Retention is king in SaaS, for both operators and lenders.

While all retention is good, not all retention is equal. And the ratio between gross revenue retention and net revenue retention contains useful diagnostic information.

We call this “The Gap.”

While the math here is simple, The Gap is a rarely discussed metric that provides helpful insights into the continuing health of your SaaS companies and customers.

While it’s not often discussed, the GRR-NRR gap can be a useful “sanity check” on a SaaS company’s metrics, and when it falls outside of the usual range, it can give a hint to operators and investors that something in a company might need tweaking.

In this webinar conducted by Chris Weber, COO at Maxio and Randall Lucas, Managing Director at SaaS Capital, we discussed:

- Retention benchmarks from this year’s annual SaaS Capital survey

- Common ranges for The GRR-NRR Gap

- What a narrow GRR-NRR Gap means (and ways to improve)

- What a wide GRR-NRR Gap means (and ways to improve)

In this article, we’ll go over the highlights from the webinar and help you understand how to benchmark retention in your own SaaS business.

Retention benchmarks from the SaaS Capital survey

Each year, SaaS Capital conducts an extensive annual survey of over 1,500 SaaS companies to gather anonymized operational and financial metrics. When it comes to retention, this year’s survey revealed several trends in the gross revenue retention (GRR) to net revenue retention (NRR) gap.

- There is a consistent gap: Across the survey sample, NRR exceeded GRR in almost every revenue range, including average ARRs and ACVs.

- The gap widens with contract value: The data showed that as average annual contract values increase, the GRR-NRR gap also grows wider. Lucas noted, “As the annual contract value increases, this gap tends to grow alongside it.”

- The gap normalizes above $1M ARR: When segmented by company revenue size, the gap stabilizes around 12% on average for firms above $1M in ARR. For smaller or younger firms, the gap is more variable above the $1M ARR mark.

- Most fall within 8-20%: While the survey saw GRR-NRR gaps ranging from 0% to over 50%, a clear majority of respondents reported a gap between 8% and 20%.

This extensive benchmark data from SaaS Capital reveals a consistent gap between GRR and NRR in SaaS businesses. But how does “The Gap” affect your business, exactly? In this next section, we’ll go over the most common GRR-NRR gap ranges and what they reveal about your business.

Download the 2023 SaaS Benchmarking Report

Common GRR-NRR gap ranges

While the gap can vary widely, SaaS Capital’s data found these to be the most common ranges:

- 0-5%: A narrow gap is abnormal and may indicate missed expansion opportunities

- 8-20%: This is the normal range for most established SaaS companies

- Above 20%: An unusually wide gap, which could mean major expansion success or volatility from customer concentration

What a narrow gap means

A 0-5% GRR-NRR gap is a “yellow flag,” according to Lucas. It likely means the business model lacks upsell opportunities and expansion potential. As he explained, “This means you’re not growing your MRR per customer, which means you’re probably missing expansion opportunities within your customer base.”

To widen a narrow gap, SaaS businesses can:

- Add usage-based pricing models

- Introduce new products/modules

- Revamp packaging and pricing

Lucas pointed out that a narrow gap means “there may not be that much growth within the customer’s usage.” So, in addition to adding expansion opportunities, it’s important to ensure your customers are satisfied with your service and able to grow usage with you over time.

What a wide gap means

A gap exceeding 20% is generally positive, signaling major expansion success. But as Weber noted, it’s still ambiguous: “I think what was really interesting about the benchmarking data was that it revealed that a company’s price point or ACV as it was defined, seemed like it produced a larger gap regardless of the overall company size.”

A wide gap could mean:

- Strong upsell and customer expansion success

- Usage-based pricing is working well

- Potentially high initial contract values

Lucas recommended investigating further: “While a wide GRR-NRR gap is generally a healthy sign, it is also advised to take a peek at and consider just exactly why that’s the case.”

In other words, even if your company is experiencing healthy retention, you need to investigate the underlying reasons behind that retention or expansion. This way, you double down on what’s working in your business and avoid any unnecessary churn across your customer base.

