Most finance teams have a firm grip on key metrics like MRR, ARR, CAC, LTV, and churn.

What’s harder is making those metrics reflect the business realities behind them.

- Can you isolate ARR by sales channel or region?

- Can you compare churn across usage-based and flat-rate plans?

- Can you separate your multi-year contracts from short-term pilots?

Without clean segmentations, those questions turn into late-night Slack threads paired with patched-together spreadsheets and a tall glass of rosé. Not because the team lacks technical ability, but because the infrastructure to support meaningful reporting doesn’t exist.

This isn’t about data availability. It’s about data usability.

In most SaaS orgs, customer and revenue data are scattered across tools that weren’t designed to work together:

CRM: Who sold the deal and key customer details

Billing: How much and how often

Accounting: What was recognized

Even when teams try to reconcile the gaps, inconsistent labeling kills the effort. One customer might be tagged as “direct” in HubSpot, “enterprise” in your GL, and “sales-led” in billing. Multiply that by a few dozen segments, and suddenly your cohort analysis becomes guesswork.

How Maxio Solves This

Maxio gives SaaS finance teams the segmentation they’ve been struggling to put together with spreadsheets.

You get the metrics you need like ARR, MRR, churn, and retention with filters that match how your business actually sells.

1. Structured Customer Data = Reporting That Makes Sense

In Maxio, every customer is a structured object. Not just an invoice or a row in QuickBooks.

Each customer can include:

- Customer metadata (sales motion, industry, customer tier, region)

- Product configuration (hardware + software, usage pricing, bundles)

- Contract details (start date, term length, billing cadence, renewal type)

- Revenue data (revenue schedules, deferred revenue, unbilled AR)

This structure powers every dashboard and export—without tags, lookups, or SQL.

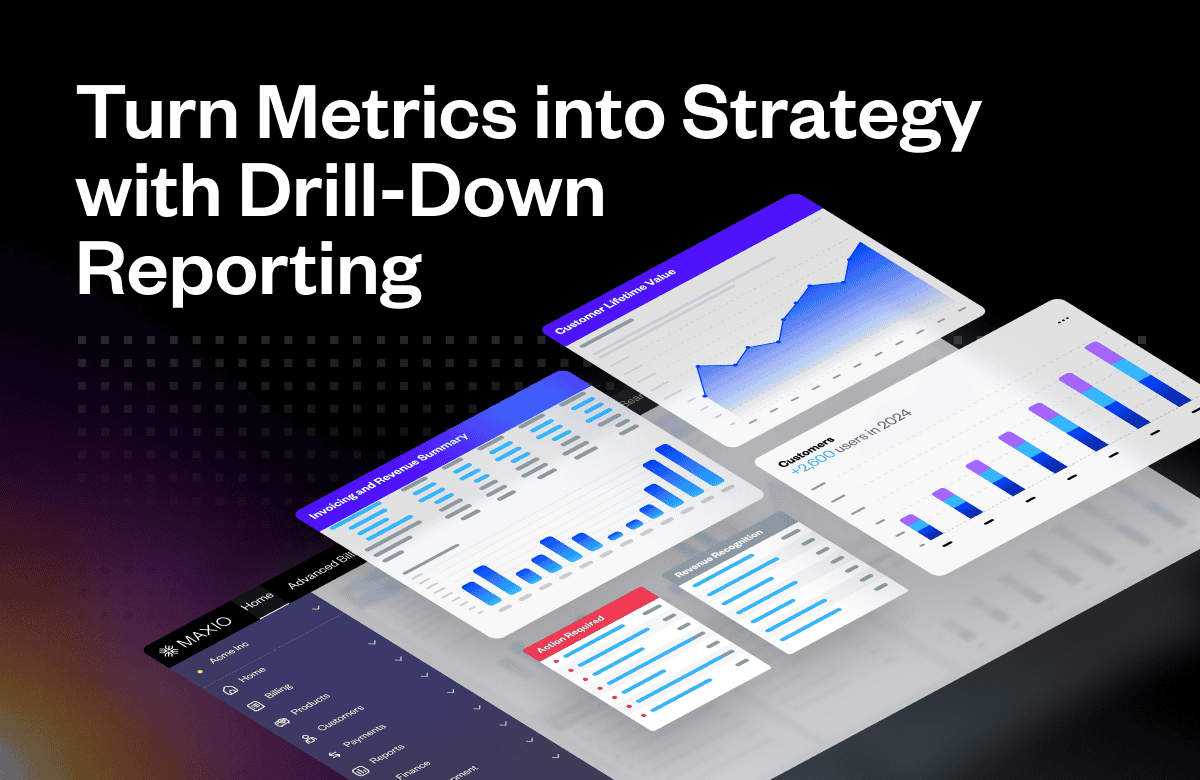

2. Real-Time SaaS Metrics, Segmented Your Way

Once customer data is in place, Maxio’s reporting engine takes over.

You can see metrics like:

- ARR and MRR by customer type, plan, or product

- Churn broken down by contract term or sales channel

- Retention trends across customer cohorts or industries

Want to track ARR from multi-year SaaS + hardware bundles sold via channel partners in the public sector?

Done.

How about understanding churn from usage-based plans sold via self-signup?

Insights in two clicks.

3. Segmentation That Stays in Sync

Custom segments are only as good as the data behind them. That’s why Maxio’s bi-directional CRM integrations matter.

Instead of relying on static tags or manually maintained spreadsheets, Maxio pulls firmographic and sales context like industry, region, sales rep, or deal source directly from your CRM. That data stays synced, so your reports reflect reality, not a stale export from three weeks ago.

You can build and save custom segments directly inside the reporting UI—no SQL required. Set it once, and it flows through your dashboards, SaaS metrics, and board-ready exports automatically.

When Metrics Start to Matter

Without segmentation, you’re stuck making directional guesses.

With Maxio, you get operational clarity.

- You know what products are working (and for whom).

- You see which segments are renewing and which need attention.

- You can finally align Finance, Sales, and Product around the same metrics.

When you’re ready to move past generic metrics and into revenue intelligence that matches how you sell, Maxio makes it possible.