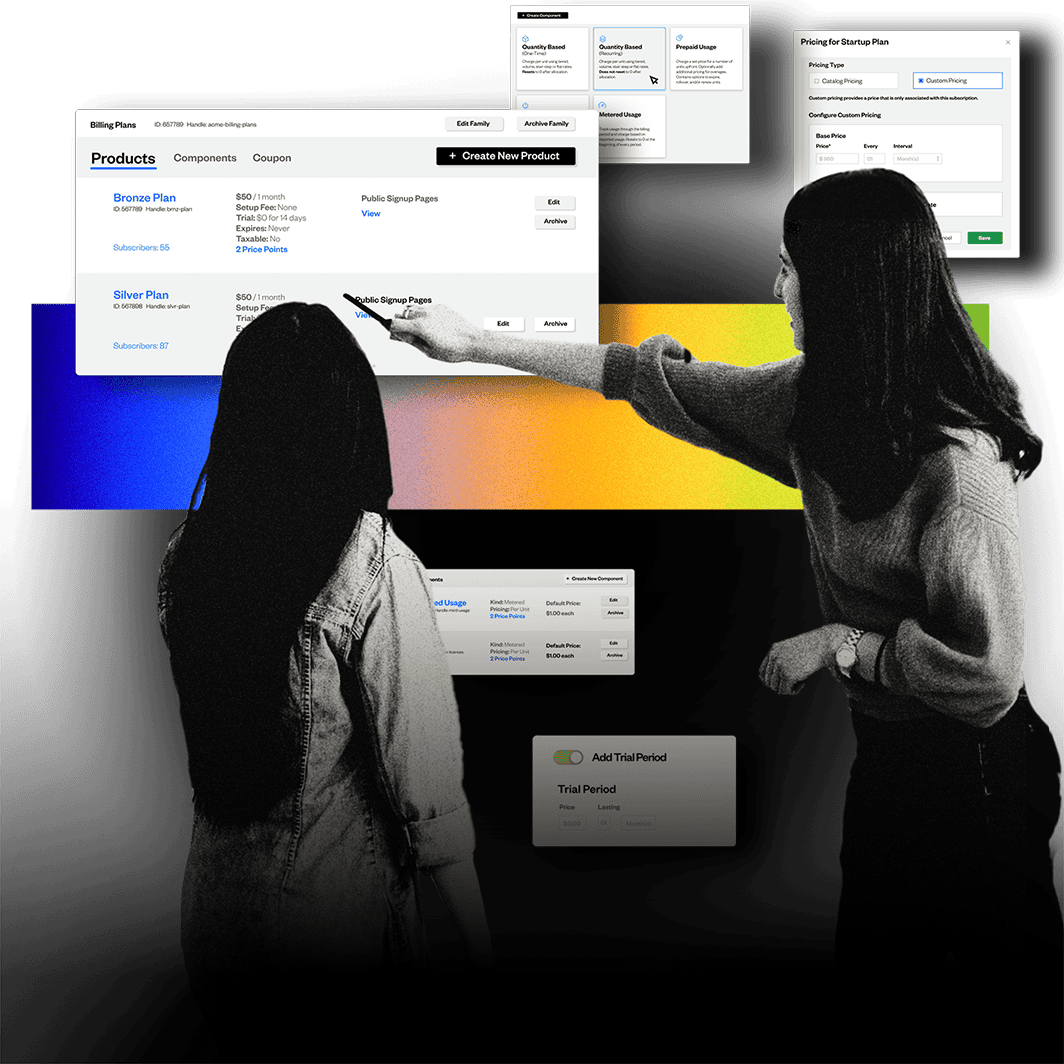

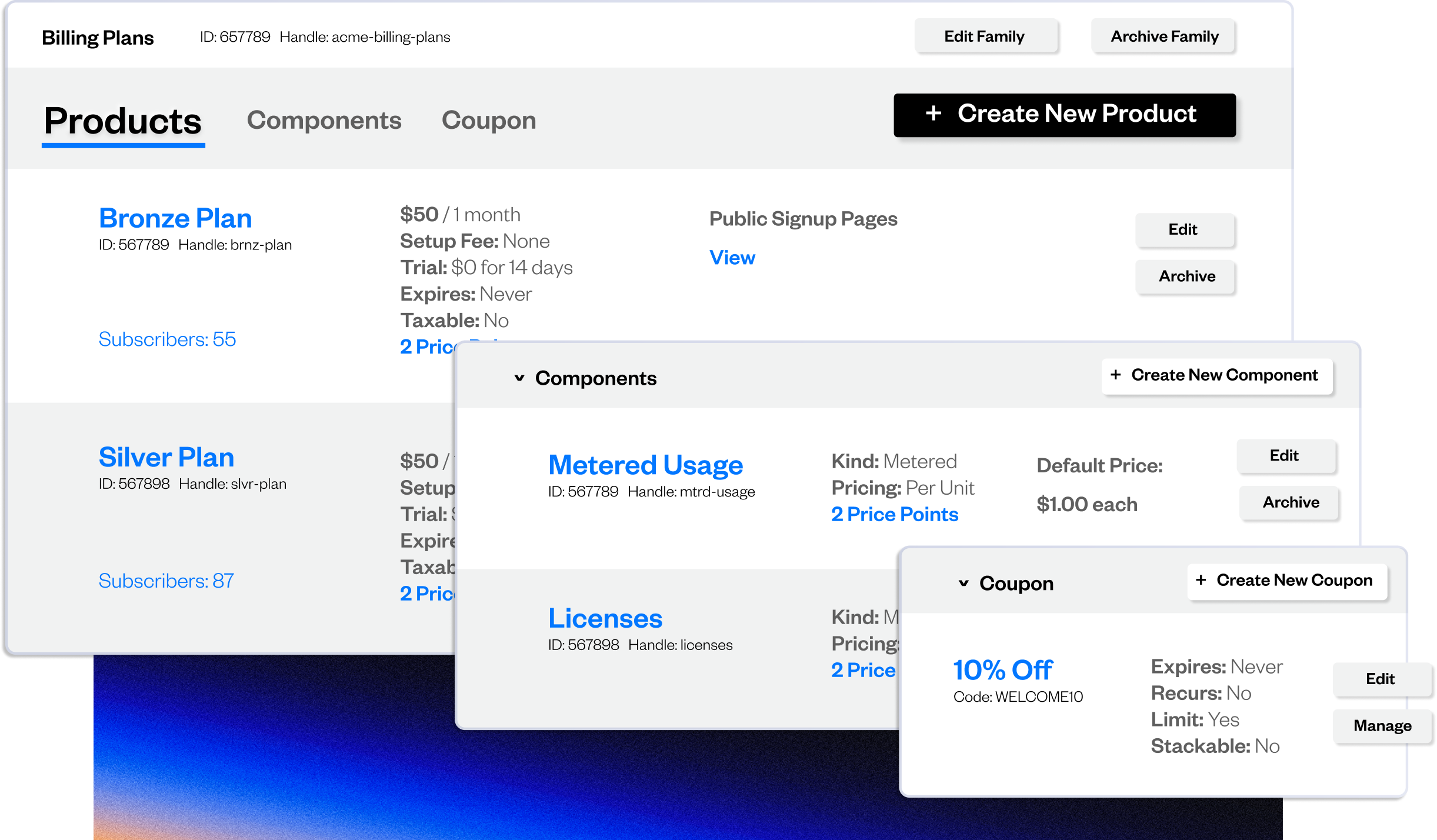

Say goodbye to product catalog bloat

Create almost any billing scenario in minutes. Quickly customize offers without cluttering your product catalog.

Start by defining the base plans your customers will subscribe to, including price, recurrence, taxation, and an optional trial period.

Diversify revenue with line items which can be added to a product as needed, such as add-ons, upsells, and usage-based pricing options.

Use standardized discounts you define to personalize offers and close deals faster.

