Billing may live in the back office, but its ripple effects are felt everywhere. It’s a critical function that fuels your company’s cash flow, supports a seamless customer experience, and helps you scale with confidence.

But as your product grows, so does the complexity of your billing system. From handling recurring invoices to managing multi-currency payments and tax compliance, the need for reliable billing software solutions is almost impossible to ignore.

Some teams consider building their own billing system from scratch, hoping to tailor it to their exact business needs. But billing software development is rarely simple. If you’re serious about building your own solution, you’ll need deep technical resources, long development cycles, and constant updates to meet compliance standards.

In this article, we’ll break down what it takes to custom-develop a billing solution, including:

- Core system components like invoicing, payment processing, and reporting

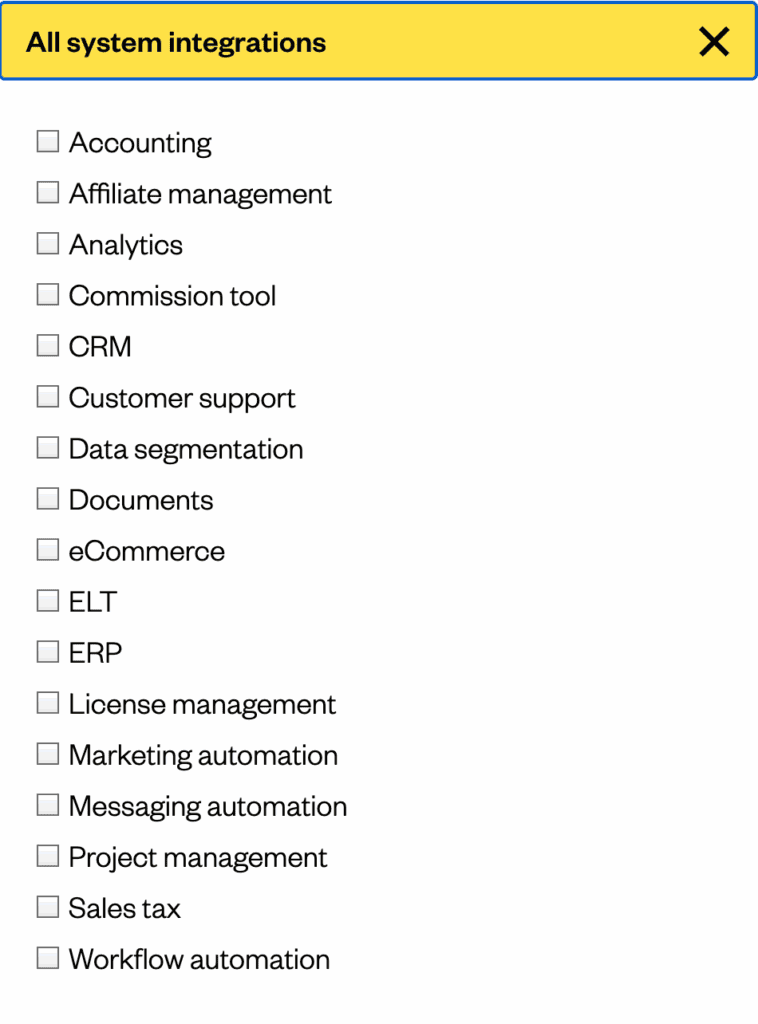

- Critical integrations with CRMs, accounting tools, and payment gateways

- Scalability challenges and customization needs as your business grows

Then we’ll show you a smarter way to automate your SaaS billing, without building the entire system from scratch.

What is billing software in SaaS?

Billing software is a tool that helps businesses automate and manage their billing processes, including invoice generation, payment processing, and financial reporting. Instead of relying on spreadsheets or manual tracking, billing systems can streamline your workflow, reduce potential human error from manual billing processes, and keep your financial operations running smoothly.

Why do SaaS companies rely on billing software systems?

As SaaS companies scale, billing becomes far more complex than simply sending out invoices. You’re dealing with:

- Recurring revenue

- Usage-based pricing

- Proration

- Tax compliance

- Multi-currency support

…all while trying to deliver a seamless and user-friendly customer experience.

That’s why companies rely on purpose-built billing software solutions. Whether it’s been built in-house or offered by a third-party like Maxio, a reliable billing system helps automate key tasks like tracking payments, issuing reminders, and syncing financial data across all of your systems. It also ensures your finance team has access to the accurate, real-time data they need for forecasting, reporting, and decision-making.

Additionally, the most reliable billing and invoicing software is built with critical security measures in mind (from data encryption to role-based permissions) to help your team maintain compliance and protect customer trust.

Ultimately, a secure and scalable billing system is essential if you want to support your business requirements, financial management goals, and long-term customer satisfaction.

What are the key steps in custom billing software development?

Custom billing software development isn’t as simple as allocating a few dedicated developer hours to create a stopgap billing solution.

