CFOs often approach us with the same problem…

“I don’t trust our reporting, and it takes too long produce”

Reconciling data takes too long, spreadsheet errors creates distrust, and we don’t have a standardized way to report key metrics to investors. Whether you’re raising funding or preparing for board meetings, producing trustworthy data is essential. See why CFOs trust Maxio as their source of truth for all things SaaS reporting.

The problem?

Operating out of disconnected systems leading to inefficient processes.

Before Maxio

- Reconciling data from disconnected systems

- Long month-end closes from inefficient processes

- Difficult or failed audits

With Maxio

- One-click investor-grade metrics & financial reporting

- More efficient month-end closes

- Audit-ready revenue reporting and audit trails

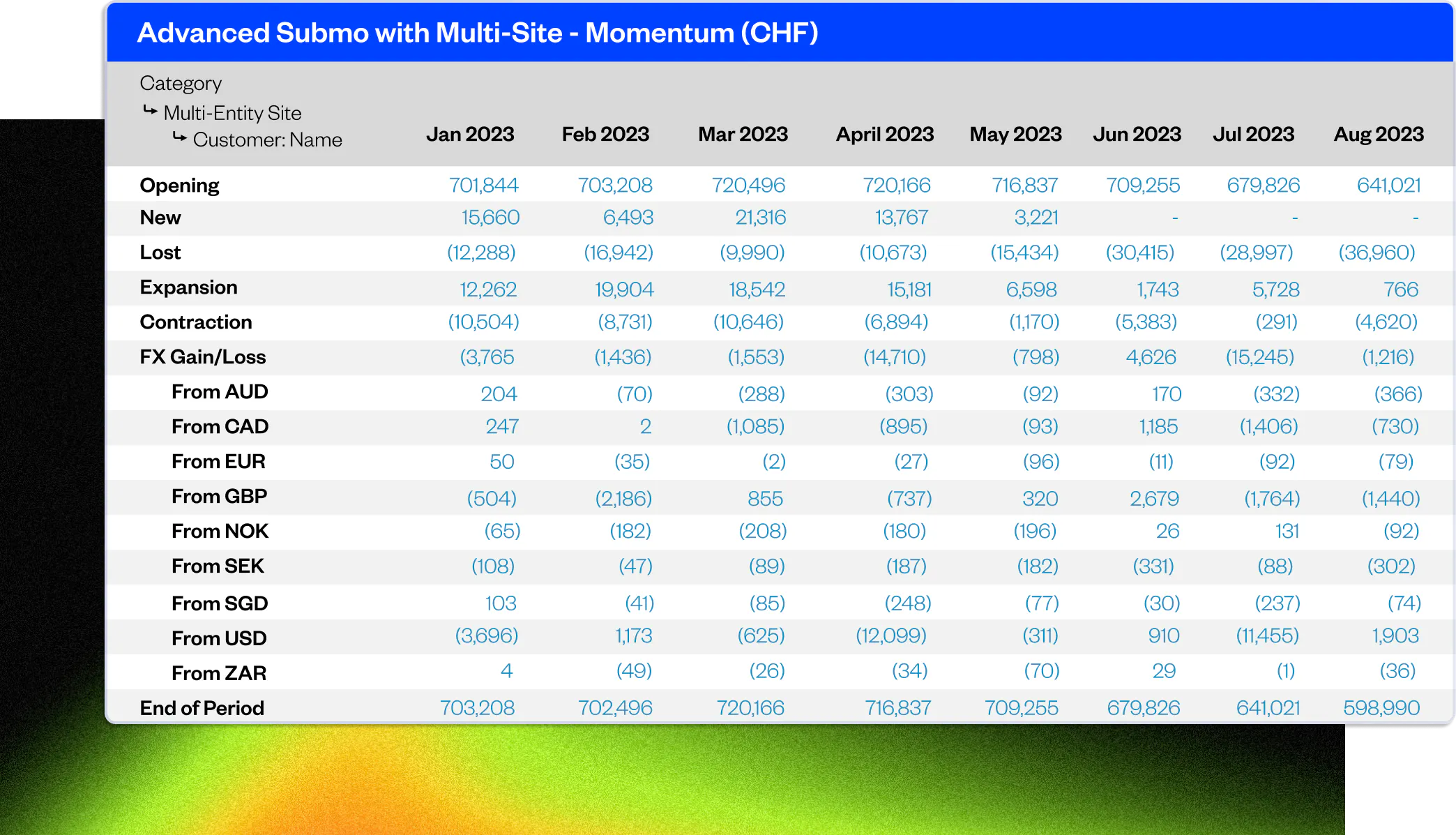

Earn and keep your investors’ trust with investor-grade SaaS metrics

One-click investor-grade SaaS metrics

- Generate key SaaS metrics like ARR, MRR, churn, LTV, and more.

- Understand what is driving your business with drillable reporting.

- Segment reports with customer data.