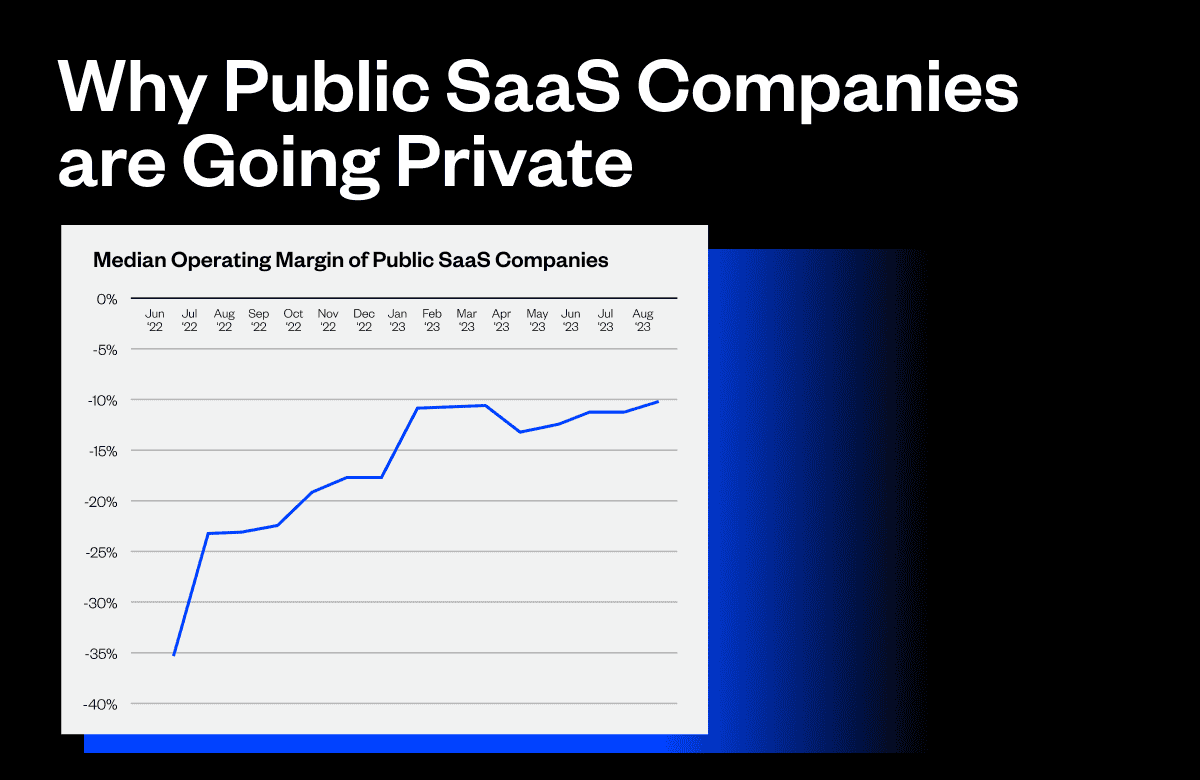

How lenders assess retention when funding SaaS companies

Now, before we dive into how you can improve your GRR-NRR gap, we need to understand how lenders are scrutinizing your retention metrics. As previously stated, if you have a wider GRR-NRR gap, then you’re likely experiencing success across your retention and customer expansion efforts. However, the health of your customer base is important to potential lenders (like Randall Lucas at SaaS Capital) for entirely different reasons.

For B2B SaaS companies seeking growth capital, customer retention takes center stage in the lender evaluation process. Retention metrics provide critical signals used to assess credit risk, set valuation multiples, and determine funding eligibility.

As Randall Lucas of SaaS Capital explained, their lending is based almost entirely on recurring subscription revenue. According to Randall, “At SaaS Capital, we are lenders to growing private B2B SaaS companies. We lend from 2 to 15 million to such companies, and our only real collateral is the recurring revenue.”

Essentially, the quality of a company’s retention is valued like an asset appraisal due to reliance on recurring revenue streams. Lucas emphasized, “The same way a banker writing a mortgage will appraise a house, we appraise the retention quality of a company’s recurring revenue. So we spend a lot of time, and we care quite a bit about this.”

Both gross revenue retention and net revenue retention provide important signals. Low gross retention suggests higher customer churn risk, decreasing the durability of the revenue stream, while net retention shows the ability to expand wallet share over time.