If you truly want to solve your billing pains, you’ll need to architect an entire financial infrastructure that’s secure, scalable, and aligned with your unique business needs. From subscription management to payment processing, each component must work seamlessly together to support your billing workflow.

Below, we’ll walk through the key steps and considerations involved in building billing software from the ground up.

Step 1: Confirm invoicing software automation

The first building block of any billing system is the ability to automate invoice generation. This means setting up logic for billing cycles, payment reminders, email automation, and invoice templates that reflect your pricing model.

At face value, it might sound simple, but custom-building this functionality involves creating a robust workflow that can handle recurring charges, one-time fees, discounts, proration, and late fees—all without human intervention.

(Source)

Additionally, if you care about creating a seamless user experience, your billing and invoicing software should support branded templates, email scheduling, status tracking, and integration with the existing CRM and accounting tools in your tech stack. Without these capabilities, your finance team will be stuck knee deep in manual process and reconciliations..

Step 2: Integrate payment processing

Once you’re able to consistently generate and send invoices, your system also needs to securely collect payments—and that’s where payment processing comes in. This involves integrating with one or more payment gateways to accept online payments via credit cards, ACH transfers, digital wallets, or other methods.

Building this from scratch means selecting the right processors, handling API authentication, mapping payment statuses back to your billing system, and designing workflows for retries, refunds, chargebacks, and failed transactions. You’ll also need to build logic for payment confirmation, syncing with financial data, and triggering customer notifications.

In other words, it’s not an easy task. However, with a pre-built SaaS Payments solution like Maxio, you can begin processing payments immediately—without getting bogged down in endless development cycles.

Beyond its actual development, your payment solution will also need to be real-time, PCI compliant, and flexible enough to support multiple payment methods across different currencies and geographies. Without a tight integration, your finance team will face delays in payment reconciliation, and customers may experience friction during checkout—both of which can impact customer satisfaction and revenue collection.

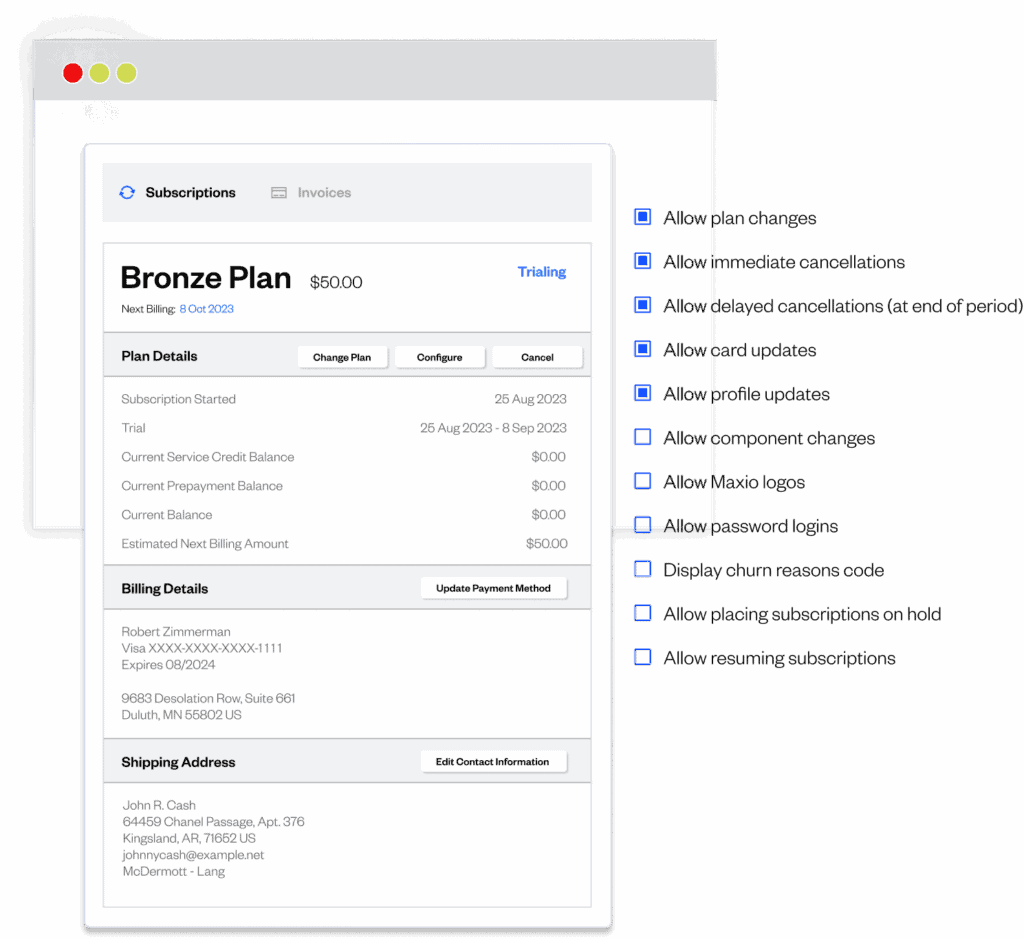

Step 3: Create subscription management modules

For many recurring revenue SaaS companies, subscriptions exist at the core of their revenue engine. That’s why your billing system must include a dedicated module to handle subscription management—tracking start and end dates, upgrades and downgrades, cancellations, trial periods, and renewal logic.