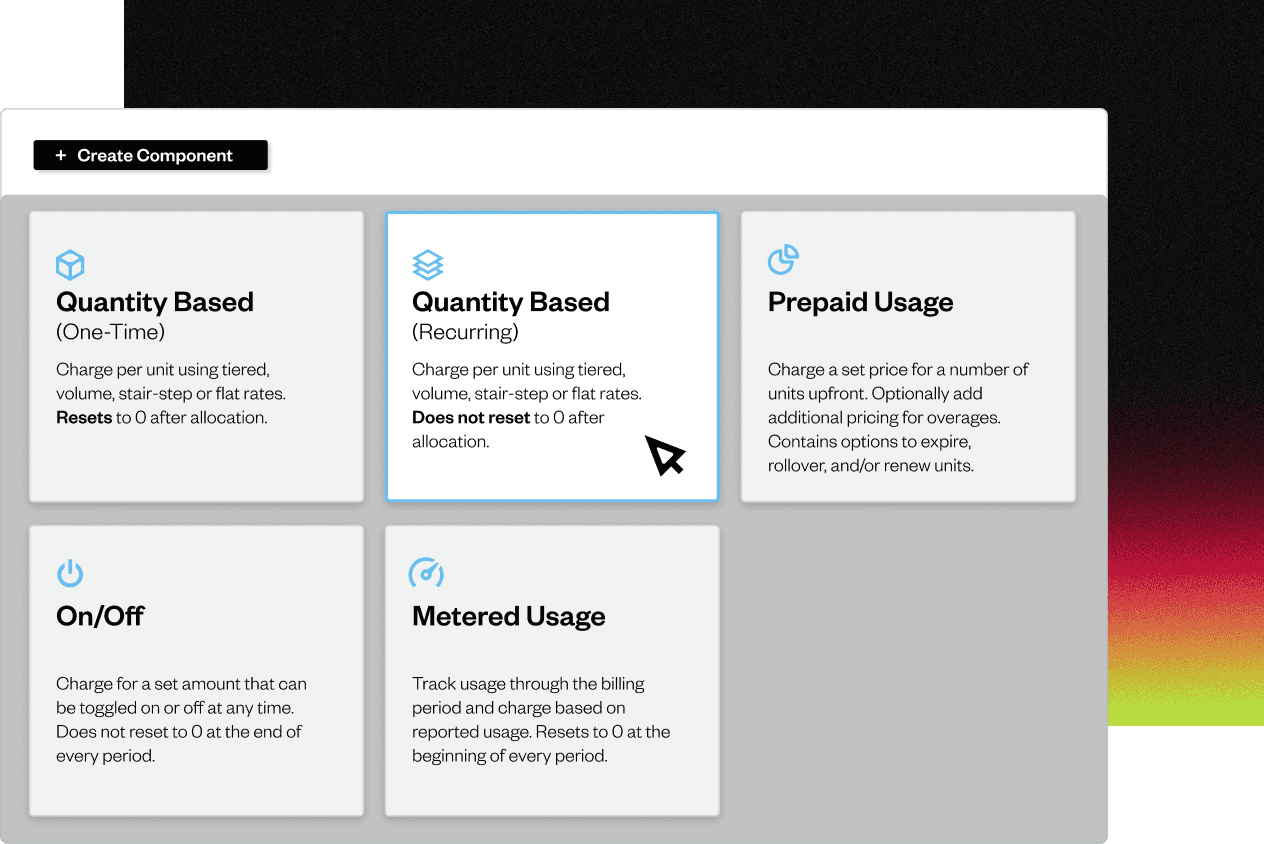

Flexible pricing options

Consolidate variable pricing and currency calculations

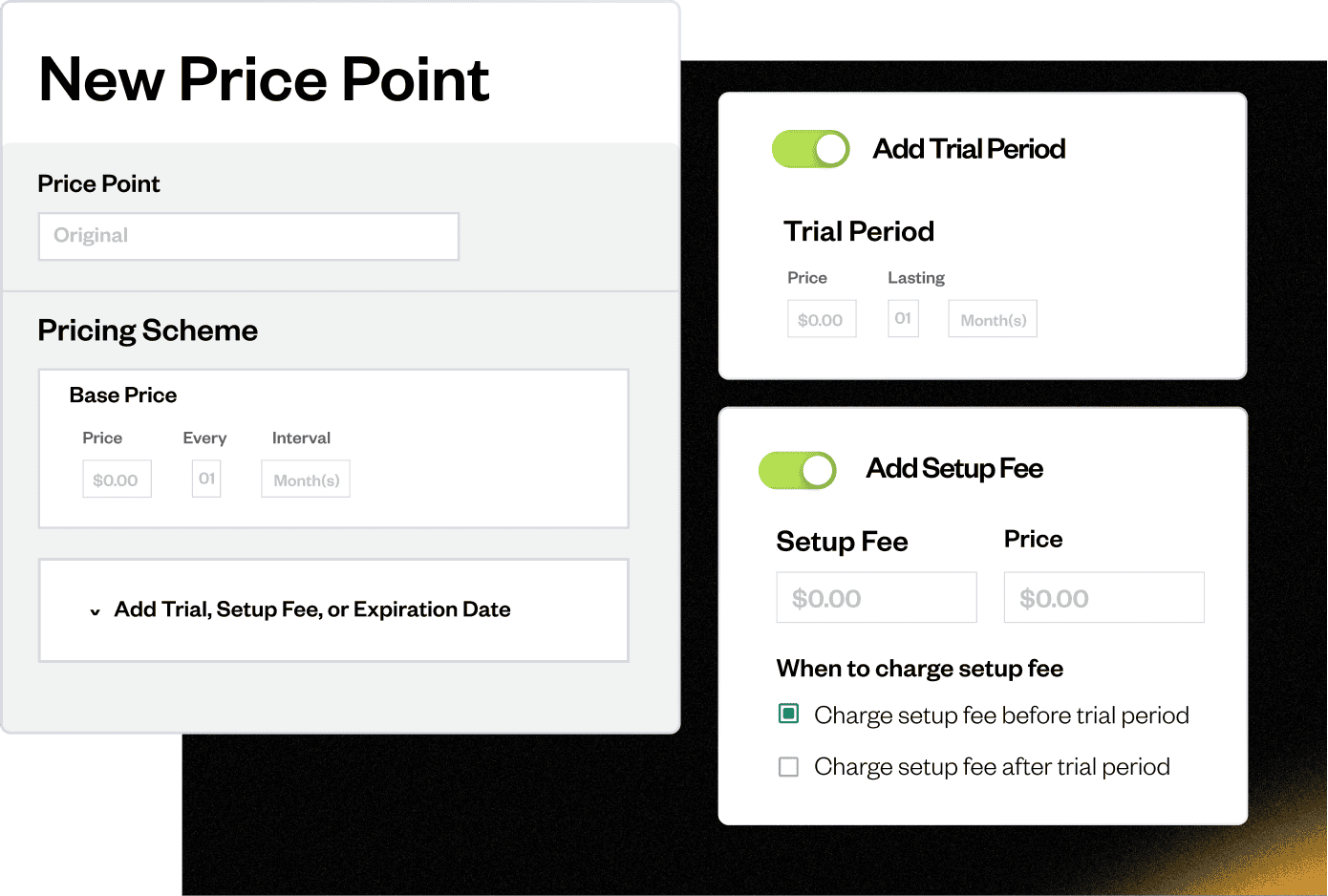

Add flexibility to your product catalog by setting multiple price points for products and components.

Offer your customers multiple currency options, product tiers, and scalable usage-based pricing packages, even when they’re subscribed to the same product.