As Lucas explained, lenders like SaaS Capital analyze the interplay between these SaaS metrics rather than taking them in isolation. He advised, “Looking at one alone, in isolation. Even if you’ve picked that as your most important KPI, it’s gonna be incomplete.”

In other words, the relationship between gross and net retention reveals risks that may not be noticeable if you were observing one metric by itself. For example, high net retention could mask excessive churn, while declining gross retention severely impedes expansion efforts.

At this point, you may be wondering, “Great… but how does this affect my funding eligibility?”

Well, according to Randall, lenders combine retention analysis along with other factors to set their interest rates and valuation multiples. For asset-based lenders, stronger retention supports higher leverage and loan amounts. And for equity investors, a company’s retention health feeds directly into their applied revenue multiples.

Ultimately, all this really means is if you’re seeking growth funding, you should demonstrate a commitment to monitoring, reporting on, and improving retention before engaging with capital partners. Developing cohort analyses and measuring retention trends over time can also add credibility when presenting metrics to potential lenders and investors.

Did we mention that all of this is possible within Maxio? Yep—just take a look at our SaaS metrics and reporting capabilities.

How to improve your GRR-NRR gap

Now that we’ve gone over how lenders think about retention, what specific steps can you take to optimize your GRR-NRR gap? Here are some practical tips that Chris and Randall recommend to improve retention in your company:

1. Trend your retention metrics over time

To start, you should be looking at your retention metrics for longer than one month or quarter at a time. Regularly calculate your GRR-NRR gap and analyze the trends over longer periods of time. Watching for positive or negative movement in the gap over the years will provide better insights than any single data point.

2. Segment your data by cohort

Do a granular analysis of the GRR-NRR gap trends by customer cohort. Look at the gap for customers acquired each quarter or year to identify any issues within specific segments. For example, you may find newer customers have much better expansion behavior and gaps than legacy customers. This could point to potential churn risks from your legacy customer base.

3. Consider adjusted NRR

As Weber suggested, you should calculate an adjusted NRR metric that adds back revenue lost from cancellations or downsells. Compare your current NRR to this adjusted NRR to quantify how much net expansion potential exists. A large difference indicates significant room for improvement in retaining and expanding your overall revenue per customer.

4. Add upsell opportunities

If you have a chronically narrow gap, actively introduce opportunities like usage-based pricing, additional products or modules, and packaging changes to facilitate expansion. However, don’t just focus on adding offerings—ensure they provide value and fill customer needs based on feedback.

5. Ensure customer satisfaction

Improving the gap long term requires keeping customers happy and naturally increasing their usage and spend. To do so, you can tap on your customer success team to survey users, run NPS studies, and research customer needs to identify areas of dissatisfaction you must address first before layering on upsells.

6. Investigate any wide GRR-NRR gaps

While a wide NRR-GRR gap is generally positive, you should analyze the source if it exceeds 20% by a large margin. An unusually wide gap could signal volatility risks if driven primarily by just a few large enterprise customers. The last thing you want is to have the rug pulled out from underneath you because a few outlier customers decided to cancel their renewals at the end of the year.

Key takeaways for SaaS leaders and operators

No matter where your GRR-NRR gap falls, the key is to trend it over time and watch out for any outstanding positive or negative movements. As Weber advised, you should layer in a cohort analysis to back up your interpretation of the metrics.

He also suggested an “adjusted NRR” metric that adds back lost revenue, revealing maximum expansion potential. Comparing your current NRR to your adjusted NRR will show you how much room for improvement exists within your retention and expansion efforts. And while GRR and NRR alone provide limited perspectives, together, they paint a more complete picture of the health of your customer base.

Ultimately, analyzing your GRR-NRR gap over time, segmented by cohort, can unlock insights into your SaaS business’s health and opportunities that you would have missed otherwise—but you need the right metrics and reporting tools to make this possible.

By leveraging a purpose-built SaaS reporting solution like Maxio, you’ll be equipped with the flexibility and tools to diagnose your GRR-NRR gap properly. You can watch the original webinar or take a tour of our platform to learn more about how thousands of other B2B SaaS leaders are improving their retention with our SaaS metrics and reporting tools.