Revenue leakage is a silent threat that can significantly impact an organization’s financial health, eroding profit margins and stunting growth. It is the death by a thousand papercuts for an organization. In the more than 20 years that I’ve spent in finance, I’ve seen how imperative addressing revenue leakage is for maintaining financial stability. Understanding revenue leakage and implementing measures to prevent it is crucial for a robust and efficient financial operation.

This post explores the causes of revenue leakage, from human error to inefficiencies in RevOps, and presents practical solutions to stop it in its tracks, ensuring your organization remains financially healthy and competitive.

What is revenue leakage?

Revenue leakage refers to the unnoticed loss of revenue within an organization due to inefficiencies, errors, or mismanagement in financial processes. It is crucial to distinguish revenue leakage from churn however. Churn represents lost customers while revenue leakage pertains to lost revenue that could have been retained or earned. This phenomenon can significantly erode profit margins and hinder potential revenue growth, making it a critical issue for any business to address. Revenue leakage often results from lost revenue, inefficiencies, and unchecked manual processes, affecting renewals and causing financial loss.

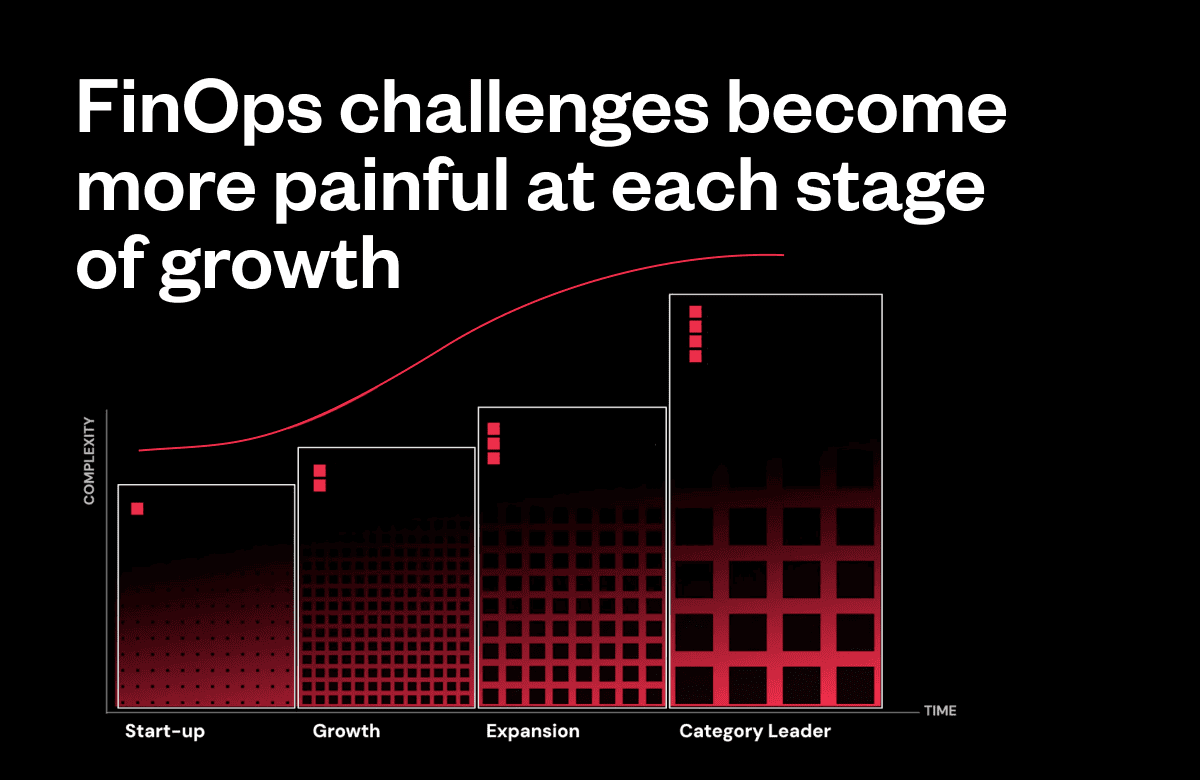

In the competitive world of B2B SaaS, it’s essential to recognize how revenue leakage can impact your business. When revenue that should be earned is lost due to avoidable factors, it impacts future growth. This revenue loss could have been invested back into the business for product development, marketing, or team expansion.