However, successfully building this functionality requires a deep understanding of your pricing model and customer lifecycle. Your system needs to account for scenarios like mid-cycle upgrades, downgrades, cancellations, renewals, free trials, and proration rules. It also needs to sync with a dynamic product catalog, ensuring that every plan, add-on, and discount aligns with your subscription logic and billing engine.

(Source)

You’ll also need to store and sync critical customer information—like their plan details, billing frequency, payment preferences, and communication settings—so your finance team, support agents, and sales reps have a shared view of the account.

Without this backbone in place, even the most advanced payment processing or reporting tools will fall short of delivering a seamless customer experience.

Step 4: Include compliance and security functionalities

Any billing system that handles financial data, customer payment details, and invoice records must be built with security measures and regulatory compliance baked in from day one. This includes supporting industry standards like PCI DSS for payment processing, SOC 2 for data handling, and relevant tax compliance frameworks depending on your operating regions.

If you plan on building these functionalities in-house, your development teams will need to implement encryption protocols, audit logging, secure user authentication, role-based access control, and data retention policies. And because billing systems often touch multiple departments and systems, you’ll also need to manage access across teams.

Failing to address these concerns early on can expose your company to data breaches, legal risk, and customer trust issues. That’s why compliance and security must be foundational elements of your billing software development process.