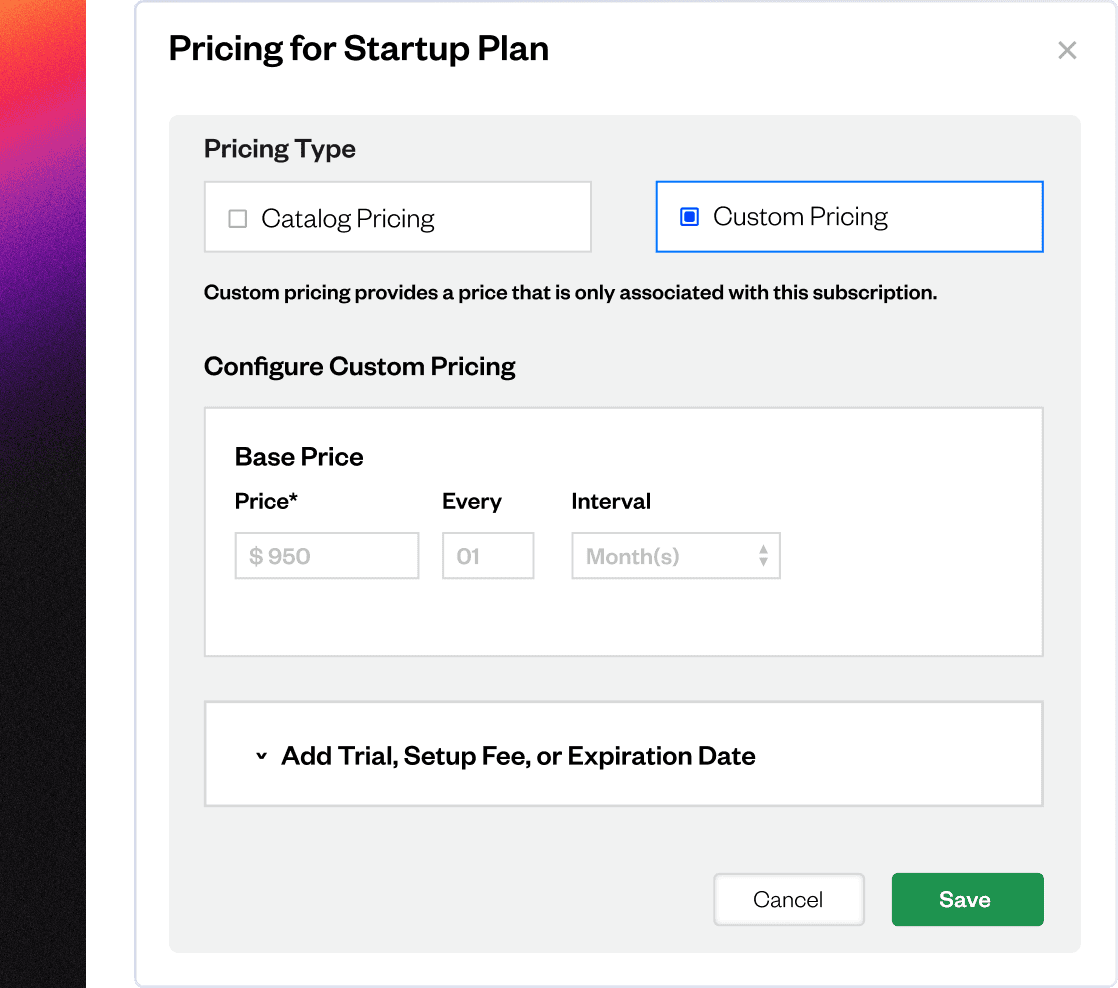

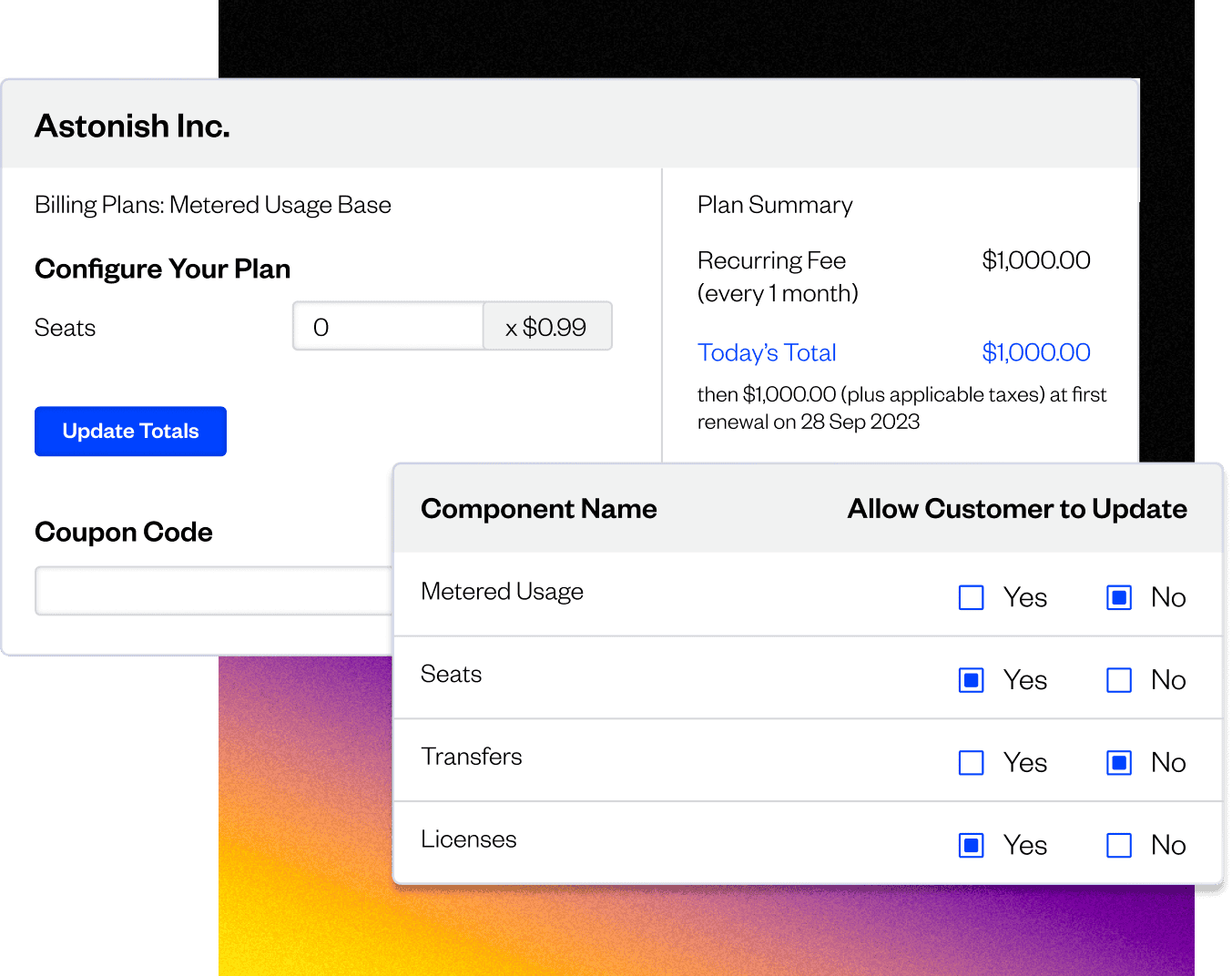

Support a sales-led strategy with custom pricing

Manage your sales-led customer growth with truly custom prices. Create a unique subscription from scratch, or tailor current product and component pricing for a specific customer without affecting the base prices set on your catalog items.

This enables you to manage sales-negotiated contracts alongside self-service signups without bloating your product catalog.