The key to combating revenue leakage is understanding its causes and implementing prevention strategies.

What are the causes of revenue leakage?

Several factors contribute to revenue leakage, each posing unique challenges to an organization’s financial stability. Some of the primary causes include:

- Human error: Simple data entry, billing, and invoicing mistakes can lead to significant revenue losses. These errors are often due to manual processes that are prone to inaccuracies. For example, a misentered invoice amount or an overlooked billing period can result in substantial revenue discrepancies over time. Additionally, relying on spreadsheets for financial data can be problematic, as maintaining their integrity is challenging and errors can easily propagate through various financial processes, leading to further revenue leakage.

- Invoicing and billing errors: Incorrect invoicing and billing can result in either underbilling or overbilling customers, leading to disputes and loss of trust, ultimately causing leaks. Ensuring accurate invoices reflect the correct amounts due is essential for maintaining healthy cash flow and customer relationships.

- Fraud: Internal and external fraudulent activities can siphon off substantial revenue, often going undetected for extended periods. This can include unauthorized discounts, falsified refunds, or other deceptive practices.

- Wrong pricing strategies: Ineffective pricing models and strategies can fail to capture the full value of products or services, leading to lost revenue opportunities. Misaligned pricing can result in undercharging or overcharging customers, hurting both revenue and customer relationships. It’s also important to be flexible in doing business the way customers want or need.

- Absence of collection solutions: The lack of dunning and collection tools to enforce contractual payment obligations and bill late fees can further exacerbate finances. Regularly review your pricing models to ensure they align with your business objectives and market conditions.

- Incomplete data/reporting: Inaccurate or incomplete data reporting can lead to misinformed decisions and financial losses. These issues can undermine the reliability of financial reports and decision-making processes, jeopardizing the organization’s revenue streams. Understanding how to look at your data and pricing from a strategic perspective can provide valuable insights into optimizing revenue.

- Lack of standardized processes: Inconsistent processes across the organization can lead to inefficiencies and missed revenue opportunities. Variability in procedures can cause confusion, errors, and delays, ultimately affecting the bottom line.

These issues can manifest in various forms of revenue leakage, affecting billable hours, customer success, and overall customer experience. Consulting firms often find these problems in the first place during audits, where real-time functionality and data entry discrepancies in CRM systems are prevalent.

How to prevent revenue leakage

Preventing revenue leakage involves a strategic approach that includes identifying sources of leakage, optimizing processes, leveraging technology, and managing contracts effectively. By taking these steps, businesses can stop revenue leakage and protect their financial health.

1. Identify sources of revenue leakage

The first step in preventing revenue leakage is reviewing business and financial operations meticulously to pinpoint areas where revenue might be leaking. This involves scrutinizing financial reports, customer data, billing systems, and compliance processes. Consistently evaluating these aspects and keeping current on SaaS billing best practices helps in identifying inconsistencies and taking corrective actions.

Key areas to review for leakage include:

- Billing systems: Ensure your billing systems are accurate and efficient. Regular audits of billing systems can identify discrepancies and ensure that all billed amounts are correct.

- Customer data: Maintain up-to-date and accurate customer data to prevent billing errors. Accurate customer data ensures that invoices are sent to the correct recipients and reflect the correct amounts due.

- Discrepancies in sales team metrics: Monitor sales team performance metrics to identify and address any inconsistencies. Regular reviews of sales metrics can highlight areas where sales processes can be improved to prevent revenue leakage.

- Forecasting and underbilling: Regularly review forecasting models and ensure accurate billing practices. Accurate forecasting helps predict future revenue and identify potential problem areas.

A practical method to validate and identify sources of leakage is to “staple yourself to an order.” By following an order from Sales to Operations to Accounting and ultimately to cash receipt, you can better identify misalignments within your organization and areas for process improvement. This approach may also reveal professional services that are rendered but never billed to a customer.