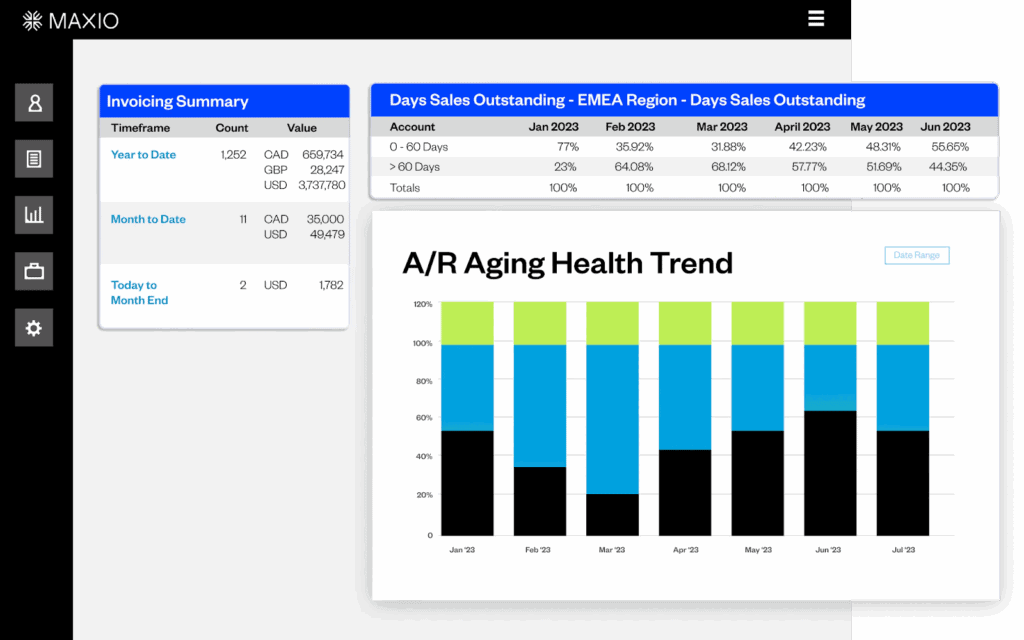

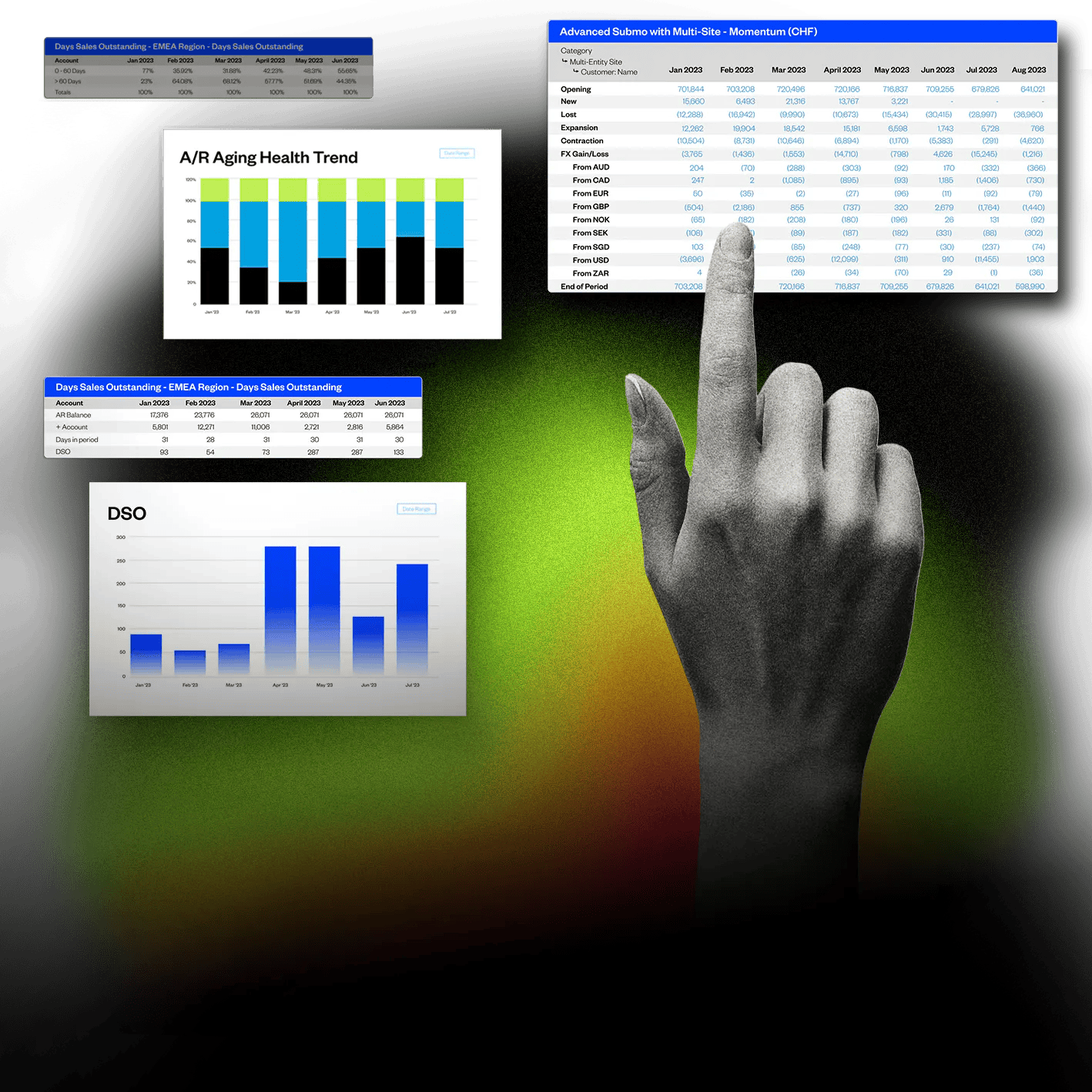

Step 5: Build out financial reporting and analytics

A billing system isn’t complete without strong financial reporting capabilities.

Your finance team needs real-time visibility into key metrics like revenue recognition, aging invoices, cash flow, and churn—often segmented by individual customer cohorts, billing plans, or geography if you’re operating internationally.

However, custom-building this functionality requires a dedicated effort to capture, store, and organize financial data across your billing workflows. You’ll need to build dashboards, export tools, and predictive analytics that help leadership teams forecast growth, monitor performance, and make data-informed decisions.

This includes logic for tax calculation, revenue deferral, and invoice status tracking—plus the ability to reconcile billing records with accounting and ERP systems.

Without this level of visibility, your billing system can’t fully support accurate planning or regulatory reporting. That’s why, at Maxio, we give our users access to investor-grade SaaS metrics and reports that enable them to:

- Access and analyze all of their customer subscription and billing information to make truly data-backed decisions

- Run calculations with always up-to-date billing and invoicing records

- Segment their financial data by associated customers and invoices

- Generate trustworthy financial reports with just a few clicks

(Source)

Step 6: Provide support for multiple payment methods

SaaS buyers expect flexibility at checkout. That means your billing system needs to support a wide range of payment methods, ranging from credit cards and ACH transfers to digital wallets and even multi-currency payment processing.

But building this feature involves more than just plugging into a specific payment gateway. You’ll also need to handle region-specific requirements, manage real-time payment status updates, and build user-friendly interfaces for adding or updating payment details. And for cloud-based products, supporting mobile wallets or in-app purchases might also be required.

You’ll also need to ensure that these methods integrate cleanly with your invoicing workflow, trigger appropriate payment reminders, and support refunds or retries when needed. Because without robust multi-method support, your billing experience risks becoming a bottleneck that can hurt both your conversion rates and customer satisfaction.

