Locking in the Lead: Strategic Positioning for 2025

Maxio’s latest B2B Growth Report reveals more than just trends—it’s a wake-up call for private SaaS companies to seize new opportunities in a rapidly shifting market. With interest rates fluctuating and customer-centric pricing gaining traction, this is a moment for bold action, not for sitting on the sidelines. Companies that act on these insights now—while also rethinking their pricing strategies and aligning with what customers truly value—will take the lead in 2025’s high-stakes funding environment. After all, insights are only valuable if they’re put to work—and for those who do, the rewards could be transformative.

The Ripple Effect of Fed Rate Cuts on Investment Opportunities

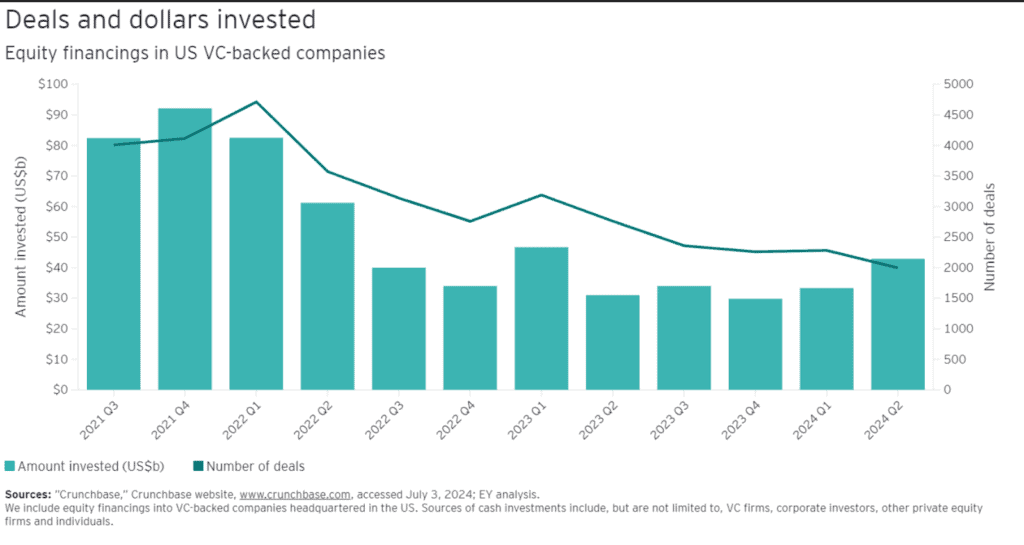

With the recent Fed rate cuts, private SaaS companies are facing a rare moment in the funding landscape—one that favors those ready to move quickly. The rate cuts will not only lower borrowing costs but also influence the broader investment landscape, affecting limited partners, venture capitalists, and SaaS operators alike. To that point, VCs are now concentrating on a select number of high-quality deals, presenting SaaS leaders to capitalize on this shift (see chart below). Those CEOs who can move the quickest will be the ones who capture the most benefit and can use this market arbitrage to create distance from slower-moving competitors.

Recommendations for SaaS Companies:

- Accelerate Growth Initiatives: With reduced borrowing costs, consider securing financing to invest in product development, market expansion, or strategic acquisitions. Obviously, you need to think about the short-term versus long-term tradeoff of these investments. But this proactive approach can position your company favorably in a competitive market.

Forbes - Strengthen Investor Relations: If you are VC-backed, you are probably going to be looking to raise money again—especially if you raised in 2020 before all the madness. Today, there is an ENORMOUS amount of capital on the sidelines and now is the time to get in front of those investors. For example, according to Carta, most venture funds deploy more of their capital in year 2 than in year 1. For the 2022 vintage, the average was 28% in year 1 and only 15% in year 2. The capital is building up. Now is the time to engage with current and re-engage potential investors to highlight your company’s resilience and growth strategy.

- Optimize Financial Management: Obviously, if you took money at a higher rate, you should evaluate what refinancing existing debt could do in terms of interest rates. The other quick action is to pay down your line of credit if you can to save those costs thereby improving cash flow and financial stability.

- Tuning Your Operations: Given the current interest environment, it’s essential to focus on the durability of the “Rule of 40,” demonstrating that a clear path to 40+ at scale is crucial for long-term growth. I also think it is just a very smart move to get profitable every once in a while to prove you can do it. Todd Gardner, one of the smartest SaaS Influencers I know, talks about this as the porpoise principle, which I expanded on in this article: Solving for EBITDA. By keeping a solid handle on your leading indicators and key metrics, you can confidently navigate toward this benchmark.

- Reassess Pricing Strategies: I’ve written about how companies pulled the two major levers during the B2B SaaS recession–reducing HC and increasing prices—as blunt instruments to minimize burn and/or to get profitable. Now is the time to align your pricing with new market conditions and customer expectations and willingness to pay. Maybe you gave some concessions to some customers who were hurting 2 years ago. If the market starts to heat back up because of the improving market conditions, you might have an opportunity to go back and say: “remember me?”

Paddle

By implementing these strategies, SaaS companies can navigate the current funding landscape effectively, leveraging the opportunities presented by the Fed’s rate cuts to drive growth and long-term success.

