For a growing SaaS company, spreadsheets should be a complementary tool to financial operations, viewed as neither a system nor a system of record for business rules.

You can run your SaaS financial operations with spreadsheets, and many do. Spreadsheets are almost free, which makes them the go-to option for startups. But as you grow, those spreadsheets become unwieldy, subjecting your business to serious risk.

Why are Spreadsheets the Default in Financial Operations?

SaaS companies use business rules spreadsheets for order management, contract management, revenue recognition, invoice tracking, renewal management, analytics/metrics, and general reporting. For these businesses, little or nothing happens in the finance function that is not accounted for by a spreadsheet.

Spreadsheets frequently end up at the heart of SaaS company’s financial operations because most finance systems which address all of a SaaS business’s needs are expensive. They’re out of reach for early and emerging stage SaaS businesses, so spreadsheets are the fill-the-gap solution.

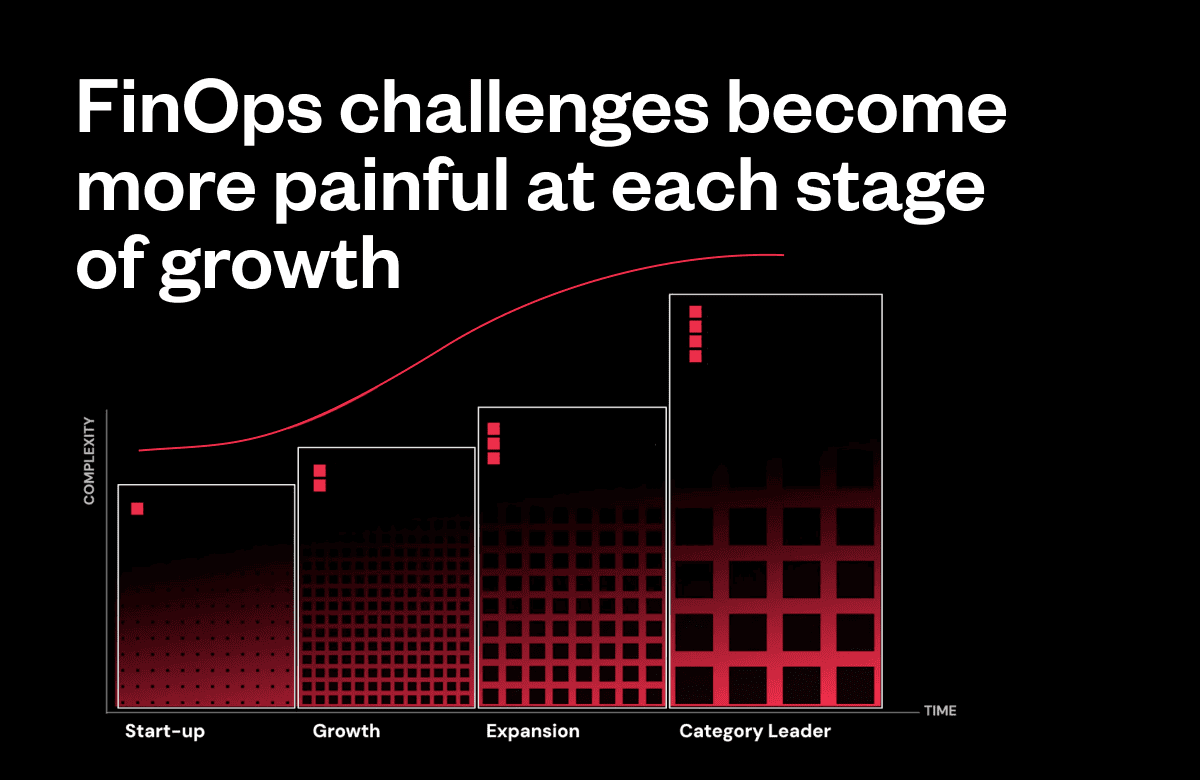

But as your company grows, your beloved spreadsheets eventually become like a pair of shoes that are a size too small. They keep you moving, but more pain and decreased momentum.

Eventually, the spreadsheet must be ditched or your entire business will suffer.

The Problems Spreadsheets Cause Growing SaaS Businesses

There are two main issues inherent to running your financial operations off spreadsheets.