Step 7: Integrate with accounting systems

Even the most well-designed billing system can create chaos if it doesn’t sync with your existing accounting software or ERP. That’s why integration with financial tools like QuickBooks, NetSuite, or Xero is a critical part of custom billing software development.

For this step, you’ll need to build reliable APIs or connectors that push invoice data, payment statuses, tax details, and customer balances into your general ledger. You’ll also need to manage reconciliation workflows, handle exceptions, and ensure that data remains consistent across systems.

(Source)

When done right, these integrations can reduce manual entry, streamline audits, and give your finance team the visibility they need to manage compliance and reporting. But if this step is handled poorly, these integrations may introduce errors, delays, and endless back-and-forth between your billing app and your backend financial operations.

Step 8: Consider scalability and customization

As your SaaS company grows, so will your billing complexity. In other words, a billing system that works for 100 customers might buckle and break at 1,000 (especially if it wasn’t built with scalability or flexibility in mind).

This is exactly why custom solutions need to account for growth from the start. That includes designing infrastructure that can handle:

- Increasing transaction volume

- Expanding product catalogs

- Evolving business needs

It also means allowing for customization of billing rules, pricing models, notification settings, and user roles—all without requiring constant developer intervention.

This means your software will need a modular framework that can support things like new pricing tiers, discount logic, promotional billing campaigns, and custom approval workflows. Without this level of adaptability, your billing software will eventually become a blocker to your growth—and require costly rewrites or workarounds just to keep up.

Step 9: Set up CRM integration

Your billing system must integrate with your CRM to maintain alignment across teams and ensure a smooth customer experience. Full stop. Whether that’s Salesforce, HubSpot, or another tool, without this connection, your sales, customer success, and finance teams will be operating in silos.

Custom-building these connections to your CRM means mapping customer records, syncing subscription details, and triggering events (like billing status changes or overdue payments) directly within your CRM. You’ll also need to ensure real-time updates so that customer touchpoints—like upgrades, renewals, or billing inquiries—are handled with full context.

Done right, these CRM integrations create a seamless order-to-cash workflow from the initial sale to payment and retention. However, if done wrong, they can lead to duplicate data, missed handoffs, and frustrated customers.

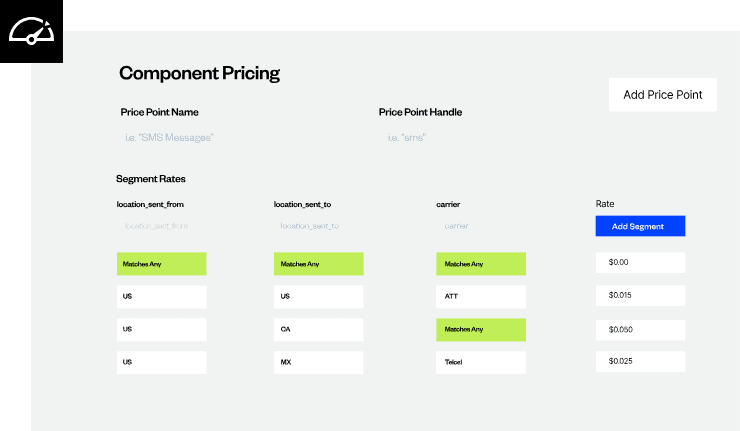

Step 10: Configure a flexible product catalog

Finally, our billing system needs more than just the ability to send invoices. It also needs a clear, structured way to define what you’re billing for. That’s where a flexible product catalog comes in.

A well-designed catalog lets you organize your products, plans, add-ons, and pricing logic in a modular, scalable way. Whether you’re offering flat-rate subscriptions, usage-based plans, or hybrid pricing models, your billing system should make it easy to create and update these offerings without manual workarounds or code changes.

Custom-building this functionality means defining a relational architecture for product families, components, price points, and billing intervals. Then, ensuring that catalog changes flow smoothly into your invoicing, reporting, and revenue recognition processes. And as your business evolves, you’ll need version control and visibility into historical changes to maintain accuracy across the board.

Without a centralized, customizable catalog, you’ll quickly run into fragmentation between your product, sales, and finance teams, which leads to billing errors, data mismatches, and slow go-to-market velocity.

What are the benefits of automated billing software for SaaS?

Here’s the truth: building automated billing software from scratch is a massive lift—and it only gets heavier as your company scales. That’s why more SaaS businesses are choosing automated billing software over custom code.

With a ready-made billing solution, your development team can stop reinventing the wheel and start building features that support your product roadmap. Instead of duct-taping together invoicing logic, payment retries, and tax compliance, you get a platform that’s already designed to streamline the entire billing workflow.

And for your finance team, it means fewer spreadsheets and fewer manual reconciliations. Real-time data, automated reporting, and built-in revenue tracking help them stay on top of cash flow without relying on devs or chasing down missing metrics.