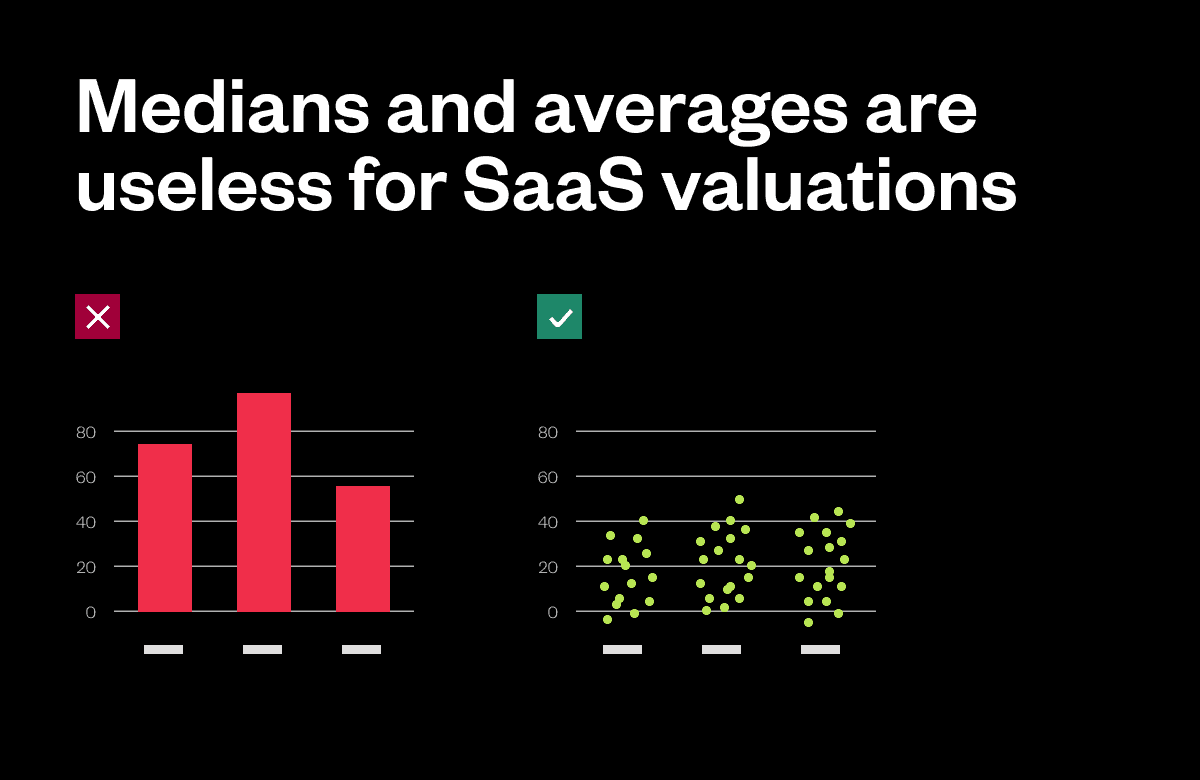

Leveraging Unique Private SaaS Data for Strategic Growth

With so much public market data out there, private SaaS companies often find themselves without a map to help chart the course. That’s where our Growth Report can be a game-changer. Unlike broad survey-based insights, our Growth Report aggregates anonymized billing data from our 2000+ customers to reveal real, actionable trends. For instance, smaller SaaS companies (those under $1 million in revenue) are growing at 23% this quarter—that’s nearly double the 12% growth rate of companies over $1 million. And here’s another insight: the growth gap between fixed-rate and usage-based pricing is narrowing fast, with usage-based strategies giving smaller companies a strong edge to attract customers and scale sustainably.

For SaaS leaders, this isn’t just about gathering benchmarks. It’s about making data-backed choices that line up with today’s growth landscape. The companies that will lead next year are the ones tuned in to these trends and ready to act—especially when it comes to pricing and growth strategy.

Embracing Usage-Based Pricing for Competitive Advantage

As the market shifts, more SaaS companies are moving to hybrid pricing models—a balance of fixed-rate stability and usage-based flexibility. It’s a way to better align your monetization strategy with customer perception of value. This kind of model is especially valuable for AI and other tech-driven companies, where balancing upfront costs with long-term value is critical. Imagine a company that charges a basic rate for platform access, with an added usage fee for premium features.

To that point, I recently attended a seminar hosted by Ibbaka that got me thinking about how companies can evolve their pricing models—especially those working with AI. They divided the AI landscape into user-based, AI cost-based, and domain-based pricing models. What struck me was how this breakdown reflects the broader complexity we’re seeing in AI pricing today. Based on a survey that Ibbaka analysts conducted, 27% of companies are sticking with the familiar user-based models, while 36% are shifting to AI cost-based, which is more like a utility model—think paying for water, something people inherently understand. However, the most interesting piece was the 37% of companies exploring domain-based pricing. This model is all about the value created within a specific domain, and the challenge lies in articulating and capturing that value effectively. As Stephen Forth at Ibbaka wrote in a recent article:

One of the most interesting recent developments is how OpenAI is pricing the first two models of its reasoning model o1. They have added a new metric, Reasoning Tokens. It is pricing these at the same price as Output Tokens. Output tokens are priced at 4X input tokens, and how many reasoning tokens will be generated in a typical process needs to be clarified. Putting all this together, higher prices, higher differential between Input and Output tokens (from 3X to 4X), a new type of token that is basically hidden but gets priced as an output token … it seems that o1 is priced anywhere from 5X to 8X higher than earlier models—quite a difference.

Embracing a hybrid model enables SaaS companies to deliver real value for customers and lay the foundation for sustainable growth.

Seizing 2025: Transforming Headwinds into SaaS Momentum

I am working on a book about the 8 Secrets of Success for SaaS CEOs. One of these is “managing/allocating capital for the short and long term.” This means that most CEOs, and their CFO partners, are always monitoring Market Trends and investor sentiment. Understanding the evolving landscape will enable you to make informed decisions and adapt strategies accordingly. We are in one of those market inflection points that afford the bold a unique opportunity to get ahead. We encourage you to download the full B2B Growth Report. It’s packed with insights to help you stay one step ahead. History shows that those ready to adapt to rate changes, leverage strategic data, and explore fresh approaches to pricing are set to thrive in the coming year.