Scale faster with usage-based pricing

Grow alongside your customers by building usage-based pricing into your product’s custom price point. Automate rating and billing activities for common usage-based billing models like metered, tiered, and stair step, or get granular with events-based billing.

Allow your customers to pre-pay for usage-based services or pay in arrears along with their monthly bill.

User-friendly subscription management

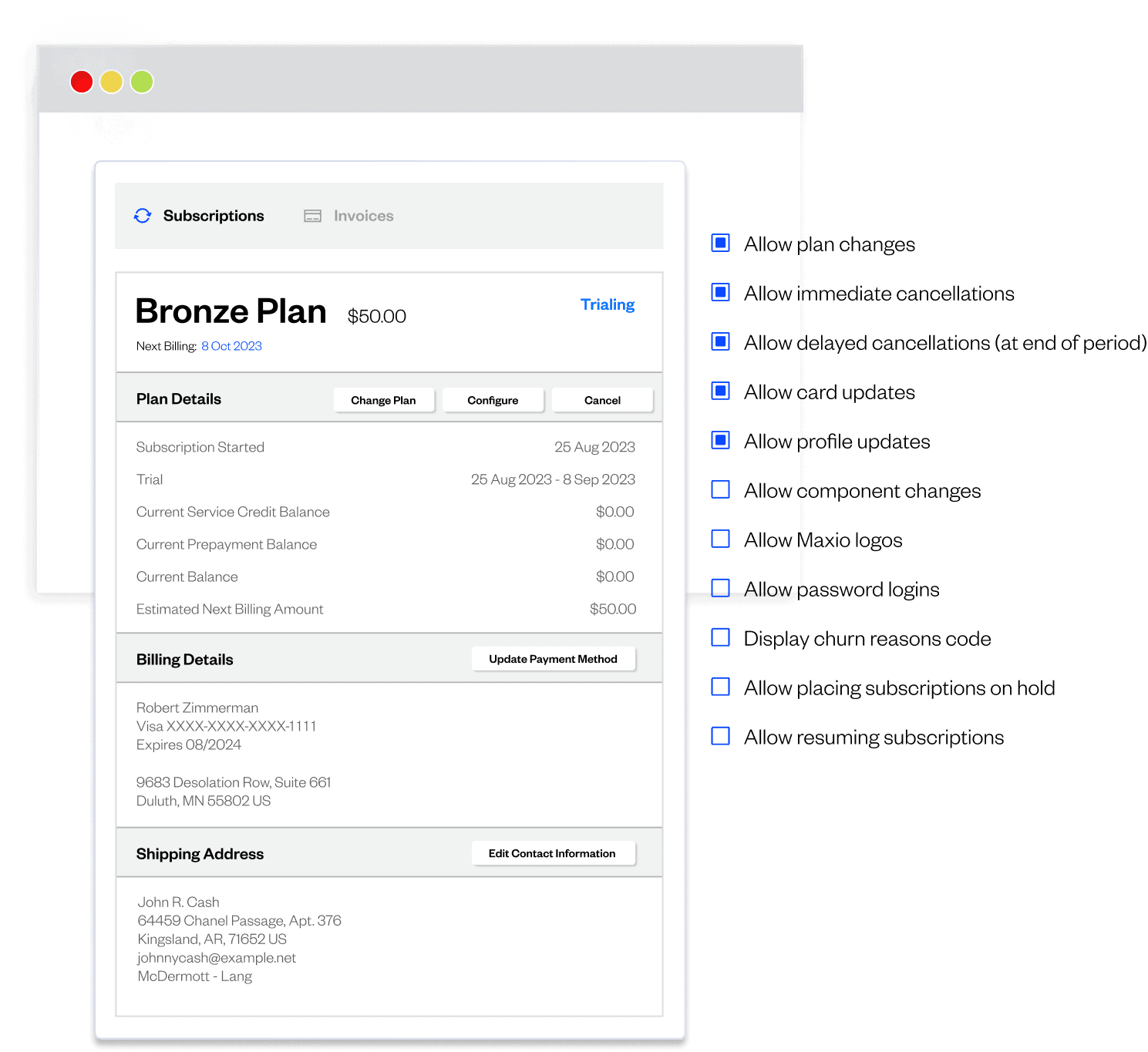

Customer billing portal

Let your customers manage their subscriptions without writing a single line of code. Maxio’s hosted billing portal allows subscribers to manage activities like updating credit cards, changing plans, and opting for upgrades or downgrades as needed—providing an empowering customer experience.

Pick and choose what actions your subscribers can take while in the billing portal, and personalize your company branding for customer recognition.