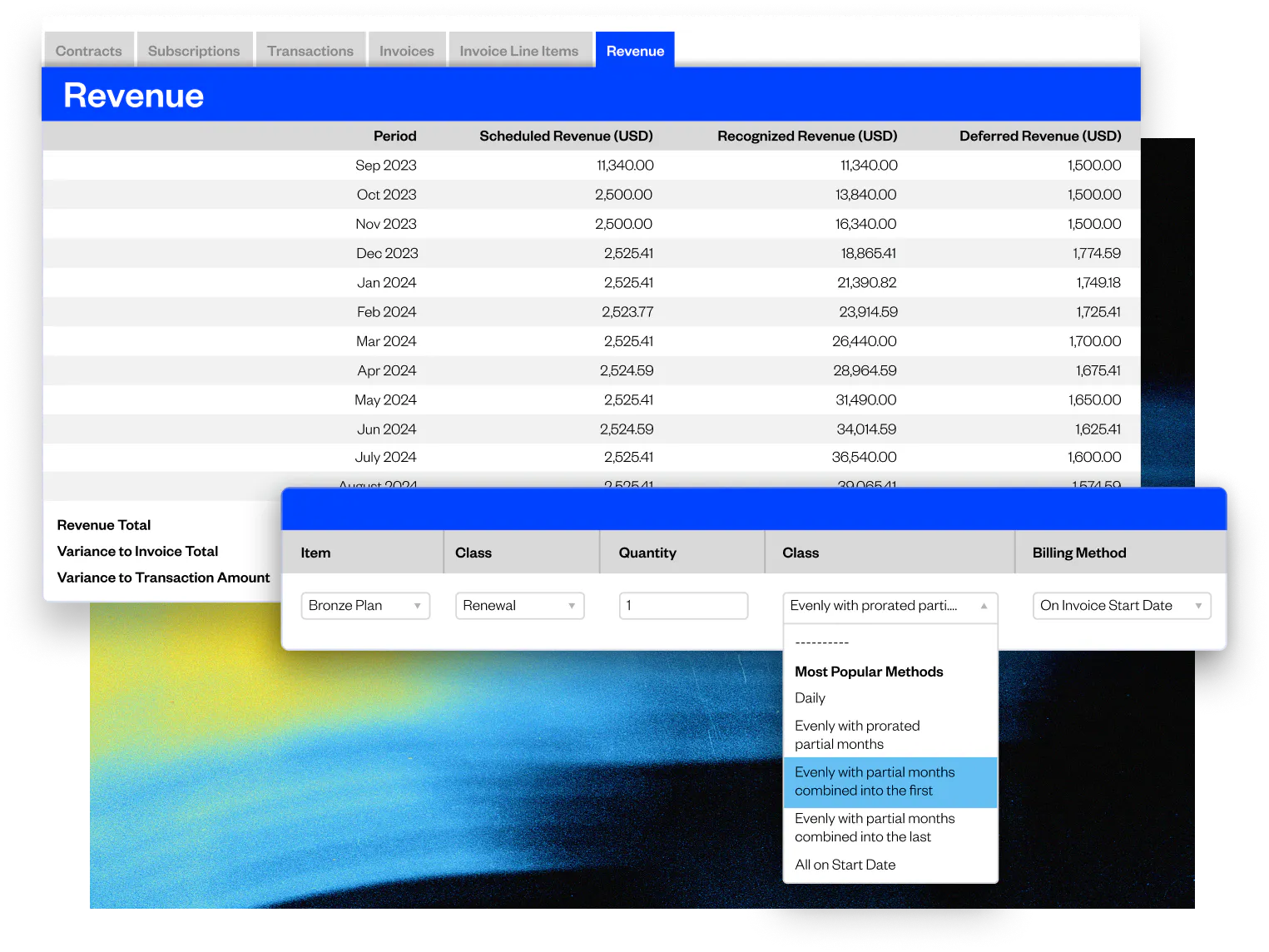

Audit-ready financial reporting

- Connect all of your customer, contract, invoice, revenue, and payment details together into a single source

- Produce accurate, reportable revenue with just one click

- Run calculations with always up-to-date billing and invoicing records

Ready to reach zero-friction-finance?

Save dozens of hours every month on month-end close

Maxio acts as a GAAP revenue sub-ledger. Track transactions, automate GAAP compliant revenue recognition, and sync payments and invoices directly to your general ledger, which makes month-end close more efficient than ever.

Make revenue recognition frictionless

- Automatically apply your revenue policy with accuracy and consistency across your entire customer base.

- Sync paid invoices with your general ledger—no manual transfer required.

- Create revenue and deferred revenue schedules instantly

Automate deposit reconciliations with Maxio Payments

Sync deposits with your GL in real time so you can spot and resolve discrepancies instantly. This will reduce manual reconciliations and accelerate your month-end close with confidence.

