The CRM says ARR is $1.2M. The billing system says it’s $1.1M. Your ERP? $1.25M.

Which one is right?

Nobody knows… not right away, at least. And it’s not because your team isn’t doing their job. It’s because the systems aren’t talking to each other. The contract terms live in Salesforce, the invoices are handled in a separate billing platform, and revenue schedules are built manually in Excel. By the time it all lands in your general ledger, you’re hoping the numbers reconcile.

This isn’t just a spreadsheet headache — it’s a strategic risk.

Instead of analyzing trends, finance is chasing inconsistencies. Instead of advising the business, you’re firefighting your way to a finish line. And when every system reports a different number, confidence evaporates across the team, the board, and the business.

What a Unified Revenue Stack Looks Like (And Why It Matters)

A modern SaaS finance team can’t afford to operate in silos. If you want clean, timely numbers and confident reporting, your revenue data needs to flow cleanly across four core systems — from contract to close.

Here’s what that looks like when it’s done right:

CRM: Where Revenue Starts

Revenue tracking starts the moment the deal closes—but only if the source of truth is your CRM, not a PDF buried in a folder. If ARR isn’t captured in CRM line items clearly, consistently, and accurately, things fall apart fast. A single added or deleted clause can force manual interpretation and rework.

ARR should be structured data, not tribal knowledge.

Billing: The Bridge Between Sales and Finance

Your billing system reflects how the contract actually plays out — subscriptions, usage, terms, invoicing cadence. But if it doesn’t pull directly from the CRM or sync with your rev rec system, you’re inviting delay and inconsistency.

ERP: Your Financial Source of Truth

The ERP is where everything lands: revenue, expenses, forecasts, and financial reporting.

But without real-time inputs from your CRM and billing tools, your ERP becomes a lagging indicator. It tells you what happened weeks ago, not what’s happening now. A connected ERP lets you manage the business in the moment.

Revenue Recognition System: Where the Rules Get Applied

This is where revenue gets structured, scheduled, and tracked. The best finance teams automate their rev rec logic — allocations, timing, policy enforcement — at the moment of contract creation. That way, finance isn’t rebuilding spreadsheets each month. They’re reviewing and validating what’s already in place.

When all four systems are synced, finance stops operating retroactively and starts operating in real time. You get faster closes, cleaner audits, and sharper insights — without the last-minute scramble.

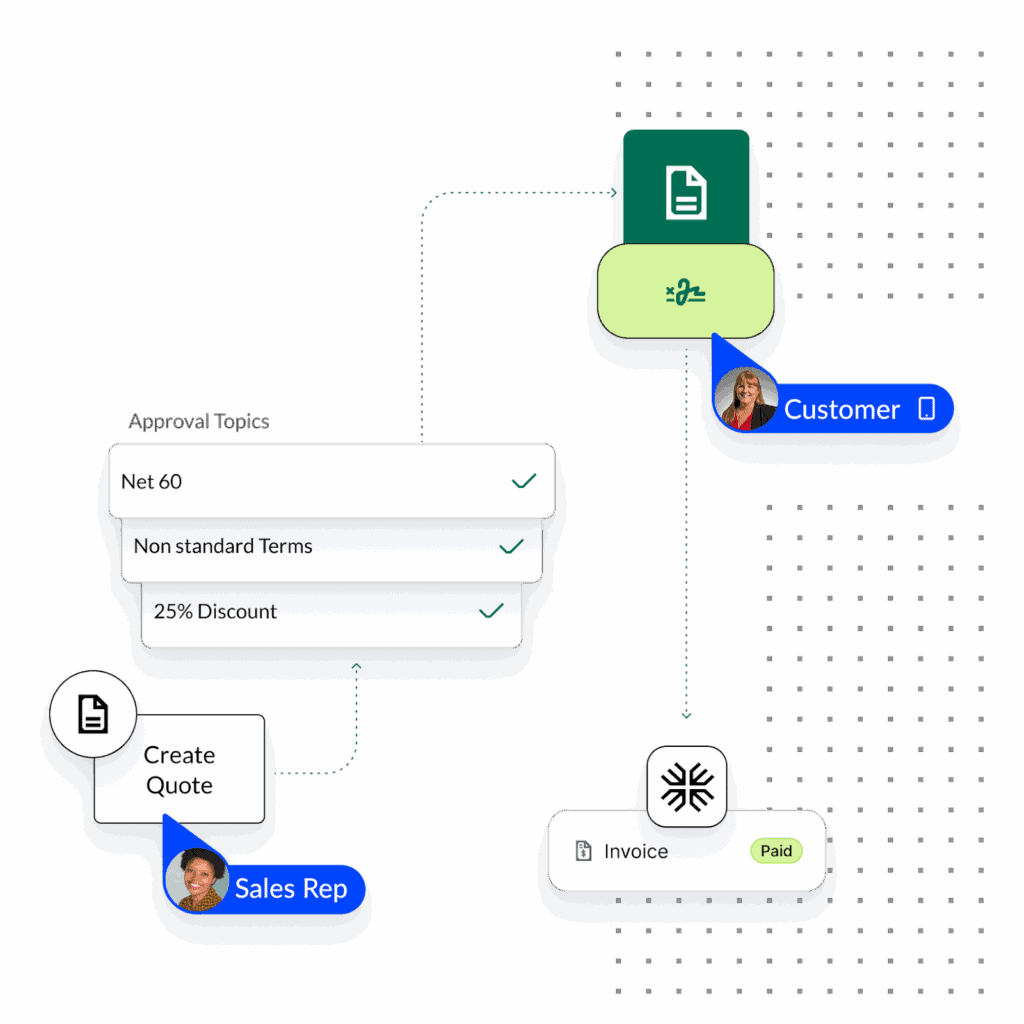

The Missing Link Between Sales and Finance: CPQ

Now, let’s walk through what a unified stack really looks like — starting with the quote, and flowing all the way to audit-ready reporting.