Public signup pages

Give your customers everything they need to get started on their own. Configure signup pages with automatic or remittance billing, specify a subscription billing cycle (with automatic proration as applicable), enable coupons, create custom fields, and more.

Maxio’s public signup pages are:

- PCI compliant

- Highly customizable with CSS and JavaScript

- Optimizable for your product and user experience

Integrate with our application via API or leverage our no-code hosted pages to fully customize your signup pages quickly and easily.

Collections, payments, and revenue management

Make your billing more flexible by selecting the best payment methods for each product and component as needed.

Automatic

Collect on invoices automatically from a payment method on file when an invoice is issued.

Remittance

Allow customers to remit payment on invoices in the form of credit card, check, or bank draft.

Prepaid

Collect an initial prepayment to fund a usage-based service; suspend services or auto-replenish once the balance reaches $0.

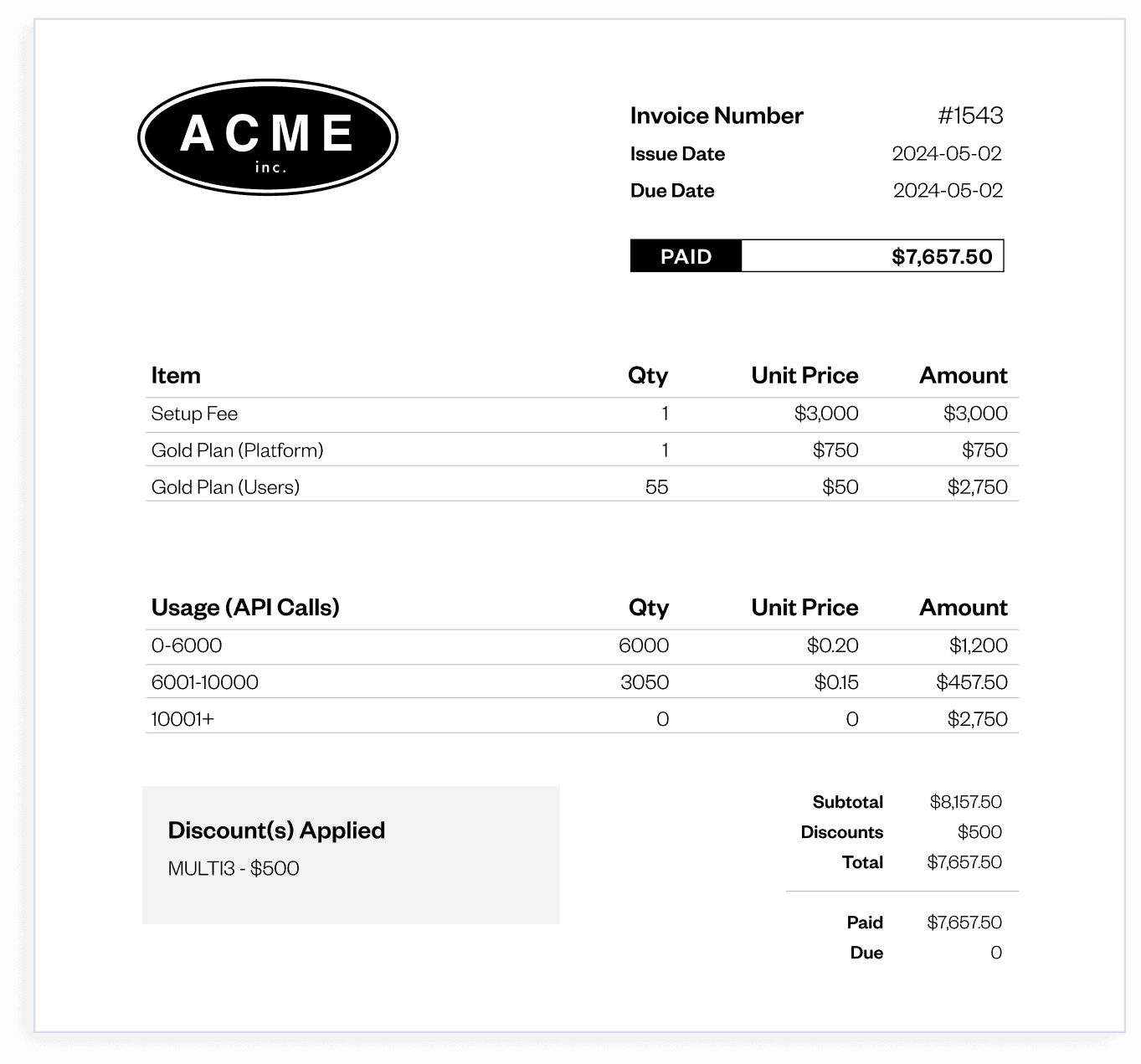

Invoice management at scale

Generate invoices for thousands of customers, and charge accurately and on time with the click of a button.