2. Create and optimize SOPs

Documented Standard Operating Procedures (SOPs) are vital in preventing revenue leakage. They help regulate processes, promote clarity, and keep everyone on the same page, reducing inconsistencies and aiding in decision-making. Developing and optimizing SOPs involves analyzing current processes, identifying gaps, and taking detailed notes to ensure every step is covered. Organizing the chaos is key to knowing what levers to push or pull to fine-tune your revenue engine.

Benefits of SOPs include:

- Standardization: Ensure uniformity in processes across the organization. This reduces the chances of errors and ensures that all team members are following the same procedures.

- Transparency: Make processes clear and understandable for all involved. Transparent processes also help in identifying areas of improvement.

- Consistency: Reduce errors and inconsistencies in operations. Consistent processes reinforce reliable outcomes.

- Informed decision making: Establish that decisions are based on accurate and comprehensive information. Well-documented SOPs provide clear guidelines, ensuring that all actions align with your organization’s goals.

Integrating project management tools in different systems can further optimize these processes, creating dependencies that streamline workflows and strengthen the bottom line.

3. Leverage software automation tools

Leveraging automation tools can significantly reduce the risk of revenue leakage by handling complex and repetitive tasks more efficiently. Automation in revenue management provides several benefits, including:

- Contract lifecycle management: By automating the management of contracts from initiation to renewal, you can reduce errors and ensure compliance. Automated alerts for renewals and compliance checks prevent contracts from slipping through the cracks, ensuring all obligations are met. Having a contract database with key attributes to score the quality and health of a contract is a foundational element to enhance revenue generation. Scoring based on key elements such as cancellation for convenience, multi-year agreements, and contractual price increases allows management to incrementally improve the value of the contracted install base.

- Recurring billing: Automating billing cycles ensures timely and accurate invoicing. This reduces the chances of missed or incorrect invoices, capturing revenue accurately and on time. Streamlined workflows deliver a clean billing process.

- Subscription management: Efficiently managing subscriptions reduces the chances of missed renewals and ensures customers are billed correctly. This seamless handling helps maintain a consistent revenue stream.

