The Cost of Disconnected Finance Systems

Finance and accounting teams often find themselves navigating a month-end close process slowed by fragmented systems, manual work, and data that never fully aligns. Billing data lives in one platform, the general ledger in another, customer activity flows through CRM tools, and spreadsheets attempt to bridge the gaps. As businesses scale, these disconnections become more noticeable and more costly.

Teams spend hours on reconciliations, resolving discrepancies, and searching for the source of errors that stem from the systems themselves, not the work being done. Slowdowns, blind spots, and reactive analysis become the norm. Many organizations end up expanding finance headcount simply to compensate for inefficient workflows, yet the underlying problems persist.

At the same time, AI-driven automation is reshaping the expectations placed on the finance function. Intelligent tools depend on clean, connected, real-time data. When systems fail to communicate, AI cannot automate processes effectively or produce meaningful insights. Modern finance teams need a unified environment where data moves freely and accurately, enabling both automation and deeper analysis.

The partnership between Maxio and Rillet was built to support this shift.

A Partnership Built to Close the Gap

The connection between Maxio and Rillet was shaped by the evolving expectations of modern finance leaders and the growing need for tools that operate cohesively. As finance stacks become more interconnected, organizations increasingly look for platforms that complement each other and fit naturally into an ecosystem rather than functioning as standalone solutions.

Both teams recognized a common pattern: organizations wanted the flexibility to pair best-in-class billing with a modern ERP that could support automation, advanced workflows, and AI-driven insights. They also needed seamless data movement across systems without compromising accuracy or introducing manual steps.

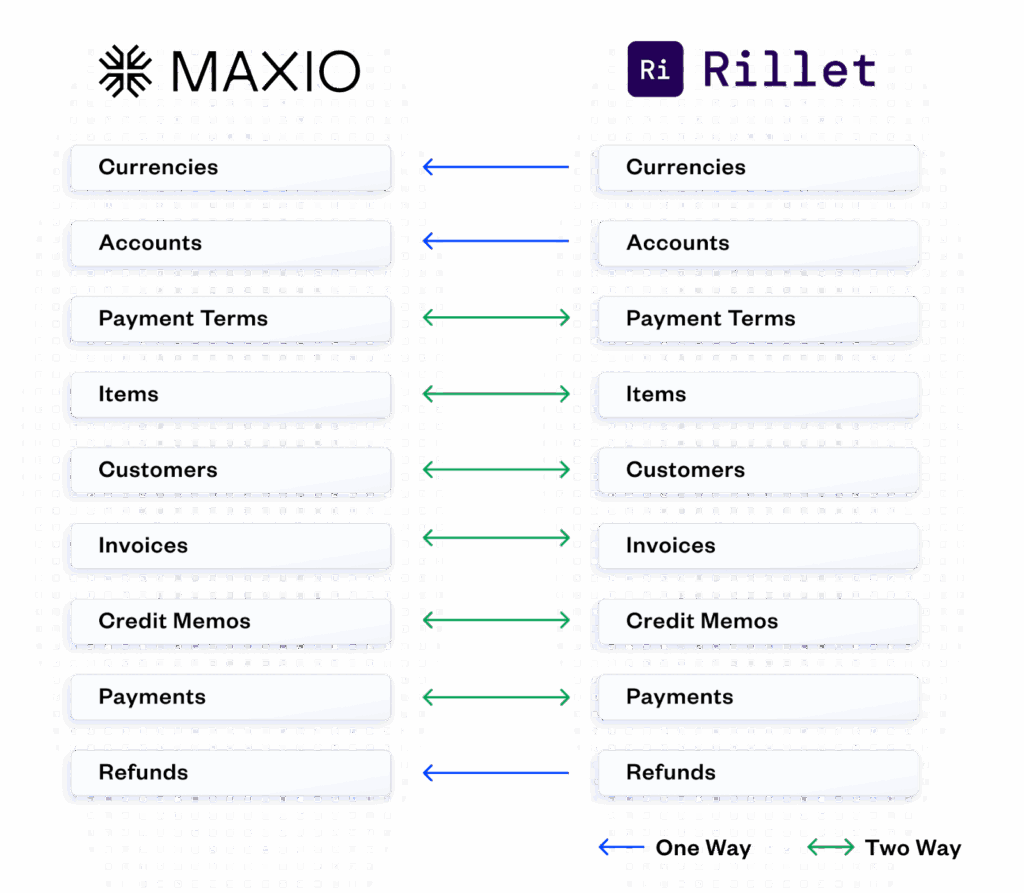

This integration reflects that shared vision. Maxio provides deep capabilities in billing, revenue, invoicing, and subscription operations, while Rillet offers a modern, AI-enabled ERP foundation built for multi-entity accounting, robust controls, and intelligent automation. Together, the two systems form a connected financial source of truth designed for speed, accuracy, and scalability.