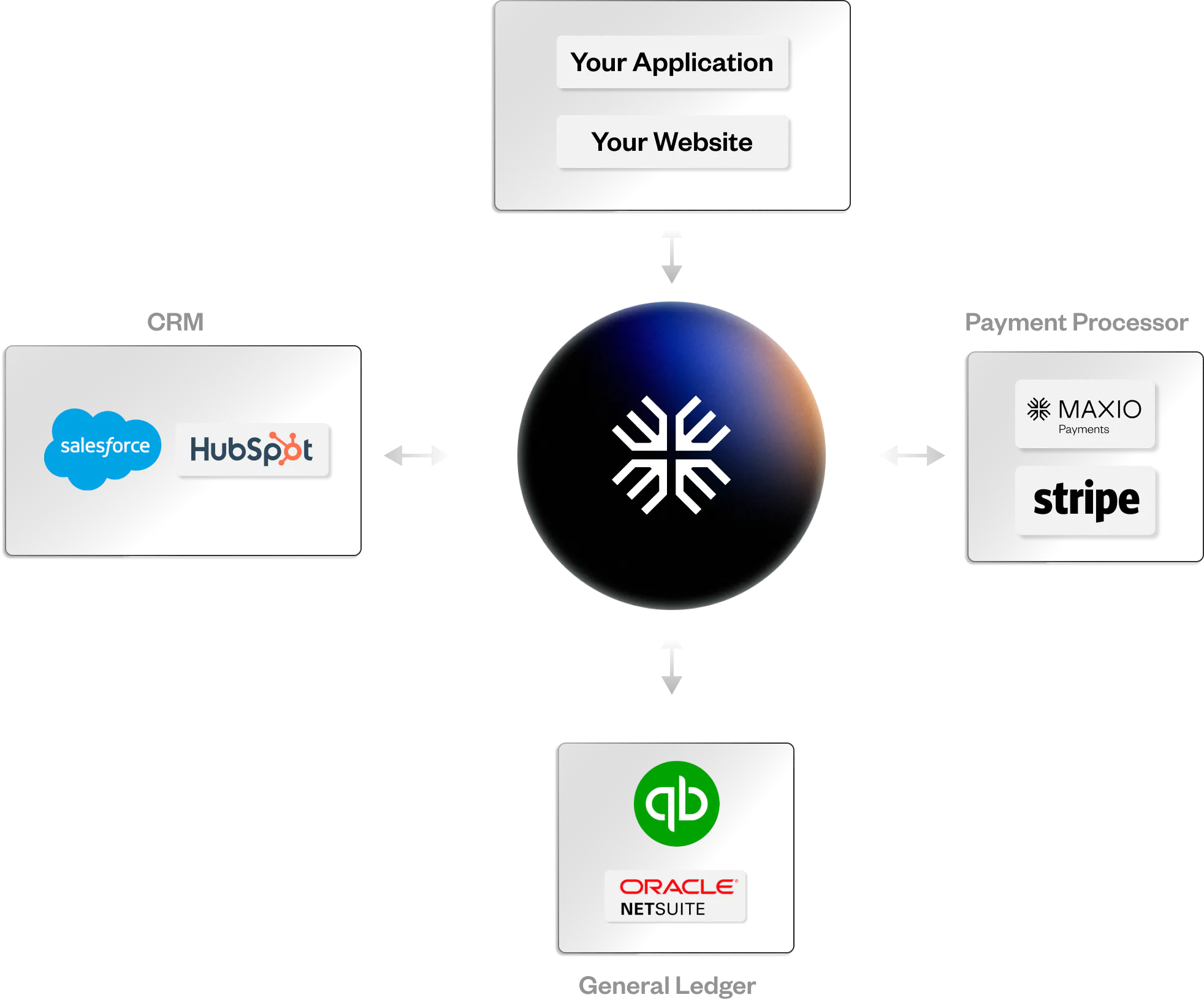

Integrate your financial tech stack

Reduce accounting errors and save time with Maxio’s bi-directional integrations. Automate tedious tasks like manual entries, reconciliation, and more.

Finance and accounting software FAQs

Finance and accounting software is software purpose built for finance teams. This type of software automates historically manual accounting processes freeing teams to dedicate time on more strategic projects. Processes like revenue recogntion, producing SaaS metrics, reconciliation, collections, and more are handled by this type of software.

Finance software helps ensure compliance with Generally Accepted Accounting Principles (GAAP) by streamlining the revenue reporting process specific to your own business model. Revenue recognition automation features ensure consistent and compliant revenue accounting within the specific requirements of IFRS 15 and ASC606 and other GAAP principles, so your finances are always in order and annual financial audits go smoothly.

Most revenue recognition tools are able to integrate with other systems. These may include customer relationship management (CRM) platforms like Salesforce; enterprise resource planning (ERP) systems like Oracle NetSuite; and a range of project management and general ledgers/accounting software your organization may use.

Integrating with these platforms streamlines workflows, allowing for real-time data synchronization, ensuring that all revenue-related activities, such as sales, renewals, and cancellations, are accounted for.

Maxio connects seamlessly with leading accounting and ERP platforms such as QuickBooks, NetSuite, Sage Intacct, and Xero. In addition, our platform integrates with top CRM systems to strengthen customer relationship management and simplify the order-to-cash cycle.

Through powerful APIs, Maxio enables connectivity across your software stack, ensuring accurate data flow and more efficient operations throughout your business.

SaaS reporting tools enable decision-makers to access accurate, real-time data, displayed in easy-to-read graphs and reports, and clearly understand the status of each of their key performance indicators in relation to their KPI goals.

By representing data in an understandable way, SaaS reporting tools enable business leaders to make informed decisions quickly, optimize strategies, and drive growth. This data-driven approach ensures that decisions are based on actual performance metrics, rather than assumed conclusions or gut feelings.

Ready to remove friction?

See how you can streamline your month-end close with Maxio by automating revenue recognition, invoicing, and reportings.