First, spreadsheets have no data integrity

Spreadsheets are the wild west of financial management. They’re great for calculations, but the lack of consistent business rules makes spreadsheets terrible for managing recurring revenue data.

I know what you are thinking. Formulas to the rescue! Using Excel to create some data rules certainly helps, but what happens when a team member edits a cell incorrectly? Your carefully-written formulas are blasted into dust. (You may not even realize this until weeks later when someone starts investigating numbers that don’t make sense.)

New solution: add conditional formatting to change the colors of cells that meet error conditions. Not a bad thought, but that can lead to a nearly unreadable spreadsheet. Data integrity issues make it difficult to trust your numbers leading to decisions based on bad data or inconsistently defined metrics. Human error is always a risk when working in spreadsheets—and an incredibly likely one at that.

What if your sales rep gets pulled into a meeting and forgets to mention a new client’s $100 discount? You can adjust and re-send an invoice, no big deal. But you’re busy too. What if you quickly move on to fight other fires and forget to update the spreadsheet? Now your revenues, bookings, and subscription metrics are all wrong. But this is just the tip of the iceberg. And once your customers start doing mid-term upgrades, downgrades, extensions, or early terminations?

Good luck.

Second, spreadsheets cause massive inefficiencies

Over time, your business rules spreadsheet gets more bloated and fragile, yet it continues to be the backbone of your company’s financial operations. Despite its size and complexity, it’s edited frequently. And because your company is growing, many other people are now working in it too. This forces you to use a clunky and inefficient system of file sharing and/or constant back-and-forth communication to ensure you and your colleagues aren’t harming each other’s work.

Sometimes businesses try to work around this by splitting their monolithic business rules spreadsheets into multiple files. This trades one problem for another; now you have multiple files that are bad at managing data and therefore multiple points of possible failure.

Before long, the spreadsheet sucks up your limited time and becomes a burden for anyone who tries to make sense of it. The problems caused by the spreadsheet begin to accelerate and multiply. You now have a bottleneck in the middle of your financial operations that causes inefficiency and overhead for your staff.

These bottlenecks cause most financial teams to eventually designate one person to mind the business rules spreadsheet. However, if that person quits (or even goes on vacation), you could have a serious problem. The vast majority of your financial intelligence is encapsulated in one file, and the person who understands it has the potential to become periodically or permanently unavailable. Couple this with an impending audit or road show to raise money, and you’ve got a mad scramble on your hands.

How to Break the Cycle: Bad Data and Inefficient Processes

If all you needed were calculations, then spreadsheets would be great. However data management and consistent definitions for reporting and metric calculations are just as (if not more) important than the calculations themselves.

And, despite our obvious distaste for relying on manual processes for financial operations, the fact remains that sometimes you’re just stuck with it.

If your business is unable to move away from spreadsheets, aligning on business rules is essential. Every member of your finance team should be on the same page when it comes to:

- Spreadsheet hygiene (number formats, tabs, named variables, colors, numbering schemes, unique identifiers, etc.)

- Definitions of metrics (MRR, churn, renewals, Customer Lifetime Value, Bookings, etc.)

- How to share files to protect each other’s hard work (e.g. file naming conventions, division of labor, etc.)

- A documented process to QA the spreadsheet as part of your monthly close (e.g. every time we close the month, we are going to check x, y, z for accuracy)

These steps are tedious, but they’ll dramatically reduce your risk of finding a two-month-old problem, trying to reconstruct what happened, and adjusting your revenues and metrics accordingly. And they’re certainly far less painful than finding out you forgot to invoice a $50K renewal.

If your business is ready to jump off the spreadsheet wheel, invest in a financial operations solution which can handle all of this tedious work for you.

Financial operations software like Maxio will provide your team with robust data tracking and guidance to operate efficiently and accurately. No need to worry about data inaccuracies—the system takes care of that for you.

And that’s just the tip of the iceberg. A dedicated FinOps tool like Maxio helps busy finance teams:

- Automate the A/R management process

- Automate revenue recognition and set schedules

- Access SaaS metrics based on the same data set as your financials

- Recognize and account for expenses like sales commissions and fixed assets

- Sleep better at night

When you compare a spreadsheet to a tool designed specifically for B2B FinOps teams, taking the leap is a no brainer.

Learn more about how Maxio can save your team from the spreadsheet cycle by visiting our website, or speaking with a representative today.