The partnership also supports the way teams actually work. Some users spend most of their time in billing workflows, others in general ledger activities, others in reporting or CRM systems. By ensuring that information remains consistent across platforms, the integration allows each team member to work confidently in the system that fits their role.

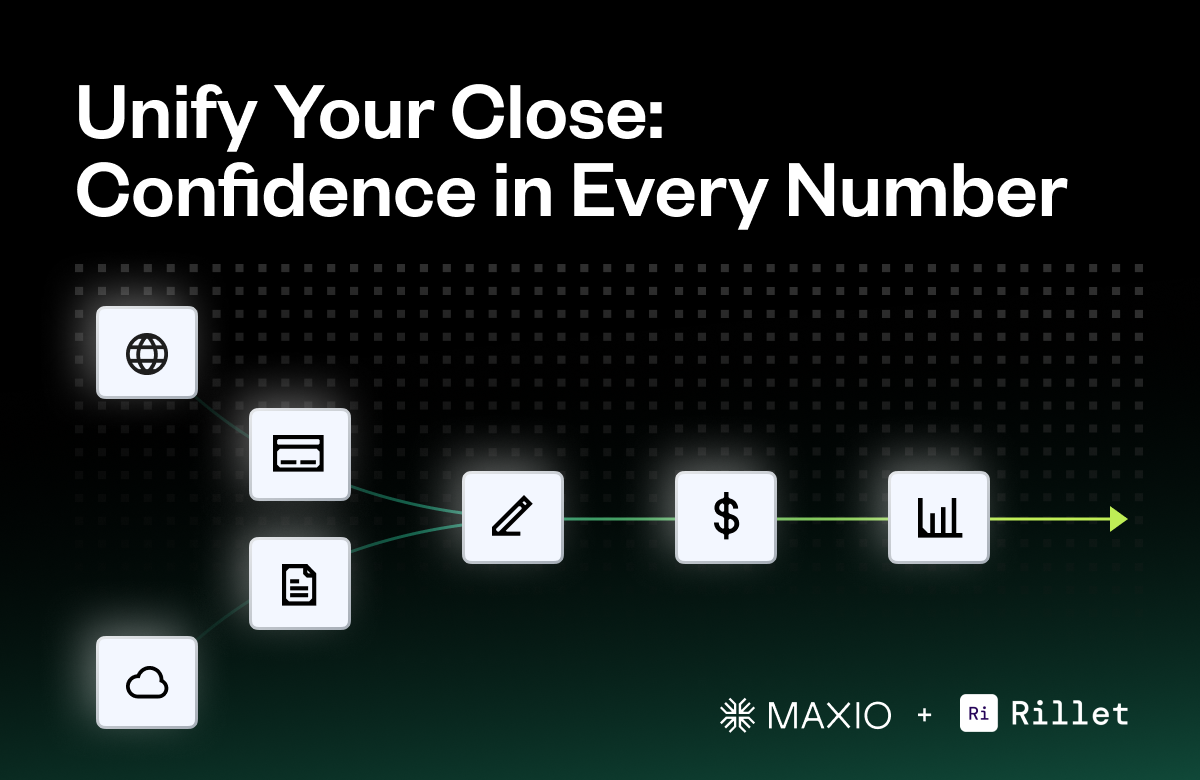

Disconnected systems create reconciliation headaches. The Maxio + Rillet integration unifies data into a single source of truth.

See It in Action: The Unified Close Workflow

The Maxio + Rillet integration brings together two powerful systems to support a faster, more predictable month-end close. By automating data movement and maintaining accuracy across platforms, finance teams gain a clearer, more up-to-date picture of their financial position.

1. Speed that shortens the close.

Maxio supports a faster close by automating the syncing of core operational data. Customers, Invoices, Payments, and Items into Rillet. For month-end journal entries, teams can run the ARS report in Maxio to gather the required entries and enter them directly. This approach reduces manual touchpoints, lowers the risk of missed or delayed entries, and provides a more reliable path off entry-level accounting systems.

2. Accuracy you can trust.

Revenue schedules, payments, invoices, and contract details remain aligned across systems without extra work. Because the integration maintains data consistency in real time, teams can rely on the numbers presented in both platforms without performing additional checks.