A unified revenue stack isn’t complete without a Configure, Price, Quote (CPQ) system that ensures every deal is structured correctly from the start. When reps build quotes with accurate products, pricing, and terms, all governed by predefined logic, it sets the tone for everything downstream: billing, revenue recognition, and audit readiness.

Without CPQ, Finance is left deciphering spreadsheets and PDFs. Discounts aren’t standardized. Product configurations get misinterpreted. And revenue teams waste time cleaning up what should’ve been correct from the start.

But with Maxio CPQ, every quote becomes a reliable source of structured data:

- ARR is enforced at the point of quote, not guessed later in the CRM.

- Contract terms flow cleanly into billing and rev rec systems.

- Recognition rules are triggered automatically based on deal structure.

That being said, CPQ isn’t just about operational efficiency. It’s about strategic control.

You get cleaner forecasts, pricing discipline, and tighter approvals that are all built into the quoting process itself. It also becomes the shared system of record between Sales, Finance, and RevOps, making approvals faster, deal desks smoother, and cross-functional alignment stronger from day one. And because reps can configure complex deals without constant handholding, you unlock faster sales cycles (without compromising control).

That means three things altogether:

- Sales gets speed

- Finance gets accuracy

- The entire revenue stack starts on solid ground

And as you scale, CPQ ensures that complexity doesn’t become chaos — because every deal starts with structure.

The Before/After Comparison

What happens when your stack is disconnected? Data lives in silos. Handoffs are manual. Numbers don’t match. Finance teams spend days reconciling what should already be aligned.

What happens when your stack is unified with Maxio at the core? Data flows cleanly across the entire revenue lifecycle from contract to close.

Here’s the side-by-side comparison:

| Step | Disconnected Stack | Unified Stack (Maxio at Core) |

| Contract Signed | CRM entry only — no automation, ARR not enforced | ARR captured at source, pushed automatically downstream |

| Invoice Issued | Manually created, often out of sync with contract | Auto-generated from billing logic tied to CRM contract |

| Revenue Scheduled | Built in Excel, manually maintained | Automatically applied based on pre-set rev rec rules |

| Journal Entry | Exported manually, uploaded to ERP | Synced to ERP in real time |

| Audit Prep | Scramble to reconstruct logic and metadata | Click-to-export, audit-ready reports with full change history |

Before (Disconnected Stack):

- Boxes: CRM → Billing → Rev Rec → ERP

- Dotted lines between boxes

- Red warning icons or ⚠️ labels: “Manual Handoff,” “No Sync,” “Excel-Based,” “Audit Risk”

After (Unified Stack with Maxio):

- Boxes: CRM → Billing → Rev Rec (Maxio) → ERP

- Clean arrows showing real-time sync

- Optional callout: “Maxio sits at the core, connecting the revenue lifecycle”

Why It’s Hard to Scale Without This

When you’re small, disconnected tools might feel manageable. You’ve got fewer contracts, simpler billing, and just enough headcount to patch the gaps.

But as the business grows, the cracks widen.

Every manual step becomes a bottleneck. Every workaround becomes a liability. Suddenly, your team is juggling hundreds of contracts, usage-based billing models, multi-entity consolidations — and still relying on spreadsheets to tie it all together.

The risks aren’t just operational. They’re strategic.

- Close timelines start to slip.

- Audit prep becomes a full-time job.

- Investors start asking questions you can’t answer confidently.

The more complex your revenue becomes, the more dangerous it is to operate on disconnected systems. Because eventually, the close breaks. And so does trust in the numbers.

How Maxio Unifies the Stack

Maxio sits at the center of your revenue stack, connecting the systems that matter most and enforcing logic that scales with you.

- Connects CRM, billing, and ERP: Maxio creates bi-directional sync between your core systems so revenue data flows cleanly from deal to dollars to disclosure. No more manual uploads, no more data mismatches.

- Automates revenue recognition and allocations: Revenue schedules are created automatically at the point of sale, using your pre-defined rules. Allocations adjust dynamically based on billing and usage, so you’re always accurate, always compliant.

- Maintains policy compliance across the stack: Maxio enforces policy logic programmatically. That means recognition rules, allocation methods, and audit metadata are applied consistently — no matter how fast you scale or how complex your contracts get.

- Provides real-time visibility across the lifecycle: From contract creation to financial reporting, your team gets one connected view of the truth. That’s what unlocks proactive decision-making, and not just reactive reporting.

Want to unify your revenue stack?

Download The New Rules of Revenue Close: How SaaS Finance Teams Move Fast and Stay Compliant to see how top-performing teams are building modern finance infrastructure from the ground up.

Book a demo with Maxio and see how a unified stack can transform your month-end close.