For your leadership team—your CEO, CFO, Head of Product—it’s freedom. Freedom to align billing infrastructure with your business goals, not your backlog. Freedom to run smarter project management, test new pricing, and optimize the customer experience without any unnecessary technical debt holding you back.

What key features should you look for in SaaS billing software?

The right billing platform for your business should have a positive ripple effect across your entire organization. From finance to product to customer support, your billing software should serve as a central command center for everything from:

- Automation and efficiency

- Payment processing capabilities

- Subscription and pricing flexibility

- Compliance and data security

- Integration with your existing tech stack

- Financial reporting and analysis

- Scalability and customization

- Customer support and reliability

Let’s break down the core capabilities every serious SaaS company should look for.

Automation and efficiency

Manual billing slows everything down. Between generating invoices, tracking overdue payments, and juggling subscription logic, it’s easy to end up with a bloated workflow that eats into your team’s time and creates room for costly errors.

But with the right recurring billing software, you can automate everything from recurring invoice generation to payment reminders—all built on pre-configured templates that adapt to your customers’ billing preferences. Automated billing platforms also handle things like proration, renewals, and usage tracking behind the scenes, so your finance team isn’t stuck cleaning up after bad data.

Ultimately, this is about getting more consistency and control out of your billing workflow. Instead of duct-taping together tools, your team gets a centralized, user-friendly system that minimizes human error and scales with your development process.

In summary, you’ll want to look for a solution that:

- Automates recurring invoices and payment reminders

- Minimizes manual errors with pre-configured templates

- Streamlines subscription changes like proration and renewals

- Frees up time for your finance and development teams

Payment processing capabilities

A billing system is only as strong as its ability to actually collect revenue, and that starts with robust payment processing.

Your platform should support a wide range of payment gateways, including credit cards, ACH, and other online payment methods, so customers can pay how and when they want. It should also offer real-time transaction monitoring, automatic retries for failed charges, and customizable payment reminders that help you recover revenue without putting pressure on your support team.

For SaaS companies, payment flexibility is essential. The ability to handle one-time payments, recurring charges, and usage-based billing requires seamless integration between your invoicing software and payment processing stack.

In summary, you’ll want to look for a solution that:

- Supports credit cards, ACH, and other online payment methods

- Automates retries for failed transactions and recover revenue faster

- Offers real-time transaction monitoring and custom payment reminders

- Seamlessly connects invoicing software with payment gateways

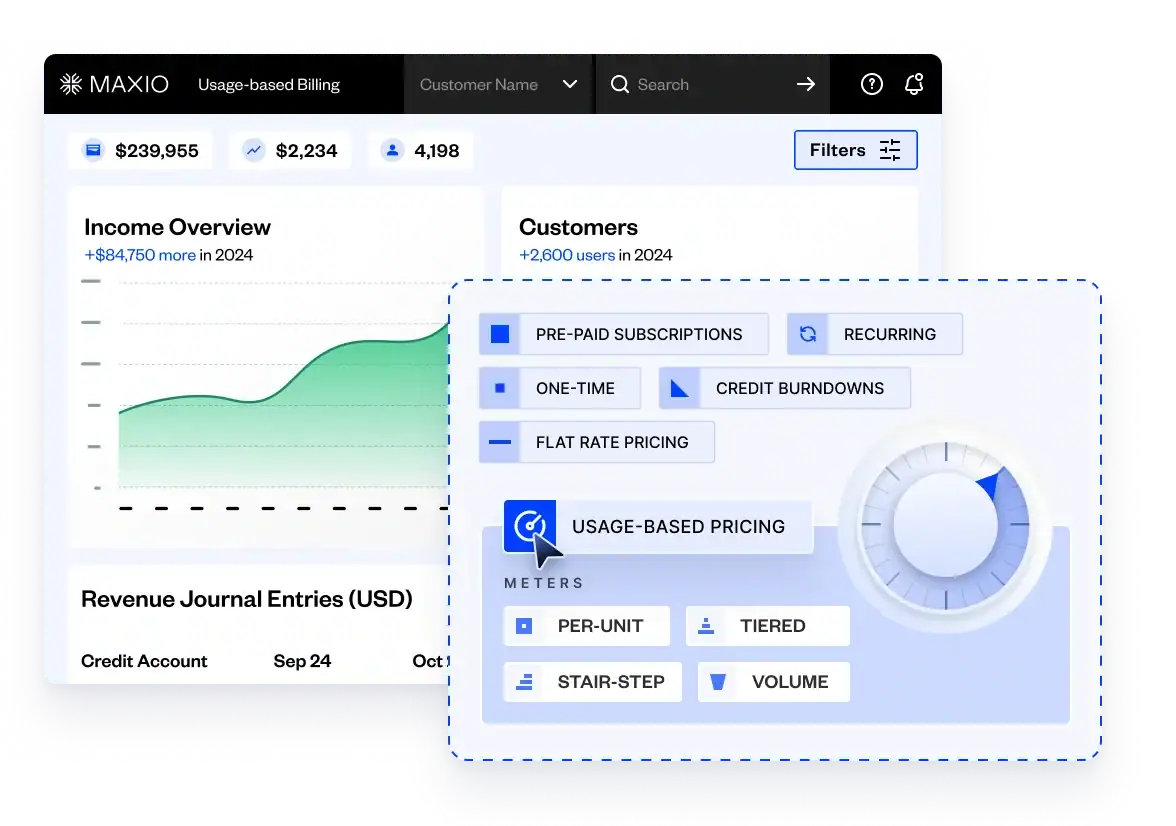

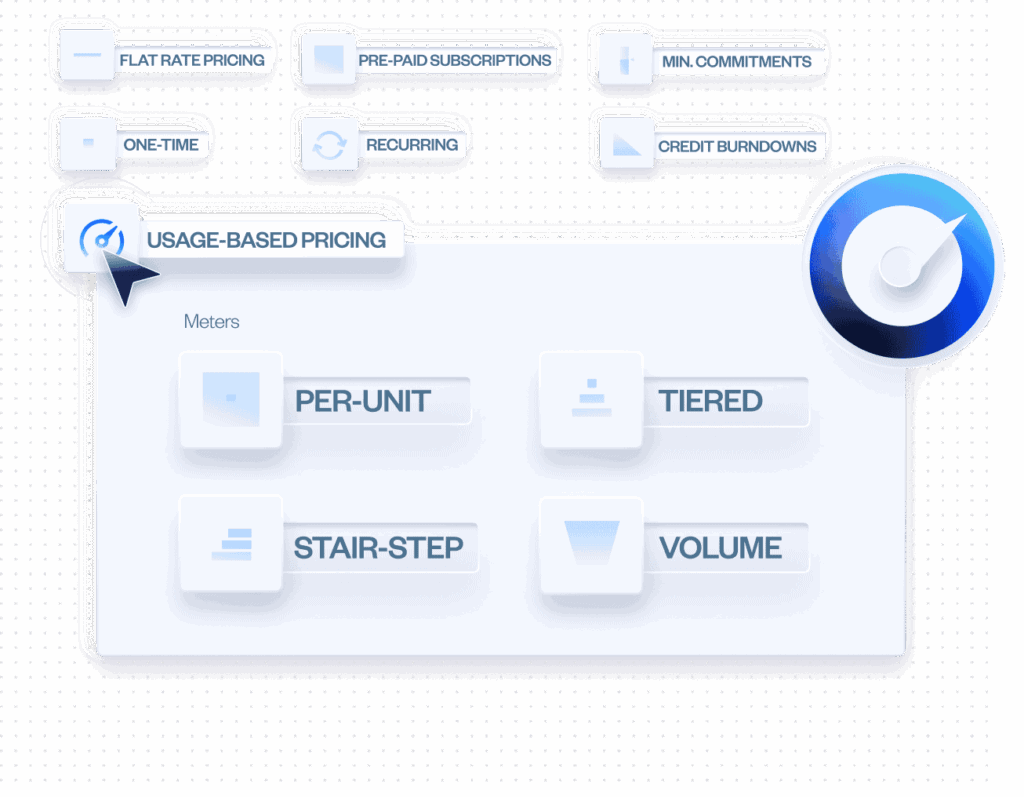

Subscription and pricing flexibility

Rigid billing structures can seriously stall your growth—especially if your product serves a diverse customer base. That’s why flexible subscription management is one of the most critical features of any SaaS billing system.

Your billing platform should let you create, test, and manage a wide range of pricing models—from flat-rate plans to usage-based billing and event-based billing. You’ll need the ability to configure free trials, apply discounts, prorate charges, and support mid-cycle plan changes without breaking your workflow or confusing your customers.

(Source)

This level of flexibility isn’t just for the sake of convenience. The ability to set up these unique billing scenarios allows you to:

- Monetize your existing customer base

- Retain existing customers for longer periods of time

- Tap into new customer segments, both up and downmarket

This is exactly why we created Maxio’s subscription billing tools—to give SaaS companies the power to support even the most complex pricing scenarios, including hybrid models and custom enterprise plans. And with usage-based billing and event-based billing, you can monetize actual product usage in real time.

In summary, you’ll want to look for a solution that:

- Supports multiple pricing models: flat-rate, usage-based, and event-based

- Easily configures free trials, discounts, proration, and plan changes

- Enables mid-cycle upgrades, downgrades, and renewals

- Allows you to experiment with pricing without rebuilding your billing system

Compliance and data security

When you’re handling sensitive financial data and storing customer information, airtight security measures and regulatory compliance are both non-negotiable.