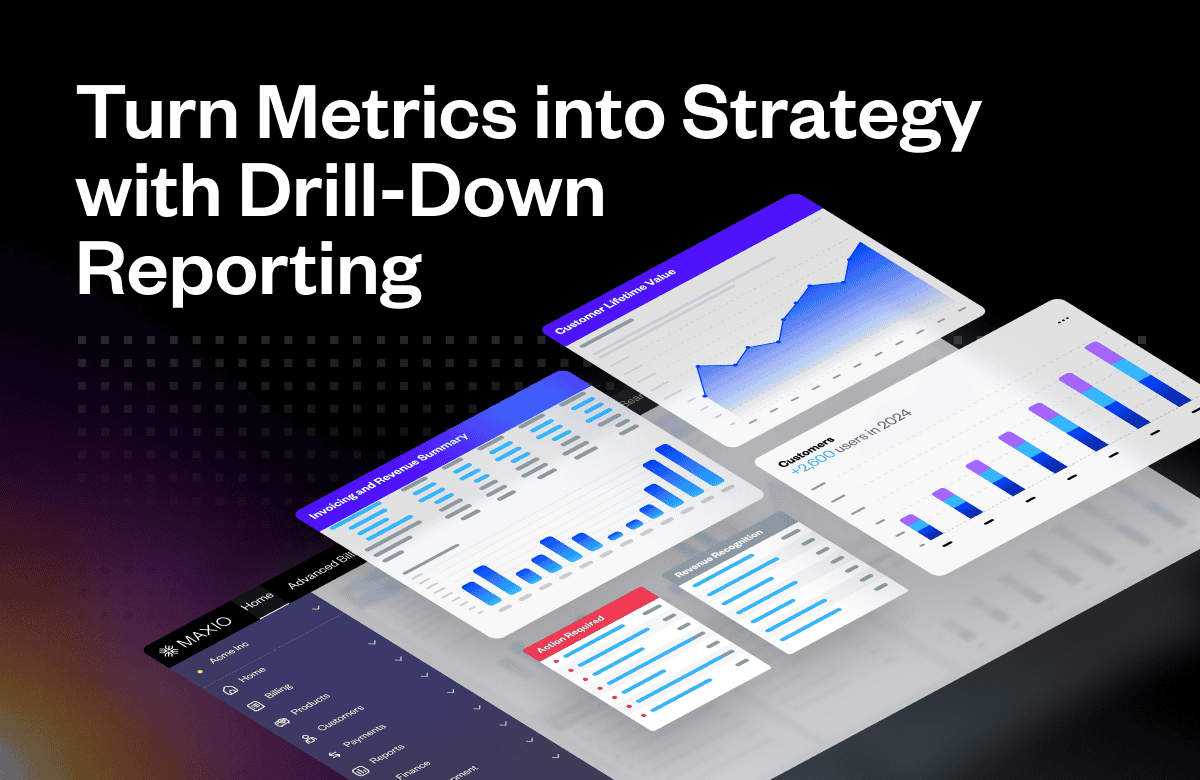

3. Visibility that drives better decisions.

Users can access the same up-to-date financial information whether they are reviewing activity in Maxio or in Rillet. This approach supports natural workflows and ensures that finance and revenue teams can make timely, informed decisions without waiting for manual updates.

4. Scalability built for growth.

The integration supports expanding financial operations, including multi-entity structures, multicurrency environments, approval workflows, and advanced reporting needs. Both platforms continue to evolve rapidly, and their shared commitment to scalability ensures that growing businesses can stay ahead of complexity without replacing core systems.

Altogether, these capabilities create a unified workflow that reduces manual intervention, improves data clarity, and supports healthier, more confident financial operations.

The Outcome: Confidence in Every Close

A clean, consistent flow of financial data unlocks significant advantages for finance teams. With Maxio and Rillet connected, organizations can close faster, identify issues earlier, and dedicate more time to interpreting results rather than assembling them.

This unified approach delivers:

- Greater trust in financial data through consistency across systems.

- Faster access to insights driven by real-time synchronization.

- Higher team productivity due to reduced manual work and fewer process bottlenecks.

- Scalability for the future as each platform continues to expand capabilities and deepen integrations.

Many organizations have already demonstrated that operating with a leaner finance team is possible when systems are aligned and automation can do its job effectively. The Maxio + Rillet integration strengthens that foundation.

Experience the Unified Close

The financial technology landscape is shifting quickly as automation and AI become more deeply embedded in how teams operate. Organizations that connect their systems and unify their data will move faster, maintain stronger accuracy, and make better decisions.

The Maxio + Rillet integration brings this modern financial workflow to life.

If you are ready to simplify your close process and unify your financial operations, explore the integration firsthand.

Watch this on-demand webinar or request early access to see how a unified close transforms the way finance teams work.