Toggle Maxio’s built-in invoice fields, or create your own custom fields, to include as much detail as necessary for your clients.

Invoices can be automatically created:

- On subscription signup

- At subscription renewal

- For prorated upgrades

- For ad hoc charges

If you choose not to automate invoice sends, you can still save time by selecting and sending multiple invoices at one time.

Maxio helps you keep track of each invoice’s status, so you can quickly see what’s been paid and what hasn’t.

If a customer has a credit balance at the time of subscription renewal, the available balance will automatically apply to their renewal invoice.

Stop losing revenue from late payments

Recover past due payments and retain customers with automated dunning capabilities.

Flexible dunning rules

Set your dinning cadence at the global level, or choose specific rules for products individually, such as issuing retries to automatic payments and a past due notice to remittance payments.

Account status

Customer accounts can remain active while payment remains past due, or you can choose to restrict access once the dunning process resolves with no payment received.

Frequency

Customize dunning notification timing, frequency, and the content of communications in dunning and retries settings.

Maxio Payments

Bring your payments in-house for a complete and automated workflow from invoice to deposit.

Maxio Payments minimizes risk and bridges the gap in your payments workflow, giving you a complete solution for payment processing, automated reconciliations, and reporting on the details of how customers pay.

With Maxio Payments, you get:

- Automated bank reconciliations, batch reporting, and journal entries

- Integrated payment and deposit syncs with your general ledger

- A seamless user experience

Reduce your developer’s workload

The Maxio Advanced Billing solution can be integrated with many environments and programming languages via our REST API, and some of our users have even contributed their API wrappers in various programming languages. Check out the API Code Overview for an introduction to the wrappers and available code samples.

Once onboarding is complete, your team can create and manage new pricing models, design billing portals, and launch self-service signup pages—no devs required.

Keep your customers secure

A winning combination of enterprise-grade security protects your customers, and proven reliability to keep your recurring subscription billing processes running smoothly.

- SOC 1 & SOC 2 Compliant

- ISO 27001

- GDPR Ready

- PCI-DSS Level 1

- 99.9% Uptime

Subscription Billing Software FAQs

Subscription billing software allows businesses to manage their subscription-based business models with automatic invoicing, recurring payment processing, late payment notifications, revenue recognition and management, and more.

By integrating subscription billing software into their operations, SaaS businesses can enhance their revenue management, reduce administrative overhead, and provide a smoother, more reliable billing experience for their customers.

Recurring billing software and subscription billing software both automate the process of charging customers at regular intervals, but they cater to different business needs. Recurring billing software is designed for any type of business that needs to charge customers periodically (e.g., monthly utility bills), focusing on the automation of repeat payments for ongoing services or products.

On the other hand, subscription billing platforms are specifically tailored for businesses, often in the SaaS realm, that utilize a subscription-based business model. These platforms are able to support various subscription models and pricing plans, manage customer subscriptions, handle upgrades, downgrades, and cancellations, and often integrate with other business tools. While both systems ensure timely payments, subscription billing platforms offer more functionalities to manage the complexities of subscription-based models, including customer lifecycle, subscription metrics, and tailored pricing strategies.

Maxio’s subscription billing software offers unmatched visibility into the financial operations of your SaaS company.

More than 600 reviewers on G2 call Maxio a “very powerful product,” a “great tool for our finance department,” and an “integral part of our business.” If you’re looking to streamline subscription management, it’s worth scheduling a demo for a personalized walkthrough of the tools Maxio provides.

Our subscription billing software addresses failed payments through a comprehensive revenue management platform that can implement several revenue management strategies, such as sending automated notifications to customers about payment issues, and working with major payment gateways like Stripe, PayPal, Braintree, and more to facilitate retries. This proactive approach ensures businesses maintain a steady cash flow while keeping customer relationships intact, offering multiple pathways to resolve payment failures and keep subscriptions active.

Create and manage a winning pricing strategy

Get a customized product demo to see how Maxio can help you streamline your subscription billing operations—no matter how complex they are.

“It’s truly made for B2B SaaS, and I recommend Maxio to everyone I know starting a SaaS company. Build out your billing system right the first time, so you don’t have to change it later!”

– Bethany Stachenfeld, Co-founder and CEO of Sendspark

Get a demo

Explore the #1 finance & billing platform for B2B SaaS

Subscription management

Streamline every step of your customer’s lifecycle, from onboarding to renewal and beyond

Revenue recognition

Help your finance team sleep at night with revenue recognition built for the complexity of B2B SaaS.

Reporting and SaaS metrics

Never lose sight of your business performance with accurate, reportable SaaS metrics.