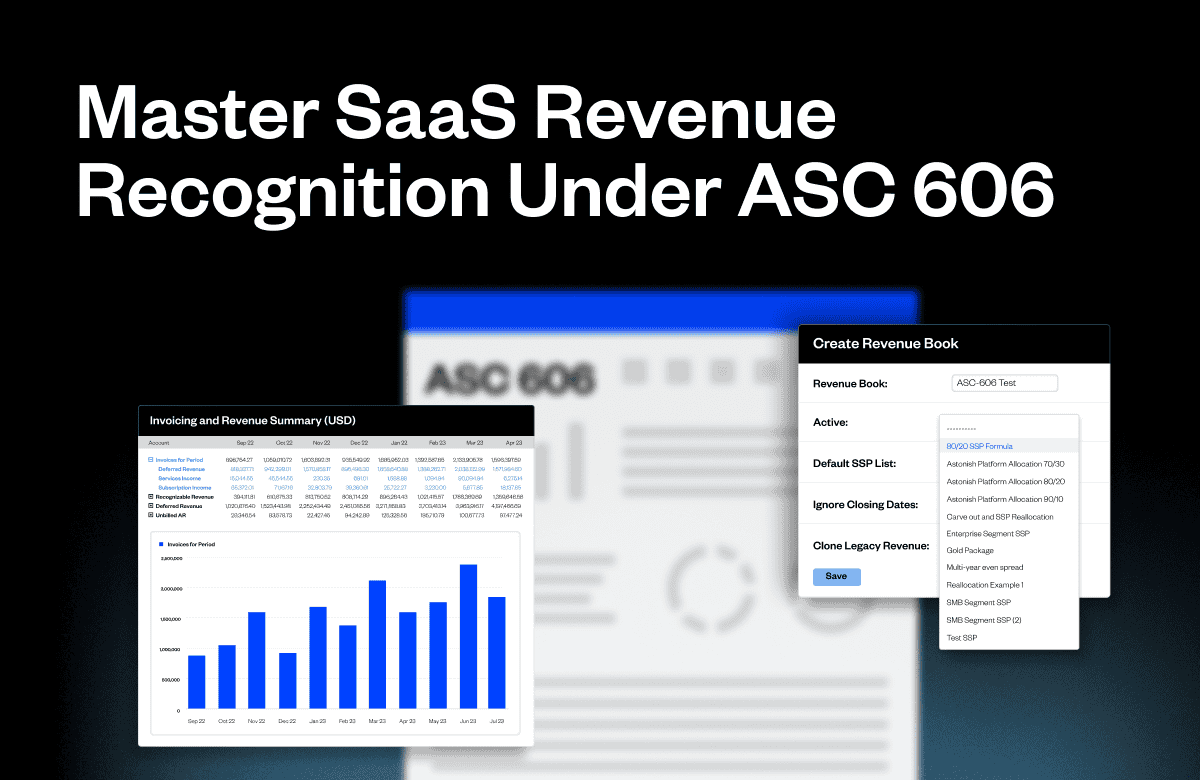

- Revenue recognition: Automating revenue recognition processes ensures compliance with accounting standards and overall accuracy. Using revenue recognition software helps recognize revenue in the correct periods, reduce manual errors, and deliver accurate financial statements.

- Revenue reporting: Automated revenue reporting systems provide real-time insights into revenue performance, aiding in the early detection of issues. Accurate and timely reports enable better decision-making and help identify revenue trends promptly. Having a process and automation that can look at the revenue/billing streams at the 30,000 foot level and identify trends or blips allows for the drilldown to specific customer and invoice line item detail, ensuring gross revenue leakage is identified and corrected.

- Revenue projections: Automated tools use historical data and analytics to create accurate revenue forecasts. These reliable projections aid in strategic planning, helping set realistic revenue goals and plan for future growth.

Utilizing these tools helps optimize time tracking, streamline revenue management, and minimize the risk of revenue leakage. Integrations with different systems ensure that workflows are smooth and efficient. Automating these processes also reduces the reliance on manual spreadsheets, further reducing errors and improving efficiency.

4. Properly manage and execute contracts

Mismanagement of contracts can lead to significant revenue leakage. Proper renewal management and execution of contracts involve conducting thorough reviews, ensuring all terms are met, and keeping updated records. Implementing a robust contract management system helps prevent leaks by ensuring all terms are adhered to, renewals are timely, and any discrepancies are addressed promptly.

Effective contract management ensures that SaaS revenue leaks are minimized and team members are aligned on revenue generation strategies. Key aspects of proper contract management include:

- Regular reviews: Regularly reviewing contracts to ensure compliance with terms and conditions. This includes checking for any discrepancies and addressing them promptly.

- Compliance: Ensuring that all contract terms are adhered to and that any changes are documented and approved. Compliance checks help in ensuring that all contractual obligations are met.

- Accurate records: Maintaining accurate records of all contracts, including renewals, amendments, and terminations. This assists in tracking contract performance as well as identifying any areas of revenue leakage.

Managing contracts effectively ensures revenue opportunities are maximized and potential revenue leakage is minimized. It also helps in building strong relationships with customers and partners by ensuring that all terms and conditions are met.

Capping revenue leaks strengthens your bottom line

People, processes, and systems working together are the key ingredients to revenue leakage prevention. By identifying and addressing the causes of revenue leakage, optimizing processes through SOPs, leveraging automation tools, and managing contracts effectively, businesses can significantly reduce the risk of revenue loss. Maxio offers comprehensive solutions designed to help B2B SaaS companies tackle revenue leakage head-on, providing advanced billing, subscription management, and more.

In conclusion, revenue leakage is a critical issue that can significantly impact an organization’s financial health. Understanding its causes and implementing effective strategies to stop revenue leakage can help businesses optimize their operations, improve profitability, and achieve sustainable growth. Maxio provides the tools and expertise needed to address revenue leakage and ensure financial stability for B2B SaaS companies.

Learn how Maxio can help your business stop revenue leakage and optimize workflows by exploring our advanced billing and subscription management solutions. Additionally, for a comprehensive guide on managing renewals effectively, visit our page on renewal management.

By taking proactive steps to address revenue leakage, your organization can protect its financial health, maintain customer trust, and support sustainable growth. Don’t let unnoticed revenue leaks undermine your success—start implementing these strategies today and see the positive impact on your bottom line.