Modern billing software solutions should come equipped with built-in tools for managing data security, user permissions, audits, and compliance with standards like PCI DSS, SOC 2, and GDPR. This is especially critical for cloud-based systems that support online payments and recurring billing, where even a small breach can create major reputational and legal fallout.

But it’s not just about keeping data safe—it’s about making sure your finance team can sleep at night. A secure workflow ensures that transactions are logged correctly, tax calculations are accurate, and customer details are encrypted across the board.

For example, the Maxio platform supports secure data handling from the ground up, with built-in compliance guardrails, audit trails, and advanced permission controls that help you automate without introducing any unnecessary security risk. It’s peace of mind for your development team—and your customers.

In summary, you’ll want to look for a solution that:

- Gives you built-in support for PCI DSS, SOC 2, and GDPR compliance

- Provides audit trails, user permissions, and secure data encryption

- Protects sensitive financial data across cloud-based systems

- Minimizes legal risk while maximizing customer trust

Integration with your existing tech stack

A billing system that doesn’t play well with your other tools will create more problems than it solves. To truly automate your billing processes, your solution should integrate seamlessly with your CRM, accounting software, ERP, and product infrastructure.

This means supporting robust APIs, real-time data syncing, and bidirectional workflows—so updates to a customer’s subscription or payment status automatically show up where they’re needed.

For instance, Maxio is already built to integrate with the tools SaaS businesses already rely on. From Salesforce and HubSpot to QuickBooks and NetSuite, our cloud-based platform ensures your billing system becomes a seamless part of your larger ecosystem—not an isolated app that requires constant workarounds.

(Source)

These tight integrations also help to reduce manual work for your finance team, lower the risk of human error, and keep your financial operations predictable and transparent.

In summary, you’ll want to look for a solution that:

- Provides robust APIs and real-time data syncing

- Is built with two-way integrations with CRMs, ERPs, and accounting platforms

- Reduces manual work and eliminates data silos

- Ensures billing updates flow seamlessly across systems

Financial reporting and analysis

Now, if you really want to get the most out of your billing platform, you should look for a solution that helps you understand the financial health of your business. That’s where SaaS financial reporting and analytics come in.

Apart from the ability to send invoices, your fintech software should also give you real-time visibility into metrics like cash flow, deferred revenue, aging invoices, and MRR—ideally through customizable dashboards and audit-ready reports. These insights can help your finance team spot trends, forecast growth, and make confident, data-driven decisions.

Good reporting also makes tax time and compliance audits far less painful by automatically tying your invoicing software, payment data, and revenue recognition rules into a single source of truth.

(Source)

In summary, you’ll want to look for a solution that:

- Provides real-time visibility into key financial metrics

- Comes with customizable dashboards and audit-ready reports

- Has automated revenue recognition and tax compliance

- Empowers data-driven decisions across your business

Scalability and customization

As your customer base expands, your billing system needs to handle more transactions, more currencies, more pricing models, and more integrations without breaking a sweat. That means scalability should be baked into the architecture from day one.

Just as important is customization. Every SaaS company has unique business needs, and your billing platform should be flexible enough to accommodate them—whether that’s tailored invoice templates, custom workflows, usage-based pricing rules, or branded notifications that match your user interface.

In summary, you’ll want to look for a solution that:

- Handles growing transaction volumes and product complexity

- Is built with modular architecture for evolving business needs

- Provides customizable billing rules, workflows, and user roles

- Supports diverse pricing models and promotional campaigns

Customer support and reliability

Finally, no matter how advanced your billing software is, issues will happen—whether it’s a failed payment gateway, unexpected API behavior, or a customer support question that needs resolving fast. That’s why reliability and responsive support aren’t nice-to-haves.

More than anything, you need a billing partner that offers more than just documentation. Look for one that provides a dedicated support team, clear SLAs, and proactive help during onboarding, system updates, or when your finance team hits a wall.

In summary, you’ll want to look for a solution that comes with:

- A reliable platform with minimal downtime

- Responsive support team with clear SLAs

- Proactive onboarding and implementation assistance

- Expert help available during system updates and scaling

How does Maxio solve the challenges of custom billing software development?

Building your own billing infrastructure might seem like the ultimate customization play—but it’s also a massive drain on your time, budget, and your software development company’s focus. From managing compliance and cloud-based integrations to supporting endless edge cases, custom invoicing software can quickly spiral into a maintenance nightmare.

Maxio offers a better path forward.

Maxio was built to help you skip the complexity of in-house builds and get straight to what matters: recurring revenue, clean data, and a frictionless customer experience. Our billing and financial reporting software includes everything from subscription management and usage tracking to tax compliance, payment recovery, and reporting—ready to go, out of the box.

Ready to eliminate custom billing headaches? Get a demo to see how Maxio can help you scale your SaaS business without the dev overhead.